How to Switch Auto Insurance Providers in 2026

Learn how to switch auto insurance providers without losing coverage and find rates as low as $55 per month. Coverage limits, deductibles, and timing can impact monthly payments, but low-mileage drivers who switch insurance companies can compare usage-based plans that are priced according to how much they drive.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

When you switch auto insurance providers, follow the steps in this guide to change your policy without any gaps in coverage.

- Start a new auto insurance policy before canceling to avoid gaps

- Switching to usage-based plans rewards safe and low-mileage drivers

- Drivers with financed cars can switch insurers with lender notice

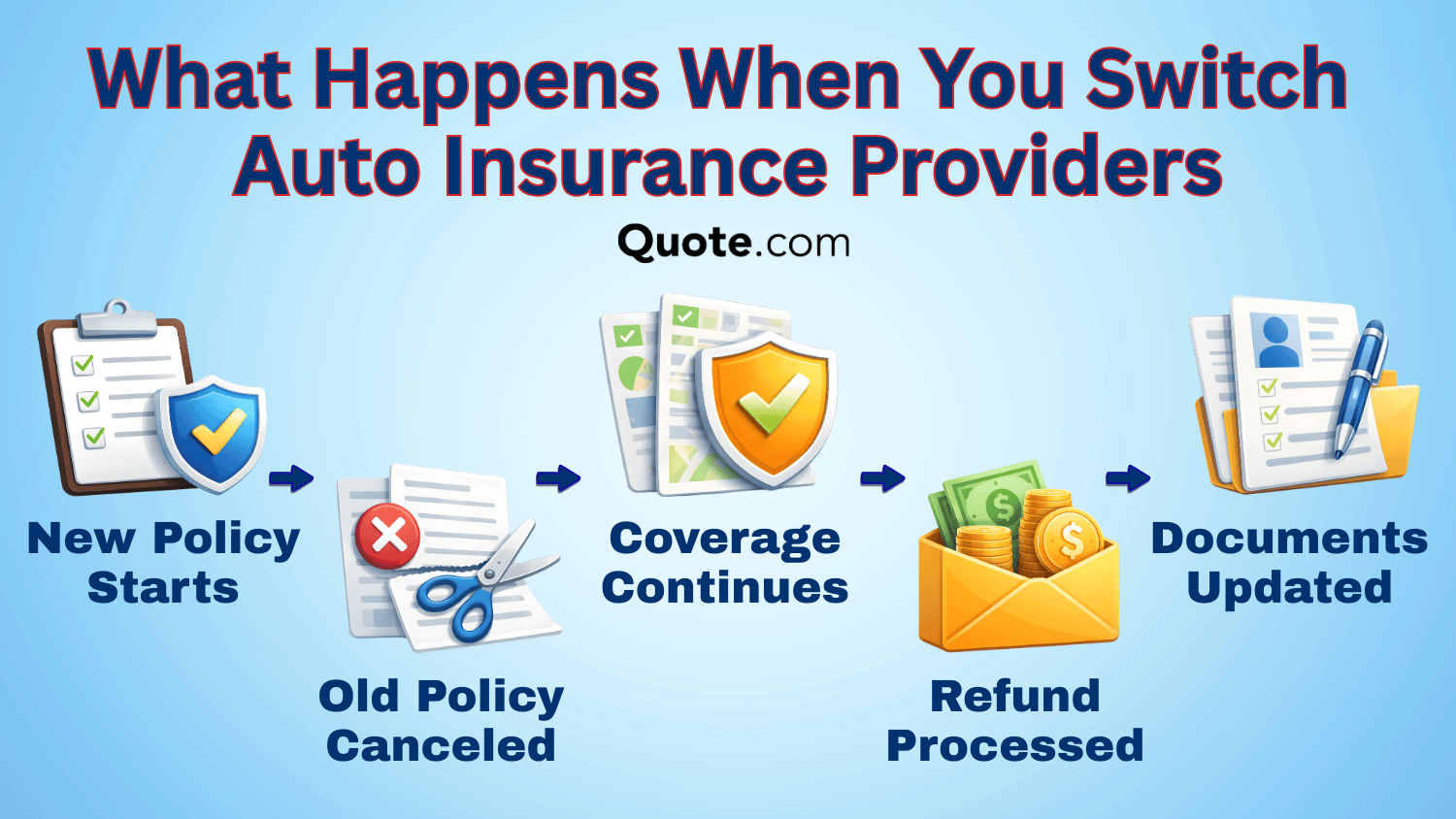

Start by getting your new coverage and confirming when it begins. Only cancel your old policy once you have proof of the new one. Most refunds are processed within five to 10 days.

