Life Insurance Riders (2026)

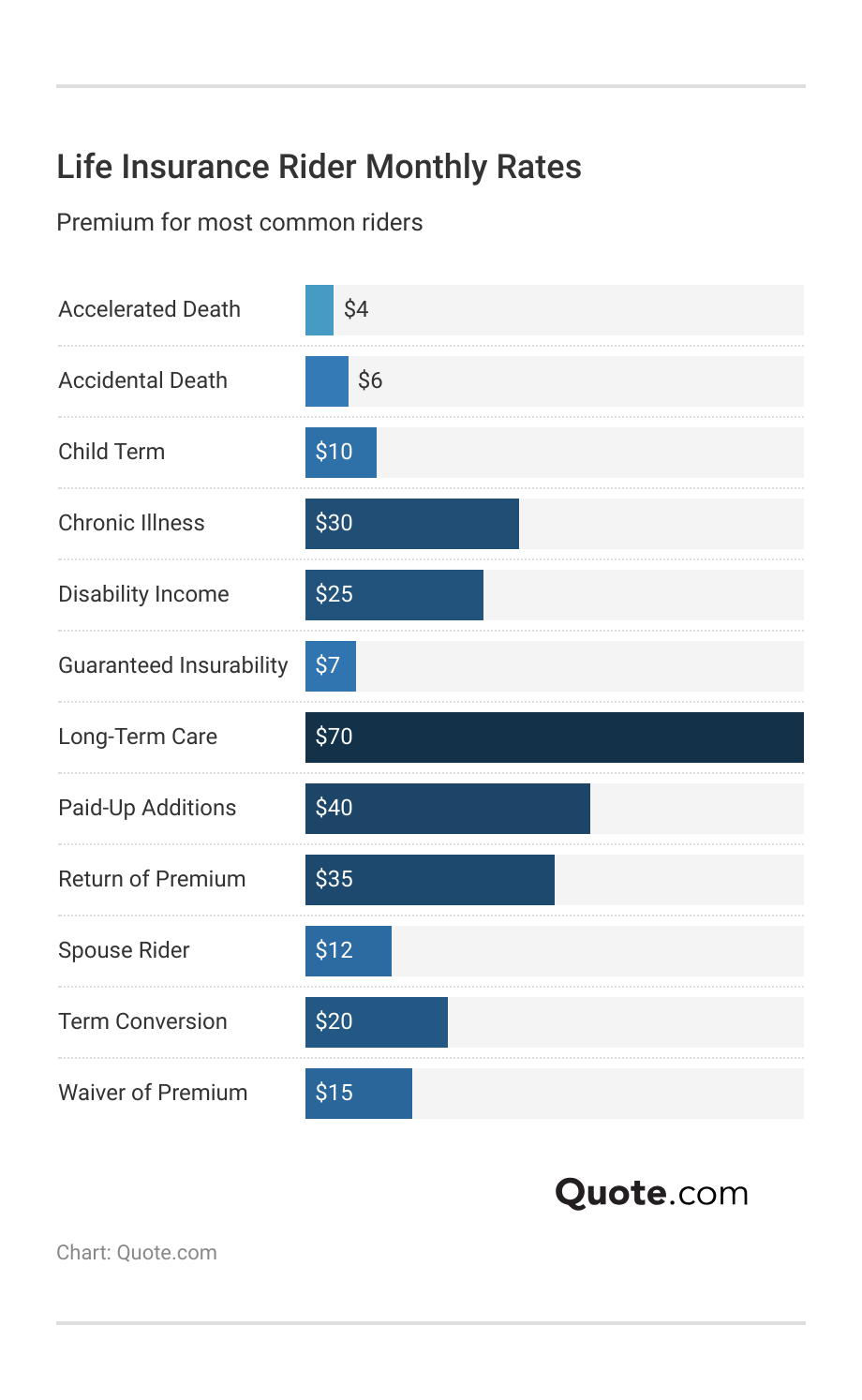

Life insurance riders are options that expand a term or whole policy’s coverage. Monthly rates for riders range from $4 to $70. Common riders cover long-term care and accelerated death benefits. Life insurance policy riders should grow with you, so review them after marriage, buying a home, and before retiring.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2026

Life insurance riders attach additional protections to a term or whole policy. Popular types of riders in insurance include living benefits, accidental death payouts, and premium waivers.

