10 Best Auto Insurance Companies in New Hampshire for 2026

The best auto insurance companies in New Hampshire are Amica, Allstate, and Geico, with minimum coverage rates starting at $30 monthly. Others also prefer State Farm for its Drive Safe & Save program, which can cut premiums by up to 30%. NH doesn’t require car insurance, but drivers who opt in must carry 25/50/25.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated November 2025

Amica, Allstate, and Geico are the best auto insurance companies in New Hampshire. They offer dividends, telematics-based discounts, and MBI coverage.

- Amica leads with 97% claim satisfaction and 20% loyalty discounts

- NH drivers must carry 25/50/25 liability limits if they get coverage

- Usage-based policies reward safe drivers in NH with lower rates

Amica stands out with dividend returns and automatic accident forgiveness on select plans. It earns consistently high claims satisfaction through fast, proactive support.

Allstate appeals with new car replacement and deductible rewards, which lower out-of-pocket costs after a claim.

Top 10 Companies: Best Auto Insurance in New Hampshire| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 735 / 1,000 | A+ | Dividend Payments | |

| #2 | 641 / 1,000 | A+ | Usage-Based Plans | |

| #3 | 639 / 1,000 | A++ | Cheap Rates | |

| #4 | 634 / 1,000 | A++ | Claim Repairs | |

| #5 | 626 / 1,000 | A | Policy Discounts |

| #6 | 622 / 1,000 | A++ | Bundling | |

| #7 | 609 / 1,000 | A | Personalized Service |

| #8 | 594 / 1,000 | A+ | OEM Coverage | |

| #9 | 587 / 1,000 | A | Tracking Claims | |

| #10 | 582 / 1,000 | A+ | Mobile Tools |

Geico car insurance in New Hampshire boasts speedy digital claims and broad discounts for military members and federal employees.

Unlock savings from the best auto insurance companies in New Hampshire by entering your ZIP code into our quote comparison tool.

Auto Insurance Costs in New Hampshire

Car insurance quotes in New Hampshire shift based on the coverage you choose, your driving history, and where you live.

New Hampshire car insurance requirements do not include a minimum liability limit, but choosing minimum coverage keeps rates lower.

New Hampshire Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $103 | |

| $41 | $90 | |

| $43 | $95 |

| $46 | $102 | |

| $36 | $81 | |

| $48 | $104 |

| $39 | $87 | |

| $38 | $85 | |

| $44 | $97 | |

| $42 | $93 |

Full coverage gives extra peace of mind with collision auto insurance protection and comprehensive coverage against animal collisions, theft, and weather-related damage.

Geico is the cheapest car insurance in NH for both types of coverage, followed by State Farm and Progressive. Amica is also competitively priced, starting at $41 a month.

However, drivers in smaller towns often see even lower rates because of fewer claims and less road congestion. You might also get by with just minimum coverage in these areas for even cheaper rates.

A clean driving record and solid credit score can also save around $20 a month compared to riskier profiles. Keep reading to see how different factors impact auto insurance in New Hampshire.

How Driving History Impacts Car Insurance Rates in New Hampshire

How you drive every day plays a big role in what you pay for car insurance in NH. A clean record usually means lower monthly costs, especially if you stick with minimum coverage.

Even one ticket or small accident can raise your rate, and a driving under the influence can double it (Read More: Cheapest Auto Insurance After a DUI).

New Hampshire Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $47 | $70 | $139 | $50 | |

| $41 | $58 | $95 | $44 | |

| $43 | $63 | $102 | $47 |

| $46 | $75 | $75 | $54 | |

| $36 | $45 | $73 | $38 | |

| $48 | $79 | $130 | $56 |

| $39 | $66 | $109 | $49 | |

| $38 | $47 | $60 | $48 | |

| $44 | $65 | $107 | $46 | |

| $42 | $77 | $97 | $43 |

If you’ve had a ticket or accident, safe driving apps and pay-as-you-go plans can help improve your driving and lower your costs again.

