10 Best Auto Insurance Companies in Wyoming for 2026

State Farm, The Hartford, and Geico are the best auto insurance companies in Wyoming, with rates starting at $39 a month. Drivers across Wyoming can unlock savings up to 40% through safe driving, bundling, and usage-based discounts to get the cheapest Wyoming car insurance rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated November 2025

The best auto insurance companies in Wyoming are State Farm, The Hartford, and Geico, offering rates as low as $39 per month.

- The best car insurance in Wyoming starts at $39 a month

- State Farm is Wyoming’s top pick for its reliable customer service

- Wyoming drivers must carry 25/50/20 in minimum liability coverage

State Farm takes the top spot for reliable claims handling and flexible coverage options, and The Hartford is ideal for senior drivers with its helpful benefits and strong customer satisfaction.

Geico offers the lowest rates in Wyoming, but drivers across the state can save up to 40% through discounts for safe driving, bundling, and usage-based programs.

Top 10 Companies: Best Auto Insurance in Wyoming| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 648 / 1,000 | A++ | Reliable Service | |

| #2 | 645 / 1,000 | A+ | Senior Drivers |

| #3 | 631 / 1,000 | A++ | Budget Savings | |

| #4 | 626 / 1,000 | A | Local Support |

| #5 | 625 / 1,000 | A+ | Vanishing Deductible | |

| #6 | 621 / 1,000 | A+ | Claims Assistance | |

| #7 | 620 / 1,000 | A | Custom Policies | |

| #8 | 607 / 1,000 | A+ | Tech-Savvy Drivers | |

| #9 | 581 / 1,000 | A++ | Industry Experience | |

| #10 | 578 / 1,000 | A | Accident Forgiveness |

Comparing quotes from these top companies helps Wyoming drivers find the lowest prices and buy auto insurance that offers the best protection for their needs.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

Wyoming Auto Insurance Rate Comparison

Geico, Progressive, and State Farm offer the cheapest Wyoming auto insurance rates. Geico has the cheapest car insurance at $39 per month for minimum coverage and $87 per month for full coverage.

Progressive follows closely with $41 per month for minimum coverage and $92 per month for full coverage.

Wyoming Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $52 | $116 | |

| $48 | $106 |

| $47 | $105 | |

| $39 | $87 | |

| $49 | $109 |

| $43 | $96 | |

| $41 | $92 | |

| $42 | $94 | |

| $50 | $111 |

| $45 | $100 |

State Farm costs a few dollars more at $42 per month for minimum coverage and $94 per month for full coverage, but it offers customer support and strong claims service through local agents.

Progressive keeps prices low for tech-savvy drivers in Wyoming looking for online policy management and claims, but its claim satisfaction is far below average when compared to State Farm or Geico.

Read More: Liability vs. Full Coverage Auto Insurance

Comparing Wyoming Auto Insurance for Young Drivers

Younger drivers pay significantly higher Wyoming auto insurance rates than older, more experienced motorists.

Among all Wyoming insurance companies, Geico, Progressive, and State Farm offer the lowest rates across every age group.

Wyoming Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $140 | $86 | $65 | $52 | |

| $102 | $61 | $53 | $48 |

| $126 | $78 | $55 | $47 | |

| $99 | $55 | $46 | $39 | |

| $128 | $80 | $58 | $49 |

| $110 | $66 | $52 | $43 | |

| $122 | $57 | $48 | $41 | |

| $105 | $63 | $50 | $42 | |

| $120 | $72 | $56 | $50 |

| $128 | $75 | $54 | $45 |

Geico is the cheapest overall, starting at $99 per month for 18-year-olds and dropping to $39 per month by age 45.

Progressive follows closely with rates from $122 per month at age 18 to $41 per month at age 45, saving older drivers around $80 a month.

Younger Wyoming drivers should focus on higher liability limits, while older drivers benefit most from strong medical and comprehensive coverage.

Michelle Robbins Licensed Insurance Agent

State Farm remains highly competitive, averaging $105 per month for 18-year-olds and $42 per month for 45-year-old drivers, offering competitive discounts for young drivers who practice behind the wheel.

