Dairyland Insurance Review for 2026

Dairyland Insurance provides auto coverage starting at $121 a month. Dairyland focuses on high-risk drivers needing flexible options and SR-22 support. Our Dairyland insurance review highlights savings of up to 10% for multiple vehicles, 15% for defensive driving, plus motorcycle and ATV coverage choices.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Dairyland Insurance specializes in high-risk auto coverage starting at $121 per month. This coverage includes liability, collision, comprehensive, and 24/7 roadside assistance.

- The Dairyland insurance rating is 3.5/5 for availability and discounts

- Dairyland files SR-22 car insurance for free for policyholders

- Policy flexibility extends to motorcycles, dirt bikes, scooters, and RVs

Dairyland is expensive but remains competitive for drivers with multiple violations who need to file SR-22 insurance and those looking for cheap auto insurance for high-risk drivers who may struggle to find coverage elsewhere.

High-risk drivers can save more money with discounts, like up to 10% for multiple vehicles and up to 15% for defensive driving.

Dairyland Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 3.0 |

| Claims Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 4.7 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 3.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 3.0 |

| Policy Options | 2.8 |

| Savings Potential | 3.8 |

With flexible policies, trustworthy claims assistance, and more ways to save money on your insurance plan, our Dairyland Insurance review finds it to be a smart choice for help on your way to cheap auto insurance.

Enter your ZIP code to start comparing premiums from top insurers in your area.

Dairyland Auto Insurance Review

Dairyland Insurance offers a variety of coverages, including liability auto insurance, collision, comprehensive, and roadside assistance, in addition to solid options for high-risk drivers.

Rates can be much higher than some competitors, particularly for teens and drivers with fewer violations. Nonetheless, its 24/7 support, customizable policies, and discounts make it a solid choice for drivers with multiple violations.