Taking defensive driving classes and keeping a clean record over time helps you earn back those savings.

The more consistent and cautious you are behind the wheel, the more likely you are to keep your New Hampshire car insurance budget-friendly.

However, if you’ve recently filed a claim or been in an accident, you can expect your rates to stay high for the next five years.

How Driver Age Affects New Hampshire Auto Insurance Rates

The best auto insurance companies in New Hampshire typically charge younger drivers more due to higher accident risks and limited experience.

As drivers reach their mid-30s, rates start dropping because insurers reward consistent, claim-free behavior and financial stability.

New Hampshire Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $131 | $77 | $68 | $47 | |

| $104 | $59 | $52 | $41 | |

| $110 | $63 | $55 | $43 |

| $117 | $70 | $56 | $46 | |

| $92 | $49 | $58 | $36 | |

| $120 | $71 | $54 | $48 |

| $114 | $60 | $49 | $39 | |

| $98 | $56 | $50 | $38 | |

| $113 | $65 | $57 | $44 | |

| $120 | $67 | $47 | $42 |

By age 45, minimum coverage becomes far more affordable. Insurers see older, experienced drivers as lower risk and often offer perks like accident forgiveness and safe-driver discounts.

Drivers in New Hampshire who maintain a clean record and choose minimum coverage can keep costs low without sacrificing essential protection (Read More: Best Auto Insurance for Good Drivers).

How Credit Impacts New Hampshire Car Insurance Premiums

Having a good credit score in New Hampshire leads to cheaper car insurance, but you’ll likely pay more if your credit is poor, even with a clean driving record and minimum coverage.

New Hampshire auto insurance companies typically offer lower rates to drivers with excellent credit because they’re seen as low-risk.

New Hampshire Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (<580) |

|---|---|---|---|---|

| $40 | $50 | $70 | $95 | |

| $36 | $45 | $65 | $90 | |

| $37 | $47 | $67 | $93 |

| $38 | $48 | $72 | $100 | |

| $30 | $36 | $54 | $80 | |

| $39 | $49 | $74 | $102 |

| $33 | $42 | $65 | $94 | |

| $32 | $40 | $60 | $88 | |

| $35 | $43 | $62 | $88 | |

| $34 | $44 | $66 | $95 |

Out of the best car insurance companies in New Hampshire, Geico offers the best rates to drivers with bad credit at $88 per month.

Paying bills on time and keeping credit balances low can help bring your rates down over time.

Fair credit can raise New Hampshire premiums despite clean records. Using auto-pay helps improve scores faster.

Michelle Robbins Licensed Insurance Agent

At 45, most drivers already benefit from lower rates, but good credit helps keep those savings consistent with minimum coverage.

Learn how better credit can lower the average cost of auto insurance and speed up New Hampshire car insurance claims.

How Location Affects Insurance Rates in New Hampshire

Where you live in New Hampshire can have a big impact on rates. Cities such as Hudson or Exeter tend to see higher premiums since busier roads and higher claim frequencies increase insurer risk.

Factors like local repair costs, vehicle theft rates, and weather conditions play a big part in what you pay each month (Read More: How to Buy Auto Insurance).

Auto insurance companies in New Hampshire often offer lower prices to drivers in quieter towns like Pittsburg or Rumney because there are fewer accidents and less traffic.

Compare NH auto insurance quotes instantly when you enter your ZIP code into the free comparison tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Hampshire Car Insurance Requirements

New Hampshire is one of the few states that doesn’t require drivers to carry auto insurance, but you must still be able to pay for any damages if you cause an accident.

- Bodily Injury Per Person: Policies must include at least $25,000 if you choose to buy insurance.

- Bodily Injury Per Accident: Policies must include at least $50,000 for all people injured in one accident.

- Property Damage Liability: Policies must include at least $25,000 in property damage coverage.

Most New Hampshire drivers still buy minimum coverage to avoid paying thousands out of pocket after an at-fault accident.

Optional NH Auto Insurance Coverage

Even though New Hampshire doesn’t require auto insurance, most drivers choose to carry coverage to avoid paying for major repairs or injuries out of pocket.

