Auto Insurance Requirements by State in 2026

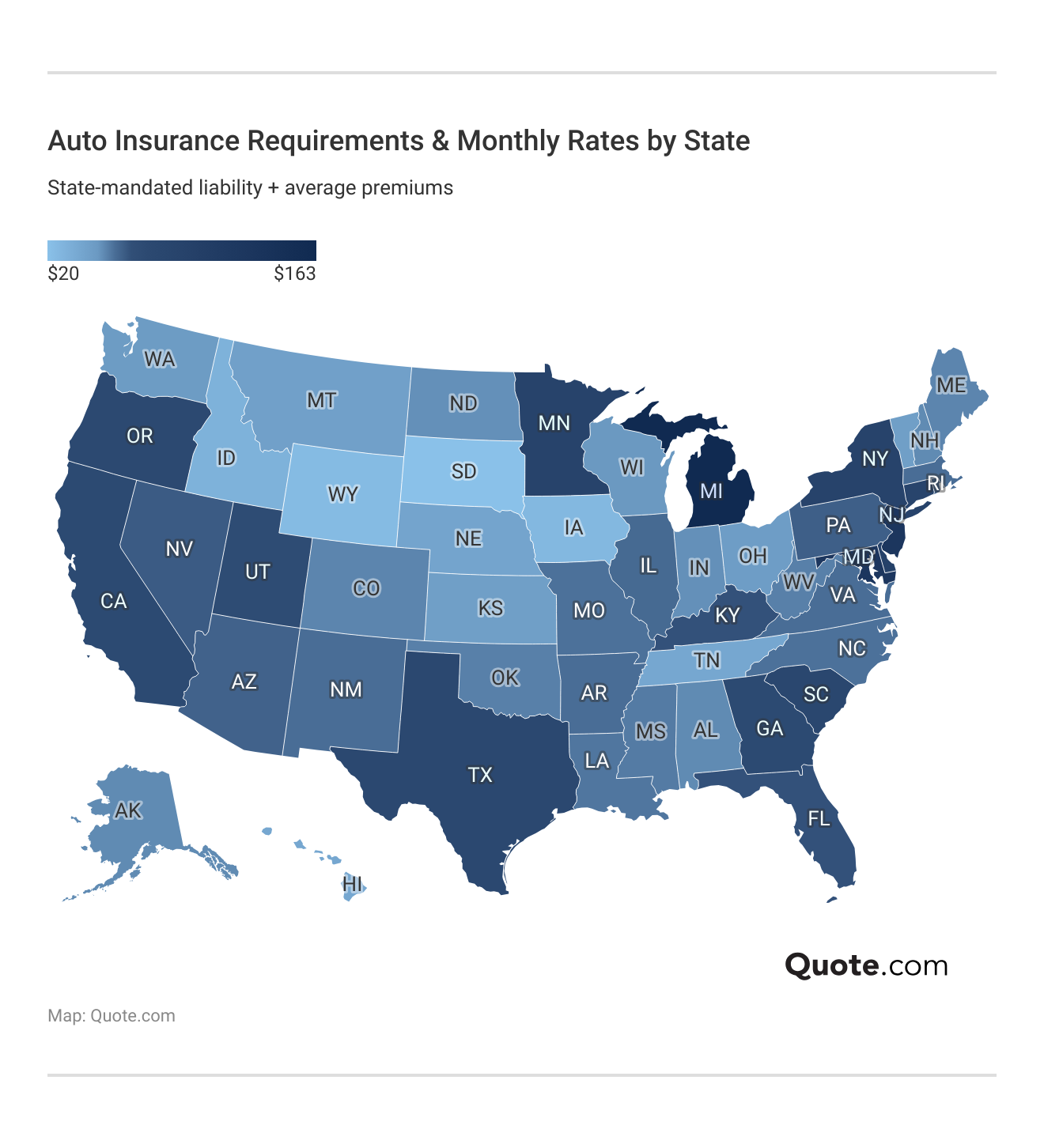

Auto insurance requirements by state almost always require liability insurance, with some states also requiring PIP, MedPay, or UM/UIM insurance. On average, South Dakota has the cheapest minimum car insurance at $20 per month, while Michigan has the highest minimum rate at $163 a month.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Auto insurance requirements by state vary, but almost all states require drivers to carry at least liability insurance. Some states may also require other types of auto insurance coverage, like personal injury protection or uninsured motorist coverage.

