Cheap Same-Day Auto Insurance in 2026

Erie, Geico, and State Farm have the cheapest same-day auto insurance, with minimum rates from $32 per month. Nationwide makes it easy to buy online and pull up proof of insurance fast, while American Family works well when you want coverage that can start the same day and discounts to keep costs in check.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated December 2025

Erie, Geico, and State Farm offer the cheapest same-day auto insurance. You can get covered fast for $32 per month.

- Erie leads for the best cheap same-day car insurance

- Same-day auto insurance is faster with your VIN ready

- Low deductibles and full coverage can raise total costs

Erie is the top choice for excellent customer service, and Geico is perfect when you want instant auto insurance online and proof of insurance right away for cheap car insurance the same day.

State Farm makes sense if you’d rather have same-day help from a local agent while you set up your policy.

10 Best Companies: Cheapest Same-Day Auto Insurance| Company | Rank | Monthly Rates | Claims Satisfaction | Best for |

|---|---|---|---|---|

| #1 | $32 | 733 / 1,000 | Customer Service |

| #2 | $43 | 692 / 1,000 | Affordable Rates | |

| #3 | $47 | 710 / 1,000 | Safe Drivers | |

| #4 | $48 | 692 / 1,000 | Reliable Service | |

| #5 | $61 | 701 / 1,000 | Organization Discount |

| #6 | $62 | 692 / 1,000 | Family Coverage |

| #7 | $63 | 728 / 1,000 | Bundling Discounts | |

| #8 | $65 | 746 / 1,000 | Dividend Payments | |

| #9 | $76 | 706 / 1,000 | Accident Forgiveness | |

| #10 | $96 | 717/ 1,000 | Flexible Policies |

This guide breaks down how same-day auto insurance works, which discounts are worth checking, and how to compare coverage so you can get car insurance fast without overpaying.

Compare the cheapest car insurance and get instant auto insurance quotes online using our free comparison tool.

Comparing Same-Day Car Insurance Rates

The cost of same-day auto insurance depends on your coverage needs and timing. Erie is the cheapest option for both full and minimum coverage.

Depending on the type of auto insurance, minimum coverage has lower rates but only covers the basics, while higher rates include more coverage and extras like roadside assistance.

Same-Day Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $166 |

| $65 | $215 | |

| $48 | $124 | |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $47 | $123 | |

| $61 | $161 |

It’s really about finding the right balance between saving money and getting fast coverage when you need it. For instance, cheap one-day auto insurance is great for short-term or temporary protection.

Understanding what each price range offers helps you choose instant cheap car insurance, a same-day policy that fits your budget and still gives you confidence every time you drive.

It always pays to shop around before buying full coverage. Getting quotes from at least three insurers can help you spot deals you might’ve missed.

Jeff Root Licensed Insurance Agent

When you start comparing options, you’ll notice that each company has its own way of calculating rates and handling claims.

Some focus on quick, affordable coverage you can activate in minutes, while others charge more for direct-to-agent service or added features for stronger protection.

Same-Day Insurance Costs in Your State

Where you live has a big impact on the cost of same-day auto insurance. If you’re trying to find the cheapest same-day auto insurance in California, just know you’ll be paying higher rates than drivers in inland states like Iowa and Arkansas.

Busy states with more traffic or accidents usually have higher premiums. City drivers typically face higher rates due to busier roads, more claims, and steeper repair costs, while rural drivers often pay less.

Location also plays a part when comparing same-day coverage options. State insurance laws can dictate how quickly drivers can get coverage, and which factors providers can use to set rates.

Compare auto insurance companies to find the best deal in your state so you can choose a same-day insurance plan that’s both affordable and reliable, and buy instant car insurance online.

How Age Shapes Same-Day Car Insurance Rates

Age affects what you’ll pay for same-day auto insurance. Younger drivers usually pay more, while experienced drivers often get lower rates.

Drivers under 25 are often ineligible for cheap same-day car insurance with no deposit since they lack insurance history, so shop around for the most affordable option near you.

