10 Best Auto Insurance Companies in Maine 2026

Amica, Allstate, and Geico are the top three best auto insurance companies in Maine, giving drivers solid coverage starting at $32 a month. Safe drivers save 25% with Amica by avoiding claims, and earn accident forgiveness with Allstate to keep Maine car insurance rates from going up after their first collision.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated November 2025

The best auto insurance companies in Maine are Amica, Allstate, and Geico. Geico has the cheapest car insurance in Maine at $32 monthly.

- Amica offers loyalty discounts and top renewal satisfaction

- The best insurance companies in Maine provide 24/7 claims support

- Policies must meet the state’s 50/100/25 liability coverage limit

Amica leads with outstanding claims satisfaction, helping drivers recover faster after accidents.

Allstate’s Drivewise usage-based insurance rewards safe driving with lower rates, while Geico offers stackable discounts on top of already affordable rates, making it a strong choice for those seeking cheap car insurance in Maine.

Top 10 Companies: Best Auto Insurance in Maine| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 735 / 1,000 | A+ | Customer Service | |

| #2 | 641 / 1,000 | A+ | Coverage Options | |

| #3 | 639 / 1,000 | A++ | Cost Savings | |

| #4 | 634 / 1,000 | A++ | Reliable Service | |

| #5 | 626 / 1,000 | A | Discount Options |

| #6 | 622 / 1,000 | A++ | Broad Network | |

| #7 | 597 / 1,000 | A | Regional Support | |

| #8 | 594 / 1,000 | A+ | Business Drivers | |

| #9 | 587 / 1,000 | A | Family Plans | |

| #10 | 582 / 1,000 | A+ | Tech Platform |

These Maine auto insurance companies make it easier for local drivers to find affordable protection in a state known for expensive weather-related claims.

Start comparing personalized rates today and use our free quote tool to see how much you can save on auto insurance in Maine.

