Aetna Insurance Review for 2026

Our Aetna insurance review found members value broad coverage and wellness perks. Starting at $345 per month, Aetna insurance offers dental, vision, Medicaid, and Medicare, plus discounts and integrated care through CVS Health. However, some plans carry higher deductibles and limited availability.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, bus...

Tracey L. Wells

Updated October 2025

Our Aetna insurance review found that plans start at $345 and vary depending on age, gender, and lifestyle. Aetna offers medical, dental, vision, Medicaid, and Medicare options, along with wellness discounts and CVS Health integration.

Aetna Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.8 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 4.5 |

| Discounts Available | 2.5 |

| Insurance Cost | 3.6 |

| Plan Personalization | 4.0 |

| Policy Options | 4.0 |

| Savings Potential | 3.3 |

Members benefit from a broad provider network and helpful digital tools, though some face higher deductibles and limited plan access. Overall, Aetna delivers strong coverage with added perks that go beyond basic insurance, making comparing plans and getting an insurance plan that works for you an essential step before enrolling.

- Aetna insurance review finds $345 starting rates for Bronze health plan coverage

- Rates vary by age, gender, and lifestyle with wellness discounts & CVS Health

- Offers medical, dental, vision, Medicaid, and Medicare plans & virtual care access

Don’t let expensive insurance rates hold you back. Enter your ZIP code and shop for affordable premiums from the top companies.