Cost of Dairyland Car Insurance

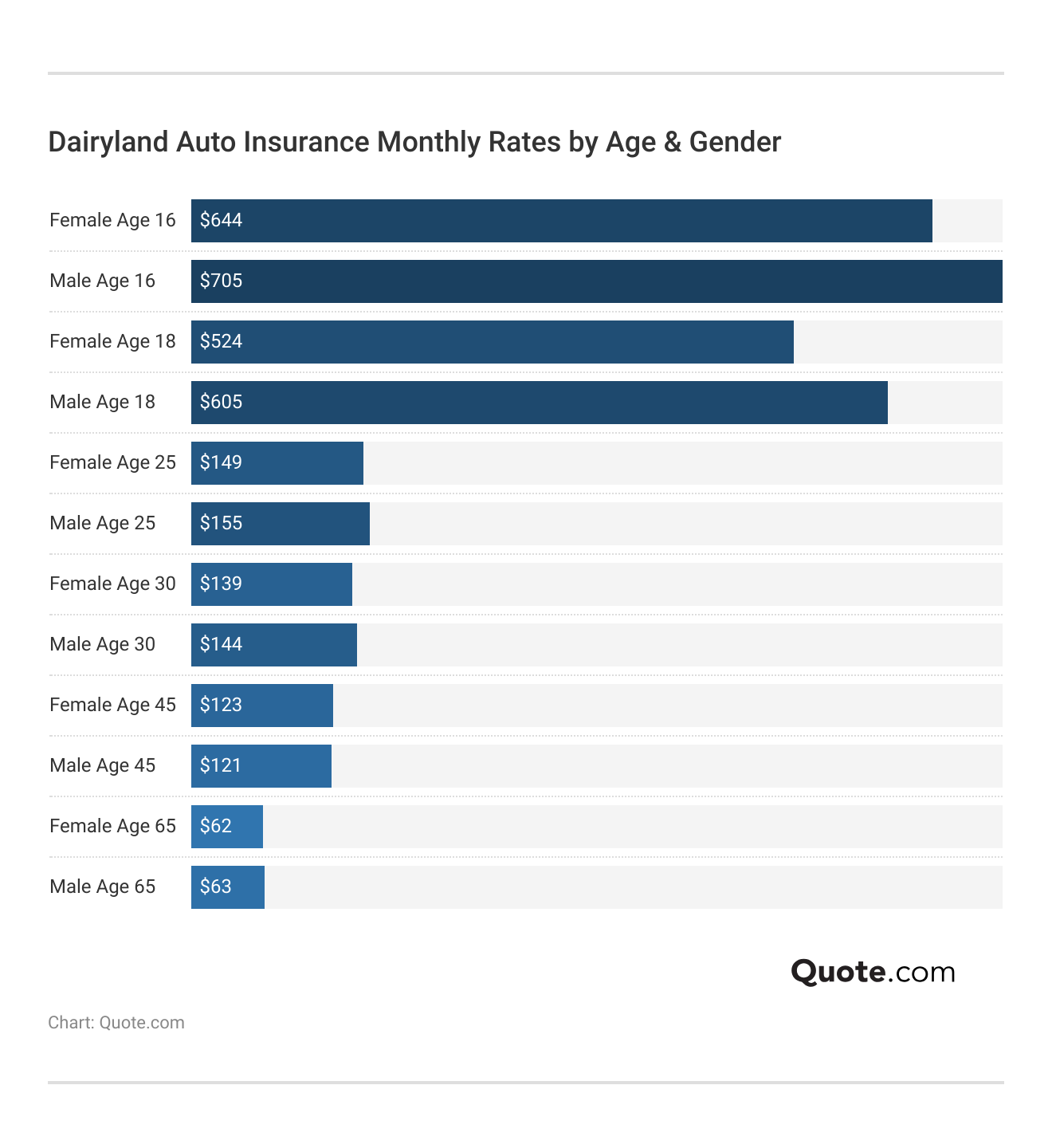

Dairyland monthly premiums depend on your age and gender, with adolescents paying the most and seniors paying the least.

Premiums also drop off rapidly by age 25 to $149 per month, with less price differentiation between genders. By age 65, seniors enjoy the lowest rates at about $62 to $63 a month, making Dairyland a source of cheap auto insurance for seniors.

Dairyland’s auto insurance rates are higher than most competitors, with $121 monthly for minimum coverage and $339 per month for full coverage.

In comparison, Geico, State Farm, and USAA offer much lower premiums, with USAA being the cheapest at $32 and $84. Dairyland is less competitive on pricing, especially for drivers seeking affordable coverage.

Dairyland vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $121 | $339 | |

| $76 | $198 | |

| $43 | $114 | |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Dairyland auto insurance rates tend to be higher across most driving records. For drivers with a clean record, Dairyland charges $121.

When compared to top competitors, it’s more expensive than popular alternatives such as Geico, State Farm, and USAA.

Auto Insurance Monthly Rates by Provider & Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $121 | $187 | $212 | $151 | |

| $76 | $109 | $178 | $95 | |

| $43 | $71 | $129 | $56 | |

| $63 | $88 | $112 | $75 | |

| $56 | $98 | $58 | $74 | |

| $47 | $57 | $38 | $53 | |

| $53 | $76 | $123 | $72 | |

| $32 | $42 | $93 | $36 |

USAA and State Farm provide the lowest rates, while Progressive and American Family are also more affordable. This makes Dairyland less competitive for drivers with no or only one violation (Learn More: Progressive vs. State Farm Auto Insurance Review).

For higher-risk drivers, Dairyland charges $187 a month after one accident, $212 per month after a DUI, and $151 a month after one ticket, all higher than many competitors.

Your driving record sets monthly rates, and violations raise costs. Review your policy when points expire. For example, a cleared ticket can mean lower premiums.

Jeff Root Licensed Insurance Agent

However, if you have two or more DUIs or accidents, or are required to file SR-22 insurance due to your driving or criminal record, Dairyland can be an affordable option.

If you are considered a high-risk driver, comparing Dairyland insurance quotes online is the easiest way to see if it or another high-risk provider is the most affordable option for you.

Dairyland Auto Insurance Coverage Options

When choosing auto insurance, it’s important to understand your options so you can create a policy that fits your needs.

Dairyland offers coverage from basic liability to added benefits that keep you protected and give you peace of mind on the road.

- Bodily Injury Liability Insurance: Pays for medical bills, lost wages, and legal fees if you injure someone in an accident, and is required in most states.

- Comprehensive Insurance: Comprehensive auto insurance protects against non-collision events such as theft, vandalism, fire, falling objects, natural disasters, or animal strikes.

- Collision Insurance: Helps pay for repairs if your car is damaged in a collision with another vehicle.

- Uninsured/Underinsured Motorist Coverage: Offers protection if you’re in an accident with a driver who has no insurance or insufficient coverage.

- Roadside Assistance: Provides help if you’re stranded due to a breakdown, flat tire, dead battery, or if you need towing services.

For high-risk drivers with suspended licenses, Dairyland will file SR-22 auto insurance for free. An SR-22 isn’t an actual policy but serves as proof of coverage. It’s often required after multiple DUIs or vehicle-related incidents.

It ensures you meet state insurance requirements, but since it signals to insurers that you’re a high-risk driver, carrying an SR-22 almost always raises your car insurance rates.

Most states require you to keep it on file for a set period, often three years, to maintain your driving privileges. It ensures you stay compliant with state laws, maintain your license, and remain insured with or without a personal vehicle.

Dairyland auto insurance coverage also includes non-owner car insurance and non-owner SR-22 insurance for drivers who rent or borrow vehicles. This provides minimum liability coverage if you don’t own a car but still need to meet SR-22 requirements.

Popular Dairyland Auto Insurance Discounts

Saving money on car insurance certainly doesn’t need to be difficult. Dairyland has several discounts to encourage good behavior, safe practices, and wise decisions, helping you keep more money in your pocket while still getting reliable coverage.