Older drivers can lower rates with home and auto bundles and loyalty discounts. Read our relevant guide about the cheap auto insurance for seniors for full details.

How Driving History Affects Car Insurance Rates in Wyoming

Driving history has a major impact on Wyoming auto insurance rates, but Geico clearly offers cheap auto insurance for high-risk drivers.

Even after a violation, Geico costs just $53 a month with one accident and $63 monthly with a DUI.

Wyoming Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $52 | $78 | $116 | $69 | |

| $48 | $72 | $108 | $64 |

| $47 | $68 | $102 | $62 | |

| $39 | $53 | $63 | $41 | |

| $49 | $74 | $110 | $66 |

| $43 | $59 | $80 | $55 | |

| $41 | $55 | $68 | $48 | |

| $42 | $57 | $75 | $53 | |

| $50 | $76 | $115 | $68 |

| $45 | $65 | $98 | $60 |

Progressive also keeps rates affordable, making it a good option for those rebuilding a record, while State Farm only has moderate increases after incidents.

Drivers in Wyoming with spotless records can expect the lowest premiums overall, but even with a past mistake, you can find reasonable options for accident forgiveness programs and defensive driving discounts.

Read More: Best Auto Insurance Companies for Claims Handling

How Credit Impacts Wyoming Car Insurance Premiums

Drivers in Wyoming with different credit scores will notice big differences in their car insurance costs. Geico remains affordable, but still charges drivers with bad credit $20 more per month.

Geico is the top choice for drivers on a budget, while Progressive only reaches $62 per month for drivers with lower credit scores.

Wyoming Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $52 | $56 | $64 | $77 | |

| $48 | $52 | $59 | $72 |

| $47 | $50 | $58 | $70 | |

| $39 | $42 | $47 | $59 | |

| $49 | $54 | $63 | $78 |

| $43 | $46 | $52 | $65 | |

| $41 | $45 | $50 | $62 | |

| $42 | $44 | $48 | $61 | |

| $50 | $53 | $60 | $74 |

| $45 | $49 | $55 | $68 |

State Farm remains a reliable option. It offers $42 per month for excellent credit and $61 per month for poor credit, maintaining competitive pricing without compromising service.

Learn how to compare auto insurance companies to get savings and dependable protection, no matter your credit standing.