- In most states, driving without car insurance is illegal

- Michigan has the highest car insurance requirements by state

- New Hampshire is one of the few states that doesn’t require auto insurance

Generally, minimum auto insurance rates will be higher in states where more coverage is required. Read on to learn about the car insurance requirements by state, as well as the average cost of auto insurance coverage in each state.

Looking to find affordable auto insurance coverage today? Compare rates with our free quote tool to find coverage in your state.

Meeting Your State Auto Insurance Requirements

Every state sets its own requirements for liability limits and auto insurance coverages, and most states require auto insurance on vehicles in order to drive them.

Liability limits refer to the amounts of liability coverage that are required for bodily injury and property damage, and are displayed in three sets of numbers.

Auto Insurance Requirements by State (+Min. Coverage Cost)| State | Liability Limits | Monthly Rate | Coverage Required |

|---|---|---|---|

| Alabama | 25/50/25 | $50 | BI + PD |

| Alaska | 50/100/25 | $50 | BI + PD |

| Arizona | 25/50/15 | $59 | BI + PD |

| Arkansas | 25/50/25 | $56 | BI + PD + PIP |

| California | 30/60/15 | $72 | BI + PD |

| Colorado | 25/50/15 | $51 | BI + PD |

| Connecticut | 25/50/20 | $87 | BI + PD + UM/UIM |

| Delaware | 25/50/10 | $96 | BI + PD + PIP |

| Florida | 10/20/10 | $64 | PIP |

| Georgia | 25/50/25 | $72 | BI + PD |

| Hawaii | 20/40/10 | $37 | BI + PD + PIP |

| Idaho | 25/50/15 | $30 | BI + PD |

| Illinois | 25/50/20 | $57 | BI + PD + UM/UIM |

| Indiana | 25/50/25 | $49 | BI + PD |

| Iowa | 20/40/15 | $26 | BI + PD |

| Kansas | 25/50/25 | $43 | BI + PD + PIP |

| Kentucky | 25/50/25 | $64 | BI + PD + PIP + UM/UIM |

| Louisiana | 15/30/25 | $54 | BI + PD |

| Maine | 50/100/25 | $51 | BI/PD + UM + MedPay |

| Maryland | 30/60/15 | $126 | BI + PD + PIP + UM/UIM |

| Massachusetts | 20/40/5 | $56 | BI + PD + PIP |

| Michigan | 50/100/10 | $163 | BI + PD + PIP |

| Minnesota | 30/60/10 | $90 | BI + PD + PIP + UM/UIM |

| Mississippi | 25/50/25 | $53 | BI + PD |

| Missouri | 25/50/25 | $55 | BI + PD + UM |

| Montana | 25/50/20 | $42 | BI + PD |

| Nebraska | 25/50/25 | $39 | BI + PD + UM/UIM |

| Nevada | 25/50/20 | $61 | BI + PD |

| New Hampshire | 25/50/25 | $50 | Can opt out for free |

| New Jersey | 25/50/25 | $126 | BI + PD + PIP + UM/UIM |

| New Mexico | 25/50/10 | $56 | BI + PD |

| New York | 25/50/10 | $90 | BI + PD + PIP + UM/UIM |

| North Carolina | 50/100/50 | $55 | BI + PD + UM/UIM |

| North Dakota | 25/50/25 | $49 | BI + PD + PIP + UM/UIM |

| Ohio | 25/50/25 | $44 | BI + PD |

| Oklahoma | 25/50/25 | $52 | BI + PD |

| Oregon | 25/50/20 | $75 | BI + PD + PIP + UM/UIM |

| Pennsylvania | 15/30/5 | $60 | BI + PD + PIP |

| Rhode Island | 25/50/25 | $61 | BI + PD |

| South Carolina | 25/50/25 | $79 | BI + PD + UM/UIM |

| South Dakota | 25/50/25 | $20 | BI + PD + UM/UIM |

| Tennessee | 25/50/15 | $37 | BI + PD |

| Texas | 30/60/25 | $77 | BI + PD + PIP |

| Utah | 25/65/15 | $66 | BI + PD + PIP |

| Vermont | 25/50/10 | $43 | BI + PD + UM/UIM |

| Virginia | 50/100/25 | $56 | Pay $500 to opt out |

| Washington | 25/50/10 | $45 | BI + PD |

| West Virginia | 25/50/25 | $52 | BI + PD + UM/UIM |

| Wisconsin | 25/50/10 | $47 | BI/PD + UM + MedPay |

| Wyoming | 25/50/20 | $24 | BI + PD |

