How to Buy Auto Insurance Online in 2026

Minimum coverage starts at $49 a month, so learn how to buy auto insurance online by gathering driver and vehicle details and comparing quotes from multiple insurers to find a better price. Learning how to compare auto insurance companies side-by-side can help you avoid overpaying for coverage you don’t need.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated February 2026

Find out how to buy auto insurance online and get covered for as low as $49 per month when you compare insurers, coverage levels, and discounts the right way.

- Buy auto insurance online by entering vehicle details and ZIP code

- Compare insurers to see how coverage limits and deductibles change rates

- Apply discounts before checkout to cut costs and avoid extra coverage

To shop for auto insurance online, collect your driver’s license and vehicle information. Research your state’s minimum requirements, examine coverage choices, and watch how the prices shift with different limits and deductibles. Read More: How to Buy Auto Insurance

Use this guide to learn how to get multiple insurance quotes in order to spot savings opportunities and avoid common mistakes that lead to higher costs or gaps in protection.

Get auto insurance without an agent by entering your ZIP code and comparing quotes for free.

How to Buy Car Insurance Online

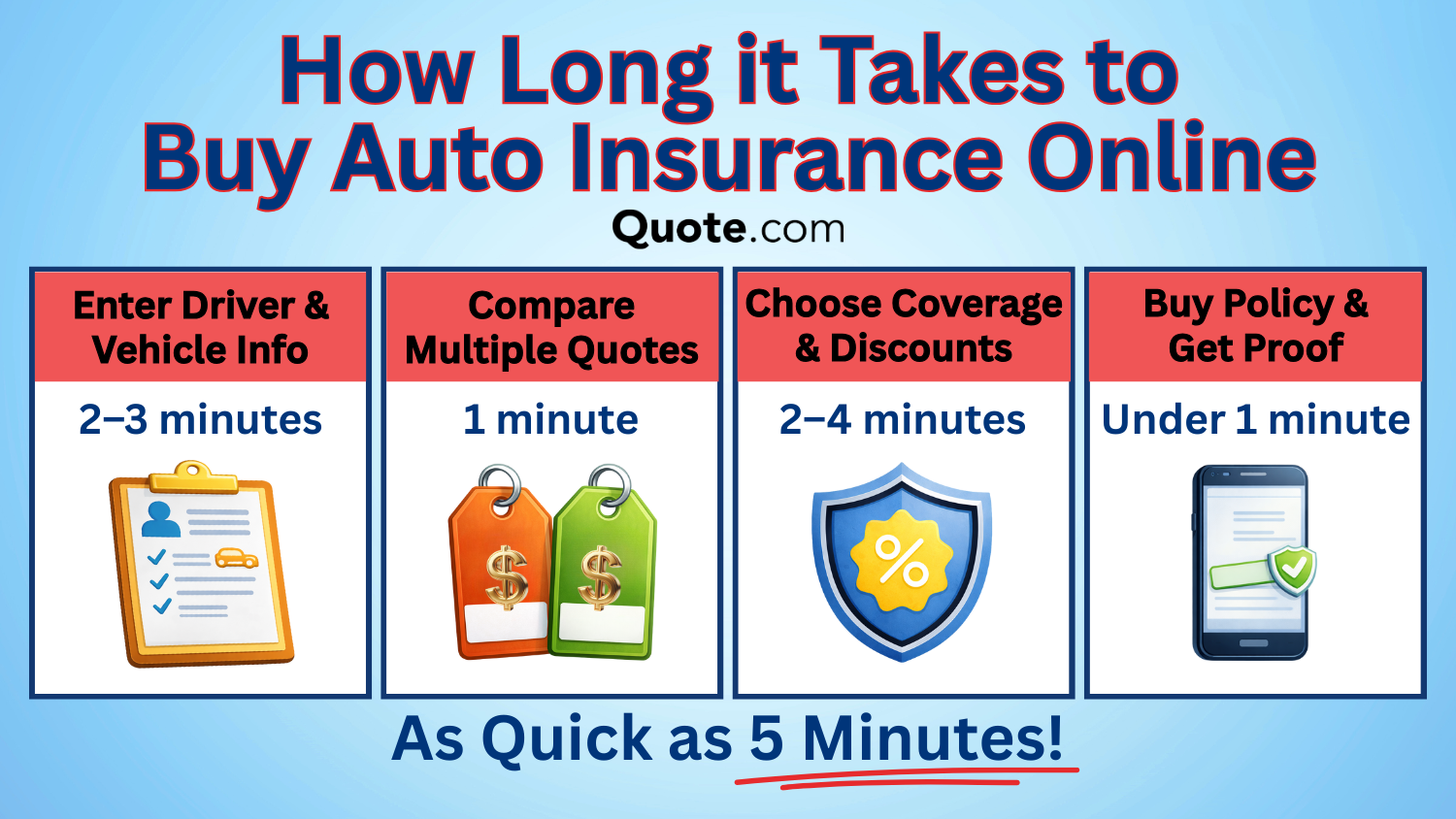

Wondering how to buy auto insurance online without overcomplicating the process? Most shoppers start by gathering basic driver and vehicle details, then use an insurance comparison website to see real prices from multiple insurers at once.

This helps you buy auto insurance online instantly and get free car insurance quotes from top companies.

How to Buy Auto Insurance Online| Step | What to Do | Why it Matters |

|---|---|---|

| #1 | Gather driver and vehicle info | Ensures accurate quotes |

| #2 | Enter details into quote tool | Generates real pricing |

| #3 | Compare quotes from insurers | Confirms best available rate |

| #4 | Choose coverage & deductibles | Sets legal coverage limits |

| #5 | Apply any available discounts | Applies eligible savings |

| #6 | Buy chosen coverage online | Activates insurance policy |

Seeing quotes next to each other helps identify differences in rates based on coverage limits, deductibles, discounts, and more.

Minimum coverage rates can start around $49 per month, but costs shift based on factors like driving history, credit profile in some states, and how much coverage you choose.

Reviewing options carefully helps you avoid paying for coverage you don’t need while still meeting the auto insurance requirements by state.

Spending a few more minutes reviewing before you check out can almost always yield better pricing and save money and surprises later after the policy is effective.