- Liability Coverage: Pays for injuries and property damage you cause to others.

- Collision Coverage: Covers repairs to your vehicle after a crash, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from theft, vandalism, weather damage, and animal collisions.

- Uninsured/Underinsured Motorist: Helps pay for injuries or damages if the other driver has little or no insurance.

- Medical Payments (MedPay): MedPay provides medical coverage for you and your passengers after an accident.

- Optional Add-Ons: Includes roadside assistance, rental reimbursement, and gap insurance.

Carrying coverage is the easiest way for New Hampshire drivers to protect themselves from unexpected repair bills, medical costs, and financial responsibility after an accident.

Read More: Collision vs. Comprehensive Auto Insurance

Ways to Save on New Hampshire Insurance

New Hampshire drivers have several ways to save big, depending on their driving habits and the discounts they qualify for.

New Hampshire drivers can unlock maximum savings by strategically combining multiple discounts with these expert strategies:

- Sign Up for UBI: Usage-based insurance (UBI) programs offer the highest savings potential, reaching up to 40% for those who drive less and practice safe habits.

- Lower Your Annual Mileage: If you work from home or take public transport, you can earn discounts for driving less than 10,000 miles per year.

- Bundle Your Policies: Bundling home and auto policies brings another layer of savings, often reducing total premiums by 25% or more across major insurers.

Safe driver and bundling programs together often provide the biggest total reductions, rewarding consistent driving and loyalty to one company.

Anti-theft discounts can also be significant, cutting rates by as much as 35% when vehicles are equipped with approved security systems.

Top Auto Insurance Discounts in New Hampshire| Company | Anti-Theft | Bundling | Safe Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 18% | 40% | |

| 18% | 30% | 15% | 20% | |

| 36% | 20% | 15% | 25% |

| 10% | 20% | 20% | 30% | |

| 25% | 25% | 15% | 25% | |

| 35% | 25% | 20% | 30% |

| 25% | 10% | 10% | $231/yr | |

| 15% | 17% | 20% | 30% | |

| 10% | 20% | 8% | 15% | |

| 15% | 13% | 15% | 30% |

Allstate offers the biggest UBI discount through its Drivewise and Milewise programs, while Amica has the biggest bundling discount at 30%.

Geico not only has the cheapest auto insurance in New Hampshire but also offers an additional 25% across multiple discount tiers that can be combined for 75% savings or more.