If you have a car loan, be sure to tell your lender about your new insurance. You typically need to do this within three days.

How to Switch Auto Insurance Providers| Step | Action | What to Do |

|---|---|---|

| #1 | Review current policy | Check limits & deductibles |

| #2 | Compare rates online | Compare pricing & coverage |

| #3 | Choose coverage level | Select appropriate coverage |

| #4 | Start new insurance plan | Activate before policy ends |

| #5 | Confirm active policy | Verify new policy start date |

| #6 | Cancel your old policy | Cancel old policy on start date |

| #7 | Notify your provider | Send updated insurance proof |

| #8 | Update insurance cards | Replace old insurance cards |

The best time to switch car insurance is at renewal, every six to 12 months, to help you find better rates. Switching to usage-based insurance (UBI) programs can be a more affordable option if you drive less than 7,500 miles a year.

Find out how to change auto insurance providers for better coverage by entering your ZIP code into our free quote comparison tool.

How to Switch Auto Insurance Companies

It’s easier to swap car insurance if you set up your new coverage before canceling your current policy. Important Details: Auto Insurance Coverage Guide

Many drivers save $50 to $80 a month by comparing quotes when their policy is up for renewal.

Check your limits and deductibles, because even small changes can affect whether claims are approved and what you might pay later.

The easiest way to switch is to start your new policy before your old one ends. This helps you avoid coverage gaps or penalties.

Step #1: Review Current Policy

Start by finding your current policy. This will help you see what you’re paying for and what coverage you have at the moment. Check your liability limits, collision deductibles, and extras such as roadside assistance.

Some policy features may raise your monthly costs as time goes on. By knowing these details, you can avoid cutting your coverage by mistake or paying for extras you don’t need anymore.

Step #2: Compare Rates Online

Next, use online quote tools to compare rates. Many insurance comparison sites let you see prices without sharing your personal information right away.

Enter your ZIP code and some basic details about your car to see how insurers set prices for drivers in your area.

Comparing several results side by side helps you spot unusual or unrealistic rates before you spend more time or share your details. We explain how to get an anonymous auto insurance quote in our guide.

This approach gives you a better overview than checking only one company and helps you avoid surprises if prices change later.

Step #3: Choose Coverage Level

After you review prices, choose the coverage level that fits your car, your budget, and the amount of risk you’re comfortable with.

Older cars often only need liability auto insurance coverage. Cars with loans usually require collision and comprehensive coverage to meet lender rules.

Be careful when changing your deductibles. Higher deductibles can lower your monthly payments, but you will pay more out of pocket if you have an accident.

Choosing your coverage carefully helps you avoid surprises if you need to file a claim and protects your budget if you need repairs.