Step #1: Gather Details

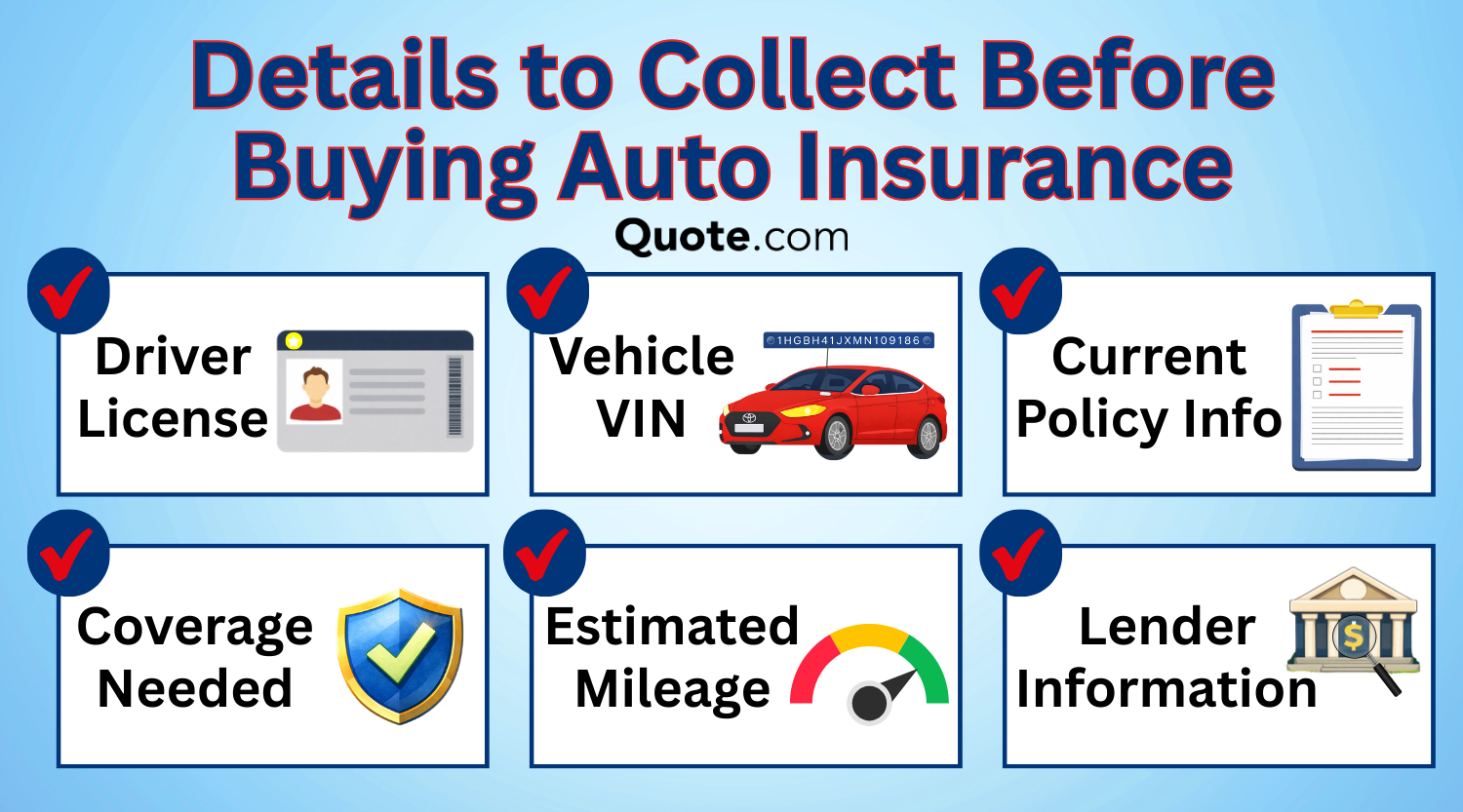

Before you compare quotes, learn how to buy auto insurance online by collecting the key information insurers use to set real prices.

This includes information from your driver’s license, VIN, estimated annual mileage, current policy information, coverage needs, and any lender or lease requirements.

Insurers use this information to assess risk, apply discounts, and confirm eligibility, which is why each item is needed to avoid delays or surprise rate increases.

The more details you can provide, the more accurate your pricing will be. You can see how your quote compares with the average cost of auto insurance, which starts at $49 a month for minimum coverage.

Step #2: Enter Information

Once you have collected your details, enter that information into a quote tool and see prices from multiple insurers at the same time.

Adjust your vehicle usage, coverage limits, and insurance deductibles to see how pricing changes based on how you actually drive and the policy you need.

Match coverage limits and deductibles across quotes, and choose a policy that fits your state requirements. Apply discounts last to lock in the best price.

Jeff Root Licensed Insurance Agent

Small adjustments in those fields can make a significant difference in rates, so researching coverage needs ahead of time is important.

After you enter your details, the information will turn into side-by-side quotes, making it easier to compare options and choose the best company.

Step #3: Compare Quotes

Comparing quotes is a key aspect of buying auto insurance online. Side-by-side comparisons help narrow options before choosing a policy that fits both your budget and coverage needs.

This makes it easier to spot which companies charge more for full coverage auto insurance, which reward safe drivers, and which include discounts upfront, so you can compare auto insurance rates with confidence.

Matching quotes based on the same liability limits, deductibles, and add-ons helps you compare true price differences rather than falling for deceptively low offers.

It doesn’t take long to get free car insurance quotes online, and it’s recommended even if you prefer to buy from an agent. Having quotes on hand can help you negotiate a more competitive premium.