For example, the liability numbers 25/50/25 mean that a driver must carry $25,000 of bodily injury coverage to pay for injuries per person, and $50,000 of bodily injury coverage to cover all injured parties in an accident.

The last number is for property damage coverage, which means that a driver must carry $25,000 of property damage coverage.

Bodily injury coverage pays for medical costs if you injure someone in an accident. Property damage coverage pays to repair or replace the other party’s vehicle or property you damage in the crash.

Liability insurance only covers the injuries and damage you cause to others, not your own medical bills or vehicle repairs. It also has coverage limits, so if costs exceed those limits, you may be responsible for the remaining expenses out of pocket.

Other coverages that may be required in states besides liability insurance include personal injury protection (PIP), MedPay, and uninsured or underinsured motorist coverage (UM/UIM).

If your state requires you to carry some of these other coverages, you can expect that your average state rates will be a bit higher.

For example, Wyoming only requires 25/50/25 of liability insurance, and the average cost of minimum liability insurance in Wyoming is only $24 per month.

Texas, on the other hand, requires 30/60/25 of liability insurance as well as personal injury protection, and has an average rate of $77 per month for minimum coverage.

States with the Highest Requirements for Auto Insurance

Does your state have comparatively strict or lenient requirements for auto insurance coverage? All of the states with the highest requirements, except for Wisconsin, require drivers to carry uninsured and underinsured motorist coverage.

These coverages will help pay if you’re hit by a driver without insurance or by a driver who has minimal insurance.

10 States With the Highest Car Insurance Requirements| State | Rank | Uninsured | Required | Reason |

|---|---|---|---|---|

| Michigan | 1 | 19.6% | 50/100/10 | $50k PIP + UM/UIM |

| Minnesota | 2 | 8.7% | 30/60/10 | $40k PIP + UM/UIM |

| North Dakota | 3 | 7.9% | 25/50/25 | $30k PIP + UM/UIM |

| New Jersey | 4 | 10.9% | 25/50/25 | $15k PIP + UM/UIM |

| Massachusetts | 5 | 8.8% | 20/40/5 | $8k PIP + UM/UIM |

| North Carolina | 6 | 10.3% | 50/100/50 | Highest PD + UM/UIM |

| Maine | 7 | 6.2% | 50/100/25 | $2k MedPay + UM/UIM |

| Alaska | 8 | 11.3% | 50/100/25 | High BI + UM/UIM |

| Wisconsin | 9 | 15.6% | 50/100/15 | High BI + UM |

| Maryland | 10 | 15.1% | 30/60/15 | High BI + UM/UIM |

Michigan ranks number one in having the highest requirements for auto insurance coverage, and it also has a higher average cost of auto insurance.

This is because Michigan requires 50/100/10 of liability insurance, $50k of personal injury protection, uninsured motorist coverage, and underinsured motorist coverage.

It is important to meet Michigan’s requirements of uninsured and underinsured motorist coverage, as 19.6% of Michigan’s drivers are uninsured, putting you at risk.

Learn More: Driving Without Auto Insurance

States with the Lowest Requirements for Auto Insurance

In other states, the requirements for auto insurance are a lot less stringent, with lower liability limits and fewer coverages required.

In some states, such as New Hampshire, auto insurance may not be required to drive. However, drivers must prove financial responsibility in order to opt out of coverage.