Same-Day Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $253 | $78 | $73 | $62 |

| $291 | $81 | $76 | $65 | |

| $223 | $60 | $55 | $48 | |

| $116 | $38 | $35 | $32 |

| $387 | $98 | $91 | $76 | |

| $153 | $50 | $46 | $43 | |

| $398 | $119 | $110 | $96 |

| $239 | $81 | $76 | $63 | |

| $178 | $60 | $56 | $47 | |

| $288 | $77 | $72 | $61 |

The price of a same-day car insurance policy really comes down to experience and consistency. Newer drivers might start off paying more, but staying safe on the road can help lower rates over time.

Older drivers usually enjoy lower costs and faster approval for same-day coverage, and the best car insurance companies make it even easier to get insured without spending too much and buy cheap auto insurance online instantly.

How Your Record Affects Same-Day Insurance Costs

If you have accidents or claims on your record, expect to pay more for same-day coverage. Insurers review your driving history to measure risk, so even a single ticket or accident can lead to higher rates.

High-risk drivers will have trouble finding cheap same-day auto insurance with no waiting period because of their record. Companies will take longer to check their history and calculate premiums.

Same-Day Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $62 | $94 | $104 | $73 |

| $65 | $99 | $123 | $81 | |

| $48 | $69 | $72 | $57 | |

| $32 | $45 | $60 | $38 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $47 | $57 | $65 | $53 | |

| $61 | $89 | $93 | $74 |

The good news is that higher rates don’t last forever. Erie and State Farm have the cheapest same-day auto insurance for high-risk drivers, but many insurers offer forgiveness programs or discounts for safe-driving courses.

Using insurance comparison sites can make it easier to find affordable same-day coverage and choose a plan that fits your budget, even if you’ve had a claim or speeding ticket recently.

Your Credit Affects Same-Day Insurance Pricing

Your credit score not only impacts premiums but also determines whether you can get cheap same-day car insurance with no down payments.

Insurers consider how reliable you are with payments. Drivers with strong credit usually get lower rates and faster approval, while those with lower scores may see slightly higher prices.

Same-Day Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $62 | $68 | $84 | $118 |

| $65 | $72 | $88 | $124 | |

| $48 | $53 | $65 | $91 | |

| $32 | $35 | $43 | $61 |

| $76 | $84 | $103 | $144 | |

| $43 | $47 | $58 | $82 | |

| $96 | $106 | $129 | $182 |

| $63 | $69 | $85 | $120 | |

| $47 | $52 | $63 | $89 | |

| $61 | $67 | $82 | $116 |

Before you buy auto insurance, compare rates from Erie, Geico, and State Farm. They offer the cheapest same-day auto insurance to drivers with fair or poor credit scores.

If your credit isn’t great, you can still find affordable same-day insurance. Make on-time payments, keep your balances down, and shop around for quotes.

Bad credit doesn’t have to lock you into high insurance rates. In particular, improving payment habits can slowly lower your premium.

Michelle Robbins Licensed Insurance Agent

Some insurers focus more on your driving record than your credit, giving you a better shot at a reasonable rate.

Understanding how credit ties into your premium makes it easier to plan and find a same-day auto insurance policy that works for you, including instant auto insurance with no down payment.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Picking Out Same-Day Insurance Coverage

Choosing the right coverage is one of the most important parts of buying cheap same-day auto insurance, especially if you want solid protection at a fair price and same-day car insurance online with no waiting period.

Most same-day policies start with liability coverage, which is required in most states and covers injuries or property damage you might cause to others in an accident.

If you have an auto loan or lease, add collision coverage for accident repairs and comprehensive coverage for theft, vandalism, or weather damage. Consider adding UM/UIM coverage so you’re protected if you’re hit by a driver who doesn’t carry enough insurance.

Some drivers add personal injury protection (PIP) or medical payments coverage to help with medical bills after an accident, no matter who’s at fault.