Aetna Health Insurance Review

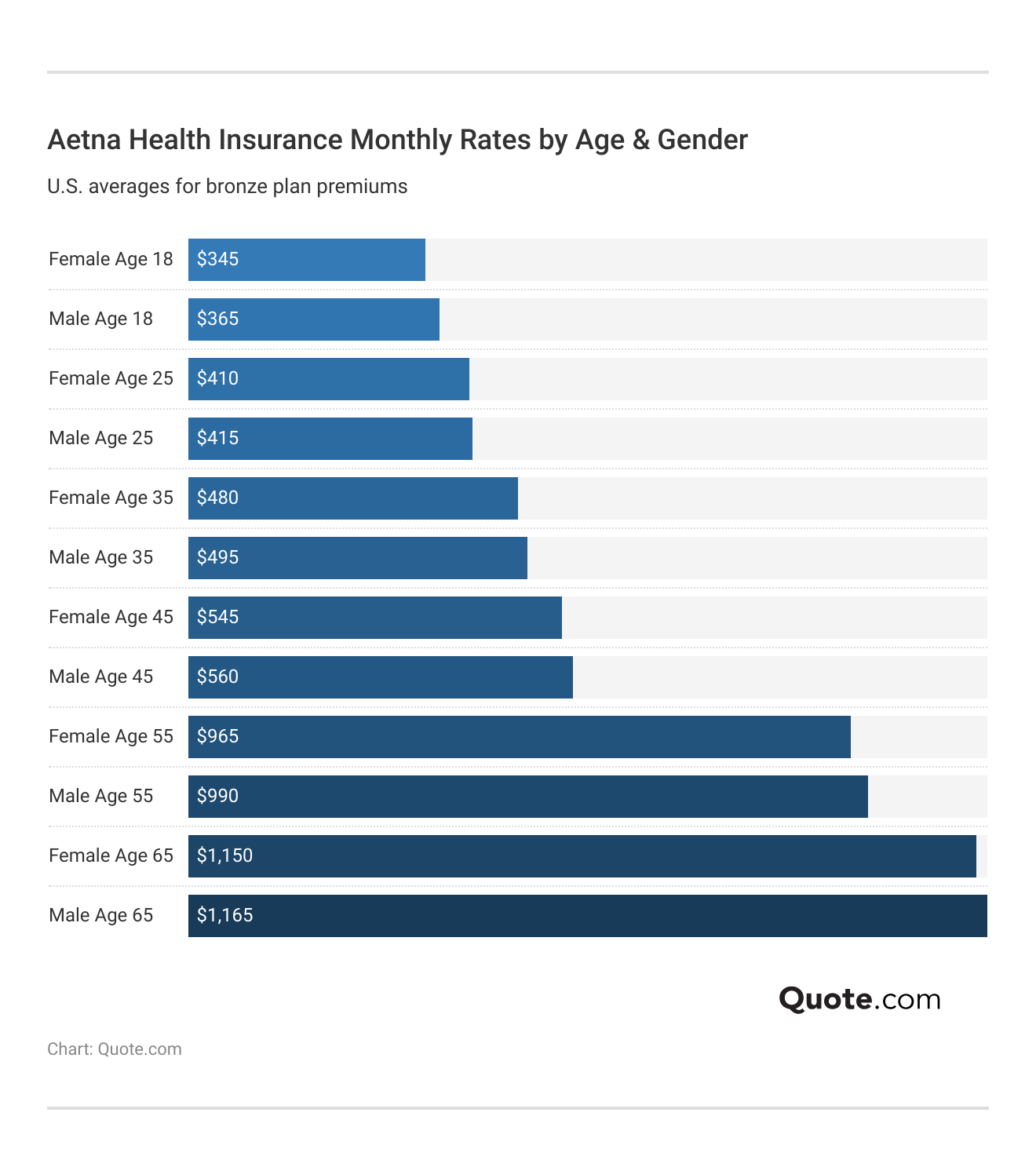

Aetna’s health insurance rates vary by age, gender, plan type, and lifestyle. An 18-year-old female pays about $345 a month, while a male of the same age pays $365. This small gap continues across age groups, with costs rising sharply over time—reaching $1,150 for women and $1,165 for men at age 65.

Compared to competitors, Aetna’s bronze plan averages $560 a month, cheaper than Blue Cross Blue Shield at $680 and Humana at $645. Its silver and gold plans, at $590 and $610, also stay below many rivals, making Aetna a cost-effective choice for tiered coverage.

Aetna vs. Top Competitors: Health Insurance Monthly Rates by Tier| Insurance Company | Bronze Plan | Silver Plan | Gold Plan |

|---|---|---|---|

| $560 | $590 | $610 | |

| $600 | $630 | $675 | |

| $680 | $710 | $760 | |

| $630 | $675 | $725 |

| $635 | $685 | $730 | |

| $645 | $700 | $750 | |

| $620 | $680 | $720 |

| $640 | $690 | $740 | |

| $570 | $600 | $665 | |

| $690 | $725 | $775 |

Lifestyle also impacts pricing. Smokers pay much more, with ACA individual plans at $615 compared to $410 for non-smokers. Short-term health and supplemental coverage show similar increases, including $45 for critical illness coverage versus $30 for non-smokers.

Aetna Health Insurance Monthly Rates: Smoker vs. Non-Smoker| Coverage Type | Smoker | Non-Smoker |

|---|---|---|

| ACA Individual Health | $615 | $410 |

| Short-Term Health | $265 | $180 |

| Employer Group Plan | $210 | $160 |

| Critical Illness Coverage | $45 | $30 |

Aetna remains competitive, with lower entry-level pricing and better rates for healthier lifestyles, though costs rise significantly with age and smoking status, making health insurance finance an important factor when budgeting for long-term coverage. Recent Aetna insurance rating results also show strong financial stability but mixed customer satisfaction.

Cost of Aetna Health Insurance

Dental insurance is $22 per month and includes exams, cleanings, X-rays, and basic procedures. Vision coverage is $15 per month and provides annual eye exams, lenses, and a frame allowance.

Aetna Insurance Monthly Rates by Coverage Type| Coverage | Premium | Eligibility | Key Benefits |

|---|---|---|---|

| Dental | $22 | Individuals and families | Exams, cleanings, X-rays, basic procedures |

| Vision | $15 | All individuals | Annual eye exam, lenses, frame allowance |

| Medicaid | $0 | Income-qualified individuals/families | Doctor visits, hospital care, prescriptions |

| Medicare | $0 | Seniors 65+ or disabled individuals | Hospital + medical coverage, drug plans, extras like dental/vision |

Medicaid has no premium for income-qualified individuals and families, covering doctor visits, hospital care, and prescriptions. Medicare also has no premium for seniors 65 and older or disabled individuals, offering hospital and medical coverage, drug plans, and extras like dental and vision.

Compare the premium, deductible, and copay side by side—these three costs reveal what you’ll spend out of pocket before your Aetna plan starts saving you money.