Check Out: Liability vs. Full Coverage Auto Insurance

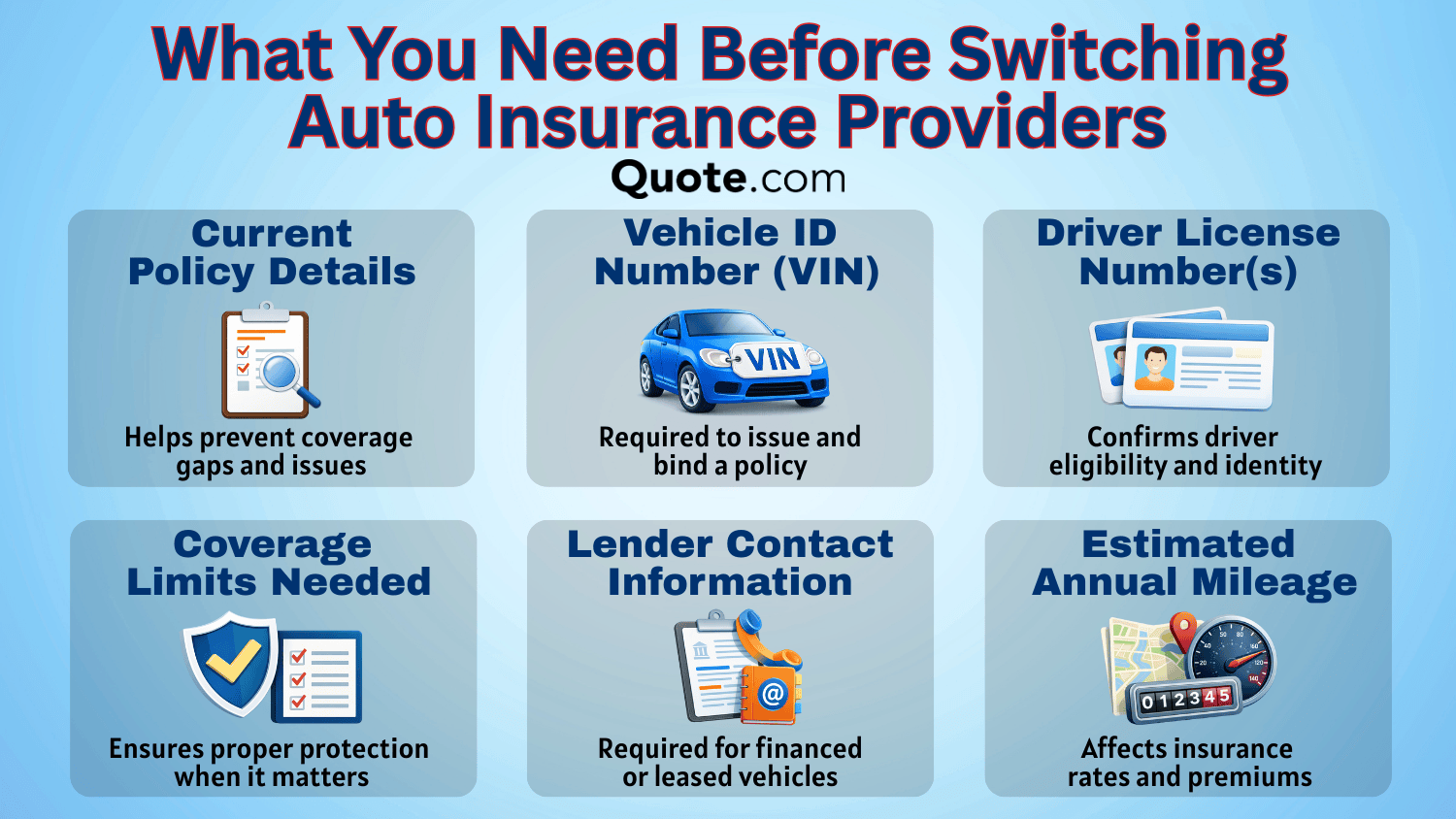

Step #4: Start New Insurance Plan

After you choose your coverage, set up your new insurance plan before your current policy ends. This helps you avoid any gaps in coverage.

Most insurers let you pick a future start date that matches the end of your current policy, so you do not have to worry about overlap.

To get a policy with a new company, have your vehicle identification number, driver’s license details, current coverage limits, and your chosen deductible ready. This helps you get an accurate quote.

If your car is financed, you will also need to provide lienholder information and proof of your previous insurance.

Read More: How to Compare Auto Insurance Companies

Step #5: Confirm Active Policy

Once you enroll, make sure your new policy is active and fully processed before you cancel your old insurance. Look at your confirmation emails, policy numbers, and declarations pages to make sure your coverage matches what you saw in your online quote.

Wait until you get written proof from your new insurer that shows the activation date before you assume your coverage has started. This helps you avoid accidental gaps in coverage, which could affect your license or registration fees or result in fines.

Learn More: How to Buy Insurance for a New Vehicle

Step #6: Cancel Your Old Policy

Cancel your old policy only after you receive official documentation from your new insurer confirming the start date of your new coverage.

Your current insurer will not cancel your coverage unless you can prove you have a new policy lined up.

Cancel only after written confirmation posts since system delays can flag uninsured status. For example start dates m,ust overlap.

Michelle Robbins Licensed Insurance Agent

Ask for written confirmation of your cancellation that shows the exact end date. This also comes in handy if you have billing questions later.

Timing is important. Canceling too early can create coverage gaps, while canceling too late can result in wasted money on overlapping premiums. Discover more in our guide: How to Cancel an Auto Insurance Policy

Step #7: Notify Your Provider

Let your lenders and leasing companies know when your new policy is active so your registration stays up to date.

Upload or email your declarations pages right away if you have an auto loan or financing agreement.

Most lenders need updated proof within a few days to avoid penalties or adding insurance to your account, which can raise your costs.

