Auto-Owners Insurance Review in 2026

Auto-Owners insurance offers auto coverage starting at $45 per month, along with home and life options, plus savings of up to 25% for multi-policy bundles and safe drivers. Our Auto-Owners insurance review highlights accident forgiveness, loan/lease gap, identity theft protection, and pet insurance benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated February 2026

Our Auto-Owners insurance review highlights the company’s value through competitive pricing and diverse policy options for drivers, homeowners, families, and businesses.

- Auto-Owners offers accident forgiveness and gap insurance

- Save up to 20% with Auto-Owners for safe driving habits

- Auto-Owners offers car insurance rates from $45 per month

With auto coverage starting at $45 per month and discounts up to 25% for bundling, customers can access affordable protection without sacrificing quality.

Auto-Owners Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.5 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 4.4 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 2.1 |

| Digital Experience | 5.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.5 |

| Policy Options | 3.8 |

| Savings Potential | 4.3 |

Beyond standard plans, Auto-Owners offers accident forgiveness, gap insurance, identity theft protection, and pet coverage, backed by strong service in 26 states.

Begin exploring budget-friendly insurance plans by entering your ZIP code into our quote comparison tool.

Auto-Owners Car Insurance

Auto-Owners car insurance has cheap rates, averaging around $45 per month, and available discounts of up to 25% for bundling while safe drivers can get discounts of around 20%. Through add-ons such as accident forgiveness, gap insurance and identity theft protection, it offers flexible coverage options.

Though limited to 26 states, Auto-Owners’ A++ financial strength and strong customer satisfaction make it a reliable choice for drivers seeking value and peace of mind in our auto insurance guide.