Step #4: Choose Coverage

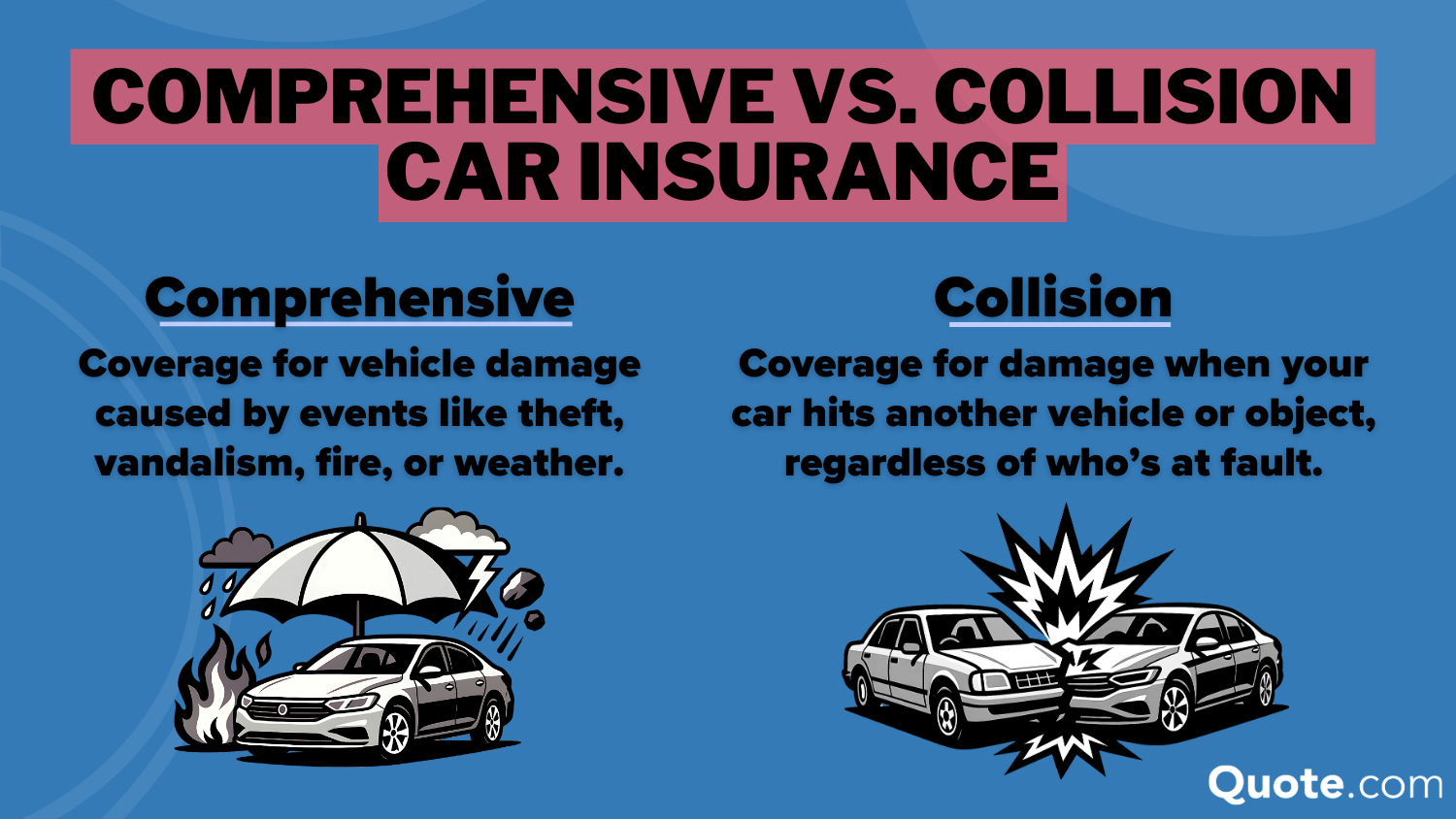

Choosing coverage and deductibles is a key part of buying auto insurance online. It determines both your legal ability to drive and what you pay out of pocket after a claim.