Take care of this quickly, especially if you have several vehicles or drivers in your household. Don’t Miss It: Best Multi-Vehicle Auto Insurance Discounts

Step #8: Update Insurance Cards

Once you switch providers, swap out your old insurance cards for new ones that list the updated policy for each vehicle.

Keep digital copies of your insurance cards on your phone and print copies to put in each vehicle in case you need them during a roadside check or an accident.

Police or lenders may ask for proof of insurance if you are stopped in traffic, have an accident, or renew your policy. Keeping your insurance cards up to date helps you stay protected and avoid fines for expired coverage.

Find Out: What Happens If You Cancel Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Insurance Rates Before Switching

It’s easier to switch auto insurance when you compare minimum coverage options from multiple providers.

Geico has the best minimum coverage at $55 per month. It also offers liability limits that meet most drivers’ needs, making it a strong choice over other companies. Check Out This Page: Geico Insurance Review

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $175 | |

| $69 | $157 |

| $61 | $140 | |

| $56 | $128 |

| $74 | $172 | |

| $55 | $136 | |

| $82 | $186 |

| $64 | $151 | |

| $59 | $143 | |

| $70 | $160 |

However, it might not be the cheapest in your state, so compare different options. For instance, UBI programs can help safe drivers save money if they drive less, without needing to change their deductibles or coverage limits.

The best times to switch are just after your policy renews, when you move, or if your credit score improves. Insurers often change prices and discounts during these times.

Shop around and compare quotes before your policy renews so you know the average premiums in your area.

Comparing auto insurance rates by vehicle can also help you find more affordable coverage if you drive a new car or have a high-value sports car or EV/hybrid.

How Driving Record Affects Auto Insurance Prices

When drivers think about switching auto insurance providers, it could be because of recent driving infractions.

If you’re looking for more stable pricing, realize your rates go up if they get into accidents, receive tickets, or have a DUI on their record, but every company treats each citation differently.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $78 | $105 | $133 | $94 | |

| $69 | $93 | $118 | $84 |

| $61 | $83 | $105 | $74 | |

| $56 | $76 | $96 | $68 |

| $74 | $100 | $127 | $90 | |

| $55 | $74 | $94 | $66 | |

| $82 | $112 | $141 | $100 |

| $64 | $87 | $110 | $78 | |

| $59 | $80 | $100 | $71 | |

| $70 | $94 | $119 | $83 |

Of all the options, Geico is a top choice for drivers with DUIs or accidents on their records because it keeps minimum coverage affordable across the country.

High-risk auto insurance costs more, so compare quotes from at least three different companies before you switch car insurance to lock in the best rates.

Side-by-Side Discount Comparison for Lower Premiums

When drivers look to switch auto insurance providers, don’t forget to ask about discounts. Combining several car insurance discounts can add up to bigger savings than just comparing monthly rates.

Amica is a great choice for households that want to bundle policies. Nationwide works well for drivers who prefer UBI, offering two programs designed for different types of drivers.

Top Auto Insurance Discounts by Savings Potential| Company | Bundling | Claims-Free | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 25% | 10% | 10% | 40% | |

| 25% | 15% | 23% | 20% |

| 30% | 10% | 25% | 20% | |

| 25% | 10% | 10% | 30% |

| 20% | 9% | 12% | 30% | |

| 25% | 12% | 25% | 25% | |

| 25% | 8% | 25% | 30% |

| 20% | 14% | 15% | 40% | |

| 17% | 11% | 20% | 30% | |

| 13% | 13% | 8% | 30% |

Allstate is also a good option for drivers who are okay with tracking their driving. Geico is a good fit for families with more than one car. See Our Article: Geico vs. Allstate Insurance Review

Switching insurance providers works best when you qualify for several discounts at once and keep a clean driving record over time.

What to Avoid During Policy Changes

Switching insurance companies may seem easy, but even small mistakes can delay your coverage refunds or slow down lender approval if you miss important timing steps.

It’s best to start your new policy before canceling the old one. Canceling too soon can lead to coverage gaps, fines, or even registration problems across the country.

Common Mistakes to Avoid When Switching Insurers| Mistake | Avoid By |

|---|---|

| Allowing a coverage lapse | Starting coverage sooner |

| Canceling insurance too early | Waiting until policy starts |

| Comparing mismatched plans | Matching coverage details |

| Forgetting to update ID cards | Replacing insurance cards |

| Lacking cancellation proof | Requesting written proof |

| Missing available discounts | Asking about discounts |

| Not notifying your lender | Sending updated details |

Many drivers forget to get written confirmation when canceling a policy, but this is important since refunds can take 5 to 10 days, especially if policy changes happen unexpectedly.

