Mutual of Omaha Life Insurance Review for 2026

Mutual of Omaha life insurance starts at $17 per month, with payouts often processed within a few business days. This Mutual of Omaha life insurance review guides families through their unique Fit Program, which improves evaluations and offers term options with coverage ranging from $25,000 to $100,000.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated September 2025

This Mutual of Omaha life insurance review helps families and seniors by highlighting its unique Medicare supplement plans.

Mutual of Omaha Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.5 |

| Claims Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 4.0 |

| Discounts Available | 2.0 |

| Insurance Cost | 3.1 |

| Plan Personalization | 3.0 |

| Policy Options | 3.5 |

| Savings Potential | 2.1 |

It offers unique Medicare supplement insurance to cover costs beyond standard Medicare and waives medical exams on term and whole life to simplify access.

Customers report that payouts are often completed within days, thanks to a Fit Program that awards favorable points toward evaluations. Explore the best life insurance companies and how Mutual of Omaha prices by health.

- Mutual of Omaha life insurance allows loans up to 90% cash value

- Waives medical exam for term and whole life up to age seventy-four

- Fit Program awards points, improving rates for eligible healthy clients

Find affordable coverage by reading our Mutual of Omaha life insurance review and entering your ZIP code into our free quote comparison tool.

Mutual of Omaha Life Insurance Cost

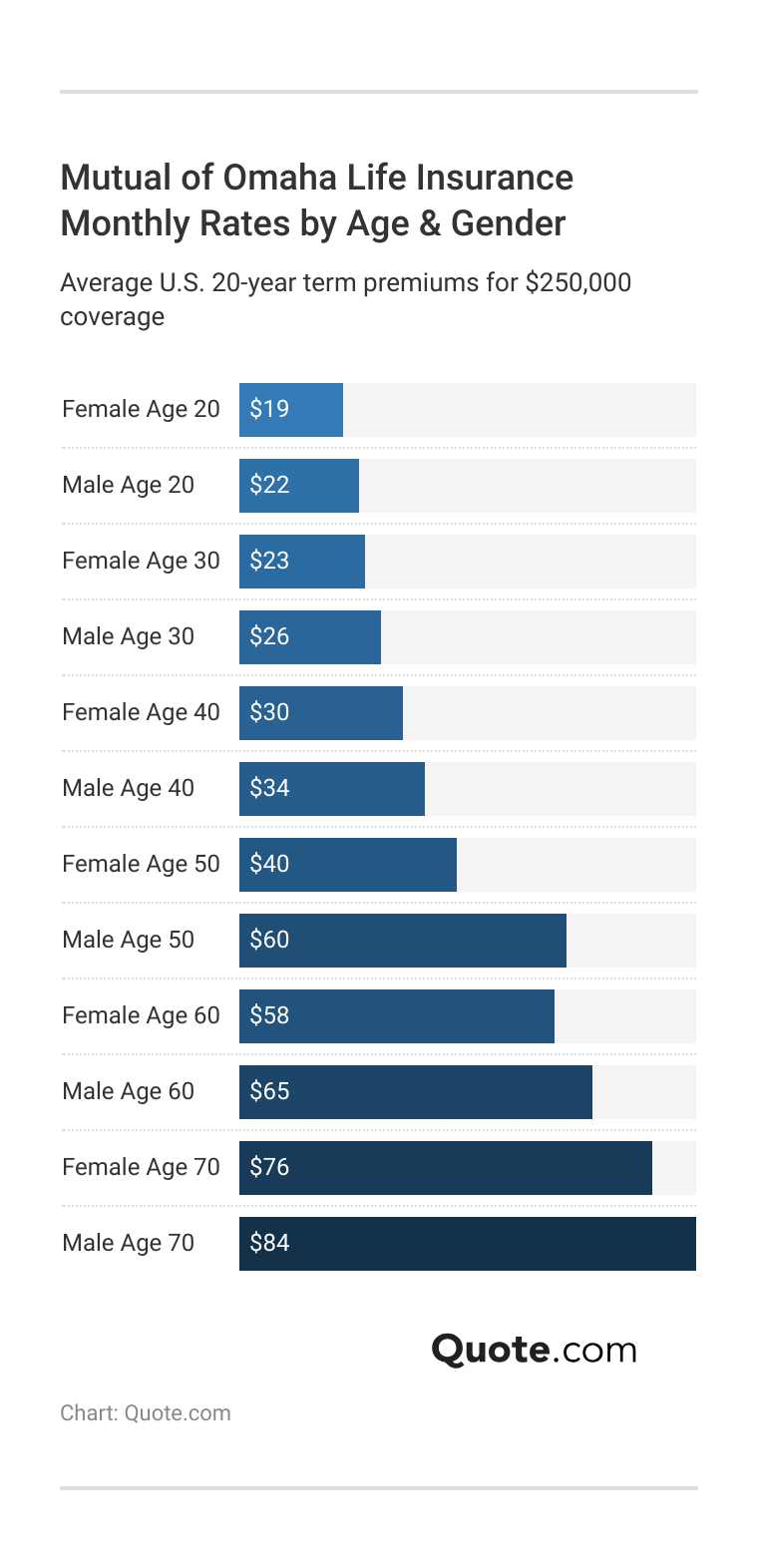

Mutual of Omaha life insurance rates change depending on your age, gender, and the type of policy you choose. This makes it easy to see how these factors affect your payment.

If you are younger, the cost is usually lower, however, as you get older, the premiums increase gradually. Women typically pay less than men for the same type of coverage. This detail helps families understand how these factors influence their decisions when choosing between term and whole life plans for long-lasting comfort and reassurance.

Mutual of Omaha competes strongly with the best life insurance providers, offering good rates for both term and whole policies. The cost can vary significantly among competitors; for example, Transamerica often offers lower premiums for term insurance, while Gerber tends to have higher costs for whole life insurance.