Minimum coverage includes liability limits that satisfy state requirements. It can also include MedPay, PIP, or UM/UIM if your state laws require it, which will raise your quotes.

Types of Auto Insurance Coverage| Policy Type | What it Covers | Scenario |

|---|---|---|

| Collision | Damage to your vehicle | You hit a pole |

| Comprehensive | Theft or non-crash damage | Storm damages your car |

| Gap Insurance | Loan balance after total loss | Car totaled, loan remains |

| Liability | Damage or injuries you cause | You hit another car |

| Medical Payments | Medical costs for passengers | Passenger needs ER care |

| Personal Injury Protection | Medical bills and lost income | You’re injured in a crash |

| Rental Reimbursement | Rental car while repairing | You need a rental car |

| Rideshare Coverage | Accidents during rideshare use | Waiting for a ride request |

| Roadside Assistance | Towing or roadside help | Car won’t start on roadside |

| Underinsured Motorist | Costs beyond other limits | Other policy limits too low |

| Uninsured Motorist | Injuries from uninsured drivers | Uninsured driver hits you |

Other types of coverage, such as collision or comprehensive auto insurance, use deductibles to determine how repairs are covered. Premiums tend to be lower with higher deductibles, but protection is broader, and cost is higher.

Only comprehensive and collision policies come with deductibles. Minimum coverage is cheaper because it doesn’t include these two policy types.

If you want to lower your monthly bill, change your deductible carefully and recheck the quote before you buy.

Always ensure you’re comparing quotes for the right coverage you need so you don’t end up with an insufficient policy.

Step #5: Apply Discounts

Discounts are essentially your very last chance to reduce your final price before buying auto insurance online. Minor tweaks can lower premiums without sacrificing necessary coverage.

Take a look at the car insurance discounts you can’t miss before checking out. The biggest savings usually come from bundling auto with home or renters insurance.