- Life insurance riders cover critical illnesses and disabilities

- Accelerated and accidental death riders are the most popular

- Long-term care riders are the most expensive at $70 per month

You can choose to add a life insurance rider when you buy your policy, but the best life insurance companies let you add them after major life events, such as marriage or retirement.

Scroll down for a full life insurance riders list, what medical documentation you need for benefits, and how each rider affects beneficiaries.

Get a free life insurance quote in minutes by entering your ZIP code into our free comparison tool.

Life Insurance Riders Explained

Life insurance riders are optional policy add-ons that let you customize whole or term life insurance by adding features like accidental death benefits or guaranteed insurability.

People add riders to cover specific what-if scenarios or to avoid buying separate standalone policies.

Types of Life Insurance Riders| Rider | Description | Best for |

|---|---|---|

| Accidental Death | Extra pay for accidents | High-risk jobs, travelers |

| Waiver of Premium | Stops payments if disabled | Young adults, main earners |

| Accelerated Death | Early payout for terminal illness | Seniors, critical illness cases |

| Child Term | Covers all kids under one rider | Parents with young children |

| Spouse Rider | Adds spouse coverage | Married policyholders |

| Guaranteed Insurability | Add coverage, no exam | Young buyers, planners |

| Return of Premium | Refund if no claim made | Budget term buyers |

| Critical Illness | Lump sum for major illness | Those with health risks |

| Disability Income | Monthly pay if disabled | Main income earners |

| Long-Term Care | Pays for long-term care | Seniors, caregivers |

| Paid-Up Additions | Adds coverage with dividends | Whole life policyholders |

| Missing Term Conversion | Switches to permanent plan | Term policyholders |

Riders can pay living benefits for terminal, critical, or chronic illness and waive premiums when qualifying for disability.

Major life moments, such as new mortgages, starting a family or new career, health shifts, or caring for aging parents, are great times to check in with your goals and decide if you need a life insurance rider.

Most riders offer living benefits that ease financial stress before death. For example, critical illness payouts can help fund treatment or hospice care.

Michelle Robbins Licensed Insurance Agent

Common picks include accelerated death benefits, waiver of premium, accidental death benefits, child and spouse riders, and disability income protection coverage.

If you add a life insurance rider, be sure to clarify beneficiary designations and work with a financial advisor to understand the tax on living benefits. For instance, certain payouts may affect public assistance eligibility.

How Life Insurance Riders Work

Life insurance riders are simple add-ons you use to tailor a base policy to real-life needs. Most are picked when you buy the policy, though some life insurance companies allow you to add it later after major life changes.

Rider coverage only kicks in when a defined event occurs, such as a serious illness or a qualifying disability. For example, an accelerated death benefit (ADB) rider only applies if the policyholder has a terminal illness.

Riders apply when their triggers occur, so choosing them early ensures the proper backup is ready when you need it (Read More: Types of Life Insurance). It lets you adjust protection without buying another policy, so you control timing as your circumstances change.

Another reason to use life insurance riders is to adjust benefits during caregiving or travel, then scale back later when expenses drop and savings goals tighten.

Benefits of Life Insurance Riders| Feature | Benefit | Rider Name |

|---|---|---|

| Protection | Extra payout for accidents | Accidental Death |

| Access | Early access to benefits | Accelerated Benefit |

| Cost Relief | Waives premiums if disabled | Waiver of Premium |

| Health Support | Covers long-term care | Long-Term Care |

| Coverage Options | Converts to permanent plan | Term Conversion |

If income stops due to a diagnosis or disability, some riders keep premiums paid, which preserves coverage while you recover and helps protect long-term plans.

You get more flexibility with life insurance riders, but remember to review your coverage annually to keep costs aligned with your goals. Life changes fast, and small adjustments can stop you from overpaying for coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Adding a Life Insurance Rider

The cost depends on the rider type and the benefit amount, but it usually nudges your premium up a little. (Learn More: Average Cost of Life Insurance).

Riders are priced monthly, starting at about $4 and ranging from $15 to $40 per month, and reaching about $70 a month for intensive care features.

Add these prices on top of your policy’s base monthly premium. For example, a $30 living benefit plus a $15 waiver turns a $62 premium into $107 monthly, before any discounts or fees.

Term life insurance plans usually cost far less each month, like Transamerica at $30 per month and Massmutual at $31 monthly.

Term vs. Whole Life Insurance Monthly Rates Without Riders| Company | 20-Year Term | Whole Policy |

|---|---|---|

| $32 | $390 | |

| $36 | $455 | |

| $33 | $472 |

| $31 | $425 | |

| $34 | $410 | |

| $40 | $465 | |

| $39 | $475 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

Whole life premiums climb with Guardian Life at $455 a month and Northwestern Mutual at $475 per month.