Mutual of Omaha vs. Top Competitors: Life Insurance Monthly Rates| Insurance Company | 20-Year Term | Whole Policy |

|---|---|---|

| $17 | $102 | |

| $32 | $390 |

| $34 | $410 | |

| $31 | $385 | |

| $36 | $455 | |

| $33 | $472 |

| $39 | $475 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

This comparison helps buyers to check premium differences and see the position of Mutual of Omaha among the top companies when choosing affordable and trustworthy life insurance.

Mutual of Omaha life insurance rates fluctuate significantly depending on health conditions. This helps people see how their own health situation affects the cost.

Mutual of Omaha Life Insurance Monthly Rates by Health Condition| Health Condition | 20-Year Term | Whole Policy |

|---|---|---|

| Excellent Health | $17 | $102 |

| Minor Health Issues | $21 | $120 |

| Chronic Conditions | $28 | $145 |

| Smoker | $34 | $160 |

| Advanced Age (60+) | $45 | $190 |

People who are very healthy pay much lower rates than smokers or older adults over 60 years old. If someone has chronic illnesses or minor health issues, their costs will fall between these two groups.

State Farm remains a significant competitor to Mutual of Omaha, offering similar products and a slightly larger market share. Mutual of Omaha has a good reputation, but it’s wise to consider different options to determine what best suits your needs. State Farm excels in customer service, consistently earning high scores from J.D. Power.

Competitors like Prudential offer larger policy limits for high-net-worth clients. For example, $10M term options aren’t rare.

Jeff Root Licensed Insurance Agent

Mutual of Omaha insurance gets more average ratings for its service. Both companies offer a range of insurance options, including life insurance, long-term care insurance, and Medicare supplemental insurance. However, State Farm does not offer an online tool to obtain quotes, and it is not available in every state, such as Massachusetts and New Jersey, which are excluded.

Mutual of Omaha dental insurance comes in two PPO plans with clear cost differences. The High PPO plan pays 100% for preventive care, 80% for basic services, and 50% for major treatments with a $2,500 annual max.