Michelle Robbins Licensed Insurance Agent

These options highlight how Aetna combines low-cost supplemental plans with essential government-backed coverage (Learn More: How the Human Eye Works). Copays are fixed amounts paid at the time of service, usually $0 to $50, and are predictable per visit. Deductibles are annual out-of-pocket costs before coverage begins, ranging from $0 to $500 in many Advantage plans, though some Aetna plans have none.

Aetna Copay, Deductible, & Premium Breakdown| Category | Copay | Deductible | Premium |

|---|---|---|---|

| Definition | Fixed amount you pay for services (e.g., $20 for doctor visit) | Amount you pay out of pocket before coverage begins | Regular monthly payment to maintain your insurance |

| Payment Timing | Paid at the time of service | Accumulates annually before full benefits kick in | Paid monthly regardless of service use |

| Medicare Parts | Applies mostly in Part C (Advantage) and Part D (drugs) | Present in some Part C and Part D plans | Applies to Part B (base premium), Part C (if any), and Part D plans |

| Typical Cost | $0–$50 depending on service type | $0–$500 for many Advantage plans; higher in some non-HMO options | $0–$100+/mo depending on plan and subsidies |

| Cost Predictability | Predictable per visit, varies by service | Less predictable—cost depends on usage | Most predictable fixed monthly amount |

| Varies by Plan | Yes – HMOs often have lower copays than PPOs | Yes – some Aetna plans have no deductible at all | Yes – premium may be $0 for some Advantage plans; varies by benefits |

Premiums are monthly payments required to keep coverage, typically $0 to over $100, depending on the plan and subsidies. Copays apply mostly to Medicare Advantage and Part D, deductibles appear in some Part C and D plans, and premiums apply across Parts B, C, and D. Copays are the most predictable, deductibles vary by plan, and premiums remain the most consistent monthly expense.

Aetna Health Insurance Coverage

Aetna offers a wide range of coverage choices designed to meet different health needs, whether you’re looking for everyday care or more specialized support. Members often ask about the Aetna cost per month, which varies by plan type, coverage level, and individual factors such as age, health, and lifestyle.

- Medical Coverage: Comprehensive health plans that include preventive care, doctor visits, hospital stays, prescriptions, and access to Aetna’s extensive provider network.

- Dental Insurance: Plans that cover routine exams, cleanings, X-rays, and standard procedures to help maintain oral health.

- Vision Insurance: Coverage for annual eye exams, prescription lenses, and allowances for frames or contacts.

- Medicaid Plans: State-supported programs managed by Aetna for income-qualified individuals and families, providing essential medical services and prescriptions.

- Medicare Plans: Options for seniors and eligible disabled individuals, including Medicare Advantage, Medicare Part D drug coverage, and supplemental benefits like dental and vision.

Together, these options give members flexibility to choose the right mix of benefits, from core medical coverage to specialized plans, while maintaining access to reliable care and nationwide support.

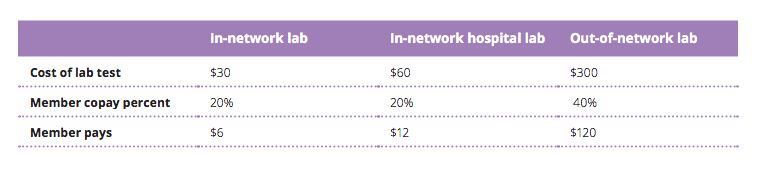

Aetna Preferred Lab Network

Aetna’s Preferred Lab network is designed to help members save money and avoid surprise bills by steering lab work to contracted providers that offer discounted rates. If your doctor orders bloodwork, diagnostic testing, or other lab services, using an Aetna Preferred Lab means the claim is filed directly by the lab, and you typically pay only the copay or coinsurance tied to your plan.

Out-of-network labs can still process tests, but costs are higher since Aetna won’t cover the full amount. Members should confirm if a lab is preferred using Aetna’s provider search tool or customer service. This ensures predictable pricing, smoother billing, and fewer denied claims, making it an important part of managing costs under Aetna coverage (Learn More: An In-Depth Review of ObamaCare).