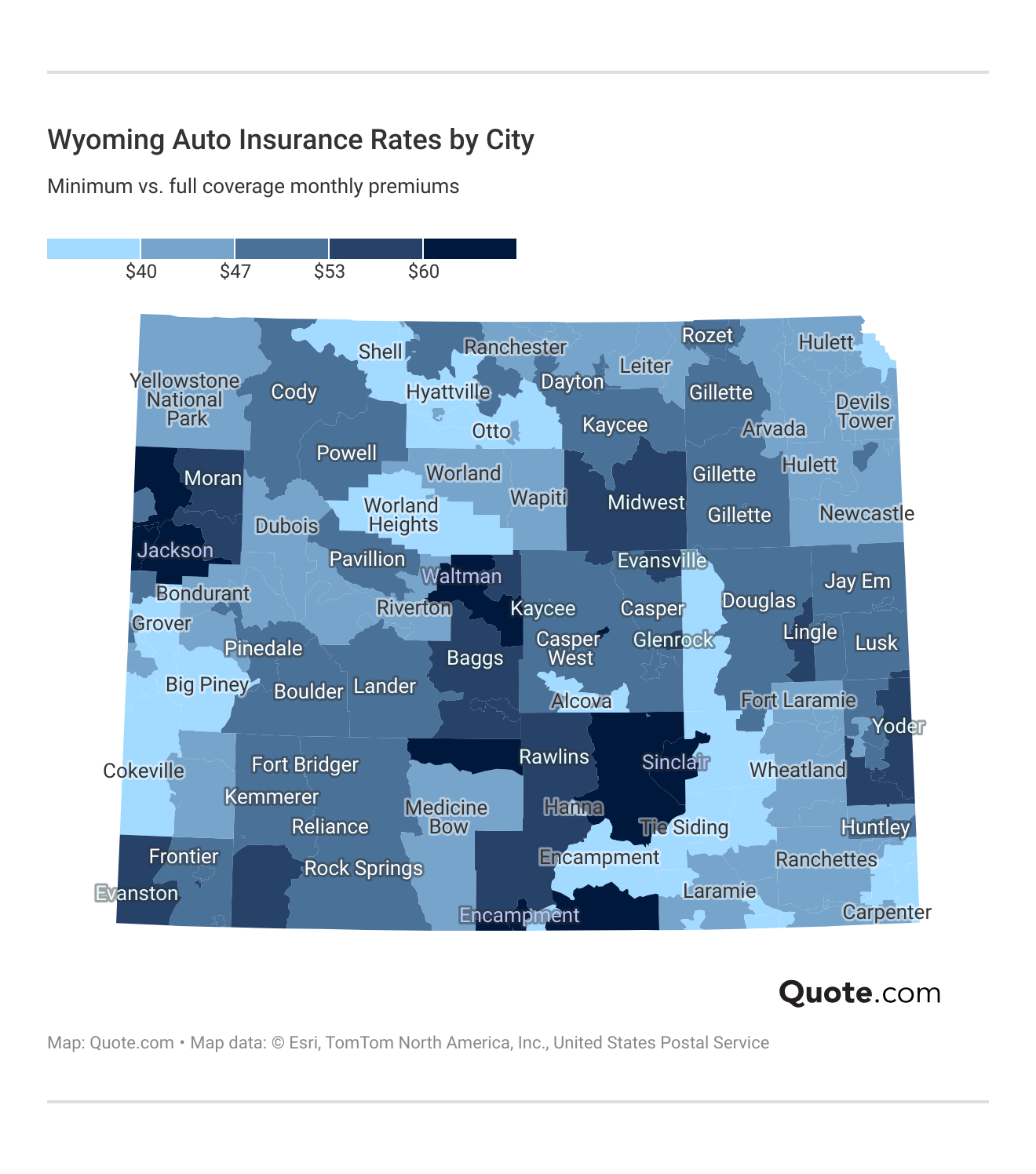

Comparing Wyoming Car Insurance Where You Live

Auto insurance rates in Wyoming can vary widely depending on location, with certain areas offering much cheaper coverage than others.

Northern and southeastern regions of the state, such as Hyattville, Shell, Wheatland, and Carpenter, tend to have the lowest rates, often around $40 to $45 per month for minimum coverage.

These smaller towns generally see fewer claims and less traffic, which keeps insurance premiums low (Learn More: Worst States for Filing Auto Insurance Claims).

On the other hand, urban areas and high-traffic zones like Casper, Gillette, and Jackson show noticeably higher monthly costs, averaging $55 to $60 due to denser traffic, higher repair costs, and more frequent accidents.

Wyoming drivers should choose coverage that fits their lifestyle. More comprehensive protection for rural travel, and higher liability limits for city driving.

Daniel Walker Licensed Insurance Agent

Central Wyoming towns such as Riverton, Lander, and Rawlins fall in the midrange, with rates hovering near $50 per month.

Overall, drivers in Wyoming’s quieter rural regions enjoy the cheapest car insurance, while those in busy city centers pay slightly more for similar coverage.

Read More: Auto Insurance Rates by State

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wyoming Car Insurance Requirements