- Multi-Car Discount: Insuring multiple vehicles with Dairyland unlocks multi-car savings, helping households cut costs while staying protected under one policy.

- Advanced Quote Discount: Get rewarded for planning with Dairyland. Request a quote before your policy expires to save and avoid coverage gaps.

- Homeowner Discount: Owning a home can earn you savings, rewarding stability, and help lower your auto premiums.

- Anti-Theft Discount: Vehicles with anti-theft or safety features may qualify for lower premiums, helping Dairyland pass savings to you.

- Defensive Driving Discount: Completing a defensive driving course can earn you some of the best defensive driving insurance discounts, with up to 15% savings.

By using these discounts, Dairyland helps drivers build policies that are both affordable and reliable. The savings reward responsible habits like insuring multiple vehicles, adding safety features, or planning ahead with an early quote.

Homeowners enjoy savings for long-term stability, while defensive driving discounts reward safer habits. These opportunities lower premiums and maximize coverage value, giving you confidence that you’re protected without overspending.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dairyland Motorcycle Insurance Review

Dairyland remains a cost-effective choice, keeping premiums below most major insurers. Riders can also save through discounts for multi-cycle policies, safety courses, and club memberships, as highlighted in our auto insurance guide.

Dairyland Motorcycle Insurance Costs

Dairyland Insurance Company is a cheaper option in motorcycle insurance, with rates that are well below those of many competitors like Allstate, Farmers, and Nationwide.

Monthly premiums as low as $25 for minimum coverage and $42 for full coverage, which is $16 less than Allstate full coverage, which adds up to savings of over $100 per year.

Dairyland vs. Top Competitors: Motorcycle Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $35 | $58 | |

| $30 | $52 |

| $25 | $42 | |

| $32 | $55 | |

| $28 | $47 | |

| $33 | $54 | |

| $23 | $40 | |

| $30 | $50 | |

| $31 | $53 | |

| $20 | $36 |

Geico, State Farm, and Travelers charge more, while USAA is the cheapest motorcycle insurance company at $20 and $36 a month. Read our State Farm auto insurance review for more quote comparisons.

Dairyland Motorcycle Insurance Coverage Options

Designed with financial security in mind, Dairyland provides a variety of core coverages to protect you, your motorcycle, and others on the road after an accident or unexpected event.

- Bodily Injury Liability: Helps cover medical bills, lost wages, and legal expenses if you’re responsible for injuring another person in an accident.

- Property Damage Liability: Pays for damage you cause to another person’s property, such as their vehicle, fence, or building, while riding your motorcycle.

- Guest Passenger Liability: Protects if a passenger riding with you is injured in an accident you cause.

- Collision Coverage: Covers the cost of repairing or replacing your motorcycle if it’s damaged in a crash with another vehicle or object, no matter who is at fault.

- Comprehensive Coverage: Protects against non-collision events such as theft, vandalism, fire, severe weather, or hitting an animal.

These coverages form the foundation of a strong motorcycle insurance policy with Dairyland, protecting against everyday risks like accidents and property damage.

Dairyland motorcycle insurance also protects against unforeseen events such as theft or weather-related losses, similar to the protections found in different types of auto insurance.

There are flexible choices for various riding and individual requirements to custom-build your policy. For instance, motorcycle policies typically have higher medical coverage needs due to the increased risk of rider injury in accidents.

Additionally, motorcycles may require specialized add-ons like custom parts coverage or roadside assistance. By selecting the right coverage, drivers can rest easy knowing they and their passengers are financially protected every time they get on the road.

Popular Dairyland Motorcycle Insurance Discounts

Dairyland Insurance offers a range of motorcycle insurance discounts that reward safe behavior, smart decisions and being involved in the community.

- Multi-Cycle Discount: Insure more than one motorcycle with Dairyland and receive a discount for covering multiple bikes.

- Motorcycle Rider Course Discount: If you complete an approved motorcycle safety or training course (e.g. MSF), you may qualify for a discount.

- Motorcycle Group / Club (Rider Association) Discount: Being a member of a qualifying motorcycle club or riding organization (e.g. H.O.G.) may make you eligible for savings.

Dairyland keeps motorcycle insurance affordable with discounts for multiple bikes, safety courses, or club memberships. These savings reward safe riding while lowering premiums and maintaining strong coverage.

Learb More: 17 Tips to Pay Less for Car Insurance

Dairyland ATV/UTV Insurance Review

Dairyland ATV/UTV insurance comes with protections such as submersion, trailer insurance, and custom equipment coverage. With competitive discounts, it’s a great choice for drivers who want dependable coverage on all their vehicles.

Cost of ATV/UTV Insurance With Dairyland

Dairyland National Insurance Company offers the most affordable ATV/UTV insurance, with monthly minimum coverage at $7 and full coverage at $15 per month.

Major insurers such as Allstate, Farmers, and State Farm fall between $20 to $40 a month, with Travelers’ offering the most affordable month rates, at $23–$42.