Aetna Health Insurance Discounts

Aetna also provides several discount programs that provide its members with savings on some services and products not covered under typical health plans. These benefits are not insurance, but rather add-ons that can make health care more affordable and encourage healthier behavior. Here are some of the biggest discounts:

- Fitness & Gym Memberships: Members get reduced rates on gym memberships, home exercise equipment, and wellness programs through partners like GlobalFit and ChooseHealthy.

- Alternative Care Savings: Discounts apply to services such as chiropractic care, acupuncture, massage therapy, and nutritional counseling.

- Vision & Hearing Discounts: Members can save on eye exams, glasses, contact lenses, LASIK procedures, and hearing services, including exams, hearing aids, and batteries.

- Nutrition & Wellness Products: Aetna partners with vendors to provide savings on vitamins, supplements, and healthy living tools like fitness trackers.

- Lifestyle & Everyday Discounts: Additional perks extend to travel, entertainment, groceries, and even electronics through Aetna’s Vital Savings program.

Aetna’s discount programs help members cut costs on health and wellness while adding everyday value beyond medical coverage. These extras make it easier to stay healthy without overspending, which is the kind of benefit often highlighted in the complete guide to health insurance.

Aetna Medicaid Coverage & Benefits

Here’s a look at what Aetna Medicaid covers and who is eligible. It is designed for low-income individuals and families who qualify for the state, but the availability of this insurance option differs from state to state. Doctor visits and checkups are free, as is primary care; specialist care is covered with a referral, subject to state rules.

Aetna Medicaid: Full Breakdown & Benefits| Feature | Details |

|---|---|

| Plan Type | Medicaid Managed Care |

| Eligibility | Low-income individuals & families who meet state requirements |

| Coverage Areas | State-specific availability |

| Primary Care | No-cost doctor visits & checkups |

| Specialist Care | Covered with referral (varies by state) |

| Hospital Services | Inpatient & outpatient care covered |

| Prescription Drugs | Covered with low or no copay |

| Preventive Care | Immunizations, screenings, and wellness visits covered |

| Maternity Care | Prenatal, delivery, and postpartum services |

| Vision & Dental | Included for children; adults vary by state |

| Extra Benefits | May include telehealth, transportation, and wellness programs |

Hospital services include both inpatient and outpatient care, and prescription drugs are usually available with low or no copay. Preventive care, such as immunizations and wellness visits, is fully covered, and maternity services include prenatal, delivery, and postpartum care.

Vision and dental are included for children, with adult coverage depending on the state. Some plans also provide extra benefits like telehealth, transportation, and wellness programs, making it more comprehensive than just basic medical care.

Aetna Medicare Advantage Coverage & Benefits

Aetna Medicare is a managed care option for low-income individuals and families who are eligible under the state’s guidelines, and the chart breaks down what that covers. Visits to primary care and checkups are free, but as is the case with specialists, care from one of the specialists to whom the patients are referred is covered with a referral; however, the process differs by state.

Aetna Medicare: Full Breakdown & Benefits| Feature | Details |

|---|---|

| Plan Type | Medicare Advantage (Part C) & Medigap |

| Eligibility | Age 65+ or qualifying disability |

| Coverage Areas | Nationwide network (varies by plan) |

| Hospital Care | Inpatient and outpatient services covered |

| Doctor Visits | Primary care and specialists covered (with copay) |

| Prescription Drugs | Included with most Medicare Advantage plans (Part D) |

| Preventive Services | Screenings, immunizations, annual wellness visits |

| Vision & Dental | Often included with Advantage plans |

| Hearing | Hearing exams and hearing aid allowance in some plans |

| Extra Benefits | Telehealth, over-the-counter allowances, fitness programs |

| Monthly Premium | Varies by plan; some $0 premium options available |

Hospital services, including both inpatient and outpatient care, are fully covered, and prescription drugs come with little to no copay. Preventive care—like immunizations, screenings, and wellness visits—is included, along with maternity services covering prenatal, delivery, and postpartum needs.

Vision and dental benefits are built in for children, while adult coverage depends on state rules. On top of that, many plans offer extra benefits such as telehealth, transportation, and wellness programs, making Aetna Medicaid a more complete support system than just basic medical coverage.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aetna Dental Insurance Coverage Options

Aetna’s dental coverage is structured to handle routine care while also providing support for more expensive procedures. The details can vary by state and plan, but here’s what members can typically expect:

- Preventive Care: Most Aetna dental plans cover two cleanings and exams per year at no cost in-network. X-rays, including bitewings, are often included to catch issues early.