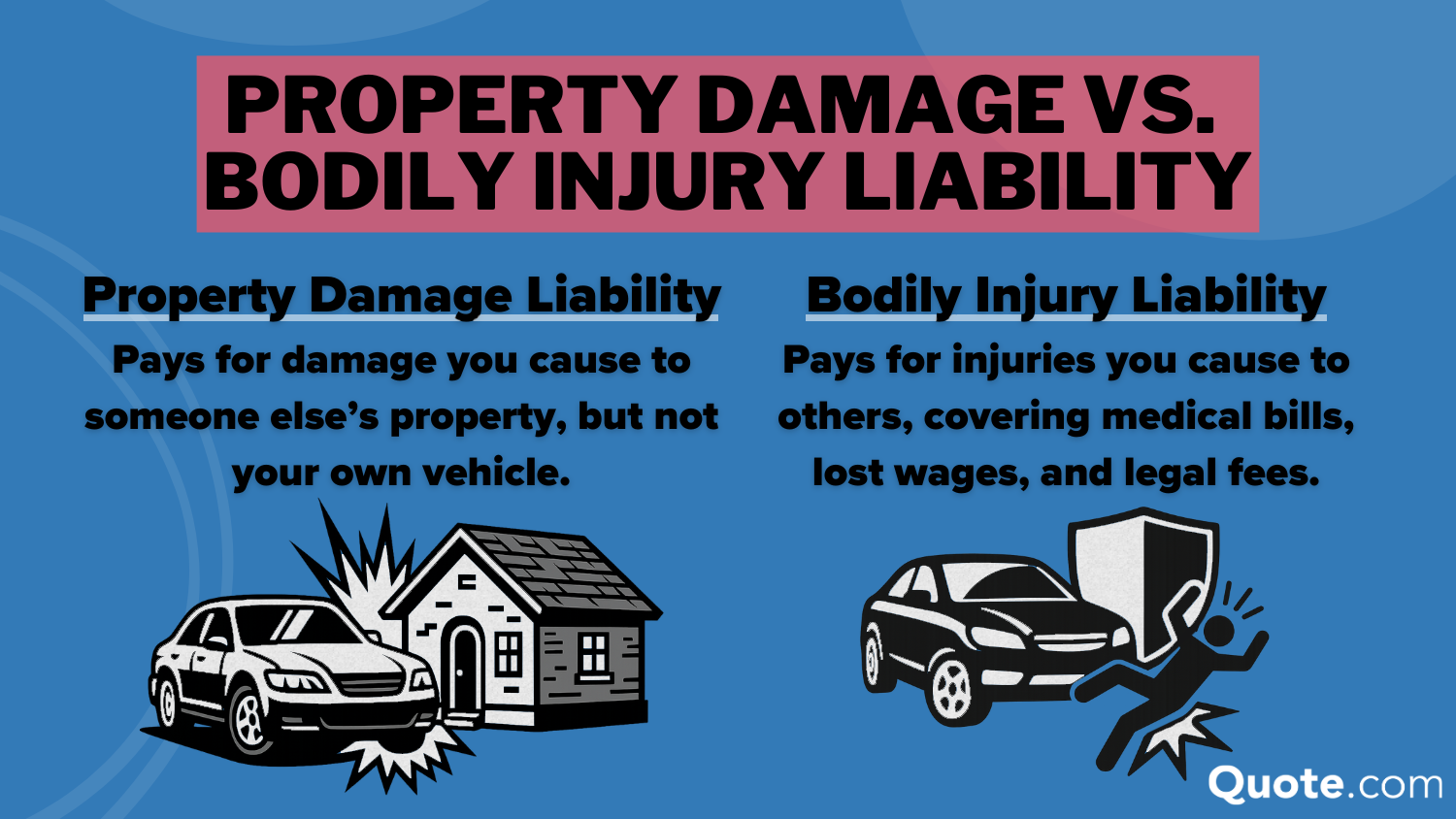

Wyoming drivers must carry liability auto insurance coverage that meets the state’s minimum requirements of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage to legally drive.

The state follows an at-fault system, meaning the driver who causes an accident is responsible for covering any resulting damages or injuries. These required limits provide basic financial protection for other drivers and property owners in the event of an accident.

This coverage pays for medical expenses, vehicle repairs, or property damage you cause to others in a crash. Wyoming also requires drivers to carry proof of insurance at all times. Failure to show valid insurance can lead to fines, driver’s license suspension, and vehicle registration revocation.

In addition, if you let your insurance lapse, you may need to pay reinstatement fees and provide proof of continuous coverage before getting back on the road.

Keeping your car insurance active helps Wyoming drivers follow the law and avoid paying big repair or medical bills after an accident.

Auto Insurance Coverage Options in Wyoming

Drivers in Wyoming can choose from several types of auto insurance coverage to meet state requirements and protect against unexpected costs.