Comparing Maine Car Insurance Rates

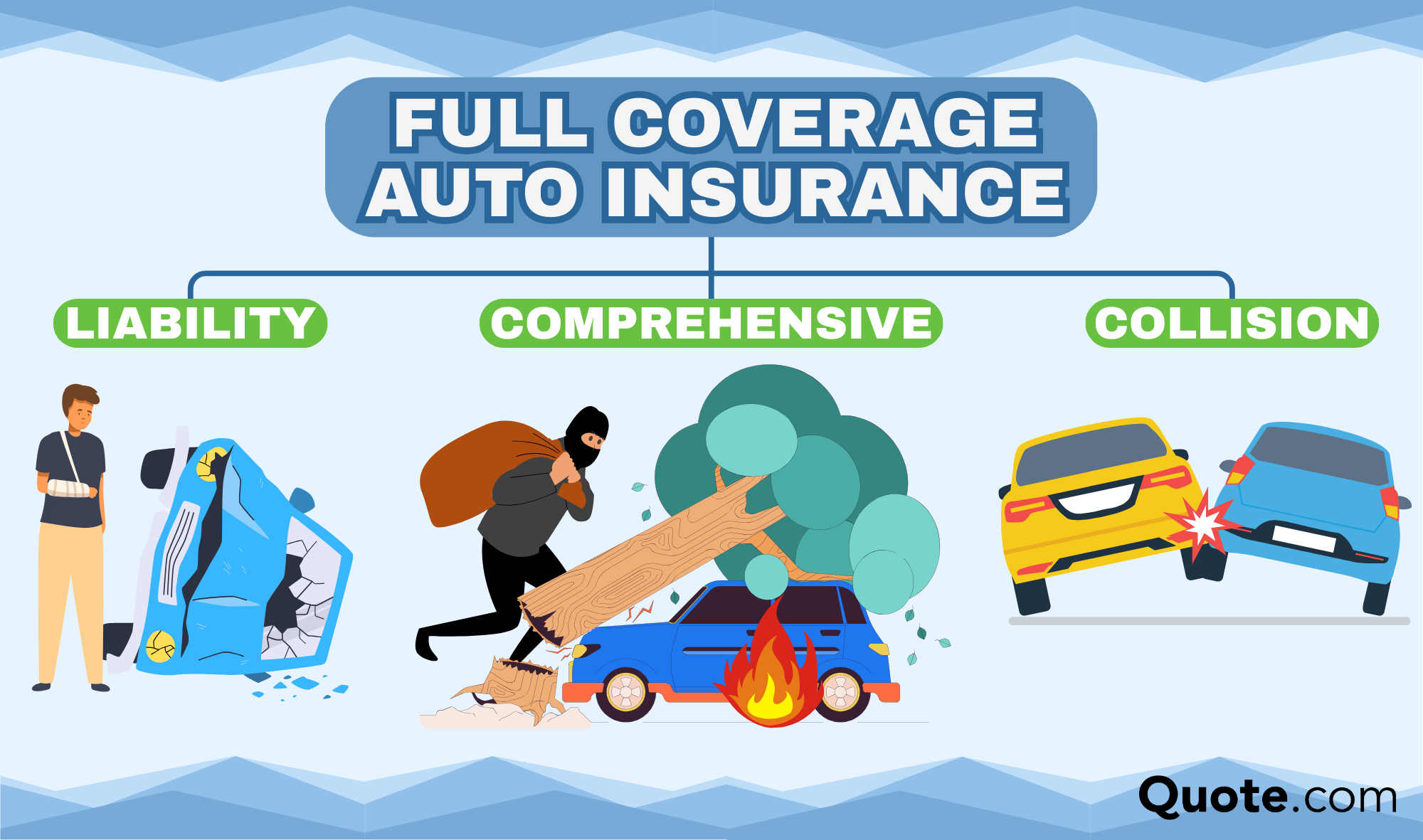

Those who opt for minimum coverage in Maine usually pay the lowest rates, but these minimum limits won’t cover your vehicle if it’s damaged or stolen.

If you prefer extra protection and peace of mind in the event something goes wrong, full coverage auto insurance can be worth the added expense.

Maine Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $39 | $88 | |

| $33 | $70 | |

| $40 | $89 | |

| $32 | $72 | |

| $41 | $92 |

| $36 | $80 | |

| $35 | $77 | |

| $34 | $76 | |

| $38 | $82 | |

| $37 | $83 |

Maine auto insurance rates double for full coverage, so knowing how coverage affects cost helps you choose plans that fit your budget. Those who drive often or have newer vehicles will want full coverage, while occasional drivers can save with basic protection.

Geico and Amica car insurance are the cheapest car insurance companies in Maine for both types of coverage, starting at $32 monthly for minimum and $70 a month for full coverage.

How Age Shapes Maine Car Insurance Costs

Age affects how much Maine drivers pay for auto insurance, and the pattern is easy to spot. Younger drivers shopping for auto insurance for teens usually pay more because insurers see them as less experienced and more likely to make mistakes.

As drivers gain more experience and maintain a clean record, their rates typically decrease, as insurers prefer to reward safe and steady driving.

Maine Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $153 | $72 | $46 | $39 | |

| $105 | $58 | $38 | $33 | |

| $113 | $66 | $44 | $40 | |

| $89 | $46 | $35 | $32 | |

| $116 | $67 | $45 | $41 |

| $99 | $55 | $40 | $36 | |

| $110 | $48 | $39 | $35 | |

| $95 | $53 | $38 | $34 | |

| $108 | $60 | $42 | $38 | |

| $118 | $63 | $41 | $37 |

Those high premiums early on can be frustrating, but they don’t last. Driving safely, keeping your credit in check, and avoiding claims can result in significant savings down the road.

Safe, consistent driving over time leads to lower, more predictable rates. This becomes especially true when searching for the best car insurance in Maine for seniors, as experienced drivers often qualify for lower, more stable premiums.

Cheapest Cities for Car Insurance in Maine

Auto insurance costs in Maine vary by location, mainly due to risk. Drivers in busy areas often pay more, as heavier traffic increases the likelihood of accidents.

People on the coast will also see higher rates, with full coverage costing over $200 a month in many places.

Even within the same state, your ZIP code can make a big difference in how much you pay each month (Read More: Auto Insurance Rates by State).

Living in a city with more traffic or rough weather may increase your premiums, but factors such as safe driving discounts or bundling policies can help offset this increase.

If you’re in a busier Maine city, expect to spend a bit more each month. Auto insurance in Maine tends to run higher than in coastal areas.

Michelle Robbins Licensed Insurance Agent

For example, compare options from the best home and car insurance companies in Maine to unlock bundling discounts of 30% with Amica and 25% with Geico and Allstate.