- Basic Services: Coverage includes fillings, extractions, and emergency treatment. Members pay a copay or coinsurance, with lower costs when staying in-network.

- Major Services: Root canals, crowns, dentures, and oral surgery are covered at a higher coinsurance rate. Some plans include waiting periods before coverage begins.

- Orthodontics: Select plans cover braces or aligners with a lifetime maximum benefit cap. This is especially valuable for families with children needing orthodontic care.

- Network Savings: Aetna dental PPO plans include thousands of dentists nationwide. Members save most with in-network providers using Aetna’s discounted rates, though out-of-network care costs more.

Altogether, Aetna’s dental coverage is designed to make preventive care affordable while also giving members financial protection against the high costs of advanced dental procedures. It combines everyday coverage with broader support, making it practical for both individuals and families.

Individual & Family Health Plans

Aetna offers ACA marketplace plans in select states with Bronze, Silver, and Gold levels. Bronze plans have lower premiums but higher deductibles, while Gold plans cost more monthly but have lower out-of-pocket costs. Silver plans sit in the middle and may qualify for cost-sharing reductions. All tiers cover essential benefits like doctor visits, hospital stays, prescriptions, preventive care, and maternity services.

Read more: Medicare Part A

Employer-Sponsored Group Plans

Aetna offers employer group plans that include medical, dental, vision, pharmacy, wellness, and telehealth coverage. Plan options include HMO, PPO, and HDHPs with HSAs. Employers also receive onsite screenings, health coaching, and cost management programs designed to lower expenses and improve employee health (Learn More: Medicare Part B).

Medicare Plans

Aetna offers Medicare options for seniors and eligible individuals. Medicare Advantage (Part C) covers hospital, medical, and often drugs, with many plans adding dental, vision, hearing, fitness, and telehealth.

Prescription Drug Plans (Part D) cover medication costs and may be bundled with Advantage plans. Aetna also offers Medigap to help with deductibles, coinsurance, and copays not covered by Medicare; benefits vary by state (Learn More: Medicare Advantage vs. Original Medicare).

Medicaid Plans

Aetna Better Health manages Medicaid and CHIP coverage in multiple states for low-income individuals, families, children, pregnant women, and people with disabilities. Benefits include primary and specialist care, hospital coverage, prescriptions, screenings, maternity and long-term care, and extras like telehealth, transportation and wellness programs for greater access.

Read more: What is Medicaid?

Dental & Vision Plans

Aetna offers dental coverage in select states for exams, cleanings, X-rays, and major services like fillings, crowns, and root canals. Some plans add orthodontics, often noted in Aetna dental insurance reviews for affordability. Vision benefits include exams, glasses, contacts, and frame allowances, with LASIK discounts praised in Aetna vision insurance reviews for savings and flexibility (Learn more: Who is eligible for Medicare?).

Supplemental Plans

Aetna offers supplemental plans to cover costs standard insurance may miss, including hospital indemnity (cash for hospital stays), critical illness (lump sum after cancer or heart attack), and accident coverage (help with injury costs). Many Aetna supplemental insurance reviews note that these options add flexibility and peace of mind by filling gaps in traditional coverage (Learn more: What is Medicare Supplemental Insurance?).

Disability Plan

Aetna disability plans protect income if you can’t work due to illness, injury, or pregnancy. Offered through employers, short-term plans cover part of your salary for weeks or months, while long-term plans extend benefits if you remain unable to work. They help with essentials like housing and bills, and some include premium waivers so coverage continues without payment if you become disabled at a certain age.

Read more: Cheap Auto Insurance for Disabled Veterans

Life Insurance Plans

Aetna life insurance is offered through employers as group term coverage with options like accidental death, portability, and policy conversion if you leave your job. Some plans include accelerated death benefits and premium waivers. These features make Aetna a flexible choice for long-term support, and many Aetna life insurance reviews highlight its value for employees and families (Learn More: Whole vs. Term Life Insurance).