Easy Ways to Save on Same-Day Insurance

Getting cheap same-day auto insurance is simple. Insurers often give better rates to safe, low-mileage drivers or those who bundle policies.

These savings show how insurers reward responsible driving and customer loyalty with lower monthly costs. Understanding how these discounts work can help you spot the best ways to save before you buy coverage.

Top Auto Insurance Discounts by Savings Potential| Company | Bundling | Good Driver | Low Mileage | Usage-Based |

|---|---|---|---|---|

| 25% | 25% | 20% | 20% |

| 30% | 25% | 25% | 20% | |

| 16% | 25% | 30% | 30% | |

| 25% | 23% | 30% | 30% |

| 20% | 30% | 10% | 30% | |

| 25% | 26% | 30% | 25% | |

| 25% | 20% | 30% | 30% |

| 20% | 40% | 40% | 40% | |

| 17% | 25% | 30% | 30% | |

| 5% | 15% | 10% | 20% |

Each discount ties to everyday driving habits that help you save. Driving less, staying safe, and bundling policies can all lower your same-day auto insurance rates while keeping solid coverage within budget.

Saving on cheap same-day auto insurance isn’t just about grabbing discounts. There are plenty of smart ways to cut costs that many drivers don’t even think about when looking for same-day insurance online.

- Bundle Your Coverage: If you already have a home or renters policy, adding your same-day auto insurance can score you an instant price break.

- Renew Early: Securing your same-day policy before your current one expires can help you avoid last-minute renewal fees.

- Set Up Automatic Payments: Enrolling in autopay can earn a small discount and keep you from missing payments that could raise your rate later.

- Try Usage-Based Programs: Driving apps or pay-per-mile plans track your habits, and safe drivers often see their rates drop quickly.

- Update Your Driving Habits: If you have started driving less or working from home, let your insurer know to see if you qualify for a lower rate.

Saving on same-day auto insurance means staying proactive. Making small changes to your policy can lower your rate while keeping the coverage you need.

Keep your info up to date, explore savings programs, and ask your insurer about ways to lower your rate so you can save money on auto insurance every month.

The Cheapest Same-Day Insurance Providers

Instead of waiting days for approval, drivers can now compare same-day car insurance, customize their plans, and get proof of insurance in just a few minutes. Learn more in our auto insurance guide.