Dairyland vs. Top Competitors: ATV/UTV Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $22 | $40 | |

| $19 | $35 |

| $7 | $15 | |

| $20 | $36 | |

| $18 | $33 | |

| $20 | $37 | |

| $16 | $29 | |

| $20 | $36 | |

| $23 | $42 | |

| $18 | $32 |

Even American Family and Geico are more costly, with rates between $18 and $19 a month for minimum coverage and $33 to $35 monthly for full coverage, which is more than double Dairyland’s pricing.

By delivering dependable ATV and UTV coverage at such competitive rates, Dairyland positions itself as the clear low-cost leader, making it an excellent choice for anyone seeking reliable and affordable insurance for off-road vehicles.

Read More: Best Auto Insurance for Jeeps

Dairyland ATV/UTV Insurance Coverage Options

Dairyland ATV/UTV insurance gets you more than just standard protection. No matter why you’ve got it out on the open road, these selections ensure that you’re covered.

At Dairyland, you can trust that your ATV or UTV is covered in more ways than one. It makes it easy to tailor coverage to your riding style and off-road risks.

- Submersion Coverage: Helps pay for repairs if your ATV or UTV becomes submerged in water, such as breaking through ice while riding over frozen surfaces.

- Enhanced Permissive Use Coverage: Extends liability coverage if someone not listed on your policy operates your ATV/UTV with your permission and causes an accident.

- Transport Trailer Coverage: Protects your ATV/UTV trailer against damages that occur during transport, ensuring you’re covered while hauling your vehicle.

- Physical Damage Plus Coverage: Guarantees that repairs to your ATV/UTV use only original manufacturer (OEM) replacement parts, keeping your vehicle restored to factory standards.

- Optional/Special Equipment Coverage: Covers customized or aftermarket parts, such as upgraded wheels, winches, racks, or other accessories you’ve added to your ATV/UTV.

From protecting custom parts to handling costly incidents like submersion or transport damage, you stay secure. As noted in a visual guide to auto insurance, these protections add value and peace of mind on every ride.

Popular Dairyland ATV/UTV Insurance Discounts

Dairyland helps keep your ATV/UTV protected for less, rewarding you with a selection of discounts for savvy decisions, safe storage, and financial responsibility.

These discounts are meant to help you manage your budget without sacrificing the quality of coverage you want, so you get reliable insurance at a great price.

- Multi-ATV/UTV Discount: Save more by bundling your ATV/UTV insurance with other Dairyland products, such as motorcycle or auto insurance, under one provider.

- Transfer Discount: Switch your ATV or UTV insurance to Dairyland and enjoy immediate savings, rewarding riders for making the move.

- Advanced Quote Discount: Planning ahead pays off. Request your ATV/UTV quote before your policy expires, and Dairyland rewards you with extra savings.

- Paid-in-Full Insurance Discount: Save by paying your premium in one lump sum, rewarding convenience and reducing overall costs.

- Garaging Discount: Get discounts for garaging and storing by keeping your ATV or UTV in a garage or secure storage, reducing risks and lowering premiums.

By taking advantage of these discounts, you can enjoy reliable Dairyland ATV/UTV coverage while saving significantly on your premiums.

ATV/UTV insurance rates depend on use, terrain, and upgrades. Match coverage to your habits for real savings. For example, seasonal storage can reduce costs.

Melanie Musson Published Insurance Expert

These savings opportunities reward smart financial choices and responsible ownership, ensuring you don’t have to sacrifice quality protection for lower costs.

Dairyland Snowmobile Insurance Review

Dairyland snowmobile insurance includes core protections plus options like special equipment, OEM parts, and PIP, making it both affordable and flexible for riders.

Dairyland’s rates are also far below most competitors, so learn how to compare auto insurance companies to see if it’s the right fit for you.

Cost of Snowmobile Insurance With Dairyland

Dairyland is the most affordable snowmobile insurer, with monthly rates at $7 for minimum and $14 for full coverage. By comparison, USAA and Geico start at $12 a month for minimum and $21–$22 monthly for full.

American Family, State Farm, and Progressive are almost double in price, ranging from $15 to $16 a month for minimum and $27 to $29 monthly for full coverage.

Dairyland vs. Top Competitors: Snowmobile Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $17 | $30 | |

| $16 | $28 |

| $7 | $14 | |

| $18 | $32 | |

| $12 | $22 | |

| $15 | $26 | |

| $15 | $27 | |

| $16 | $29 | |

| $17 | $30 | |

| $12 | $21 |

Allstate, Farmers, and Travelers charge $17–$18 a month for minimum and $30–$32 monthly for full coverage. Find more quotes in our Travelers auto insurance review.

This makes Dairyland a clear low-cost leader again, while still offering dependable protection for all of your off-road vehicles.

Dairyland Snowmobile Insurance Coverage Options

Snowmobiling is exciting and adventurous, but also dangerous. Dairyland snowmobile insurance features protection both on and off the trails to help keep your sled and you in one piece.