Step #6: Buy Policy

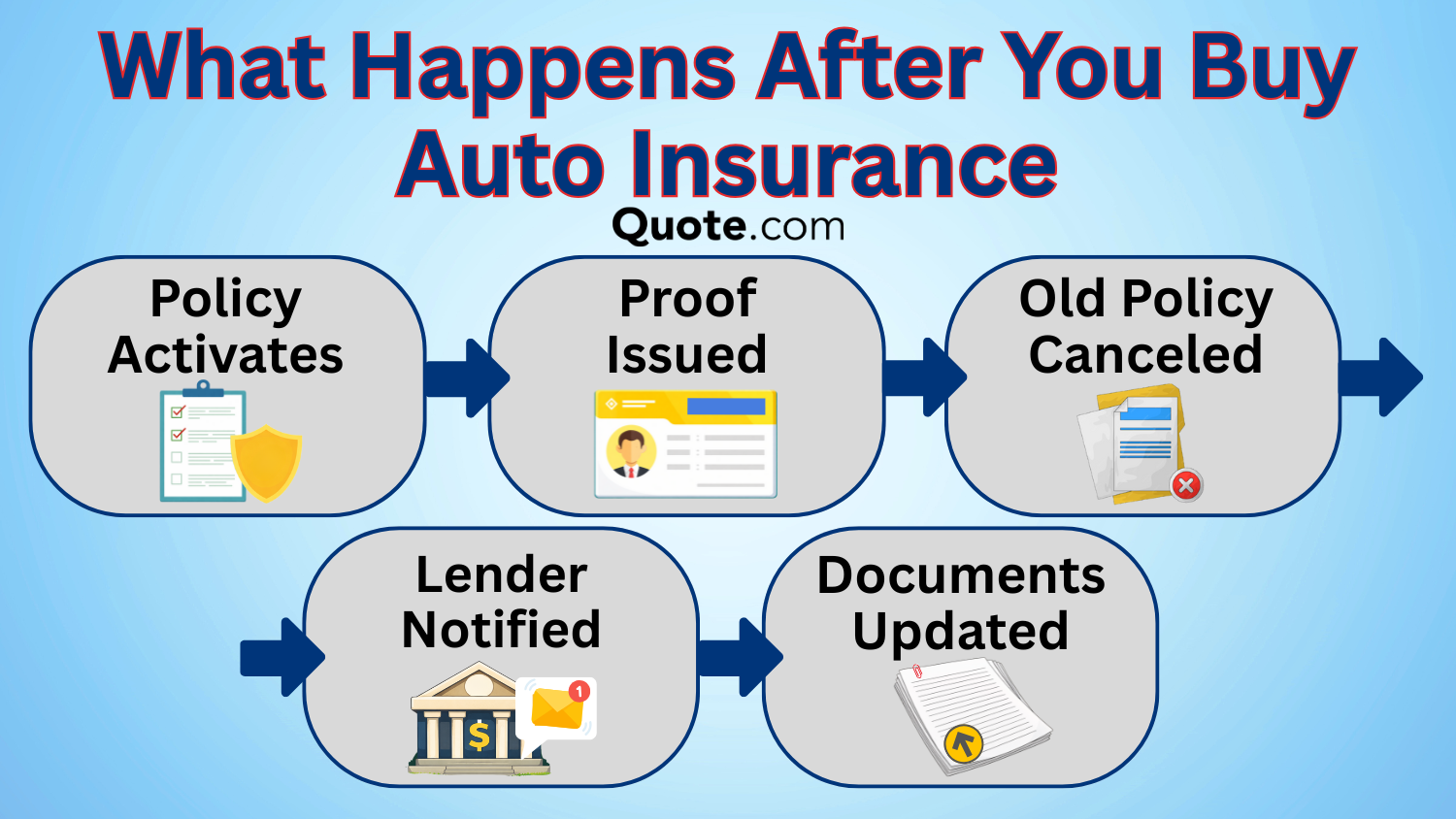

Finishing the purchase is the last step in how to buy auto insurance online. Review and confirm your policy details, including deductibles and applied discounts, before selecting a payment method.

Coverage will start taking effect as soon as your payment is processed or on your chosen effective start date.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $147 |

| $78 | $175 | |

| $74 | $172 | |

| $55 | $126 | |

| $82 | $186 |

| $64 | $151 | |

| $71 | $166 | |

| $59 | $133 | |

| $70 | $160 | |

| $49 | $112 |

You want your new policy to start on the same day your old one ends, so you aren’t caught driving without auto insurance.

Finalizing the policy ensures coverage starts on time, satisfies state requirements, and prevents gaps that could leave you uninsured.

After submitting everything, insurers usually send proof of insurance immediately by email or through an app.

Many insurers use digital proof of insurance, but you can request a paper insurance card through the mail once you buy coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Popular Online Auto Insurance Companies