Cost of Auto-Owners Car Insurance

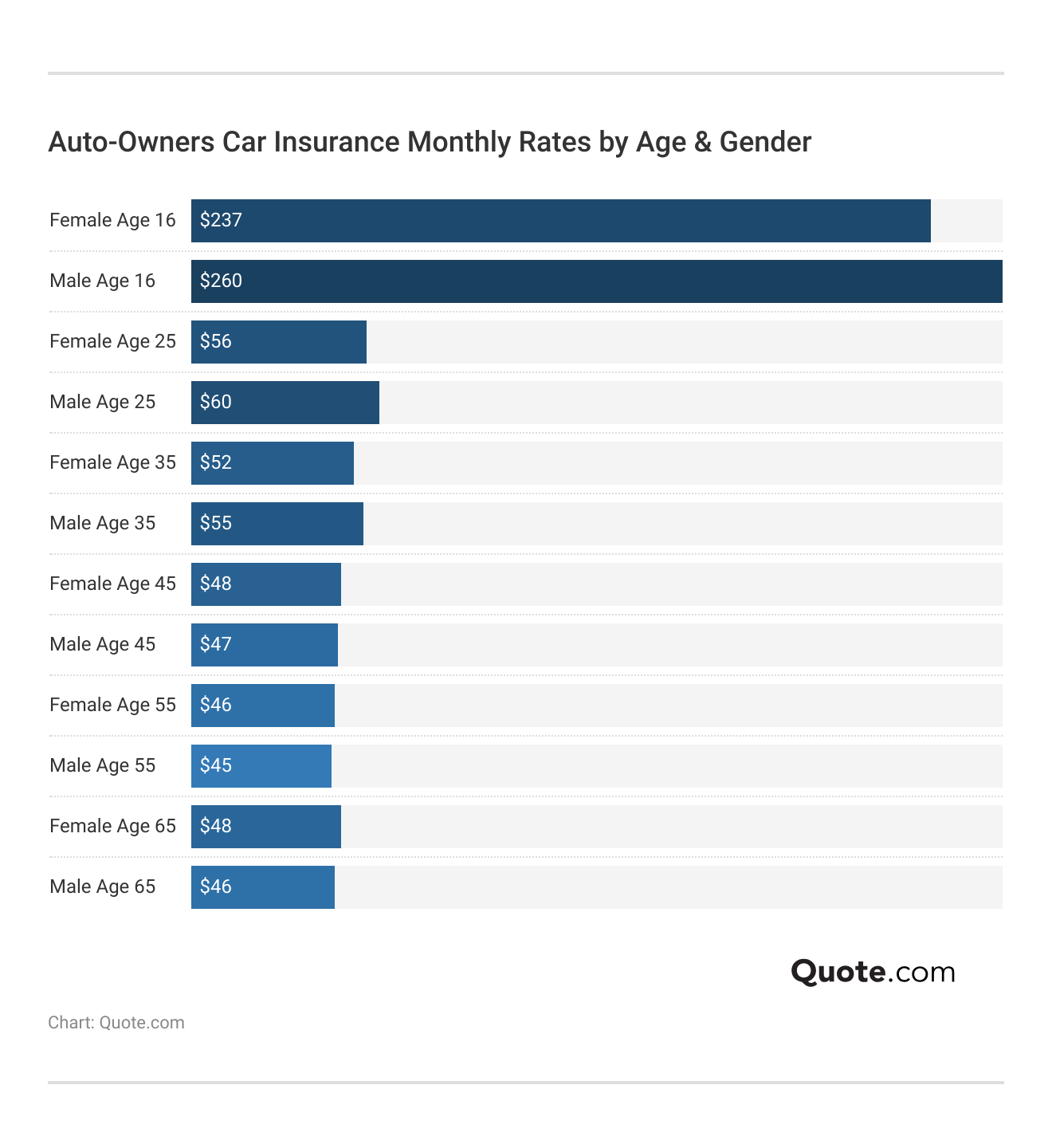

Auto-Owners’ car insurance premiums change based on your age and gender. 16-year-old drivers pay the most, with monthly rates of $237 for females and $260 for males. This is because drivers in this age group are seen as higher risk.

Rates drop significantly by age 25, averaging $56 for females and $60 for males, and continue to decline into middle age, where drivers often find the cheapest car insurance at about $45 to $48 per month.

Car insurance rates drop with experience, though young males pay more. Good credit and telematics help. For example, safe driving in these programs earns discounts.

Jeff Root Licensed Insurance Agent

Females often pay less for car insurance because insurers see them as lower-risk drivers, especially in their teens and early twenties. On the other hand, males in these younger age groups tend to have higher accident rates, which leads to higher premiums.

As drivers get older, accident rates even out and both genders show similar risk patterns, so the price gap becomes very small.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $124 | |

| $62 | $94 | $104 | $94 |

| $47 | $69 | $72 | $69 | |

| $76 | $109 | $105 | $109 | |

| $43 | $71 | $117 | $71 | |

| $96 | $129 | $178 | $129 |

| $63 | $88 | $129 | $88 | |

| $56 | $98 | $75 | $98 | |

| $47 | $57 | $65 | $57 | |

| $53 | $76 | $112 | $76 |

Auto-Owners insurance offers some of the most competitive monthly rates among major insurers, at $47 for a clean record, $69 after one accident, $72 after one DUI, and $69 after one ticket.

State Farm also offers affordable premiums, costing $47 per month with a clean record, which jumps to $65 after a DUI.

Rates drop significantly by age 25, averaging $56 for females and $60 for males, and continue to decline into middle age, reaching about $45 to $48 monthly for drivers aged 45 to 65. Read our State Farm auto insurance review for more.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $47 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Auto-Owners is one of the most affordable insurance providers, with minimum coverage costing $45 and full coverage at $124. These prices are similar to what State Farm offers and only slightly higher than Geico’s lowest rates.

Young drivers may pay $237 monthly, but rates can drop to $45 with age; bundling policies early helps maximize savings.

Michelle Robbins Licensed Insurance Agent

In comparison, other companies like Allstate, Farmers, and Liberty Mutual typically charge much more, making Auto-Owners a great value option. Auto-Owners offers competitive car insurance rates across all credit tiers, at $97 for good credit, $117 for fair credit, and $137 for poor credit.

Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (<580) |

|---|---|---|---|---|

| $87 | $96 | $113 | $130 | |

| $62 | $69 | $82 | $95 |

| $47 | $52 | $62 | $73 | |

| $76 | $83 | $98 | $112 | |

| $43 | $48 | $58 | $68 | |

| $96 | $107 | $128 | $149 |

| $63 | $70 | $84 | $97 | |

| $56 | $62 | $75 | $88 | |

| $47 | $52 | $63 | $75 | |

| $53 | $58 | $69 | $79 |

These rates are lower than Allstate, Farmers, and Travelers, and close to top low-cost options like Geico and State Farm, making Auto-Owners a strong choice for affordable coverage regardless of credit score. Find the full list in our Travelers auto insurance review.