Because Wyoming experiences heavy winter storms and long stretches of rural highways, having more than just basic coverage is often a smart choice. Understanding each type of coverage helps drivers stay protected financially and legally on Wyoming roads.

- Liability Coverage: Mandatory in Wyoming, covering at least 25/50/20 liability coverage.

- Collision Coverage: Collision auto insurance pays to repair or replace your vehicle after a crash, regardless of fault.

- Comprehensive Coverage: Protects against theft, vandalism, hail, or animal-related damage—common risks in Wyoming.

- Uninsured/Underinsured Motorist Coverage: Covers costs if you’re hit by a driver without enough insurance, a frequent issue on rural WY roads.

- Medical Payments Coverage (MedPay): MedPay helps cover hospital bills for you and your passengers after an accident, no matter who’s at fault.

Choosing the right coverage in Wyoming depends on where and how you drive. Rural drivers may want stronger protection from wildlife collisions, while city drivers might prioritize comprehensive coverage for theft or vandalism.

Meeting state minimums keeps you legal, but upgrading your plan ensures full protection against high repair and medical costs. By comparing coverage options, Wyoming drivers can find affordable, reliable insurance that fits their lifestyle and location.

How to Get the Best Wyoming Auto Insurance

Wyoming car insurance companies can be affordable if you know how to take advantage of discounts and smart coverage choices. Many insurance companies in WY reward drivers for safe habits, bundling policies, and adding safety features to their vehicles.

State Farm, The Hartford, and Geico are the best auto insurance companies in Wyoming. They stand out with low rates and reliable claims service. Geico consistently provides the lowest rates, starting at $39 per month.

Wyoming drivers can also lower their costs by using usage-based car insurance that can save up to 40%. Nationwide and Allstate give the biggest usage-based savings in Wyoming.

Liberty Mutual offers one of the best anti-theft discounts at 35%, great for drivers with newer or well-equipped cars.

Top Auto Insurance Discounts in Wyoming| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 10% | 5% | 15% | 20% |

| 15% | 13% | 10% | 30% |

Geico and American Family make it easy to save up to 25% by bundling car insurance with homeowners or renters coverage. Farmers, Progressive, and State Farm also reward good driving records with discounts up to 30%.

Beyond discounts, Wyoming drivers can reduce their premiums by making small changes to their coverage and habits. Even simple adjustments can lead to noticeable savings over time:

- Raise Your Deductible: Increasing your deductible lowers your monthly payments and keeps premiums down.

- Compare Quotes Often: Checking rates from Geico, Nationwide, and State Farm helps find better deals as prices change.

- Adjust Coverage on Older Cars: Removing collision or comprehensive coverage on older vehicles can reduce costs.

Using discounts, raising deductibles, comparing rates regularly, and cutting unnecessary coverage all work together to lower monthly costs while maintaining dependable protection.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Wyoming Car Insurance Providers