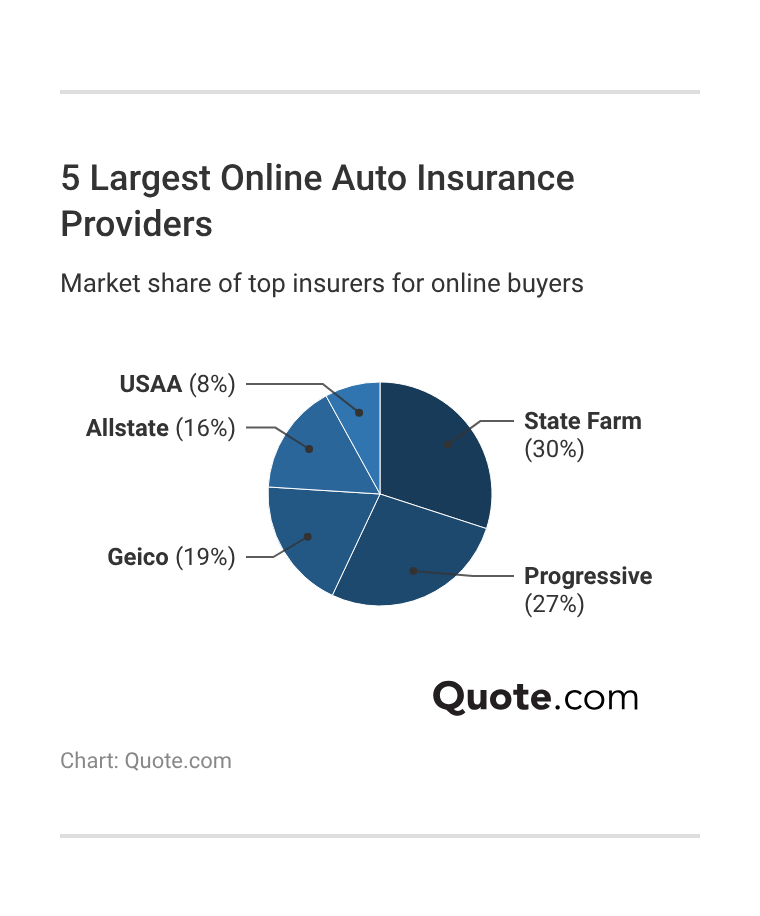

Shopping online for auto insurance tends to focus on a few well-known companies. State Farm and Progressive attract the most shoppers before purchase. Read More: Progressive vs. State Farm Auto Insurance

USAA, Geico, and Allstate are also popular options due to their easy-to-use online tools, broad coverage options, and established reputations for claims handling.

USAA and State Farm, in particular, are some of the best auto insurance companies for claims handling, while Geico and Progressive make it easy to get auto insurance online instantly through their mobile apps.

Seeing how buyers are spread across these providers helps put comparisons into context and underscores why checking multiple companies often leads to better choices.

Saving Money With Online Car Insurance

Cutting the cost of auto insurance is a smart way to save some money, and most of us are always on the lookout for ways to save.

Bundling auto with home or renters can unlock multi-policy discounts, and comparing quotes helps you find the best auto and home insurance bundles with the lowest price for the same coverage.

Ways to Save Money When Buying Auto Insurance| Action to Take | Why it Works |

|---|---|

| Bundle auto with home or renters | Unlock multi-policy discounts |

| Compare quotes from insurers | Find the most affordable rates |

| Keep credit in good standing | Affects pricing in many states |

| Raise your deductible amount | Lowers monthly premiums |

| Review coverage every six months | Accounts for life changes |

| Use a driving monitoring program | Rewards safe driving habits |

If you increase your deductible, you can lower what you pay each month, provided you can afford the extra out-of-pocket expense at claim time.

Reviewing your coverage every six months helps you adjust for life changes like a new commute or a paid-off car, and a driving monitoring program can reward safe habits with additional savings.

What to Avoid When You Buy Insurance Online

A lot of people overpay or end up underinsured because they make a few common mistakes when buying auto insurance online.

Choosing minimum coverage can leave you short when repair bills or medical costs hit, and ignoring coverage details often creates gaps you don’t notice until you file an auto insurance claim.

Common Mistakes When Buying Auto Insurance| What to Avoid | Risk Involved |

|---|---|

| Choosing minimum coverage | Leave you underinsured |

| Ignoring coverage details | Cause coverage gaps |

| Overlooking policy discounts | Miss available discounts |

| Rushing final purchase | Lead to poor decisions |

| Setting deductibles too low | Raise monthly premiums |

| Skipping quote comparisons | Miss lower-priced options |

You can also overlook ways to save if you don’t consider policy discounts that could apply to your driving habits or vehicle features.

Rushing the final purchase can lead to poor decisions, like picking a deductible that’s too low and drives up your monthly premium.