It’s important to match your coverage limits, deductibles, and endorsements with the types of auto insurance each provider offers. If these don’t line up, you might miss price differences and have less protection if you need to file a claim later.

Timing Matters When Changing Insurers

Timing is more important than many drivers realize. Switching at the right time can quickly change how insurers set your prices. Compare Now: Average Cost of Auto Insurance

Switching is usually easy after a rate increase, at renewal, or when moving to a new state, as long as the new policy starts first.

Best Time to Switch Auto Insurance Providers| When to Switch | Why It’s Smart |

|---|---|

| After credit improves | Qualify for better pricing |

| After a rate increase | Lower monthly premium |

| After a recent move | Location may change rates |

| After ticket drops off | Reduced risk lowers costs |

| Before plan renewal | Lock in lower rates |

| Every 6–12 months | Keep rates competitive |

| When buying a car | Get better policy options |

Many drivers get the best results by switching just before their policy renews, but if your credit score goes up by even 50 points, you might qualify for better pricing tiers earlier.

Many drivers are surprised to learn how flexible switching can be once they know which situations allow changes without penalties or delays.

When You Can Switch Auto Insurance Providers| Scenario | Allowed? |

|---|---|

| After adding a driver | ✅ |

| After changing states | ✅ |

| After policy renewal | ✅ |

| After rate increase | ✅ |

| Before policy renewal | ✅ |

| During active claim | ✅ |

| During renewal period | ✅ |

| If license is suspended | ❌ |

| Overdue payments | ❌ |

| With financed vehicle | ✅ |

| With leased vehicle | ✅ |

| With unpaid balance | ❌ |

You can still switch policies during an active claim, but keeping the same liability limits can help prevent claim handling problems.

The best time to switch is before your policy renews. This way, underwriting starts fresh, and if you have a financed or leased car, it stays eligible as long as you notify your lender.