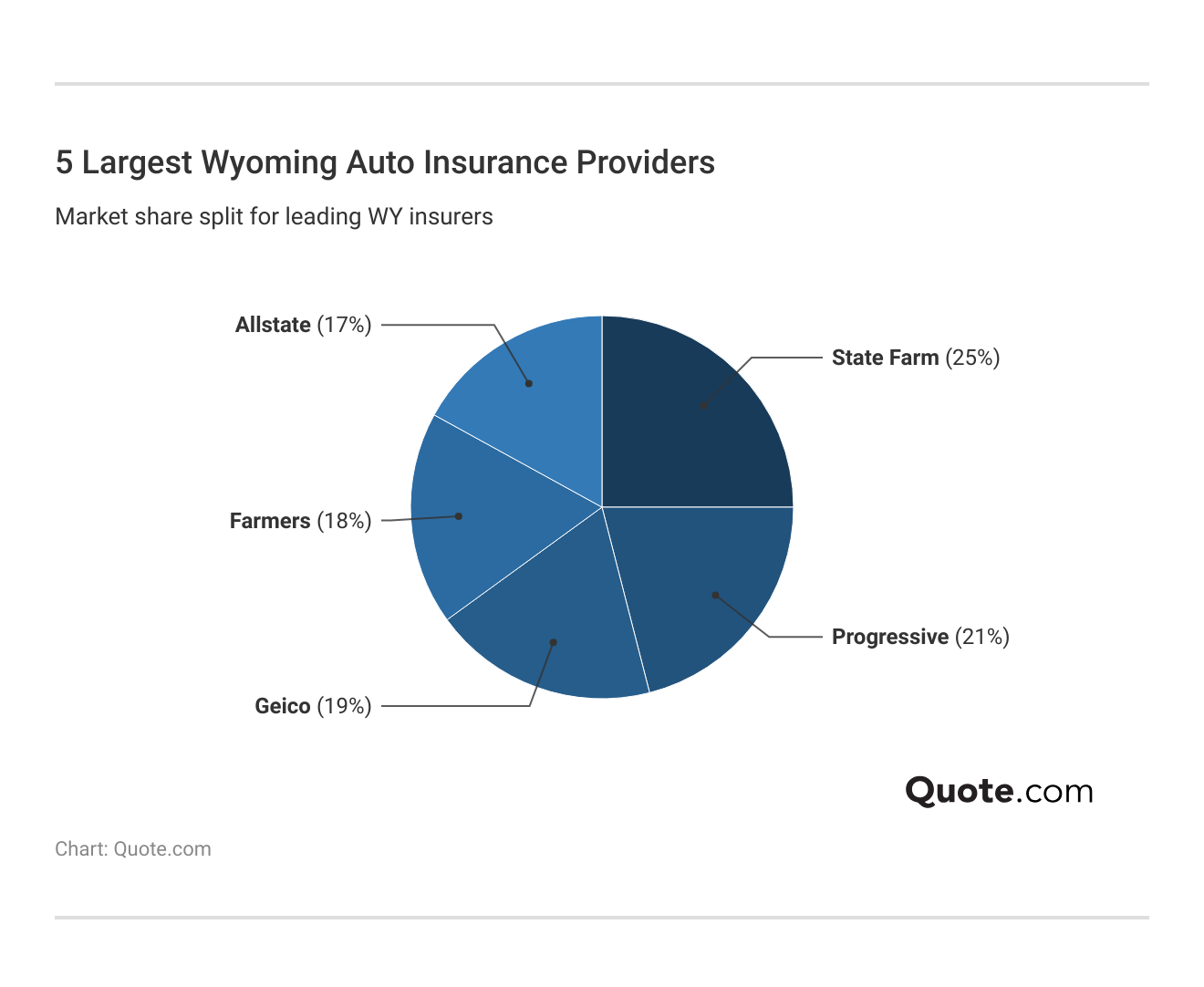

When shopping for auto insurance in Wyoming, it’s helpful to look at which companies hold the biggest share of the market and what that means for drivers.

State Farm leads with 25% of the market, giving Wyoming drivers access to a wide local agent network and reliable claims service (Read More: State Farm vs. Progressive Auto Insurance).

Although these large insurers dominate the Wyoming market, smaller regional companies still play an important role in offering personalized service and competitive pricing.

Comparing quotes from both national and local providers helps Wyoming drivers find the right mix of cost, coverage, and customer care.

#1 – State Farm: Top Overall Pick

Pros

- Reliable Coverage: It offers dependable customer service and claims support, making it the most trusted option for WY drivers. Read more in our State Farm Insurance review.

- Affordable Rates: Minimum coverage in Wyoming starts at $42 per month, giving drivers a strong balance between price and protection in WY.

- Strong Discount Variety: WY drivers can save up to 30% with bundling, safe driving, and multi-car discounts that make coverage even more affordable.

Cons

- Limited Usage-Based Savings: State Farm’s Drive Safe & Save program offers smaller rewards than some competitors for WY drivers.

- Higher Full Coverage Rates: Full coverage in WY can cost $94 per month, which is more expensive than cheaper options like Geico.