You can ride with peace of mind against accidents, medical expenses, and damage done to your gear with Dairyland snowmobile coverage.

- Collision Coverage: Collision coverage helps pay for repairs to your snowmobile if it’s damaged in an accident, such as hitting a rock, tree, stump, or other obstacle on the trail.

- Medical Expense Coverage: Provides financial help for medical bills if you or your passengers are injured in an accident, regardless of who is at fault.

- Optional/Special Equipment Coverage: Covers custom parts or accessories added to your snowmobile, like upgraded tracks, windshields, or storage compartments beyond factory standard.

- Physical Damage Plus Coverage: Keep your snowmobile in top condition, following a covered HUD, and it will be repaired with original manufacturer (OEM) parts after an accident.

- Personal Injury Protection (PIP): Personal injury protection covers medical expenses for you and others in an accident, regardless of fault. Availability may vary by state.

Because snowmobiling carries a higher risk of accidents and injuries, policies often emphasize medical payments and personal injury protection (PIP) more heavily than standard auto insurance.

These coverages give you the confidence to ride in all conditions, but riders may also add optional medical coverage to protect themselves and passengers, since health insurance alone may not cover all accident-related costs.

With these coverage options, Dairyland makes it easy to tailor your snowmobile insurance to your lifestyle and riding habits.

By choosing the right mix of protections, you can focus on enjoying the thrill of the trails while Dairyland provides dependable support to protect what matters most.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dairyland Dirt Bike Insurance Review

Dairyland dirt bike insurance provides affordable, flexible coverage with protections for bikes and riders, plus discounts that make staying insured practical and cost-effective. Pair it with these hacks to save money on auto insurance.

Comparing Dirt Bike Insurance Rates With Dairyland

Dairyland offers highly affordable dirt bike insurance, with minimum coverage at $7 per month and full coverage at $14 a month, close to USAA and Progressive rates.

Competitors like Allstate, Farmers, or Travelers cost slightly more per month, making Dairyland an affordable option in terms of well-refined insurance.

Dairyland vs. Top Competitors: Dirt Bike Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $10 | $18 | |

| $9 | $17 |

| $7 | $14 | |

| $10 | $18 | |

| $8 | $15 | |

| $9 | $16 | |

| $7 | $14 | |

| $9 | $17 | |

| $10 | $18 | |

| $7 | $13 |

Dairyland Insurance is a great option for dirt bike riders who want affordable, reliable coverage when they go off-roading.

It’s even cheaper than the most popular options, such as Geico, Nationwide, American Family, and State Farm. Read our American Family vs. Travelers auto insurance review for full details.

Dairyland Dirt Bike Insurance Coverage Options

Dairyland dirt bike coverage is built to fit your off-road lifestyle. With unique coverage choices, it provides protection for both you and your bike that is built for accidents, equipment damage, and unexpected hazards.

- Collision Coverage: Pays for damages if your dirt bike collides with another vehicle or object, helping cover repair or replacement costs.

- Medical Payments: Medical payments coverage provides financial support for medical bills if you or a passenger is injured in an accident.

- Optional/Special Equipment Coverage: Protects custom or aftermarket parts you’ve added to your dirt bike, such as upgraded suspensions, exhausts, or accessories.

- Physical Damage Plus Coverage: Ensures your dirt bike is repaired using only original manufacturer (OEM) parts, keeping it restored to factory standards after a covered accident.

- Submersion Coverage: Helps cover repair costs if your dirt bike becomes submerged in water, such as during river crossings or unexpected flooding.

From safeguarding expensive aftermarket parts to ensuring OEM-quality repairs after a claim, these options keep your dirt bike in top condition.

Popular Dairyland Dirt Bike Insurance Discounts

Dairyland knows riders are looking for reliable coverage at a competitive price, and there are several dirt bike insurance discounts.

These discounts incentivize responsible riding, financial stability, and community involvement as a rider into continued coverage without breaking the bank.

- Rider Group Discount: Members of recognized riding clubs or associations can save, as group involvement often reflects safer and more responsible riding.

- Rider Course Discount: Get rewards by demonstrating better riding techniques and lower accident exposure by taking an insurer-approved rider course.

- Claim-Free Renewal Discount: Riders with a clean record earn lower premiums at renewal

- Prompt Payer Discount: Paying premiums on time or early can earn you a discount, reflecting financial responsibility.

- Ownership Discount: Owning your dirt bike outright may reduce your rates, as it signals long-term care and commitment to maintaining the vehicle.

These savings opportunities are designed to reward a variety of smart choices. From joining a recognized riding group or completing a safety course to staying claim-free or paying premiums promptly.

Call the Dairyland insurance phone number to find out which discounts you qualify for and take advantage. Riders can significantly lower their premiums while still maintaining access to comprehensive and reliable coverage.