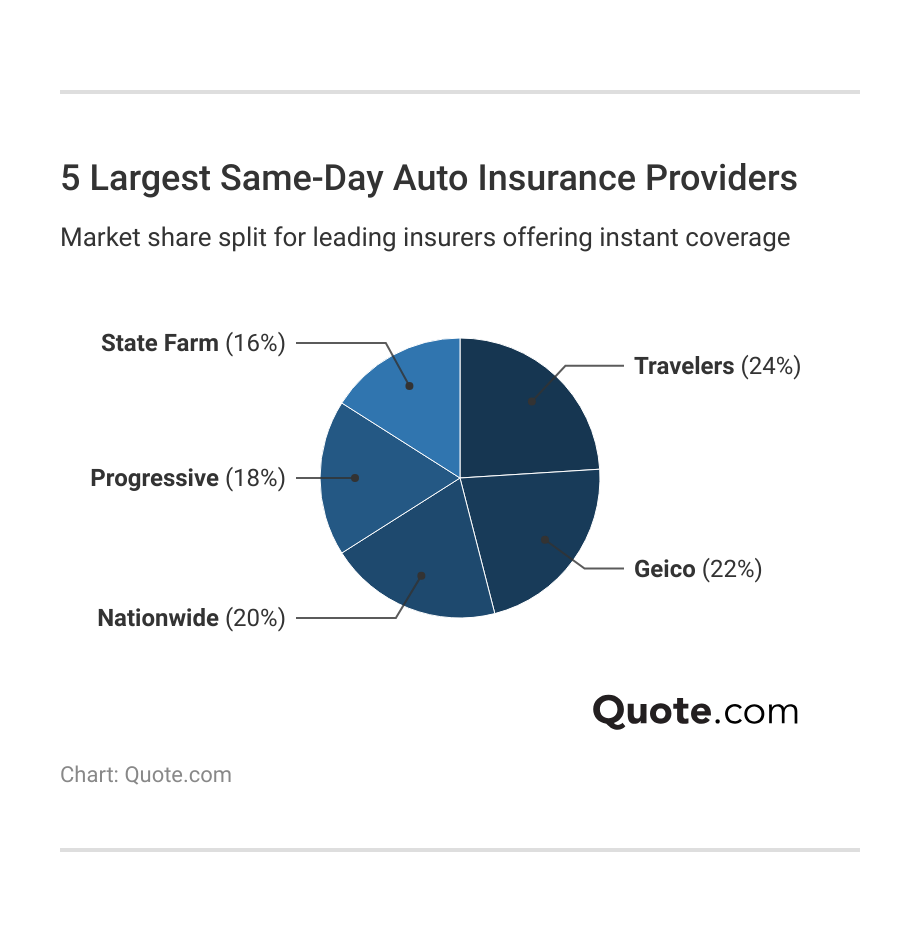

Many insurers are making it easier to get instant auto insurance online, but Geico and State Farm are among the most popular for their cheap rates and national reach.

Travelers, Progressive, and Nationwide are also available throughout the country in almost every state, but Erie only sells coverage in 12 states, which is why you won’t see it on this graph.

However, it could still be the cheapest same-day auto insurance near you. Compare the top ten companies with the lowest rates to get the best price on your coverage.

#1 – Erie: Top Pick Overall

Pros

- Claims Satisfaction Support: With a 733/1,000 claims satisfaction score, Erie shows strong service when same-day auto insurance is needed after purchase.

- Cheapest Monthly Rate: The $32 per month rate supports cheap same-day auto insurance for drivers trying to start coverage fast.

- Strong Financial Stability: Our Erie Insurance review highlights its A+ A.M. Best rating and reliable support for same-day claims payouts.

Cons

- Fewer Instant Discounts: Erie doesn’t offer many digital discounts, meaning you might need to call an agent to apply savings before starting same-day auto insurance.

- Basic Online Tools: Limited digital tools can make same-day policy activation slower than online competitors.

#2 – Geico: Best for Affordable Rates

Pros

- Affordability Focus: With an average monthly rate of $43, Geico ranks among the lowest-priced carriers for same-day auto insurance.

- Fast Online Enrollment: Drivers can purchase coverage and download same-day proof of insurance within minutes, according to the Geico insurance review.

- Multiple Discounts: Eligible customers can benefit from the multi-vehicle, good driver, and defensive driving discounts for additional savings.

Cons

- Average Claims Score: With a 692/1,000 rating, Geico’s claims satisfaction shows room for improvement for drivers needing help after activating auto insurance.

- Limited Agent Assistance: Same-day support is mostly online, but Geico same-day car insurance offers quick digital tools for convenience.

#3 – State Farm: Best for Safe Drivers

Pros

- Safe Driver Rewards: With programs like Drive Safe & Save and Steer Clear, State Farm helps drivers lower their premiums when applying for same-day auto insurance.

- Reliable Claims Record: Scoring 710 out of 1,000 for claims satisfaction, State Farm is known for handling claims quickly after same-day activation.

- Agent Accessibility: Over 19,000 local agents can help finalize coverage and issue proof of insurance the same day, according to the State Farm insurance review.

Cons

- Slower Online Process: Setting up same-day auto insurance can take longer, since most applications go through local agents rather than receiving instant digital approval.

- Limited After-Hours Access: Same-day auto insurance purchases made outside business hours may not activate until an agent confirms your policy.

#4 – Auto-Owners: Best for Reliable Service

Pros

- Trusted Reliability: With an A++ rating from A.M. Best, Auto-Owners is known for dependable help when you need same-day insurance.

- Competitive Monthly Cost: At around $48 a month, Auto-Owners keeps its cheap, same-day auto insurance pretty affordable and not too far off from the lowest-priced options.