Aetna Insurance Reviews & Ratings

When you look at Aetna’s ratings across major agencies, you get a well-rounded view of how it performs in the market. J.D. Power scores Aetna 835 out of 1,000 for average customer satisfaction, which puts it in a competitive spot but not at the very top. The Aetna insurance reviews from the BBB give Aetna an A+ for business practices, a key detail often cited, which emphasizes its strong reliability.

Aetna Insurance Business Ratings and Consumer Reviews| Agency | |

|---|---|

| Score: 835/1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 70/100 Avg. Customer Satisfaction |

|

| Score: 0.75 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

On customer satisfaction, Consumer Reports rates it 70 out of 100, so plenty of members are happy, but it has room to improve. Regulatory-wise, Aetna scores a 0.75, indicating the company receives significantly fewer complaints than the industry average. Finally, AM Best provides Aetna an A for financial strength, which means it’s financially strong enough to pay claims.

Altogether, these Aetna reviews show a financially stable company with a solid reputation, though customer experiences can vary depending on the plan and state. For example, one Aetna insurance review on Yelp post from a Los Angeles member praised a representative for quickly resolving billing issues and walking through plan details step by step.

From my experience with Aetna, reviewing premiums, copays, and insurance deductibles together is the key to avoiding surprise costs.

Melanie Musson Published Insurance Expert

Similarly, several Banner Aetna insurance reviews highlight strong provider access and customer support in certain regions. This kind of one-on-one service made members feel supported and better informed about their coverage. It also shows why resources like a millennial’s guide to health insurance are valuable for younger buyers needing clear, simple explanations when choosing a plan.

Proven Ways to Save Money on Aetna Insurance

Finding ways to cut healthcare costs is important, and Aetna offers several practical options to help members lower their overall expenses without sacrificing necessary care.

- Choose The Right Plan Level: Bronze, Silver, and Gold plans balance premiums and out-of-pocket costs. Bronze saves money if you rarely visit doctors, while Gold works better for frequent care.

- Use In-Network Providers: Staying within Aetna’s network costs less because of negotiated prices. Out-of-network care frequently results in much higher bills.

- Take Advantage of Wellness Discounts: Aetna offers discounts on gyms, nutrition programs, hearing aids, and alternative care like acupuncture and massage therapy.

- Consider Supplemental Coverage: Low-cost options like dental, vision, or hospital fixed benefit plans help cover expenses not included in standard insurance.

- Use Preventive Care Benefits: Aetna covers many preventive services at no cost in-network, including checkups, immunizations, and screenings to lower future risks.

Altogether, saving on Aetna healthcare insurance comes down to understanding your plan, using in-network care, and taking full advantage of included perks and preventive services. Factoring in insurance deductibles is also key, since knowing how much you pay before coverage begins helps keep costs predictable while giving you more value from your coverage.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

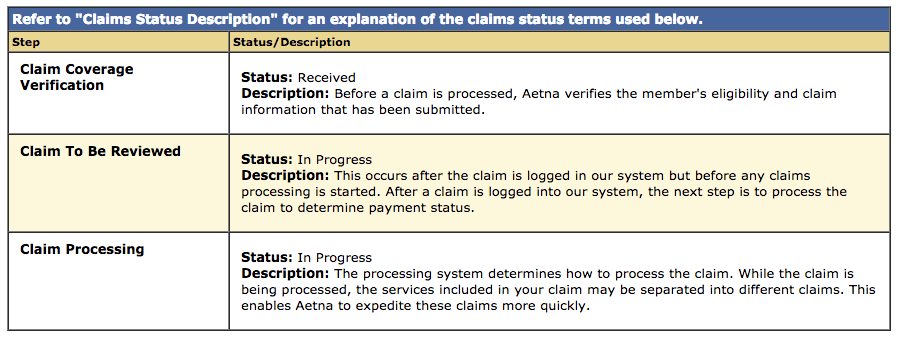

How to File an Insurance Claim With Aetna

Filing an insurance claim with Aetna is usually straightforward, but the process depends on whether you’re using an in-network or out-of-network provider. Here’s what members need to know:

- In-Network Providers File: Aetna in-network doctors and hospitals submit claims for you, saving paperwork, though you should still check your Explanation of Benefits for accuracy.

- Out-of-Network Requires Member Filing: If you use an out-of-network provider, you must complete and submit the claim form directly to Aetna.