#2 – The Hartford: Best for Senior Drivers

Pros

- Senior-Friendly Policies: The Hartford tailors coverage and claims support for older drivers in Wyoming, ensuring safer and simpler policy management.

- High Claims Satisfaction: With a score of 645/1,000, it delivers consistent service quality for WY policyholders. Our The Hartford insurance review provides full ratings.

- Fair Rates: Minimum coverage in Wyoming averages $50 per month, competitive for drivers over 55 seeking stability.

Cons

- Limited Discount Range: WY drivers have fewer available discounts compared to State Farm or Nationwide

- Restricted Eligibility: Some programs in WY, including AARP membership discounts, require qualifying memberships and limit options for non-seniors.

#3 – Geico: Best for Budget Savings

Pros

- Cheapest Rates: Geico offers the lowest minimum coverage at just $39 per month, making it the most affordable insurer in Wyoming.

- High-Tech Policy Tools: Wyoming drivers can easily manage policies, claims, and payments through Geico’s mobile app and online dashboard.

- Safe Driver Discounts: WY customers can save up to 26% through the DriveEasy program and an accident-free history. Learn more in our Geico insurance review.

Cons

- Limited Local Support: Fewer in-person agents across Wyoming may make customer service less personal.

- Coverage Customization Limits: Geico’s add-ons in Wyoming aren’t as flexible as those from Farmers or American Family.

#4 – American Family: Best for Local Support

Pros

- Community-Based Service: American Family provides strong local agent support across WY, giving drivers personalized assistance.

- Competitive Rates: Minimum coverage starts at $48 per month, offering reliable protection with a strong local presence for WY drivers.

- Bundling Benefits: WY drivers can save up to 25% by combining auto and homeowners insurance. See full details in our American Family review.

Cons

- Limited Availability: American Family’s network in some rural Wyoming areas is smaller than larger carriers like State Farm.

- Digital Tools: For WY divers, the mobile app and online claim-filing system lag behind tech-savvy competitors like Progressive.

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Unique Vanishing Deductible: Wyoming drivers earn $100 off their deductible each year of safe driving with Nationwide’s program.

- Affordable Rates: Minimum coverage starts at $43 per month, making it cost-effective for steady WY drivers. See more quotes in our Nationwide auto insurance review.

- Strong Financial Stability: With an A+ A.M. Best rating, Nationwide ensures claim reliability for WY drivers.

Cons

- Higher Young Driver Rates: WY drivers under 25 may see premiums above $100 a month, higher than Geico or State Farm.

- Complex Discount Qualifications: Some bundling and telematics discounts require additional policy steps or renewals in WY.

#6 – Allstate: Best for Claims Assistance

Pros

- Reliable Claims Help: Allstate’s dedicated claims team provides quick and responsive service for WY drivers after an accident.

- Wide Coverage Options: Minimum coverage in Wyoming starts at $52 per month, with flexible upgrades for roadside and accident forgiveness.

- Safe Driving Discounts: Drivers in WY can save up to 25% with Allstate’s Drivewise program. Learn about policy benefits in our Allstate auto insurance review.

Cons

- Higher Base Rates: Full coverage can cost over $116 per month, higher than most Wyoming competitors.

- Discount Restrictions: Some discounts are not available in rural WY areas or require policy bundling.

#7 – Farmers: Best for Custom Policies

Pros

- Customizable Coverage: Farmers allows WY drivers to adjust liability and comprehensive options for better budget control.

- Strong Agent Support: With agents throughout Wyoming, drivers get personalized help and fast claims resolution.

- Affordable Rates: Minimum coverage starts at $47 per month, balancing cost and customization for WY drivers. Compare more rates in our Farmers insurance review.

Cons

- Digital Tools: Farmers’ app experience is less advanced than Progressive’s in Wyoming.

- Discount Limitations: Savings for multi-car and telematics users in WY are smaller compared to Nationwide and Geico.

#8 – Progressive: Best for Tech-Savvy

Pros

- Snapshot Program Savings: WY drivers can save up to 30% through usage-based monitoring with Progressive’s Snapshot app.

- Affordable Minimum Coverage: Starting at $41 per month, Progressive offers balanced value and tech tools.