Mutual of Omaha Dental Insurance Coverage & Cost| Category | High PPO Plan | Low PPO Plan |

|---|---|---|

| Annual Deductible | $50 per person / $150 per family | $50 per person / $150 per family |

| Preventive Services | 100% covered, no deductible | 100% covered, no deductible |

| Basic Services | 80% coverage after deductible | 70% coverage after deductible |

| Major Services | 50% coverage after deductible | 50% coverage after deductible |

| Orthodontics | 50% coverage, up to $1,500 lifetime max | 50% coverage, up to $1,000 lifetime max |

| Annual Benefit | $2,500 per person per calendar year | $1,000 per person per calendar year |

The Low PPO plan also covers preventive care fully, but drops basic services to 70% and caps benefits at $1,000. Orthodontics are included in both, though lifetime limits are higher under the High PPO option.

Mutual of Omaha Medicare: Full Breakdown & Benefits| Feature | Details |

|---|---|

| Plan Type | Medicare Advantage (Part C), Medicare Supplement (Medigap), and Prescription Drug Plans (Part D) |

| Eligibility | Age 65+ or qualifying disability |

| Coverage Areas | Nationwide (availability and benefits vary by plan and state) |

| Hospital Care | Inpatient care, skilled nursing, some home health, and hospice services |

| Doctor Visits | Primary care and specialist visits (copays or coinsurance may apply) |

| Prescription Drugs | Covered under Part D or included in most Medicare Advantage plans |

| Preventive Services | Screenings, immunizations, and annual wellness visits at no cost |

| Vision & Dental | Often included with Medicare Advantage plans; varies by provider |

| Hearing | Some Advantage plans cover exams and hearing aids |

| Extra Benefits | May include fitness memberships, transportation, telehealth, or OTC allowances |

| Monthly Premium | Varies by plan type, location, and coverage level |

Mutual of Omaha Medicare provides Part C Advantage, Medigap, and Part D drug coverage for seniors 65+ and those with qualifying disabilities. Plans include hospital stays, skilled nursing, and doctor visits with set copays or coinsurance.

Read more: Whole vs. Term Life Insurance

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mutual of Omaha Life Insurance Coverage

Mutual of Omaha offers a range of life insurance options to suit various needs at different life stages. If you want to secure your family’s finances, handle retirement expenses, or pay for final costs, their plans offer specific benefits suited to your situation. Here are the main life insurance coverages they offer.

- Term Life Insurance: This provides affordable, short-term coverage for 10, 15, 20, or 30 years, with death payouts ranging from $25,000 to $100,000.

- Whole Life Insurance: Offers coverage that lasts a lifetime with stable premiums. Benefits range from $2,000 to $25,000.

- Universal Life Insurance: This type of permanent life insurance offers flexibility and customization options. You can adjust the premiums and death benefits over time.

- Guaranteed Issue Whole Life: This plan is designed for individuals who may not qualify for approval from other life insurance plans. It does not require any medical tests and helps cover final expenses.

- Children’s Whole Life Insurance: This is a permanent policy designed for children, with premiums that remain the same for their entire life, offering protection for their lifetime.

- Accidental Death Insurance: This insurance gives benefits if death happens because of a covered accident. It is an inexpensive addition to regular life insurance.

Mutual of Omaha offers additional insurance options, beyond regular life products, to help fill certain gaps in financial security.

- Medicare Supplement Insurance: This helps cover healthcare costs that Medicare does not cover, such as copayments and deductibles.

- Long-Term Care Insurance: This helps cover the costs of care at home or in nursing facilities for older individuals who wish to remain independent.

- Disability Income Insurance: This insurance helps by providing a portion of your income if you are unable to work due to illness or injury. It makes sure you have money while getting better.

Mutual of Omaha offers a variety of life and additional insurance products, enabling families and individuals to create a personalized plan.

Whether you want to protect your income, prepare for retirement, or care for loved ones, their solutions offer specific benefits that align with what is important to you.

Mutual of Omaha Customer Reviews & Complaints

Mutual of Omaha life insurance receives high ratings from key agencies, which gives buyers confidence in its stability. A.M. Best gives it an A+ rating for its financial strength.

