Finding the right short-term coverage can be challenging, especially when you only need protection for a limited time. However, there are plenty more providers who can meet your temporary needs.

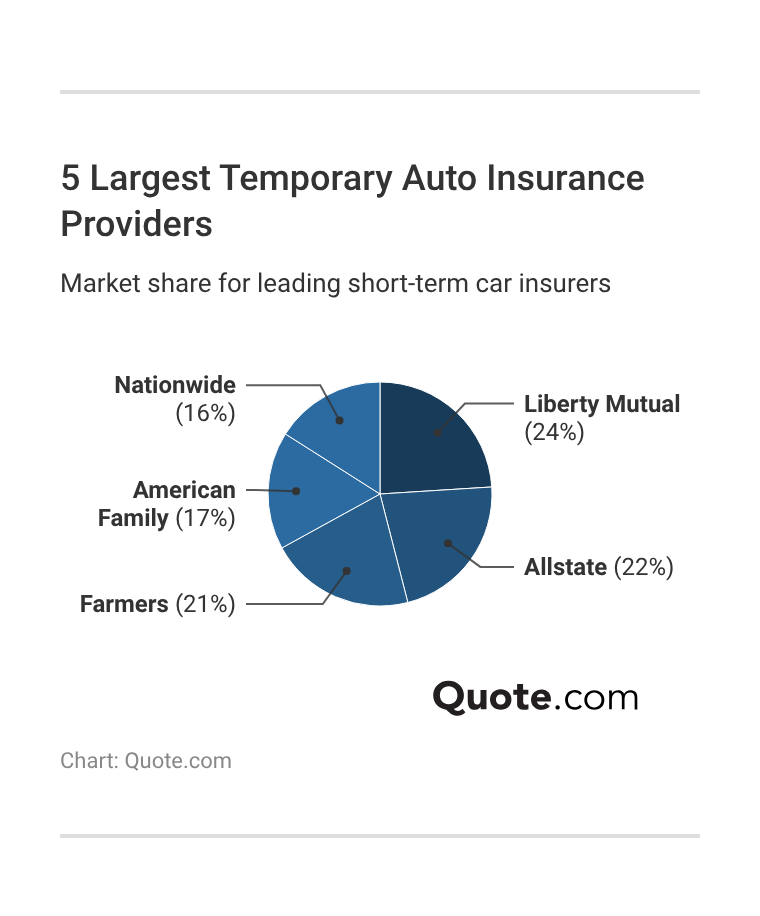

Leading our rankings are Erie Insurance, Liberty Mutual, and Nationwide, thanks to their dependable customer service, broad coverage options, and nationwide availability.

See More: Erie vs. Metlife Insurance Review