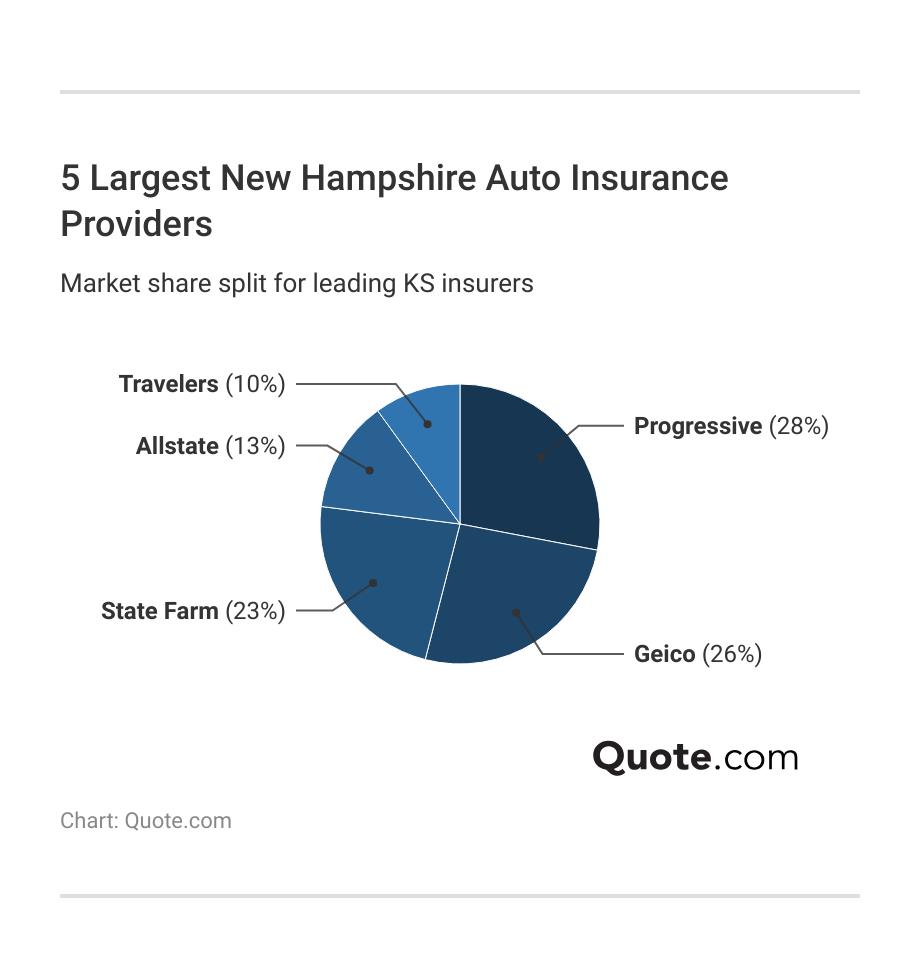

The Best New Hampshire Insurance Companies

For drivers in New Hampshire, knowing which insurers dominate the market can make shopping for coverage a lot easier.

Larger companies usually offer more competitive pricing since they can spread out costs and take on more customers.

That means lower premiums, better online tools, and reliable customer service for most policyholders.

Comparing quotes from these top insurers helps you find a plan that fits your budget while keeping you covered on the road.

#1 – Amica: Top Pick Overall

Pros

- Dividend Returns: Many policyholders in NH see up to 20% back through dividend policies, which meaningfully offsets long-term premium spend.

- Bundling Power: Pairing home and auto in NH can trim bills by about 30% when accounts stay claim-free. See more details in our Amica insurance review.

- Accident Forgiveness: The Platinum Choice package in NH adds first-accident forgiveness and a vanishing deductible that rewards safe streaks year after year.

Cons

- Telematics Ceiling: Usage-based savings in NH often cap near 20%, which trails programs that advertise 30% to 40% for cautious drivers.

- Availability Trade-Off: In rural NH, in-person service can feel limited, so most support flows through phone and digital channels.

#2 – Allstate: Best for Usage-Based Savings

Pros

- Drivewise Savings: Careful braking and lower miles in NH can unlock up to 40% with Drivewise, which steadily improves scores over months.

- New Car Replacement: Total a new vehicle in NH, and Allstate replaces it with a brand-new model of the same make and trim. Learn more in our Allstate insurance review.

- Deductible Rewards: Safe driving in NH earns $100 off the deductible each year, up to $500, which softens the sting of minor claims.

Cons

- Price Posture: Base premiums in NH often start 10% to 15% higher than bargain carriers, so discounts carry extra weight.

- App Dependency: Drivewise in NH lives and dies by your phone’s sensors, and rural stretches can skew trip data when signals fade.

#3 – Geico: Best for Cheap Rates

Pros

- Budget Pick: Minimum coverage in NH often starts near $36 per month, which keeps everyday commuting costs pleasantly predictable.

- MBI Coverage: Mechanical breakdown insurance in NH can extend protection to 7 years or 100,000 miles beyond a factory warranty. Learn more in our review of Geico insurance.

- Military Discounts: Eligible service members in NH commonly see double-digit discounts, and quick claim uploads speed direct reimbursements.

Cons

- Fewer Add-Ons: Highly customized endorsements can be harder to build with Geico car insurance in New Hampshire.

- Agent Access: Face-to-face support options in NH are sparse, so most shoppers rely on chat, phone, and the mobile app.

#4 – State Farm: Best for Claim Repairs

Pros

- Repair Certainty: The preferred shop network in NH emphasizes OEM parts options and workmanship guarantees that simplify post-accident logistics.