Auto-Owners Car Insurance Coverage

Auto-Owners Insurance Company offers car insurance coverages that protect you, your passengers, and your vehicle from unexpected costs, covering everything from accident repairs to medical expenses and loan protection.

- Collision Coverage: Pays for repairs or replacement of your car if it’s damaged in an accident, no matter who caused it.

- Comprehensive Coverage: Protects against non-collision-related damage, such as theft, fire, vandalism, severe weather, or accidents involving animals.

- Loan or Lease Gap Coverage: Covers the gap between your car’s value and your remaining loan or lease balance if it’s totaled, preventing out-of-pocket costs.

- Medical Payments and Personal Injury Protection: Covers medical, hospitalization, and rehab costs for you and your passengers after an accident, regardless of fault (Learn More: Personal Injury Protection (PIP) Insurance)

- Uninsured/Underinsured Motorist Coverage: Help you if you get into an accident with a driver who doesn’t have any insurance or whose insurance isn’t enough to cover your injuries, property damage, or even death.

By bringing these different coverages together, Auto-Owners offers drivers more than just standard insurance—it delivers well-rounded protection that helps drivers feel more secure every time they get behind the wheel.

With tailored options to fit different lifestyles and budgets, you can choose the plan that best meets your needs while knowing you’re well-protected.

Auto-Owners Car Insurance Discounts

Auto-Owners offers numerous car insurance discounts that can greatly lower premiums, with the biggest savings of 25% for multi-policy and multi-car customers, and 20% for the best good student auto insurance discounts and safe driver rewards.

Drivers can also qualify for savings based on their payment history, which rewards consistent on-time payments with lower long-term costs.

Car Insurance Discounts Offered by Auto-Owners| Discount | |

|---|---|

| Advance Quote | 10% |

| Affinity Group | 5% |

| Anti-Theft | 8% |

| Defensive Driving | 5% |

| Good Student | 20% |

| Green Discount | 10% |

| Loyalty | 8% |

| Multi-Car | 25% |

| Multi-Policy | 25% |

| Paid-in-Full | 15% |

| Safe Driver | 20% |

| Safety Features | 15% |

| Student Away | 10% |

| Teen Driver | 7% |

Customers who use the Auto-Owners mobile app may receive extra savings for participating in optional usage-based insurance programs that track driving habits.

Other discounts include 15% for paid-in-full or safety features, 10% for green discount, advance quote, or student away, 8% for anti-theft or loyalty, 7% for teen driver monitoring, and 5% for affinity group or defensive driving.

Since discount availability varies by state, it’s helpful to compare quotes or speak with an agent to confirm which opportunities apply to your policy.

These rewards lower coverage costs while promoting safe driving, vehicle safety upgrades, and proactive steps like bundling policies or completing driver education to reduce expenses and risk.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto-Owners Home Insurance

Auto-Owners home insurance costs more than some competitors, but its homeowners insurance coverage explained shows broad protection for your home, belongings, liability, and living expenses with add-ons like water backup coverage.

With strong claims service and multiple discounts, Auto-Owners is best suited for homeowners who value comprehensive coverage and reliable support over the lowest price.

Cost of Auto-Owners Home Insurance

Auto-Owners’ home insurance rates trend higher than many competitors, at $106 per month for $200K in coverage and $432 for $1M, compared to others like Farmers and State Farm that charge under $100 and around $270–$295, respectively.

Home Insurance Monthly Rates by Policy Amount| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $94 | $118 | $165 | $285 | |

| $91 | $115 | $160 | $275 |

| $106 | $183 | $214 | $432 | |

| $89 | $112 | $158 | $270 | |

| $92 | $116 | $162 | $278 | |

| $95 | $119 | $167 | $290 |

| $93 | $117 | $163 | $280 | |

| $95 | $119 | $166 | $287 | |

| $90 | $114 | $159 | $273 | |

| $96 | $120 | $170 | $295 |

While not the cheapest option, Auto-Owners appeals to homeowners who value personalized service, broad coverage, and a strong claims reputation, making it important to compare homeowners insurance quotes before choosing a policy.