Mutual of Omaha Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 76/100 Good Customer Feedback |

|

| Score: 805 / 1,000 Above Avg. Satisfaction |

|

| Score: 1.27 Avg. Complaints |

Mutual of Omaha life insurance reviews from Consumer Reports and J.D. Power indicate that customers are generally satisfied with the company’s service. Mutual of Omaha reviews on BBB also reflect positive business practices and reliability, while Mutual of Omaha Google reviews show a mix of praise and occasional criticism.

Customer support includes phone and online help for claims, billing, and account updates. In fact, many issues are addressed directly.

Melanie Musson Melanie Musson

The NAIC reports a slightly higher number of complaints than average, offering a balanced view of customer experiences with this well-known and trusted insurer. Some are frustrated with the company’s late payments and its third-party insurance brokers. Slow payouts were a common refrain. Some people have complained online about the speed (or lack thereof) with which the company paid out their claims.

A Reddit post points out that mutual life insurance companies with over 120 years in business stand out for their financial strength and quick responsiveness.

Comment

byu/Screen_Acrob from discussion

inLifeInsurance

Examples like New York Life and Northwestern Mutual show how longevity, proven stability, and strong customer support make these insurers reliable options for long-term protection. Explore what a life insurance beneficiary is and how Mutual of Omaha calculates benefits.

Ways to Save on Mutual of Omaha Life Insurance

Mutual of Omaha provides programs and special categories that help qualified applicants save money, all while keeping good life insurance coverage.

- Fit Program: When you finish the Fit Program health questionnaire, it can help with better underwriting and reduce premiums for those who have good wellness profiles.

- Non-Smoker Rating: Applicants who do not use tobacco pay much less in premiums compared to smokers. This is because lower health risks are taken into account when calculating the insurance costs.

- Healthy Lifestyle Classification: Individuals with excellent health, a normal weight, and stable vital signs may be eligible for better rates. These rates can often be 10–20% less than the regular ones.

- Multi-Product Discount: Bundling life insurance with another Mutual of Omaha product, like Medicare supplements or dental coverage, can cut monthly costs.

Mutual of Omaha offers savings for non-smokers, policyholders with strong health records, and customers who bundle multiple products.

Discover more by reading our guide: What is a modified endowment contract (MEC)?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mutual of Omaha Digital Tools

It’s hard to evaluate Mutual’s digital options. Mutual of Omaha offers an online account interface that allows you to pay your bill, modify your billing options, and view your Medicare supplement Explanation of Benefits. They make comparison shopping easy. Mutual of Omaha has a sophisticated calculator on its website to help you figure out how much insurance coverage you need and what it will cost you on a monthly basis.

You don’t have to call up an agent to get a quote, which is super helpful and relatively rare. Mutual of Omaha also automatically displays the nearest independent agents and brokers when you visit its online site. Discover one quote that convinced me to get life insurance and see how Mutual of Omaha rates vary by health.

Its app is okay for Android users. Mutual of Omaha’s mobile app has 3.7 out of 5 stars in the Google Play store and an average of three stars among nine ratings in the Apple store. With the mobile app, you can check balances, deposit or transfer funds, and pay bills.

The company offers helpful customer service and competitive rates. It comes through for customers in tough times. The most favorable customer reviews praised Omaha for its knowledgeable customer service. They also praised Omaha for its fast and seamless payouts when a family member passed away. Omaha’s most ardent fans say their policies were paid out anywhere from a couple of days to a month.

Customers also praised Omaha for the rates it offered on whole life and term life policies. With this in mind, they noted that they might sometimes like a little more flexibility on those rates and terms.

Unlike some of its competitors (State Farm, for instance), Mutual of Omaha offers its products in all 50 states. No medical exam needed. The company has eliminated the medical exam requirement for term life insurance and whole life products. Keep in mind its universal life insurance may still require one, depending on the individual.

Depending on the broker you use, you may be able to complete a Mutual of Omaha Fit Program questionnaire, which can result in more favorable points toward your evaluation. Explore what a life insurance annuity is and how Mutual of Omaha rates vary with health risks.