10 States With the Lowest Car Insurance Requirements| State | Rank | Uninsured | Required | Reason |

|---|---|---|---|---|

| New Hampshire | 1 | 6.1% | None | Insurance not required |

| Virginia | 2 | 12.1% | None | $500 opt-out fee |

| California | 3 | 16.6% | 15/30/5 | Lowest PD, no PIP |

| New Mexico | 4 | 21.8% | 25/50/10 | Low PD no PIP |

| Arizona | 5 | 11.8% | 25/50/15 | Low Min no PIP |

| Ohio | 6 | 13.0% | 25/50/25 | Low Min no PIP |

| South Carolina | 7 | 10.9% | 25/50/25 | Avg Min, no PIP |

| Pennsylvania | 8 | 6.0% | 15/30/5 | Lowest PD + $5k PIP |

| Florida | 9 | 15.9% | 10/20/10 | Low BI/PD + $10k PIP |

| Delaware | 10 | 8.5% | 25/50/10 | Low PD + $15k PIP |

Virginia also doesn’t require insurance if drivers can prove financial responsibility, but there is a $500 fee to opt out of coverage (Learn More: Best Auto Insurance Companies in Virginia).

Each of these states’ lower liability limits is the minimum required for drivers. This means that drivers can opt to carry more than the minimum coverage of liability insurance if they wish to.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Factors Affecting Minimum Auto Insurance Costs

The minimum car insurance required in your state is just one factor that affects how much you’ll pay for coverage. Another major factor that affects rates is your driving record.

No matter what state you live in, a poor driving record will result in higher rates because insurance companies view you as more likely to file a future claim.

State-Average Auto Insurance Monthly Rates by Driving Record| State | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Alabama | $55 | $73 | $85 | $63 |