- Strong Agent Network: Local agents make it easy to wrap up paperwork and get proof of insurance so you’re covered the same day.

Cons

- Manual Purchase Process: You’ll usually need to work with an agent to set up same-day auto insurance, which can take a little longer.

- Limited State Coverage: Availability depends on where you live, and the Auto-Owners insurance review notes that same-day auto insurance isn’t offered everywhere.

#5 – The Hartford: Best for Organization Discount

Pros

- Exclusive Group Savings: Members of AARP and other partner organizations can save up to 20% on same-day auto insurance policies.

- Good Claims Support: A 701/1,000 satisfaction score highlights reliable claims service for customers who activate coverage immediately.

- Extra Protection Options: Features like accident forgiveness and lifetime renewability add extra peace of mind for same-day policyholders.

Cons

- Limited Online Tools: The Hartford’s website and app aren’t the most modern, so setting up same-day auto insurance can take a little longer.

- Eligibility Requirements: Discounts depend on verified memberships, and the Hartford insurance review notes this can limit access for some drivers.

#6 – American Family: Best for Family Coverage

Pros

- Family-Focused Plans: American Family makes it easy for households to bundle drivers and vehicles into a single-day auto insurance policy.

- Reasonable Pricing: At about $62 a month, American Family is an excellent pick for families who want affordable same-day coverage without sacrificing solid protection.

- Safe Driving Incentives: Programs like KnowYourDrive offer real-time rewards for cautious drivers after same-day activation.

Cons

- Average Claims Rating: A 692/1,000 satisfaction score places it below higher-rated carriers.

- Slower Policy Setup: Some states require agent involvement, and the American Family insurance review notes this can delay same-day issuance for certain drivers.

#7 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Power: When you bundle your auto and home insurance with Nationwide, you can save up to 20% on same-day auto insurance.

- Strong Financial Standing: Backed by an A+ rating from A.M. Best, Nationwide gives you reliable support and fast help with same-day claims.

- Good Claims Performance: Earning a 728 out of 1,000 in claims satisfaction, customers say Nationwide delivers dependable service once coverage kicks in.

Cons

- Bundle Dependence: Discounts mostly apply only when you bundle multiple policies together, according to the Nationwide Insurance review.

- Rate Fluctuation: Pricing for same-day auto insurance can vary widely by ZIP code and driving record.

#8 – Amica: Best for Dividend Payments

Pros

- Dividend Advantage: With Amica, you might earn up to 20% back in dividends, helping lower your overall same-day auto insurance costs over time.

- Excellent Claims Record: Scoring 746 out of 1,000 in customer satisfaction, Amica is well-known for smooth, stress-free service after you buy your policy.

- Strong Financial Foundation: Backed by an A+ rating from A.M. Best, Amica gives you reliable support for same-day claims and long-term coverage.

Cons

- Higher Cost: Monthly rates for same-day auto insurance start at around $65, which is higher than what some competitors charge.

- Dividend Variability: Same-day auto insurance payouts depend on the company’s performance, and the Amica insurance review notes they may vary from year to year.

#9 – Farmers: Best for Accident Forgiveness

Pros

- Forgiveness Feature: The accident forgiveness program prevents rate increases after the first at-fault accident for same-day policyholders.

- Good Claims Support: A 706/1,000 rating demonstrates solid same-day claims handling and assistance, according to the Farmers Insurance review.

- Comprehensive Coverage Choices: Optional add-ons such as rideshare insurance and new car replacement improve protection for same-day customers.

Cons

- Above Average Cost: The $76 monthly rate is less competitive than those of other cheap same-day auto insurance providers.

- State Restrictions: Some features are not available in all locations, affecting same-day auto insurance eligibility.

#10 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Customization: Liberty Mutual lets you personalize same-day auto insurance with add-ons like accident forgiveness, deductible fund, and new car replacement.