Get The Details: The Best Time to Buy a New Car

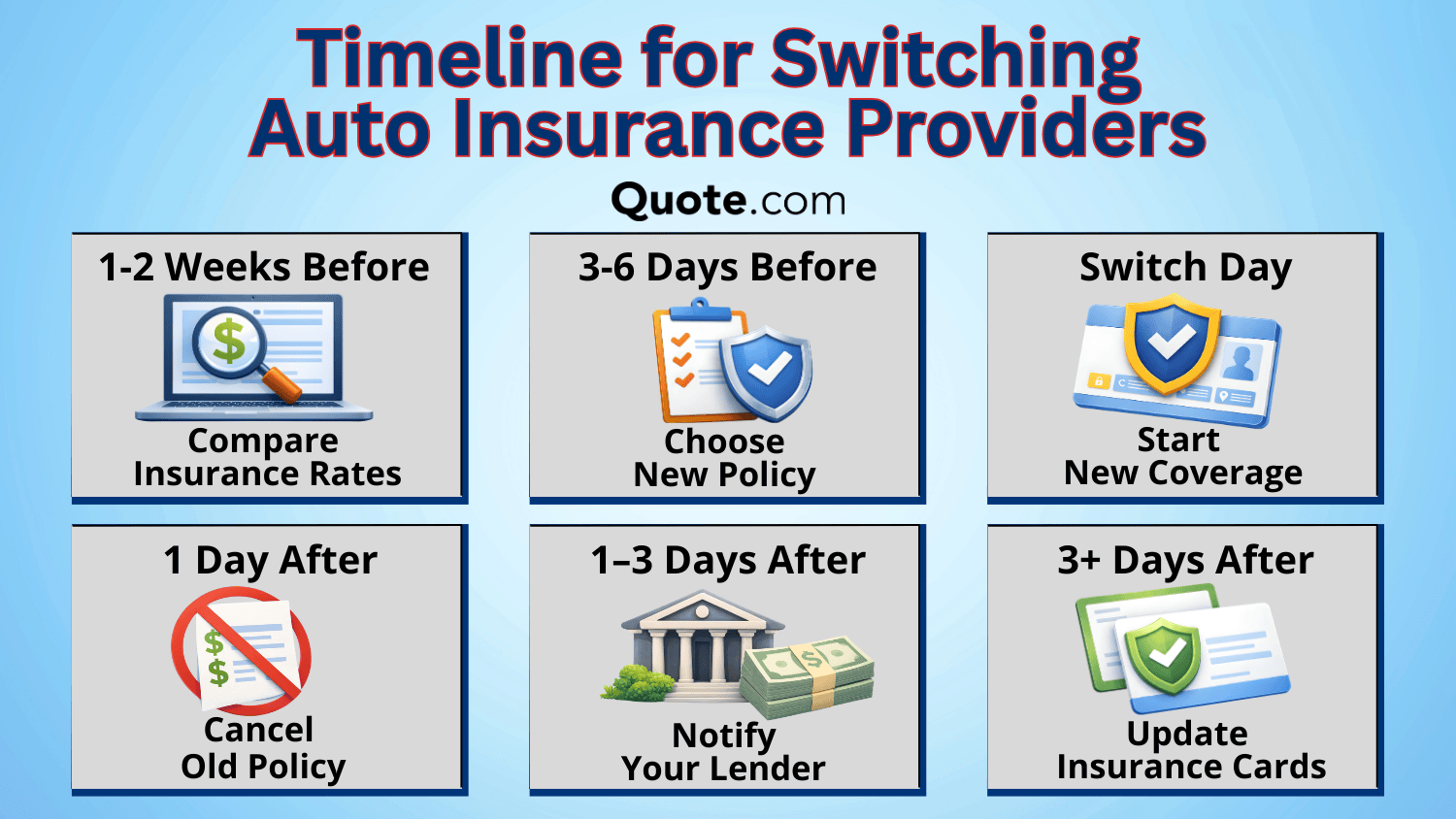

Timeline for Switching Car Insurance Companies

Switching insurance is easier when drivers use a simple checklist. It’s best to start your new policy right away before canceling your old one.

If you have a car loan, let your lender know within three days and update your insurance cards right away to prevent any problems.

Checklist for Switching Auto Insurance Providers| Step | Verify | Timing |

|---|---|---|

| Start new policy | Coverage active | Instant |

| Cancel old policy | Cancellation complete | 1 day |

| Notify your lender | Lender informed | 1–3 days |

| Update insurance cards | Cards updated | Same day |

| Confirm refund | Refund issued | 5–10 days |

This helps you avoid fines, registration problems, and denied claims. See more in our guide: How to File an Auto Insurance Claim & Win

After you cancel, you’ll usually get your refund within five to ten days. This helps keep your coverage and records up to date while you switch.

Who Gains the Most From Switching Policies

Some drivers get the most benefit from switching auto insurance providers when life changes quietly affect their risk and pricing in big ways.

If your credit score improves, tickets are cleared, or drivers are removed from your policy, you may qualify for better insurance rates. Read more in our article: Cheap Auto Insurance for High-Risk Drivers

Who Should Consider Switching Auto Insurance Providers| Eligible Drivers | Reason to Switch |

|---|---|

| Coverage needs update | Policy no longer fits |

| Credit score improved | Better pricing possible |

| Driver added or removed | Change in policy risk |

| Moved to new address | Location affects rates |

| New vehicle on policy | Coverage needs update |

| Policy renewal upcoming | Easier to compare options |

| Rate recently increased | Rates may be negotiable |

| Ticket no longer on record | Risk profile improved |

Moving to a new ZIP code, getting a different car, or adding drivers to your household can change your coverage needs and make your current policy obsolete.

If you decide to switch insurance, Geico is often a good option because its prices tend to adjust quickly when your risk profile gets better.