You aren’t stuck with high Maine car insurance rates just because you live in a high-risk area. Comparing quotes puts you in a better position to find the cheapest car insurance that suits your location and budget.

Driving History & Maine Auto Insurance Rates

Your driving habits directly affect how much your car insurance in Maine costs. Keeping a clean record helps you get lower rates because it shows you’re less likely to file a claim.

On the other hand, accidents, tickets, or DUIs can increase your premiums, as insurers view them as indicators of higher risk.

Maine Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $39 | $55 | $94 | $41 | |

| $33 | $47 | $74 | $36 | |

| $40 | $69 | $92 | $49 | |

| $32 | $42 | $72 | $38 | |

| $41 | $59 | $97 | $50 |

| $36 | $52 | $82 | $44 | |

| $35 | $54 | $89 | $40 | |

| $34 | $48 | $88 | $43 | |

| $38 | $57 | $85 | $42 | |

| $37 | $67 | $90 | $45 |

Many of the best car insurance companies in Maine won’t increase rates much after a speeding ticket, but rates double for a DUI, reaching $97 a month with Liberty Mutual.

Finding auto insurance after a DUI can be more expensive, but improving your habits and staying violation-free can gradually lower your rates again.

Even one mistake can lead to higher costs for a while, but improving your habits helps turn things around.

Taking defensive driving courses, staying claim-free, and driving safely are simple ways to earn back lower Maine auto insurance rates over time.

Credit Score & Maine Auto Insurance Rates

Your credit score can really impact what you pay for car insurance in Maine, and many drivers don’t realize how much it matters.

Insurance companies in Maine reward good credit because it shows you’re responsible with payments, which can lead to lower premiums and better savings opportunities.

Maine Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $39 | $45 | $58 | $79 | |

| $33 | $37 | $46 | $64 | |

| $40 | $44 | $55 | $75 | |

| $32 | $36 | $47 | $68 | |

| $41 | $47 | $59 | $81 |

| $36 | $41 | $53 | $72 | |

| $35 | $40 | $51 | $70 | |

| $34 | $38 | $49 | $66 | |

| $38 | $43 | $54 | $73 | |

| $37 | $42 | $52 | $71 |

Geico has the lowest rates for drivers with good credit at $32 monthly, but Amica and State Farm car insurance in Maine are the cheapest for drivers with bad or poor credit, starting at $46 a month.

If your credit could use some work, don’t worry. There are simple tips to help you pay less for car insurance that can make a significant difference. Paying bills on time, reducing debt, and watching your credit report can really help.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maine Car Insurance Requirements

You must meet the minimum insurance requirements in Maine to stay legal and protected.

These coverages ensure you can handle costs if an accident happens, including your own medical bills and property damage if the other driver is uninsured.

- Bodily Injury Liability: $50,000 per person and $100,000 per accident to cover injuries to others.

- Property Damage Liability: $25,000 per accident to pay for damage to someone else’s car or property.

- Medical Payments Coverage (MedPay): $2,000 per person to help with medical bills for you or your passengers, no matter who’s at fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): $50,000 per person and $100,000 per accident if a driver hits you without enough coverage.

Maine requires extra coverage that other states don’t. It’s an at-fault state for car insurance, but drivers are responsible for their share of the accident, which is where MedPay and UM/UIM step in.

Meeting the basics keeps you legally compliant, but many Maine drivers opt for higher liability coverage for added peace of mind. Comparing Maine car insurance quotes helps you find solid protection without overpaying.

Optional Maine Auto Insurance Coverages

If you want more peace of mind behind the wheel, Maine offers plenty of optional coverages worth considering.

Even if you’re at fault or get hit by an uninsured driver, these extras can help with repairs and medical costs so you’re not left paying out of pocket.

Many drivers opt for collision coverage to handle accident repairs and comprehensive coverage to stay protected from events such as theft, vandalism, or storm damage. (Learn More: Collision vs. Comprehensive Auto Insurance).

Given Maine’s snowy winters and wildlife crossings, both can really come in handy. You can also add roadside assistance, rental reimbursement, or gap coverage for extra protection.

Before updating your policy, it’s a good idea to compare your options and get a Maine car insurance quote to see which company offers the best value for the coverage you need. These options make driving in Maine a lot less stressful and keep you better prepared for the unexpected.

It’s also smart to review your coverage annually, as rates and driving conditions in Maine can change over time.