- Easy Online Management: Wyoming drivers can quote, file, and track claims completely online. Read how it works in our Progressive insurance review.

Cons

- Rate Increases After Claims: WY drivers with at-fault accidents may face higher rate hikes than average.

- Limited Agent Network: Progressive’s online-first model means fewer local offices in rural Wyoming.

#9 – Travelers: Best for Industry Experience

Pros

- Established Brad: With an A++ A.M. Best rating and over 100 years of selling insurance, it offers stability and reliability for Wyoming policyholders.

- Wide Coverage Range: Travelers provides multiple optional coverages, including gap and rental reimbursement for WY drivers. See what stands out in our Travelers review.

- Affordable Rates: Minimum coverage averages $45 per month, providing great value for Wyoming drivers’ comprehensive protection.

Cons

- Limited Discount Availability: Some discounts are not accessible to all WY drivers, depending on location.

- Higher Deductibles: Wyoming drivers may need to select higher deductibles to reduce monthly premiums.

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual helps Wyoming drivers avoid rate increases after their first accident. Get more details in our Liberty Mutual auto insurance review.

- Strong Discount Programs: WY drivers can save up to 35% through bundling and safety feature discounts.

- Competitive Pricing: Minimum coverage starts at $49 per month, offering affordable protection for Wyoming drivers.

Cons

- Mixed Claims Reviews: Some Wyoming customers report delays in claims processing.

- Higher Young Driver Rates: Teens and new drivers in Wyoming often pay above $100 per month for minimum coverage.

Frequently Asked Questions

What are the best auto insurance companies in Wyoming?

The best Wyoming car insurance companies are State Farm, The Hartford, and Geico. State Farm offers dependable service and strong local support. The Hartford is ideal for senior drivers, and Geico provides the lowest average rates starting at $39 per month.

Read More: State Farm vs Farmers, Geico, Progressive, and Allstate Review

How much does car insurance cost in Wyoming?

For most drivers, minimum coverage costs around $43 per month, while full coverage averages about $98 per month. Rates vary depending on your driving record, age, credit score, and where you live in Wyoming.

What is the minimum car insurance required in Wyoming?

Wyoming law requires liability coverage of $25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage. This coverage pays for damages or injuries you cause to others.

Read More: Personal Injury Protection

Who has the cheapest car insurance in Wyoming?

Geico consistently offers the cheapest rates in Wyoming, with minimum coverage starting at $39 per month. Progressive and State Farm also provide competitive pricing for safe and experienced drivers.

Does Wyoming require uninsured motorist coverage?

No, uninsured and underinsured motorist coverage is not required by law in Wyoming. However, adding this coverage is recommended because it protects you if another driver without enough insurance causes an accident.

What discounts can Wyoming drivers qualify for?

Wyoming drivers can save up to 40% through discounts for safe driving, policy bundling, anti-theft devices, and usage-based programs. Companies like Nationwide, Allstate, and Liberty Mutual offer some of the biggest savings. Discover ways to pay less for car insurance.

Why do car insurance rates vary by Wyoming location?

Rates differ because factors like population density, accident frequency, and weather risks affect premiums. Drivers in rural towns like Hyattville or Shell often pay less than those in busier areas like Casper or Gillette. Enter your ZIP code to compare rates near you.

How does credit score affect Wyoming car insurance rates?

Drivers with higher credit scores tend to pay less. For example, someone with excellent credit may pay $39 per month, while a driver with poor credit could pay $59–$78 per month, depending on the company.

What coverage should I add beyond Wyoming’s minimum requirement?

It’s smart to consider collision, comprehensive auto insurance, and medical payments (MedPay) coverage. These options help cover repair costs, theft, weather damage, or injuries after an accident—common concerns on Wyoming’s rural roads.

How can I find the best car insurance rates in Wyoming?

To find the best car insurance in Wyoming, compare quotes from multiple insurers, check for available discounts, and review your coverage needs regularly. Shopping around is the most effective way to find affordable, high-quality coverage in Wyoming. Get fast and cheap Wyoming car insurance coverage today with our quote comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.