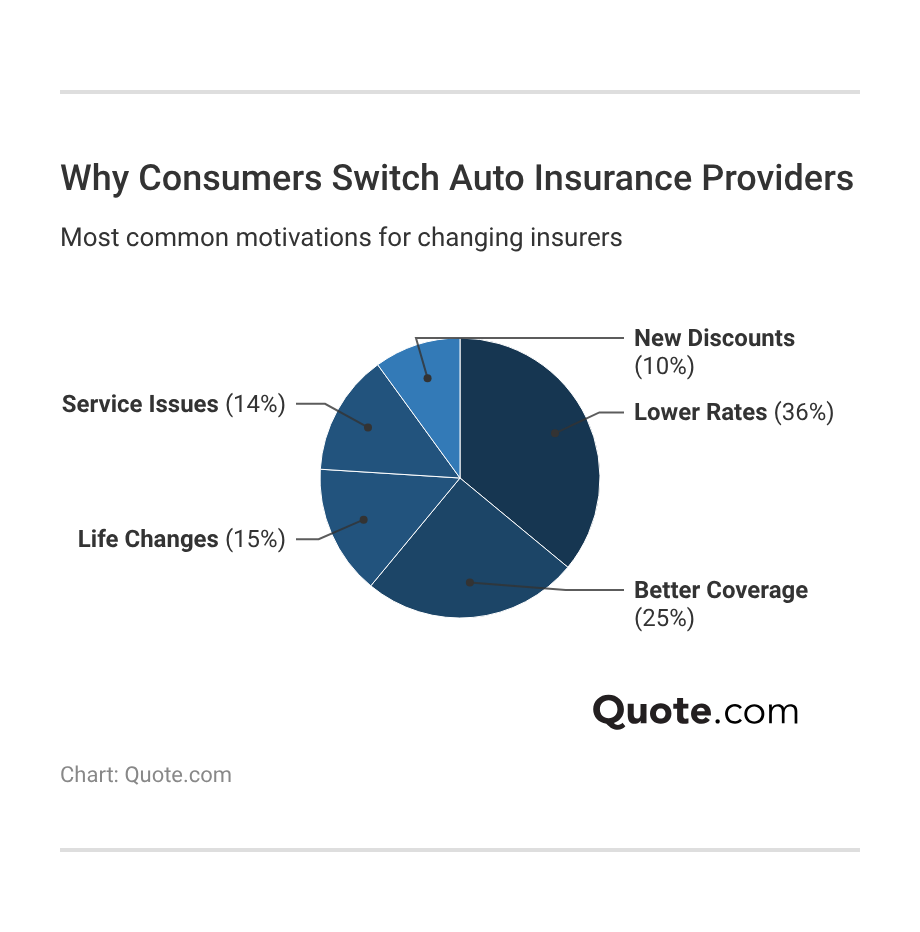

What Pushes Drivers to Switch Providers

Many people see their monthly bills go up over time, so it’s a good idea to compare options even if you haven’t had tickets, accidents, or major coverage changes.

Most drivers consider switching auto insurance when they move or change jobs, since their new driving habits might not match their current policy.

People often switch insurance when their household changes, because insurers offer discounts to married couples or families adding a teen to a policy.

Some drivers leave their insurer after a claim because of service problems, such as payment errors or poor response times. Other service issues influence policyholders to leave, especially billing issues.

Policy changes happen when mileage passes 8,000 miles a year. In particular, tracking programs adjust risk quickly.

Jeff Root Licensed Insurance Agent

Drivers may also switch when they lose discounts, which can happen if they file a claim, change their policy, or miss a verification step at renewal.

It’s best to review your needs first, then switch during your policy’s renewal period so your rates and coverage fit your situation.

Check Out: Best Car Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Swap Car Insurance Companies Today