| Alaska | $38 | $73 | $85 | $63 |

| Arizona | $73 | $86 | $100 | $74 |

| Arkansas | $70 | $81 | $95 | $70 |

| California | $85 | $104 | $122 | $90 |

| Colorado | $97 | $74 | $87 | $64 |

| Connecticut | $63 | $126 | $148 | $109 |

| Delaware | $59 | $139 | $163 | $120 |

| Florida | $115 | $93 | $109 | $80 |

| Georgia | $78 | $104 | $122 | $90 |

| Hawaii | $36 | $54 | $63 | $46 |

| Idaho | $52 | $44 | $51 | $38 |

| Illinois | $64 | $83 | $97 | $71 |

| Indiana | $57 | $71 | $83 | $61 |

| Iowa | $52 | $38 | $44 | $33 |

| Kansas | $73 | $62 | $73 | $54 |

| Kentucky | $77 | $93 | $109 | $80 |

| Louisiana | $115 | $78 | $92 | $68 |

| Maine | $45 | $74 | $87 | $64 |

| Maryland | $67 | $183 | $214 | $158 |

| Massachusetts | $63 | $81 | $95 | $70 |

| Michigan | $84 | $236 | $277 | $204 |

| Minnesota | $67 | $131 | $153 | $113 |

| Mississippi | $71 | $77 | $90 | $66 |

| Missouri | $70 | $80 | $94 | $69 |

| Montana | $66 | $61 | $71 | $53 |

| Nebraska | $67 | $57 | $66 | $49 |

| Nevada | $83 | $88 | $104 | $76 |

| New Hampshire | $48 | $73 | $85 | $63 |

| New Jersey | $78 | $183 | $214 | $158 |

| New Mexico | $62 | $81 | $95 | $70 |

| New York | $94 | $131 | $153 | $113 |

| North Carolina | $50 | $80 | $94 | $69 |

| North Dakota | $55 | $71 | $83 | $61 |

| Ohio | $45 | $64 | $75 | $55 |

| Oklahoma | $80 | $75 | $88 | $65 |

| Oregon | $61 | $109 | $128 | $94 |

| Pennsylvania | $63 | $87 | $102 | $75 |

| Rhode Island | $71 | $88 | $104 | $76 |

| South Carolina | $68 | $115 | $134 | $99 |

| South Dakota | $56 | $29 | $34 | $25 |

| Tennessee | $66 | $54 | $63 | $46 |

| Texas | $83 | $112 | $131 | $96 |

| Utah | $63 | $96 | $112 | $83 |

| Vermont | $45 | $62 | $73 | $54 |

| Virginia | $59 | $81 | $95 | $70 |

| Washington | $63 | $65 | $77 | $56 |

| West Virginia | $55 | $75 | $88 | $65 |

| Wisconsin | $52 | $68 | $80 | $59 |

| Wyoming | $58 | $35 | $41 | $30 |

| U.S. Average | $65 | $91 | $112 | $76 |

However, having a DUI in one state may cost less than having a DUI in another state. For example, the average for a DUI auto insurance in Michigan is $277 per month, but in South Dakota, DUI insurance only averages $34 per month (Read More: Cheap Auto Insurance for High-Risk Drivers).

Another factor that may have some influence on your rates is your gender. When you look at average rates by gender in states, you will see that females tend to pay slightly more than males in some states.

State-Average Annual Auto Insurance Premiums by Gender| State | Female | Male | Difference |

|---|---|---|---|

| Alabama | $600 | $600 | $0 |

| Alaska | $612 | $600 | $12 |

| Arizona | $696 | $708 | $12 |

| Arkansas | $672 | $672 | $0 |

| California | $864 | $864 | $0 |

| Colorado | $624 | $612 | $12 |

| Connecticut | $1,044 | $1,044 | $0 |

| Delaware | $1,152 | $1,152 | $0 |

| Florida | $768 | $768 | $0 |

| Georgia | $852 | $864 | $12 |

| Hawaii | $444 | $444 | $0 |

| Idaho | $372 | $360 | $12 |

| Illinois | $696 | $684 | $12 |

| Indiana | $588 | $588 | $0 |

| Iowa | $312 | $312 | $0 |

| Kansas | $516 | $516 | $0 |

| Kentucky | $768 | $768 | $0 |

| Louisiana | $636 | $648 | $12 |

| Maine | $540 | $612 | $72 |

| Maryland | $1,524 | $1,512 | $12 |

| Massachusetts | $672 | $672 | $0 |

| Michigan | $1,968 | $1,956 | $12 |

| Minnesota | $1,080 | $1,080 | $0 |

| Mississippi | $636 | $636 | $0 |

| Missouri | $660 | $660 | $0 |

| Montana | $504 | $504 | $0 |

| Nebraska | $468 | $468 | $0 |

| Nevada | $732 | $732 | $0 |

| New Hampshire | $588 | $600 | $12 |

| New Jersey | $1,524 | $1,512 | $12 |

| New Mexico | $600 | $672 | $72 |

| New York | $1,104 | $1,080 | $24 |

| North Carolina | $672 | $660 | $12 |

| North Dakota | $576 | $588 | $12 |

| Ohio | $516 | $528 | $12 |

| Oklahoma | $612 | $624 | $12 |

| Oregon | $912 | $900 | $12 |

| Pennsylvania | $720 | $720 | $0 |

| Rhode Island | $732 | $732 | $0 |

| South Carolina | $948 | $948 | $0 |

| South Dakota | $240 | $240 | $0 |

| Tennessee | $480 | $444 | $36 |

| Texas | $900 | $924 | $24 |

| Utah | $792 | $792 | $0 |

| Vermont | $504 | $516 | $12 |

| Virginia | $672 | $672 | $0 |

| Washington | $540 | $540 | $0 |

| West Virginia | $636 | $624 | $12 |

| Wisconsin | $540 | $564 | $24 |

| Wyoming | $288 | $288 | $0 |

| U.S. Average | $744 | $732 | $12 |

In other states, there is no cost difference in the average rates for male and female drivers. However, the U.S. averages show that females pay an average of $744 per year for auto insurance, while males pay an average of $732 per month.

Note that this doesn’t apply to all states, as some have banned the use of gender in determining auto insurance rates.

Claims Impact State Minimum Auto Insurance Requirements

Minimum car insurance requirements are higher in states with high accident rates, traffic fatalities, or a high volume of claims.

For example, California has 3.5 million accidents a year, with the average claim cost set at $1,026,000.