- Solid Claims Satisfaction: Scoring 717 out of 1,000, Liberty Mutual has a good track record for handling claims quickly and keeping things hassle-free.

- Financial Strength: With an A rating from A.M. Best, you can count on Liberty Mutual for dependable same-day coverage when you need it.

Cons

- Highest Price Point: At around $96 a month, Liberty Mutual is on the higher end for same-day auto insurance.

- Add-On Costs: Those extra features can add up fast, and the Liberty Mutual insurance review notes they can make same-day coverage a little pricier than expected.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Same-Day Car Insurance Online

If you need cheap same-day auto insurance, shop with Erie, Geico, and State Farm for low rates, simple online tools, and helpful support.

You can get even cheaper same-day rates by keeping a clean driving record, picking a higher deductible, and joining a low-mileage program.

It also helps to check your policy every now and then and drop any extras you don’t actually need, so you’re not overpaying. Read our guide for more tips to pay less for car insurance.

If you’re searching for cheap same-day car insurance near me, compare quotes online. The best same-day auto insurance companies make it easy to handle everything from your phone while still offering solid support when you need it.

To get started, enter your ZIP code and explore while comparing the best rates in your area today. Choose coverage that matches your budget and driving needs, and look for added savings like bundling and autopay discounts.

Frequently Asked Questions

Can you get same-day auto insurance online?

Yes, many major insurers, like Geico, Progressive, and State Farm, let you buy and activate car insurance online the same day. Once you submit your driver and vehicle details, you can pay and download your proof of insurance instantly, making it ideal for same-day car purchases or renewing expired coverage.

Does Geico offer same-day coverage?

Yes, Geico offers same-day car insurance through its website and mobile app. Drivers can complete a quick online quote, adjust their coverage limits, and instantly get digital proof of insurance, which is especially useful if you need immediate protection to drive a new or used vehicle off the lot.

Does State Farm offer same-day insurance?

Yes, State Farm offers same-day insurance through local agents and its online portal. Agents can issue proof of coverage within minutes, and the ultimate insurance cheat sheet can help you find the best same-day rates.

Is one-day car insurance legit?

Yes, one-day car insurance is legitimate when purchased from licensed short-term insurers like Hugo or Cuvva. It’s designed for temporary needs such as borrowing a friend’s car, test driving a vehicle, or using a rental for just a few hours, providing legal, short-term protection.

Is there any insurance that starts immediately?

Yes, most major providers offer immediate-start policies when you buy online. After entering your information and making payment, your policy begins right away, and you can access your digital ID card, making it perfect for same-day driving requirements.

What is the highest fine for driving without insurance?

Penalties vary by state, ranging from $300 to $5,000. In California, fines can reach $1,000, so comparing auto insurance companies in California helps you find affordable same-day coverage and avoid penalties.

How does instant car insurance work?

Instant car insurance allows drivers to apply, pay, and receive proof of coverage online in just minutes. Insurers use real-time data to verify driver information, issue digital ID cards, and activate coverage immediately upon payment, ensuring there are no coverage gaps.

Is one-day insurance worth it?

Yes, one-day insurance can be worth it if you only need short-term coverage, like borrowing a car for a move or test drive. It’s cost-effective since you only pay for the hours or days you need coverage rather than committing to a full monthly policy.

Does a credit score affect same-day car insurance?

Yes, your credit score impacts same-day car insurance rates. Insurers use it as a financial risk indicator, meaning drivers with good credit often get lower premiums. Checking auto insurance rates by state helps you see how your credit score impacts pricing.

Is same-day insurance cheaper than adding someone as a named driver?

Not always. Adding a named driver is usually cheaper for long-term use, while same-day insurance is better for short-term or one-time needs. For example, a one-day policy may be better for borrowing a car, while adding a driver makes sense for family members using your car regularly.

How can you lower same-day insurance rates?

What is covered by a same-day car insurance policy?

What do you need to apply for same-day auto insurance?

Can you take out a daily car insurance policy on different vehicles?

Can you get three-day car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.