The easiest way to save is to compare quotes with matching coverage limits, raise the deductible if the budget allows, and apply every discount before checkout to avoid overpaying.

Melanie Musson Published Insurance Expert

Skipping quote comparisons is another big one, since it can keep you from finding lower-priced options for the same coverage.

Always take your time and review all of your quotes before making a decision so you don’t end up overpaying or driving underinsured.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buy Auto Insurance Online Today

Buying auto insurance online works best when you remain focused on the fundamentals. Enter your driver and vehicle information, compare similar coverage quotes from multiple companies, and select the limits and deductibles that are best for you.

Minimum rates can start around $49 per month, but your price still changes based on the insurer, coverage level, and your driving profile, which is why an auto insurance guide helps you compare options the right way.

Use every discount you are eligible for before checkout, and review the policy details to avoid gaps in coverage. This method keeps you from overpaying and eliminates hard surprises after the policy kicks in.

If you’re wondering how to get a car insurance quote, start with your ZIP code and basic vehicle info, then choose how to get your quotes using an insurer site or a comparison tool.

Frequently Asked Questions

Can I buy auto insurance online?

Yes, you can purchase auto insurance entirely online. Enter your information and take the policy out. A lot of insurers will allow you to quote the cost, compare coverage options, and even start a policy right on their own site. Just be sure your driver and vehicle information is accurate so you get the right price and coverage.

Which online car insurance is the best?

The best online car insurance comes down to what you need, but State Farm, Geico, Progressive, and Allstate Insurance are popular choices. Compare a few quotes to find the right balance of cost and coverage.

Read More: Allstate vs. Geico Auto Insurance Review

What is the first step in buying insurance online?

The first step to buying auto insurance online is to gather your information. Have your driver’s license details, VIN, yearly mileage, and your current policy info if you’re switching companies. Start comparing total coverage auto insurance rates by learning how to buy auto insurance online and entering your ZIP code here.

Is it better to buy insurance online or in person?

Buying auto insurance online is usually the simplest option because you can compare prices and get quotes quickly without leaving home. But if you’d rather talk things through or you have specific questions, buying in person can be a better fit. Online quotes also make it easier to shop around and find a cheaper rate.

Can I buy auto insurance without an agent?

Yes, you can purchase car insurance online without an agent. Lots of companies let you do the whole thing digitally, from getting a quote to buying and managing your policy. This can be particularly beneficial for people who like to do things on their own and avoid any additional costs that might arise from using an agent.

What is the best way to buy car insurance?

The best way to get car insurance is to compare companies online. Use a quote tool to get multiple auto insurance quotes side by side, then look for discounts and choose coverage that meets your needs and your state’s requirements. Review the details before you hit buy.

Is it smart to buy car insurance online?

Buying car insurance online is a smart choice for most people. It saves time, offers competitive rates, and allows you to easily compare quotes from various insurers. Online tools also give you quick access to discounts and help you choose coverage that suits your needs without the pressure of an in-person sales pitch.

What are the disadvantages of online auto insurance?

One downside of buying auto insurance online is that you don’t get face-to-face help from an agent. If you have questions about coverage, it can be harder to sort out the details on your own. Online forms also require careful, accurate info, and you may miss personalized advice.

Can I get car insurance online without talking to anyone?

Yes, you can get car insurance online without speaking to anyone. A lot of insurers let you type in your info, see quotes right away, and buy coverage from start to finish on their website or app. It’s a good fit if you want a quick, no-contact option.

How to buy auto insurance for the first time?

When buying auto insurance for the first time, start by gathering your driver and vehicle details, such as your driver’s license and VIN. Use an online comparison tool to explore quotes from multiple insurers. Be sure to choose the right coverage types and limits for your state, and don’t forget to apply any available discounts before finalizing your purchase.

Learn More: Best Auto Insurance for New Drivers

Is it possible to buy cheap auto insurance online instantly?

Can I get instant auto insurance with no down payment online?

How do I get full coverage car insurance quotes online?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.