When shopping for life insurance, it’s helpful to compare options through an independent agent who works with multiple insurance companies. Mutual of Omaha policies can only be purchased through an agent, and while online tools are limited, enabling location-sharing on their site will show the three nearest agents.

The National Association of Insurance Commissioners also offers resources, including a guide to choosing an agent and a map of state regulators if you run into issues. Because life insurance can be complex, relying on an agent’s expertise ensures you make informed decisions.

A good agent will:

- Understand your needs, income, and risk before offering advice

- Explain choices clearly without jargon for your situation

- Guide you patiently without pressure to decide confidently

- Be properly licensed through your state’s insurance department

- Share how many years they’ve been serving in the insurance field

- Provide client references openly when you ask for them directly

One easy way to work with a reputable agent is to ask your friends, family, and colleagues for advice on who to hire. If someone loves an agent and can tell you why, then Mutual of Omaha is a good company to consider as your provider.

Learn more: The Life Insurance Guide

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

See if Mutual of Omaha is Right for You Now

Mutual of Omaha isn’t the largest life insurer in the U.S., but it’s a long-established company with a good reputation for customer service, making it worth your consideration. It’s challenging to make direct comparisons between insurance companies here because rates can vary significantly depending on an individual’s location and needs.

Mutual of Omaha LTCI offers flexible benefit periods (e.g., 2–5 years, with some longer) and emphasizes benefits for care at home, enabling aging in place.

Michelle Robbins Licensed Insurance Agent

However, with a free online quoting tool and a nationwide network of independent agents and brokers, Mutual of Omaha makes comparison shopping easy. Learn how Allianz became the world’s largest insurer and how Mutual of Omaha compares on health-based rates.

Additionally, selecting the right agent or broker to do business with is crucial for a positive experience with Mutual of Omaha. Discover the Mutual of Omaha reviews for the best rates by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What do Mutual of Omaha reviews and complaints commonly mention?

Mutual of Omaha complaints and reviews often highlight the company’s positive customer service and prompt claim payouts, although some customers report delays in payments and inconsistent experiences with agents. Understand what is universal life insurance and why Mutual of Omaha reviews note its adjustable coverage options.

Where can the Mutual of Omaha life insurance rate chart be viewed?

The Mutual of Omaha life insurance rate chart is typically provided by licensed agents or available through a personalized quote request on the company’s official website.

How does the Mutual of Omaha login work for policyholders?

The Mutual of Omaha login enables policyholders to access their accounts online, view policies, pay premiums, and manage beneficiary information securely.

What do Mutual of Omaha mortgage reviews say about their lending services?

Mutual of Omaha mortgage reviews describe solid customer service and competitive rates, but occasionally cite slower processing times compared to larger lenders.

What is the phone number for Mutual of Omaha auto insurance customer service?

The Mutual of Omaha auto insurance phone number for customer inquiries is 800-775-1000, which connects to their general customer service department. See why comparing plans and getting an insurance plan that works for you is easier with reliable customer service.

Does Mutual of Omaha offer term life insurance policies with no medical exam?

Mutual of Omaha term life insurance offers no-medical-exam policies for certain coverage amounts and eligible applicants, simplifying the approval process.

How can a Mutual of Omaha long-term care quote be requested?

A Mutual of Omaha long-term care quote can be requested online through their website or by speaking directly with a licensed Mutual of Omaha agent.

Is Mutual of Omaha a good Medicare supplement provider?

Mutual of Omaha is considered a good Medicare supplement provider, offering competitive monthly rates, nationwide availability, and strong financial ratings.

Is United of Omaha Life Insurance a good company?

United of Omaha Life Insurance, a subsidiary of Mutual of Omaha, is a good company with A+ ratings from A.M. Best and reliable customer service. Compare a Colonial Life insurance review and see how United of Omaha stands as a reliable life insurance provider.

What do Mutual of Omaha disability reviews say about their coverage?

Mutual of Omaha disability reviews highlight affordable monthly premiums and flexible policy options, although some mention slower claims processing times.

What do Mutual of Omaha Medicare supplement plans reviews typically highlight?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.