Learn More: How to File a Claim and Win it Each Time

Dairyland Scooter & Moped Insurance Review

Dairyland insurance for scooters and mopeds stays competitive with Geico, Progressive, and USAA while costing less than Allstate, Farmers, and Travelers. Find out more in our Farmers Insurance review.

Compare Dairyland Insurance Rates for Scooters & Mopeds

Dairyland offers some of the most affordable scooter and moped insurance rates on the market, with minimum coverage starting at $7 per month and full coverage at $13 monthly.

Rates are comparable to Geico and coming in just above Progressive and USAA, which lead with the lowest monthly rates at $6 and $12.

Dairyland vs. Top Competitors: Scooter/Moped Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $9 | $16 | |

| $9 | $15 |

| $7 | $13 | |

| $10 | $17 | |

| $7 | $13 | |

| $8 | $15 | |

| $6 | $12 | |

| $8 | $14 | |

| $9 | $16 | |

| $6 | $12 |

Allstate, Farmers, and Travelers charge $9 a month or minimum and $16–$17 monthly for full coverage, while Dairyland remains more affordable.

With its low rates and reliable coverage, Dairyland is the affordable option for scooter and moped riders who want to cut costs without sacrificing road peace of mind.

Learn More: State Farm vs. Progressive Auto Insurance Review

Scooter & Moped Insurance Policy Options With Dairyland

Scooters and mopeds are convenient, economical, and fun to ride, but they also come with unique risks. Dairyland offers coverages that can protect your two wheels, you, and others in such situations as accidents, repairs, and emergencies.

- Underinsured Motorist Property Damage (UIMPD): Covers damage to your scooter or moped when another driver’s insurance is insufficient after an at-fault accident.

- Underinsured Motorist Bodily Injury (UIMBI): Helps pay for your medical bills and injuries when the other party is at fault but has too little insurance to cover it.

- Roadside Assistance: Offers help during emergencies like flat tires, dead batteries, running out of gas, or towing.

- Optional / Special Equipment Coverage: Protects custom or aftermarket parts and accessories you’ve added to your scooter or moped.

- Physical Damage Plus: Ensures that repairs are made with original, manufacturer-authorized parts after a covered loss.

Dairyland offers flexible auto coverage options to give drivers financial protection and peace of mind, no matter where the road leads.

From ensuring repairs use only quality parts to covering medical bills or roadside emergencies, you’ll have the confidence to ride knowing you’re supported in every situation.

Read More: At-Fault Accident: What it Means & How it Affects Insurance Rates

Dairyland RV Insurance Review

Monthly Dairyland RV insurance is cheaper than providers like Allstate and Farmers, keeping it budget-friendly. With choices such as storage, rental reimbursement, emergency expense, or vacation liability, the coverage is flexible for RV owners.

Cost of RV Insurance With Dairyland

Dairyland RV insurance starts at $40 for minimum and $100 for full coverage, aligning with liability vs. full coverage auto insurance comparisons.

This is cheaper than competitors like Allstate, Farmers, State Farm, and Travelers, which charge $55–$60 for minimum and $100–$110 for full coverage.

Dairyland vs. Top Competitors: RV Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $110 | |

| $50 | $95 |

| $40 | $100 | |

| $60 | $105 | |

| $45 | $90 | |

| $50 | $95 | |

| $50 | $88 | |

| $60 | $100 | |

| $55 | $100 | |

| $40 | $80 |

It falls in the mid-range compared to Geico, American Family, and Nationwide, with minimum coverage at $45–$50 monthly and full coverage at $90–$95 a month.

Progressive and USAA are the cheapest per month, at $88 and $80 for full coverage, respectively. USAA also matches Dairyland’s $40 monthly minimum, but it’s only available to military families. Dairyland balances affordability and solid protection for all RV owners.

Dairyland RV Insurance Coverage Options

Owning an RV offers freedom and adventure, but it also comes with unique risks that require specialized protection. With these coverage choices, Dairyland gets you on the road with a way to ride confidently and securely.

Dairyland RV insurance policies offer many coverage options to protect your vehicle, personal property, and lifestyle, whether you’re on the road, at a campsite, or putting the RV away for the year.

- Full Coverage: A comprehensive policy that includes both liability and physical damage protections (collision, comprehensive, etc.).

- Storage Coverage: Suspends or reduces certain coverages (like liability and collision) while your RV is in storage, helping to lower your premium when it’s not being used.

- Rental Incentives / Rental Coverage: Allows you to rent out your RV without violating policy terms or provides coverage when the RV is rented.

- Emergency Expense Coverage: Pays for lodging, meals, and transportation if your RV becomes inoperable due to a covered loss while you’re away from home.

- Vacation Liability Coverage: Provides protection for third-party incidents (such as slip-and-fall or campfire damage) that occur while on vacation in your RV.

Whether you’re parking your RV in storage for the off-season, taking it across country on a road trip, or need premium protection at a campsite during vacation, our covers will help maintain the value of your recreational vehicle.