Rider and policy prices vary by insurer because underwriting classes and waiting periods differ. For instance, one company could charge more for a smoker than another or raise its rates based on your career.

Start comparing life insurance quotes online and choose riders that match your budget. You may find that some providers don’t offer the rider you need, or that some sell it for much less than the competition.

It’s best to get quotes from at least three different companies in order to get a fair assessment of how much life insurance riders cost near you.

How to Choose the Right Riders

To choose the right life insurance riders, look at your age, health, family needs, and job risks. Then, map riders to situations you are most likely to face (Read More: Reasons to Buy Life Insurance).

Several provide living benefits that pay while you are alive through an accelerated death benefit, a waiver of premium during disability, or a disability income rider.

Riders personalize coverage to match major life changes and risks. In particular, they keep your policy useful as your goals evolve.

Jeff Root Licensed Insurance Agent

Others handle specific risks like an accidental death rider, a child term rider that can convert later, or long-term care support triggered by limits in daily activities.

Follow these tips to pick the best life insurance riders for your lifestyle and financial goals without overpaying:

- Skip add-ons that duplicate benefits you already have through work, like disability insurance or accidental death.

- Ask your insurer what protections are automatically included so you do not pay twice for the same thing.

- Review each rider annually, and drop the ones you no longer need to lower your premiums.

Insurance riders personalize a term or whole life insurance policy with additional benefits and payouts following serious incidents, such as accidental death, dismemberment, or terminal diagnoses.

You’ll want to consider adding a life insurance rider as life changes, such as marriage, a mortgage, or a new child. Customize your coverage today by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What is a life insurance rider?

The official meaning of a life insurance rider is a contract add-on that customizes coverage by adding features like accelerated death benefit, child term coverage, disability income, or long-term care. Riders take effect only when stated triggers and eligibility rules are met. Learn how to get life insurance quotes, including rider pricing and triggers.

Are life insurance riders worth it?

Yes, when they address a real risk without duplicating benefits. A life insurance rider usually covers living benefits starting near $4 per month, waiver of premium often $15 to $25, and long-term care about $70 or more monthly, depending on age and benefit levels.

What is an example of a life insurance rider?

Examples of life insurance riders include a waiver of premium, which pauses payments after a qualifying disability, typically after a waiting period. Another example is an accelerated death benefit that pays part of the benefit after a terminal diagnosis. See more life insurance riders by entering your ZIP code into our free quote comparison tool.

What is a death benefit rider?

It is a rider designed to increase or preserve the policy’s death benefit under defined conditions. The most common version is an accidental death benefit that adds an extra payout if death results from a covered accident.

What is a child rider in life insurance?

A child term rider covers all eligible children under one policy in set amounts, commonly $10,000 to $25,000. Coverage typically begins after 14–15 days and can often convert to permanent insurance at adult age without a new medical exam. Calculate how much life insurance you need before adding a child rider to your life insurance.

What is the difference between a life insurance rider and a beneficiary?

A rider is an optional policy add-on that changes coverage or benefits for an added monthly premium. A beneficiary is the person or entity that receives the death benefit.

How many riders are in a life insurance policy?

There is no fixed number. Most carriers offer roughly 6-12 common options such as accelerated death benefit, waiver of premium, child term, accidental death, guaranteed insurability, and long-term care.

Which rider, when attached to a permanent life insurance policy, provides an amount?

A term insurance rider adds a specified extra death benefit to the permanent policy. Most versions allow conversion of that term amount to permanent coverage within a stated window without new medical underwriting.

What is the cheapest whole life insurance for seniors?

No single insurer is always the cheapest. For a simplified issue whole life, a non-smoker might see about $40 to $60 per month at age 60 for $10,000 of coverage, $70 to $110 at age 70, and $120 to $200 at age 80, subject to health and state rules. Check how single premium life insurance compares to whole life with riders.

At what age should you stop term life insurance?

There is no fixed age. Consider ending term coverage when debts are paid and dependents are financially independent, or convert before windows that often close around age 65 to 70. Many carriers issue new terms into the 70s, subject to underwriting.

How much does a $1,000,000 life insurance policy cost per month?

How much will a $100,000 annuity pay monthly?

What is the 7-pay rule for life insurance?

Who gets the death benefit when someone dies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.