- Access Claim Forms Online: Aetna makes the necessary forms available on its website. You can log in to your member account to download medical, dental, or pharmacy claim forms specific to your plan.

- Submit Online or Mail: Forms can be sent through Aetna’s secure portal or mailed to the listed address, with all supporting documents like itemized bills and receipts attached.

- Track Claim Status: Once submitted, you can log into your account and use the Claims Center to check real-time status updates. Aetna also emails confirmations when claims are received.

If there’s a network in your area, small or large, it’s the easiest way to go, because the claims are filed for you, and it saves time and minimizes errors. If you have to file a claim on your own, Aetna’s digital resources, straightforward instructions, and Claims Center tracking make the process easily manageable.

Having online access to forms and updates also helps you stay organized and avoid delays, which gives members confidence that their claims will be processed correctly and on time (Learn More: How to File an Insurance Claim & Win).

Steps to Cancel Your Aetna Insurance Policy

Canceling an Aetna insurance policy depends on the type of coverage you have. If you’re enrolled in an individual health plan, you can cancel by calling the number on the back of your Aetna member ID card. For employer-sponsored coverage, cancellation must go through your HR department since they manage enrollment.

If you bought your plan through a broker or an agent, you need to contact them directly. Most Medicare Advantage and Part D plans require members to be covered for the full year, leaving cancellations to the Annual Enrollment Period or allowing you to end coverage only if you qualify for a Special Enrollment Period. Understanding these rules will make you less vulnerable to gaps or penalties in coverage.

Read more: What Happens If You Cancel Auto Insurance

Aetna Behavioral Health Programs

Beyond standard coverage, Aetna provides a suite of programs that promote healthier living, offer specialized care, and support members through challenges—while also extending into behavioral health for a more complete approach to wellness.

- Wellness & Lifestyle Discounts: Aetna members get savings on fitness, weight management, vision, hearing, and LASIK services through partners like EyeMed, Hearing Care Solutions, and QualSight.

- Workplace & Corporate Wellness: Aetna Health Connections offers employer plans with health coaching, mindfulness, women’s health support, metabolic care, and 24/7 nurse access.

- Specialty Care Through Aetna Institutes: Aetna Institutes link members to leading hospitals, including Institutes of Excellence for transplants and Institutes of Quality for bariatric, cardiac, & behavioral care.

- Compassionate & Condition-Specific Care: Provides nurse case managers for illness support, hospice planning, and care coordination, plus apps for early intervention and long-term management.

- Integrated Behavioral Health: Aetna’s programs link mental health clinicians with your primary care doctor. Members start with three sessions, and providers coordinate ongoing treatment.

These programs underscore the fact that Aetna is more than an insurance company. With health and wellness discount programs, focused medical links to cancer and other serious illness support, additional compassionate care, and its integrated model of behavioral health, Aetna puts members’ physical and mental health to work for them with less stress.

Read more: How much does Medicare cost?

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aetna Insurance Pros & Cons

Aetna has been in the health insurance business for over 160 years, and as part of CVS Health, it now reaches millions of members across the U.S. Like any insurer, it has strengths and weaknesses that matter depending on what kind of coverage you’re looking for. Here’s what stands out most:

Pros

- Strong Medicare Advantage Options: Aetna offers $0 premium plans with drug, dental, vision, hearing, fitness, and OTC benefits, making it a top choice for seniors.

- Wide Provider Network: Access 1.5 million professionals, 5,000+ hospitals, and CVS MinuteClinics for convenient in-network care.

- Wellness and Member Perks: Discounts on gyms, weight-loss programs, hearing aids, and acupuncture help members save on preventive and lifestyle needs.

Cons

- Customer Service Complaints: Aetna sees many complaints about denied claims, delays, and inconsistent support, reflected in Consumer Affairs and NAIC data.

- Limited Availability for Some Products: ACA marketplace and Medicaid plans aren’t available in every state, limiting access for some members.

Aetna is known for strong Medicare Advantage options, a broad provider network, and valuable wellness perks. However, potential members should weigh these benefits against its mixed customer service reputation and the limited availability of some plans. Always compare the options in your zip code and check reviews from members in your state before enrolling.