Learn More: Best Travel Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dairyland Renters Insurance Review

Dairyland Renters Insurance starts at $15 for minimum and $25 for full coverage. While not as cheap as USAA or Geico, it balances affordability with strong value. With essential coverages included, it earns recognition among the best renters insurance companies.

Comparing Dairyland Renters Insurance Costs

Dairyland offers renters for $15 minimum coverage and $25 full coverage, the same as State Farm, but slightly less than Farmers and Allstate, both of which come out to $28 full coverage.

Compared to budget-friendly options like Geico and Nationwide at $12 for minimum and $24–$26 for full, Dairyland falls in the midrange.

Dairyland vs. Top Competitors: Renters Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $15 | $28 | |

| $14 | $26 |

| $15 | $25 | |

| $16 | $27 | |

| $12 | $24 | |

| $12 | $26 | |

| $13 | $27 | |

| $15 | $25 | |

| $14 | $28 | |

| $10 | $18 |

Progressive and Travelers are on the pricier side with full coverage at $27–$28, while USAA is by far the cheapest at $10 for minimum and $18 for full.

That’s how competitive the renters insurance market is, with some insurers targeting budget-friendly renters, while others charge more for additional features or a well-known name.

Renters insurance rates rise with coverage, but higher deductibles lower costs. Raise your deductibles by $100 to cut monthly rates.

Daniel Walker Licensed Insurance Agent

Dairyland is an affordable choice for renters who want reliable protection. It’s a strong choice if you want to be covered without spending too much.

Shoppers can also use compare homeowners insurance quotes to explore alternatives beyond ultra-low-cost providers like USAA and Geico.

Dairyland Renters Insurance Coverage Options

Renting a home involves risks, and your landlord’s insurance won’t protect your belongings or liability. Dairyland renters insurance offers the coverage you need to protect your belongings, your liability, and living expenses if something were to happen.

With these coverages, Dairyland makes it simple and practical for renters to safeguard what matters most in their daily lives.

- Personal Property Protection: Covers damage to or loss of your personal items (furniture, electronics, clothing, etc.), whether they’re at home or away.

- Liability Protection: Provides legal defense and pays judgments if you’re found responsible for bodily injury or property damage to others.

- Guest Medical Protection: Pays medical expenses if someone is injured while visiting your residence, regardless of fault.

- Reimbursed Living Expenses: Covers additional living costs (hotel, meals, etc.) if your rental becomes uninhabitable due to a covered loss.

From protecting personal belongings like furniture, electronics, and clothing to covering liability in case of accidental damage or injuries to others, you’ll have a strong safety net in place.

Guest medical protection offers peace of mind, while reimbursed living expenses cover costs if your rental becomes uninhabitable.

Unlike many of the cheapest home insurance companies, Dairyland provides practical coverage for renters. With these protections, you can enjoy comfort and stability in your rental home.

Ways to Save on Dairyland Insurance

With Dairyland, there are a variety of ways to save on your premiums and still maintain reliable coverage. By using discounts and cost-saving strategies, you can design a policy that fits your needs.

- Low-Mileage Discount: Drive fewer miles than the average driver each year, and you may qualify for low-mileage discounts since fewer miles mean reduced accident risk.

- Good Student Discount: Students who maintain a strong GPA may qualify for good student insurance discounts, as academic responsibility often reflects safer driving habits.

- Continuous Insurance Discount: Keeping your policy up to date without breaks demonstrates dependability and can make you eligible for further discounts.

These discounts available demonstrate that Dairyland values those who are responsible, proactive, and savvy when making good financial decisions in their lives. And having more control over the cost of your coverage because of them.

Choosing a higher deductible and agreeing to pay more out of pocket for claims also significantly lowers monthly premiums for all types of Dairyland insurance, including auto, motorcycle, and homeowners.

By matching the right discounts with smart strategies and coverage that meets your needs, you can reduce your premiums without sacrificing the quality of protection you get.

Dairyland Insurance Customer Reviews

Dairyland Insurance reviews on BBB highlight the company’s strong ratings, reflecting both financial stability and customer experience.

The Better Business Bureau grades it as A+ in quality business practices, the best rating among equivalent market standards.

Dairyland Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 73/100 Mixed Customer Feedback |

|

| Score: 820 / 1,000 Above Avg. Satisfaction |

|

| Score: 1.10 Avg. Complaints |

Dairyland Insurance reviews consumer reports show a score of 73/100, reflecting mixed customer feedback. J.D. Power rates it 820/1,000 for above-average satisfaction.

The NAIC score of 1.10 indicates an average level of customer complaints compared to other insurers, but according to Yelp reviewers, Dairyland impresses with affordable monthly rates and helpful customer service.

Dairyland made getting their first car insured simple and convenient, with a responsive and supportive team ready to resolve issues.

If you’re a new or high-risk driver, read these insurance success stories to learn how people use Dairyland and other providers to find the best insurance coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Dairyland Insurance

When considering Dairyland Insurance, it’s important to weigh both its strengths and potential drawbacks. The company has some advantages, such as financial strength, discounts, and availability of high-risk drivers.