- Drive Safe & Save: Consistent, smooth driving in NH can earn telematics credits approaching 30%. Find insights in our State Farm auto insurance review.

- Bundling Stability: State Farm insurance in New Hampshire bundles policies and multi-line savings, often holding premiums steady over time.

Cons

- Feature Gaps: Some NH drivers want deeper app analytics and trip breakdowns than the current telematics view provides.

- Slower Claims: Extra verification steps in NH can slow complex losses, which feels cautious to some and meticulous to others.

#5 – Liberty Mutual: Best for Policy Discounts

Pros

- Anti-Theft Boost: Approved devices in NH can shave up to 35% from comprehensive, which is compelling for garaged vehicles and commuters.

- RightTrack Help: Usage-based tracking in NH commonly targets savings up to 30% for gentle acceleration, smooth turns, and calmer speeds.

- Bundle Flexibility: Home and auto combos in NH often reach around 25% in multi-policy credits. Learn more by reading our Liberty Mutual insurance review.

Cons

- Rate Level: Full coverage in NH often trends higher than bare-bones rivals, so shoppers should stack discounts to stay competitive.

- Rural Returns: RightTrack results in remote NH, which can fluctuate when trip data uploads lag, which can dampen expected credits.

#6 – Travelers: Best for Bundling Home & Auto

Pros

- Bundling Value: Pairing auto and home in NH can trim premiums around 13%. Find out more in our Travelers auto insurance review.

- Custom Add-Ons: Travelers lets NH drivers layer endorsements like gap coverage, accident forgiveness, roadside help, and full glass repairs.

- Usage-Based Help: IntelliDrive in NH can cut costs up to 30% for smooth braking, limited phone use, and consistent daylight commuting.

Cons

- Price Posture: Full coverage quotes in NH often land about 10–12% above lower-cost rivals before discounts apply.

- App Feel: Some NH drivers find the mobile experience dated, with slower claim uploads than newer telematics platforms.

#7 – Arbella: Best for Personalized Service

Pros

- Neighborhood Touch: Arbella’s NH footprint leans on nearby agents, giving small-town NH drivers clearer claims guidance. See how to file an auto insurance claim fast in NH.

- Safe-Driver Savings: Clean-record motorists in NH can see up to 25% off after defensive driving completion and multi-year violation-free streaks.

- Fast Resolutions: Local adjusters in NH often close straightforward claims within three to five business days, reducing downtime after fender benders.

Cons

- Limited Footprint: Arbella’s regional model means NH policyholders have fewer options if relocating beyond New England.

- Digital Gaps: The NH portal lacks deeper trip analytics and real-time claim maps that tech-forward competitors highlight.

#8 – The Hanover: Best for OEM Coverage

Pros

- Original Parts Replacement: The Hanover’s OEM parts endorsement in NH helps restore vehicles to pre-loss condition. See what our The Hanover insurance review reveals.

- Discount Stack: NH drivers can pair 20% bundling, 10% anti-theft, and 8% safe-driver credits for meaningful premium relief.

- Agent Access: A strong NH agent network streamlines estimates, shop scheduling, and paperwork when collisions derail plans.

Cons

- Rate Level: Full coverage with Hanover in NH often trends 8–10% higher than price leaders before applying discounts.

- App Simplicity: NH users report limited telematics detail, making it harder to coach habits for larger usage-based savings.

#9 – Farmers: Best for Tracking Claims

Pros

- Clear Claims Tracking: The claim portal in NH shows status, documents, and payout progress so drivers know exactly what happens next.

- Signal UBI Rewards: Farmers’ Signal in NH can reach up to 30% savings for gentle acceleration, fewer late-night trips, and minimal phone interaction.

- Coverage Add-On Variety: NH policies can add roadside, rental reimbursement, and new car replacement. Dive more into our Farmers insurance review.

Cons

- Higher Base: Farmers’ minimum coverage in NH often starts 5–10% above budget carriers until discounts stack.