Ways to Save on Maine Auto Insurance

Saving on car insurance in Maine starts with understanding how discounts work. The biggest discounts often come from things like bundling home and auto insurance, adding safety features, or joining usage-based insurance programs that track how you drive.

Insurance companies in Maine also reward safe driving and smart habits that help you keep good coverage while paying less each month.

Top Auto Insurance Discounts in Maine| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 18% | 30% | 25% | 20% | |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 15% | 25% | 20% | 20% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 10% | 20% | 15% | 15% | |

| 15% | 13% | 10% | 30% |

You can enjoy lower premiums with basic vehicular maintenance and safe driving habits.

Comparing car insurance quotes in Maine from multiple providers is another smart way to see which discounts and coverage combinations work best for your budget. But saving on auto insurance in Maine isn’t just about discounts.

Maintain good driving habits and match coverage to Maine’s changing seasons to lower premiums.

Jeff Root Licensed Insurance Agent

Maine drivers have several smart ways to lower their auto insurance costs without compromising solid coverage.

Learning a few hacks to save money on auto insurance can help you make smart choices that fit your lifestyle and daily driving habits.

- Use Winter Tires: Investing in quality snow tires reduces risk during harsh Maine winters and can lead to lower rates.

- Keep Continuous Coverage: Avoiding breaks between policies helps you qualify for better loyalty savings over time.

- Shop During Policy Renewals: Comparing rates before your renewal date can uncover new savings, especially since Maine’s market is pretty competitive.

- Take a Defensive Driving Course: Completing a Maine Bureau of Motor Vehicles-approved class can earn you credits and lower your premium.

- Review Coverage After Your Car’s Paid Off: Once your vehicle loan is paid off, you can adjust or drop collision coverage to save money.

However, comparing Maine car insurance companies online is the fastest way to find the best policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Providers in Maine

Most Maine drivers turn to Progressive car insurance in Maine for its low prices and easy-to-manage online platform, featuring tools that help drivers customize their monthly premiums.

State Farm and Geico remain top picks because Maine drivers trust their reliable service and quick assistance when filing claims.

Allstate and Amica may have smaller market shares, but Maine drivers who value customer experience over online convenience often choose these providers.

Comparing multiple auto insurance quotes and companies will help you to find the best balance of savings and service in Maine.

#1 – Amica: Top Pick Overall

Pros

- Exceptional Customer Service: With a 735/1,000 claims score, Amica is known in Maine for quick, reliable, and helpful claim support.

- Financial Stability: Backed by an A+ A.M. Best rating, Amica provides Maine drivers with dependable support and secure claim payments.

- Dividend Policies: Maine customers can get up to 20% back on their premiums through Amica’s annual dividend program, making it an easy way to save more over time.

Cons

- Limited Discount Options: Maine drivers have fewer discount options compared to those in companies with larger national operations.

- Limited Local Offices: Drivers in rural Maine may struggle to find nearby in-person centers, as noted in our Amica insurance review, which limits access in those areas.

#2 – Allstate: Best for Coverage Options

Pros

- Flexible Coverage Options: Allstate lets Maine drivers personalize coverage with add-ons like sound system insurance, personal injury protection, and accident forgiveness.

- Safe Driver Savings: Through the Drivewise program, safe drivers in Maine can earn up to 40% off their premiums by maintaining good driving habits.

- Strong Financial Health: With an A+ A.M. Best rating, Allstate gives Maine drivers confidence that their claims will be handled quickly and reliably.

Cons

- High Deductibles: Some Maine drivers may have deductibles as high as $1,000, primarily on comprehensive coverage. Learn more in our Allstate insurance review.

- Higher Premiums for New Drivers: Younger or less experienced drivers in Maine often pay more for coverage compared to the state average.

#3 – Geico: Best for Cost Savings

Pros

- Unmatched Affordability: Geico keeps things affordable for Maine drivers, with premiums starting at $32 a month, making it one of the most budget-friendly options.

- Bundled Discounts: Maine drivers can save even more with multi-vehicle, good driver, and military discounts, helping lower costs without cutting coverage.

- Financial Strength: With an A++ A.M. Best rating, Geico gives Maine drivers confidence that their claims will always be paid promptly.

Cons

- Limited Coverage Options: Maine customers may find fewer add-ons available, such as gap or new car replacement coverage. See policy options in our Geico review.