Comment

byu/Naughtai from discussion

inNorthCarolina

One Reddit user shared that Aetna processed claims faster than Blue Cross Blue Shield of North Carolina and offered better coverage and pricing. This shows how member experiences vary and why checking Aetna insurance reviews on Reddit gives valuable insight before choosing a plan (Learn More: How to Sign up for Medicare).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Deciding if Aetna Insurance Is the Best Fit for You

Our Aetna insurance review demonstrates that the company is still a good choice for the average individual’s and senior citizens’ health insurance shopping needs, as they have a great balance of affordable rates and wide-ranging coverage. Aetna is distinguished by its large provider network, competitive Medicare Advantage plans, and extra offerings such as dental, vision, and wellness plans.

However, members should weigh Aetna’s strengths against drawbacks like uneven customer service and limited plan availability in some states. The key is to compare plan details, costs, and benefits in your state—especially if you live in one of the best states for employer-provided health insurance, where Aetna group coverage may be more affordable.

Searching for more affordable premiums? Insert your ZIP code to get started on finding the right provider for you and your budget.

Frequently Asked Questions

Does Aetna cover international health needs?

Yes, Aetna International offers coverage for people living, working, or studying abroad. These plans typically include access to global provider networks, routine and specialist care, emergency medical evacuation, and preventive services. However, standard U.S.-based Aetna health plans have limited international coverage, often requiring out-of-pocket payment and reimbursement.

What is the rating of Aetna life insurance?

Aetna’s life insurance products are usually offered through employer-sponsored group plans, not as individual retail policies. Aetna’s parent company holds an A rating from A.M. Best, reflecting strong financial strength and reliability to pay claims. This means policyholders can trust Aetna to remain stable when fulfilling life insurance benefits.

Is Aetna a life insurance company?

Aetna began in 1853 as a life insurance company in Hartford, Connecticut, before shifting into health care. Aetna primarily provides health, dental, vision, Medicare, and Medicaid coverage, but life insurance is still available through many employer group plans rather than individual retail offerings, often priced in line with the average cost of life insurance available through workplace benefits.

Which is better, Aetna or Blue Cross?

Comparing Aetna and Blue Cross Blue Shield (BCBS) depends on what you value most. Aetna’s Bronze plan averages $345 per month, which is more affordable than BCBS at $680. Both companies have large provider networks, but BCBS tends to score higher in customer satisfaction surveys, while Aetna is often praised for its wellness perks and Medicare Advantage offerings.

Who is the owner of Aetna?

Aetna is owned by CVS Health, which acquired the company in 2018. This integration allows Aetna members to combine insurance with CVS services, including pharmacy benefits, access to MinuteClinic walk-ins, and coordinated care programs. This ownership has made Aetna unique in blending retail pharmacy with health insurance.

How long has Aetna Life Insurance been around?

Aetna has been operating for over 160 years, starting as a life insurance provider in 1853. Over time, Aetna expanded into health insurance and became one of the most recognized names in the industry. While it is no longer a stand-alone life insurer for individuals, it still offers group life insurance benefits, and employees can often learn how to get life insurance quotes through their workplace enrollment process.

Start comparing affordable insurance options by entering your ZIP code into our free quote comparison tool today.

Is Blue Cross Blue Shield better than Aetna for health insurance?

Blue Cross Blue Shield has higher name recognition and strong satisfaction ratings, but Aetna offers lower monthly rates in most tiered plans. For example, BCBS Bronze plans average $680 versus Aetna’s $345. Aetna also provides wellness discounts and strong Medicare Advantage benefits, while BCBS has a broader national reach.

Which is better, Cigna or Aetna?

Aetna and Cigna are close competitors in health coverage. Aetna’s Bronze plan costs $345, while Cigna averages $630. Aetna provides stronger integration with CVS Health services, like pharmacy discounts and MinuteClinic access, while Cigna often ranks higher in specialized care and international coverage. The better option depends on your priorities for cost versus global access.

What does a Vital Savings by Aetna review show?

Vital Savings by Aetna is an ancillary dental, medical, and prescription discount program that combines discounts on special services with health-related resources. Reviews mention that it’s not insurance, but does offer real value for out-of-pocket costs — especially for dental and alternative care. Members report 15% to 50% savings on most health and lifestyle services.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.