Annual Accidents & Insurance Claims by State| State | Accidents | Traffic Deaths | Claims | Claim Cost |

|---|---|---|---|---|

| Alabama | 520K | 10,196 | 168K | $53,760 |

| Alaska | 60K | 8,219 | 28K | $13,160 |

| Arizona | 730K | 10,000 | 280K | $106,400 |

| Arkansas | 350K | 11,667 | 125K | $45,000 |

| California | 3.5M | 8,861 | 1.9M | $1,026,000 |

| Colorado | 480K | 8,276 | 360K | $270,000 |

| Connecticut | 290K | 8,056 | 140K | $67,200 |

| Delaware | 150K | 15,152 | 65K | $27,950 |

| Florida | 2.5M | 11,521 | 1.6M | $1,024,000 |

| Georgia | 850K | 7,944 | 790K | $734,700 |

| Hawaii | 120K | 8,571 | 65K | $35,100 |

| Idaho | 230K | 12,105 | 110K | $52,800 |

| Illinois | 950K | 7,540 | 800K | $672,000 |

| Indiana | 690K | 10,147 | 520K | $390,000 |

| Iowa | 300K | 9,375 | 200K | $134,000 |

| Kansas | 310K | 10,690 | 200K | $130,000 |

| Kentucky | 440K | 9,778 | 420K | $403,200 |

| Louisiana | 450K | 9,783 | 420K | $390,600 |

| Maine | 160K | 11,429 | 85K | $45,050 |

| Maryland | 490K | 8,033 | 430K | $378,400 |

| Massachusetts | 680K | 9,855 | 470K | $324,300 |

| Michigan | 830K | 8,300 | 710K | $610,600 |

| Minnesota | 640K | 11,228 | 380K | $224,200 |

| Mississippi | 340K | 11,333 | 230K | $156,400 |

| Missouri | 670K | 10,807 | 540K | $437,400 |

| Montana | 120K | 10,909 | 90K | $67,500 |

| Nebraska | 160K | 8,000 | 130K | $105,300 |

| Nevada | 270K | 8,438 | 260K | $249,600 |

| New Hampshire | 140K | 10,000 | 110K | $86,900 |

| New Jersey | 800K | 8,989 | 720K | $648,000 |

| New Mexico | 200K | 9,524 | 170K | $144,500 |

| New York | 1.1M | 5,641 | 1.1M | $1,100,000 |

| North Carolina | 840K | 7,851 | 850K | $858,500 |

| North Dakota | 90K | 11,539 | 60K | $40,200 |

| Ohio | 900K | 7,692 | 820K | $746,200 |

| Oklahoma | 380K | 9,500 | 350K | $322,000 |

| Oregon | 340K | 7,907 | 330K | $320,100 |

| Pennsylvania | 1.0M | 7,752 | 880K | $774,400 |

| Rhode Island | 120K | 10,909 | 85K | $60,350 |

| South Carolina | 520K | 10,000 | 510K | $499,800 |

| South Dakota | 90K | 10,000 | 70K | $54,600 |

| Tennessee | 700K | 10,000 | 700K | $700,000 |

| Texas | 3.2M | 10,848 | 2.4M | $1,800,000 |

| Utah | 240K | 7,273 | 220K | $202,400 |

| Vermont | 80K | 12,308 | 50K | $31,500 |

| Virginia | 780K | 9,070 | 620K | $496,000 |

| Washington | 750K | 9,615 | 510K | $346,800 |

| West Virginia | 150K | 8,333 | 120K | $96,000 |

| Wisconsin | 650K | 11,017 | 450K | $310,500 |

| Wyoming | 90K | 15,517 | 50K | $28,000 |

Another risky state is Florida, with 2.5 million accidents a year and an average claim cost of $1,024,000.

In riskier states like this, it is wise to protect yourself financially in an accident with adequate, full coverage auto insurance.

Read More: Worst States for Filing Auto Insurance Claims

Required Auto Insurance to Protect Against Claims

One of the main reasons it is so important to meet your state’s auto insurance requirements is to protect yourself financially.

If you don’t have liability insurance, you could be sued by the people you injure or be required to pay the entire bill out of pocket.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

For example, liability insurance claims for bodily injury to others average $20,000 per claim and account for 12% of claims.

However, collision claims are the most common type of auto insurance claim, accounting for 30% of claims.