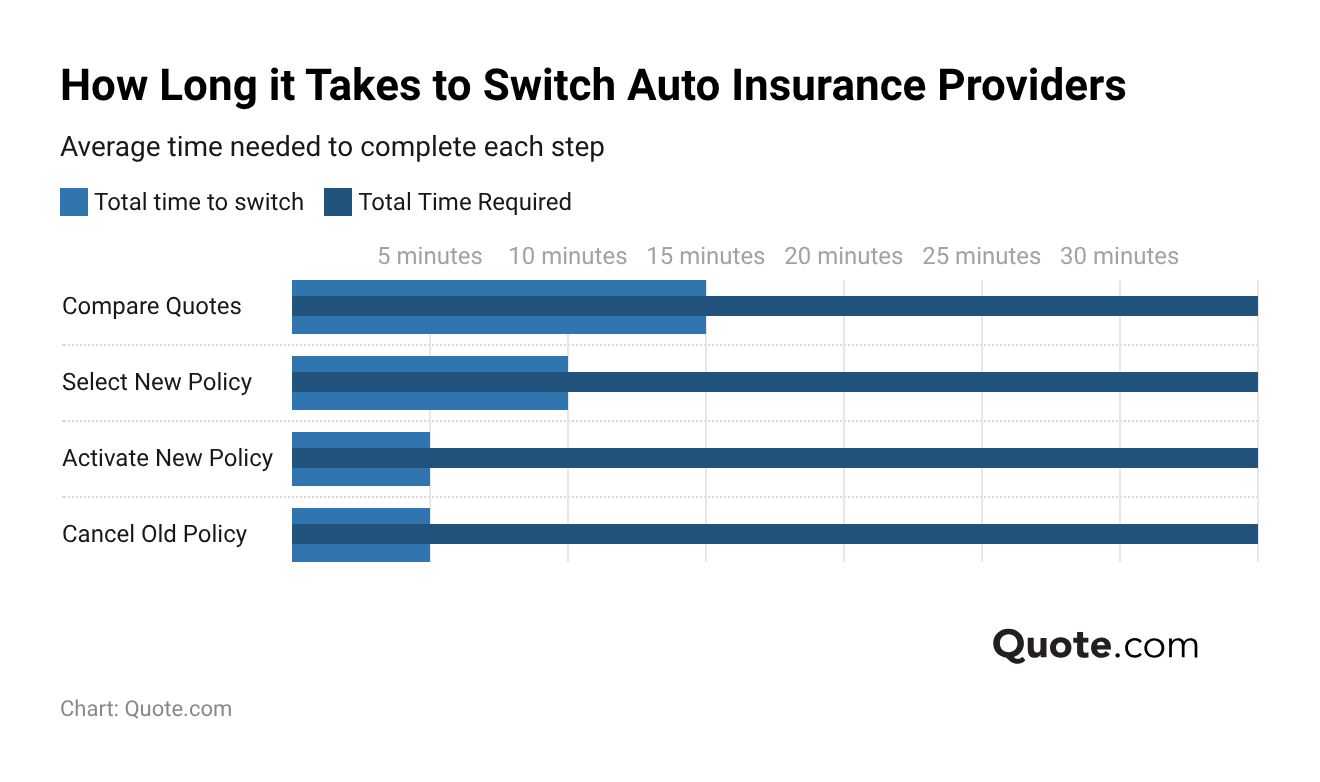

When you know how to switch auto insurance providers, you can speed up the process by getting your documents ready ahead of time.

Most drivers can compare quotes and choose a new policy in about 15 minutes, then easily activate their coverage online from home. Get The Details: How to Buy Auto Insurance Online

Canceling the old policy usually takes under 10 minutes once you have proof of your new coverage and the start dates match up.

The whole process usually takes less than 30 minutes, and the best way is to set up your new coverage first. Enter your ZIP code in our free tool to compare auto insurance quotes and see how to switch car insurance companies.

Frequently Asked Questions

Can you just swap insurance companies?

You can switch insurance companies at any time as long as the new policy starts before the old one ends to avoid coverage lapses. Is it easy to swap insurance? Swapping insurance is easy for most drivers, especially when done online, and coverage limits and deductibles remain consistent.

How do I switch my auto insurance to another company?

Car insurance changes by selecting a new provider, setting a start date, sharing proof with lenders if needed, and then canceling the old policy. Shop around for a new provider today by entering your ZIP code into our free quote comparison tool.

Should I cancel my car insurance before switching?

No, insurance should not be canceled before switching. Driving without auto insurance is illegal, and even a one-day gap can trigger fines or higher future monthly premiums.

How do you transfer insurance from one provider to another?

Insurance transfers by purchasing a new policy first, confirming the effective date, then canceling the old policy after coverage is active.

How hard is it to switch car insurance providers?

Switching insurance providers is usually simple and often takes under 30 minutes when documents such as the VIN and driver details are ready. Check out our guide: What We Learned Analyzing 815 Insurance Companies

Can I switch insurance companies in the middle of a policy?

Yes, insurance companies can be switched mid-policy if the new coverage starts first, since most states allow cancellation at any time without penalties. Get the Details: Auto Insurance Rates by State

What are the risks of changing insurance companies?

The main risks of changing insurance companies include coverage gaps, mismatched limits, and delayed lender notifications, which can raise future monthly rates.

Can drivers change car insurance before renewal?

Drivers can change car insurance before renewal, often locking in better monthly pricing when rates increase on renewal notices.

Can you change my car insurance coverage at any time with Geico?

Yes, Geico allows coverage changes at any time during the policy term, with adjustments to monthly premiums taking effect immediately or on a chosen date. Read our Geico insurance review for more coverage details.

Can I switch car insurance companies in the middle of a claim?

Yes, switching is allowed during an active claim, but the original insurer remains responsible for handling that claim until resolution.

What are the pros and cons of changing insurance companies?

Is there a penalty for canceling car insurance?

Does cancelling car insurance affect credit score?

How do I save money on car insurance?

How do I switch health insurance companies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.