Dairyland Insurance can be a solid option for drivers who value flexibility, financial security, and opportunities to save through discounts.

- High-Risk Friendly: Dairyland tends to be more welcoming to drivers with less-than-perfect records, DUIs, or credit challenges, who may otherwise struggle to find coverage.

- Strong Financial Standing: The Dairyland Insurance rating of A+ from A.M. Best highlights its solid financial strength and strong ability to pay claims.

- Discount Opportunities: Provides multiple discounts (multi-car, advanced quote, etc.) to help reduce premiums when eligible.

However, fewer bundling options and reports of mixed customer service experiences may cause some policyholders to explore alternatives.

Understanding how some limitations may affect certain customers will help you decide whether Dairyland is the right fit for your insurance needs.

- Fewer Bundling Options: It doesn’t offer many options to bundle with homeowners, renters, or life insurance, limiting multi-policy savings.

- Mixed Customer Service Reports: Some customers report inconsistencies in claims handling, delays, or difficulties depending on region or adjuster.

Dairyland is strong in terms of financial stability, high-risk auto coverage, and available discounts, but if you value the convenience offered by the best auto and home insurance bundles or expect consistently smooth claims handling, Dairyland may not be the best match.

By taking a close look at the pros and cons, you can understand whether Dairyland is the best choice for your insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Compare Dairyland Insurance Options Now

Our Dairyland insurance review shows that while Dairyland may not always be the cheapest option, it stands out for its accessibility and flexibility, especially for high-risk drivers. High-risk auto insurance starts at about $32 per month. Motorcycle coverage also remains affordable, starting at $25 for minimum protection.

Drivers benefit from SR-22 support, multiple discount opportunities, and 24/7 claims service, making Dairyland a practical choice among the best car insurance companies.

Dairyland can be a good option for drivers with accidents or suspended licenses who need flexibility and reliable service.

However, higher-than-average premiums, limited bundling, and mixed customer service reviews remain drawbacks to consider. Discover the lowest auto insurance rates available by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

Is Dairyland a good auto insurance company?

Dairyland is a good option for high-risk drivers. It provides insurance that starts at $32 per month, with SR-22 insurance available and 24/7 claims assistance.

What rating does Dairyland Insurance have?

Dairyland Insurance reviews complaints show mixed customer experiences despite strong ratings. The company holds an A+ from A.M. Best and the BBB, reflecting solid stability. Consumer Reports scores it 73/100, while its NAIC score of 1.10 indicates an average complaint level.

What kind of insurance does Dairyland offer?

Dairyland provides insurance products for high-risk drivers and everyday vehicles. Options include motorcycle, ATV/UTV, snowmobile, dirt bike, scooter, RV, and renters insurance. It also offers guidance on what to do if you can’t afford your auto insurance, helping customers stay protected.

Is Dairyland car insurance for high-risk drivers?

Yes, Dairyland is well-suited for high-risk drivers, offering flexible policies, SR-22 filings, and coverage options for those with DUIs, tickets, or poor credit, making it a reliable choice when traditional insurers may deny or overprice coverage.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool.

What is Dairyland Insurance’s customer service availability?

Dairyland Insurance offers 24/7 customer service, allowing policyholders to file claims or request support at any time of day.

How does Dairyland compare to other insurers?

Dairyland often costs more than Geico, State Farm, and USAA for clean drivers. Still, it appeals to high-risk drivers with flexible options and specialty coverage. Check out our USAA insurance review for a closer comparison.

How financially stable is Dairyland Insurance Company?

Dairyland is considered financially stable, holding an A+ rating from A.M. Best for superior financial strength and an A+ rating from the Better Business Bureau, which reflects excellent business practices and a strong ability to meet policyholder obligations.

What is the Dairyland Insurance claims process?

The Dairyland Insurance claims process starts with reporting a claim online or by phone anytime, 24/7. The firm acts quickly to settle claims, communicating with you so you remain informed and receive an equitable payment for your covered losses.

Is Dairyland a non-standard insurance company?

Yes, Dairyland is a non-standard insurance company, specializing in coverage for high-risk drivers with DUIs, accidents, tickets, or poor credit. It offers flexible policies and SR-22 auto insurance support that many standard insurers don’t provide, while also extending affordable options for motorcycles, ATVs, and other specialty vehicles.

Does Dairyland Insurance offer monthly payments?

Yes, Dairyland Insurance has monthly payments, and auto coverage premiums begin at $32 per month. This flexibility enables policyowners to extend premium payments in a manner that makes it easier to afford premiums while keeping coverage secure and certain.

What is Dairyland Insurance’s average claim response time frame?

What discounts does Dairyland Insurance offer?

How much does Dairyland Insurance cost?

How is customer service in Dairyland Insurance reviews on Reddit?

Does Dairyland Insurance create a user-friendly experience for customers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.