If you don’t have collision auto insurance, you will have to pay for your own vehicle’s repairs in the majority of accident cases.

Comprehensive insurance claims are another common type of auto insurance claim, accounting for 15% of all claims and averaging $2,500 per claim.

What’s the difference between collision vs. comprehensive auto insurance? Comprehensive coverage covers most accident situations outside of collisions, as well as damages due to theft or vandalism.

While not required, collision and comprehensive coverages should be carried by most drivers and are required on leased or loaned vehicles.

Full coverage is important to have in no-fault auto insurance states, where claims are usually made on a driver's own insurance policy, regardless of who caused the accident.

Dani Best Licensed Insurance Producer

Wondering at what point is full coverage not worth it? If your car is older and has a low resale value, then you may not need full coverage.

Essentially, if the cost of full coverage will soon equal the value of your car, it is best to carry just minimum coverage that meets the state car insurance requirements.

Saving Money on State-Required Auto Insurance

If you’re unhappy with the cost of your auto insurance after meeting the personal or commercial auto insurance requirements by state, make sure that you are taking advantage of auto insurance discounts.

Discounts can be grouped into three main categories, and providers usually offer at least a few discounts in each category.

Most Common Auto Insurance Discounts| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Carrying multiple policies at one insurance company is an easy way to earn a larger discount at a company, as well as making the management of different types of insurance easier.

Another discount that can earn customers a significant price cut is usage-based discounts, as percentages off can be as high as 40% (Read More: 17 Car Insurance Discounts You Can’t Miss).

Top Usage-Based Auto Insurance (UBI) Programs| Company | Program | Savings | System |

|---|---|---|---|

| Drivewise® | 40% | Mobile App | |

| KnowYourDrive | 20% | Mobile App |

| TrueRide® | 30% | Mobile App | |

| YourTurn® | 30% | Mobile App |

| RightTrack® | 30% | Plug-in Device |

| SmartRide® | 40% | Mobile App or Plug-in | |

| Snapshot® | 30% | Mobile App | |

| Drive Safe & Save™ | 30% | Mobile App or Plug-in | |

| TrueLane® | 25% | Mobile App |

| IntelliDrive® | 30% | Mobile App |

To earn a usage-based discount, however, you have to allow the auto insurance company to track your driving habits for a period of time, and the discount may vary based on how well you score in the program.

If you want to find the cheapest auto insurance in your state today, we recommend shopping around and comparing quotes. You can enter your ZIP in our free tool to get started.

Frequently Asked Questions

Is auto insurance required in all states?

No, car insurance is not required in all states. Which states do not require car insurance? New Hampshire does not require auto insurance, but drivers must prove financial liability to qualify.

What auto insurance is required by most states?

Liability auto insurance is required by most states. Shop for affordable liability insurance today by entering your ZIP code in our free quote tool.

What does 15/30/10 mean in insurance?

These numbers refer to the minimum liability auto insurance requirements: $15,000 for an injured person, $30,000 for all injured persons, and $10,000 for property damage.

What is PIP insurance?

PIP stands for personal injury protection, and it helps pay for you and your passengers’ medical bills, lost wages, and more.

What does UM/UIM mean?

UM stands for uninsured motorist, and UIM stands for underinsured motorist.

What is the minimum car insurance required in PA?

Pennsylvania requires 15/30/5 liability insurance and personal injury protection insurance. If you are looking for auto insurance providers in PA, read our guide on the best auto insurance companies in Pennsylvania.

What is the minimum car insurance required in Ohio?

Ohio requires 25/50/25 in liability insurance.

What is the minimum car insurance required in Florida?

Florida requires 10/20/10 of liability insurance and personal injury protection insurance. Compare quotes from the best Florida auto insurance companies to find the lowest rates.

What is the minimum auto insurance coverage in New York?

New York requires 25/50/10 of liability insurance, personal injury protection, uninsured motorist, and underinsured motorist insurance. Read our guide on the best auto insurance companies in New York to find a reputable provider.

What state has the cheapest insurance?

South Dakota has the cheapest minimum coverage rate at $20 per month.

What state has the worst insurance rates?

Is auto insurance valid in all 50 states?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.