- Eligibility Rules: Shared-vehicle setups in NH can limit Signal participation and reduce expected telematics credits.

#10 – Progressive: Best for Mobile Tools

Pros

- Convenient Mobile Tools: The Progressive insurance app delivers instant ID cards, quick claim photos, and side-by-side quote adjustments.

- Snapshot UBI Discounts: Safe drivers in New Hampshire often see double-digit discounts up to 30%. Learn how to sign up in our Progressive auto insurance review.

- Wide Discount Menu: Progressive insurance in New Hampshire allows drivers to combine multi-car, bundling, paid-in-full, and paperless to save extra.

Cons

- Variable Outcomes: Snapshot results in NH can raise premiums if you’re prone to hard braking and night driving.

- Less Face Time: Progressive’s NH model leans online, which may not suit drivers who prefer in-office agent conversations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting Auto Insurance in New Hampshire

Amica, Allstate, and Geico are the best auto insurance companies in New Hampshire. Amica is the top pick because it returns dividend payments to policyholders that can be applied to premiums.

Allstate’s Drivewise UBI rewards safe drivers in New Hampshire with a big 40% discount, while Geico keeps bills low with fast digital quotes and multi-policy savings (Read More: How to Get Multiple Auto Insurance Quotes).

Rates in New Hampshire shift by town, mileage, vehicle age, and driving record. Compare several quotes side by side and stack every discount you qualify for.

Daniel Walker Licensed Insurance Agent

Auto insurance in New Hampshire isn’t required, but drivers must prove that they can afford to repair damages out-of-pocket. It’s often cheaper to buy minimum coverage.

Use our free online comparison tools to see local options near you, bundle when it makes sense, and recheck prices after changes like moving or adding a driver to lower your New Hampshire car insurance quote.

Frequently Asked Questions

What is the best car insurance company in New Hampshire?

Which company provides the best car insurance? Amica has the best car insurance in NH, offering dividend-paying policies, accident forgiveness, and consistently high claims satisfaction scores.

Who has the cheapest car insurance in New Hampshire?

Geico offers the most affordable car insurance in New Hampshire, with minimum-coverage rates starting around $36 per month for many drivers. Find cheap car insurance in New Hampshire by entering your ZIP code into our free quote comparison tool.

What liability coverage do drivers need in New Hampshire?

Drivers who choose to buy auto insurance in NH must carry 25/50/25 liability coverage, which includes $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage.

Why does New Hampshire not require car insurance?

New Hampshire doesn’t require mandatory car insurance, but drivers must prove financial responsibility and cover damages if found at fault in an accident. Compare auto insurance rates by state to see how NH differs.

What percentage of New Hampshire drivers are uninsured?

Around 10% of NH drivers are uninsured, which is less than the national average of 12%.

What is Jessica’s Law in New Hampshire?

Jessica’s Law in New Hampshire requires drivers to clear snow and ice off their vehicles before driving to prevent road hazards and accidents.

Is Geico or Progressive car insurance better in New Hampshire?

Geico is generally better for New Hampshire drivers seeking low monthly premiums and fast digital service, while Progressive benefits those using telematics programs like Snapshot.

What is the average cost of auto insurance in New Hampshire?

The average cost of auto insurance in New Hampshire is around $36 per month for minimum coverage and $90 for full coverage. Get smart tips to pay less for car insurance and lower your monthly costs without reducing coverage.

Is New Hampshire the most expensive state for car insurance?

No, New Hampshire is actually one of the cheapest states for auto insurance, with an average minimum rate of $48 a month. Coverage is cheap because NH has fewer collision claims than other states.

What happens if the person at fault in an accident has no insurance in NH?

You will not be able to recover any damages from the person at fault in an accident. New Hampshire is a no-fault insurance state, meaning each individual driver is responsible for their own costs in an accident.

What are the big three car insurance companies in New Hampshire?

Who are the top five insurance companies in the U.S.?

Which auto insurance company is the most trusted in New Hampshire?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.