- Minimal Local Support: Most assistance for Geico Insurance in Maine customers is handled online, with limited in-person services available across the state.

#4 – State Farm: Best for Reliable Service

Pros

- Reliable Claims Service: Earning a 634/1,000 satisfaction score, State Farm is trusted by Maine drivers for its quick and reliable claims support.

- Local Agent Support: Many Maine drivers like having a local agent they can call or visit, making it easy to get help and advice close to home.

- Strong Financial Backing: Rated A++ by A.M. Best, State Farm provides Maine drivers with peace of mind, knowing their coverage is backed by solid financial strength.

Cons

- Limited Online Tools: Some Maine drivers find the app and website to be somewhat basic for managing policies or tracking claims.

- Higher Rates for New Drivers: Younger drivers in Maine often pay higher premiums because of limited driving experience. Compare rates in our State Farm insurance review.

#5 – Liberty Mutual: Best for Discount Options

Pros

- Extensive Discount Programs: Liberty Mutual’s RightTrack program can save Maine drivers up to 30% on their premiums for maintaining safe driving habits.

- Custom Add-On Coverage: Maine policyholders can add new car or better car replacement for extra protection. Our Liberty Mutual insurance review has a full list of add-ons.

- Strong Local Presence: Liberty Mutual has local agents throughout Maine, providing drivers with personalized assistance and prompt policy support when needed.

Cons

- Above-Average Premiums: Full coverage in Maine averages $92 per month, making it higher than the state’s average rate.

- Longer Claim Processing: The 626/1,000 claims rating indicates slower-than-average turnaround for Maine claims.

#6 – Travelers: Best for Broad Network

Pros

- Expansive Repair Network: Travelers gives Maine drivers access to more than 13,000 repair shops, helping get vehicles back on the road faster after an accident.

- Accident Forgiveness: Maine customers benefit from accident forgiveness that prevents rate increases after their first at-fault accident.

- Exceptional Financial Strength: With an A++ A.M. Best rating, Travelers offers Maine drivers peace of mind knowing their insurer is financially stable and dependable.

Cons

- Limited Discount Variety: Maine drivers have fewer discount options compared to what’s available with some other large insurers.

- Limited Local Branches: According to our Travelers review, there are fewer agent offices across Maine, which makes it harder for drivers to access face-to-face service.

#7 – Mapfre: Best for Regional Support

Pros

- Localized Support: Mapfre tailors its coverage for Maine drivers, taking into account the local weather, roads, and driving needs.

- Flexible Payments: Maine drivers can choose a select payment plan that suits their budget, whether that’s paying monthly or annually (Read More: Auto Insurance Guide).

- Quick Claims Help: The local claims team in Maine is easily accessible and helps keep the whole claims process simple and stress-free.

Cons

- Smaller Agent Network: Some parts of Maine have fewer Mapfre agents, which can make obtaining in-person assistance more challenging.

- Limited Online Tools: The website and mobile tools are fairly simple, offering fewer features for Maine drivers to manage their policies or file claims online.

#8 – The Hanover: Best for Business Drivers

Pros

- Commercial Auto Expertise: Hanover offers Maine businesses solid options for fleet and business auto coverage that actually fit their day-to-day needs.

- Financial Security: With an A+ A.M. Best rating, Hanover provides Maine business owners with confidence that their claims will be handled smoothly and promptly.

- Personalized Service: Local agents in Maine take the time to understand each business, helping owners build policies that truly match their operations and budget.

Cons

- Complex Policy Setup: In our The Hanover review, some Maine drivers say the process can take a little longer because coverage is customized for each company.

- Limited Discount Availability: The company offers fewer savings programs and discounts than other Maine auto insurance companies.

#9 – Farmers: Best for Family Plans

Pros

- Bundling Benefits: Maine families can save up to 20% by combining auto and home policies under Farmers.

- Accident Forgiveness: Prevents premium hikes for Maine drivers after minor accidents. Read our Farmers insurance review to see if you qualify.

- 24/7 Claim Support: With 24/7 claims help in Maine, Farmers makes sure drivers can reach someone anytime they need assistance.

Cons

- Higher Premiums: Full coverage in Maine costs around $89 a month, which can be a bit pricey for families trying to save.

- Limited Digital Features: The app and website are pretty basic, so Maine drivers don’t get as many online tools to manage their policies.

#10 – Progressive: Best for Tech Platform

Pros

- Innovative Tech Tools: Progressive’s Name-Your-Price tool allows driver to build a policy based on their budget.

- Fast Digital Claims: Many Maine drivers get online claim approvals within 48 hours, making the process quick and hassle-free.

- User-Friendly App: The Progressive app makes it easy for Maine drivers to manage policies, track discounts, and access ID cards anytime.

Cons

- Rate Fluctuations: Maine premiums vary by driving record, and many drivers note significant rate increases at renewal, according to our Progressive insurance review.

- Customer Service Gaps: Some Maine users report delayed live support during peak claims periods.

How to Choose the Best Car Insurance in Maine

The best auto insurance companies in Maine give you solid protection, dependable service, and fair prices. Amica is known for fast and reliable claims service, Allstate rewards safe drivers through Drivewise, and Geico keeps things affordable with $32 monthly rates.

When you take the time to compare auto insurance companies, you can find a policy that keeps you confident and covered on Maine roads all year long.

- Compare Several Quotes: Obtain quotes from a few companies, as rates in Maine can vary depending on factors such as your age, where you live, and your driving record.

- Check Financial Strength: Go with insurers that have strong A.M. Best or Moody’s ratings so you know they’ll come through when you file a claim.

- Read Local Reviews: Many local customers give feedback on the best car insurance in Maine on Reddit to help drivers find companies with real value and service.

- Ask About Maine-Specific Coverage: Some insurers offer better options for wildlife collisions or winter-related damage, which are common in the state.

- Look for Discounts: Check for savings from bundling, safe driving, good credit, or programs like Drivewise and Snapshot.

You can save even more by bundling your policies, maintaining a good credit score, and keeping a clean driving record. Adding an anti-theft device or choosing a higher deductible can also help reduce your premium.

To find the best car insurance company in Maine, use insurance comparison sites to compare quotes online. Enter your ZIP code to see the best local options.

Frequently Asked Questions

Who is the best car insurance company in Maine?

Amica, Allstate, and Geico stand out as Maine’s top-rated auto insurance providers. They offer a mix of affordable pricing, strong protection, and dependable customer service, giving drivers options that match both their needs and budgets.

What is the average cost of auto insurance in Maine?

Maine drivers pay around $36 per month for minimum coverage and $77 per month for full coverage. Enter your ZIP code to compare average rates near you.

Is Progressive or Geico car insurance better in Maine?

Geico offers rates starting at $32 a month, while Progressive is great for easy online management and flexible options. Use our ultimate insurance cheat sheet to help you compare both.

What car insurance company in Maine has the most complaints?

Recent data show that Liberty Mutual receives more service-related complaints than its competitors. Checking reviews and complaint ratios before buying can help Maine drivers choose a provider with smoother claims handling.

How does a credit rating affect car insurance in Maine?

Good credit can lower your Maine car insurance rates by up to 40%. Keeping up with bills and minimizing debt can help you save more on car insurance.

What is a good deductible for auto insurance in Maine?

An insurance deductible of $500–$1,000 often hits the right balance between affordable premiums and repair costs for most drivers in Maine.

How can I reduce my Maine car insurance rates?

Bundling home and auto coverage, maintaining a clean driving record, and improving your credit score are easy ways to lower your costs. It’s also worth asking your insurer about discounts for safety features or programs that reward good driving habits.

Is Progressive known to deny claims in Maine?

Progressive isn’t widely known for unfair claim denials in Maine. Providing accurate details and documentation during a claim can help ensure a faster, smoother process.

How does your age affect car insurance in Maine?

Younger drivers typically face higher rates due to their limited experience, while older drivers often receive discounts and lower premiums. With auto insurance for seniors, maintaining a clean record and steady driving habits helps secure the best rates. Over time, good behavior behind the wheel pays off with consistent savings.

At what point is full coverage not worth it in Maine?

If your car’s value falls below $5,000, or your annual premium equals more than 10% of your car’s value, full coverage might not make financial sense. Switching to liability-only can help reduce expenses.

What should you not say when making an auto insurance claim in Maine?

Is it better to have collision or comprehensive in Maine?

What are three things you can do to save money on Maine car insurance?

How much car insurance coverage is required in Maine?

What if I don’t want comprehensive and collision coverage in Maine?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.