Auto-Owners Home Insurance Coverage

Auto-Owners offers homeowners insurance that protects your property and finances, covering your home, belongings, and living expenses to give you peace of mind when the unexpected happens.

- Additional Living Expenses: Pays for housing and meals if you can’t live in your home after a covered loss.

- Dwelling Coverage: Protects your home and attached structures, such as garages or decks, against covered losses.

- Personal Liability Protection: Provides coverage for lawsuits and claims if you or your family are responsible for injuries or property damage.

- Personal Property Coverage: Covers your belongings anywhere in the world, with options for high-value items like jewelry or collectibles, similar to the best auto insurance for luxury and exotic vehicles.

- Water Backup of Sewers or Drains: Covers damage caused by backed-up sewers or drains, including floors, walls, and furniture.

With these comprehensive coverages, Auto-Owners ensures you’re prepared for whatever life throws at you—whether you need to repair storm damage, replace your valuables, or cover legal expenses.

You can also add optional endorsements, such as identity theft protection or equipment breakdown coverage, to strengthen your policy even further.

When you customize your protection to fit your unique needs, you can have peace of mind knowing both your home and your way of life are secure.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Auto-Owners Home Insurance Discounts

Auto-Owners helps homeowners protect their property while saving money, offering discounts that reward safe habits, smart choices, and bundled policies for affordable coverage.

- Green Discount: Save when you enroll in paperless billing and pay premiums online.

- Multi-Policy Discount: Save when you bundle your home insurance with other qualifying Auto-Owners policies.

- Paid-in-Full Discount: Receive a discount when you pay your annual premium in full and on time (not available for escrow direct bill accounts).

- Payment History Discount: Earn savings if you’ve paid your premiums on time over the past 36 months.

- Protective Devices Discount: Qualify for savings if your home has smoke detectors, deadbolt locks, or fire extinguishers.

When you combine and maximize these discounts you get a lower homeowners insurance premium and a well-protected home.

Be sure to ask your independent Auto-Owners agent which savings you qualify for, and learn how to estimate home insurance costs based on where you live to maximize your value.

Auto-Owners Life Insurance

Auto-Owners life insurance has mid-range rates, from $34 for term to $410 for whole life, positioning it between low-cost and higher-priced options among the best life insurance companies.

It offers flexible options like term, whole, and universal life, plus annuities and disability income insurance. Backed by strong financial stability, Auto-Owners is a dependable choice for protection and long-term planning.

Cost of Auto-Owners Life Insurance

Auto-Owners’ life insurance rates are mid-range compared to competitors, at $34 per month for a 20-year term and $410 for whole life coverage.

Auto‑Owners vs. Competitors: Life Insurance Monthly Rates| Insurance Company | 20-Year Term | Whole Policy |

|---|---|---|

| $32 | $390 |

| $34 | $410 | |

| $36 | $455 | |

| $33 | $472 | |

| $31 | $425 | |

| $39 | $475 | |

| $29 | $395 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

While Auto-Owners insurance rates are slightly higher than Pacific Life and Transamerica, they remain more affordable than Lincoln Financial and Northwestern Mutual. Learn more in our Pacific Life insurance review.

Locking in a life insurance policy while you’re young and healthy can secure lower monthly rates for decades, since premiums typically rise with age and health risks.

Melanie Musson Published Insurance Expert

The pricing reflects Auto-Owners’ focus on flexible coverage, strong financial stability, and personalized service through local independent agents.

Auto-Owners Life Insurance Coverage

Auto-Owners provides a variety of life insurance and financial products, including short-term coverage, lifelong protection, income replacement, and retirement solutions to help ensure long-term security.

- Annuities: Annuities are a way to grow your money on a tax-deferred basis and receive a reliable income stream during retirement, sometimes for the rest of your life.

- Disability Income Insurance: Replaces lost income if you become unable to work due to sickness, injury, or other covered conditions.

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years, with an affordable, level death benefit.

- Universal Life Insurance: Combines lifelong protection with the ability to build cash value and adjust coverage, premiums, and payment schedules (Read More: Universal Life Insurance).

- Whole Life Insurance: With this insurance, you’re covered for your entire life—up to age 110. It comes with guaranteed growth of cash value and offers several payment options to fit your financial situation.

With all the options Auto-Owners provides, you can easily find coverage that matches your unique needs, goals, and budget.

No matter if you’re looking to secure your family’s future, get ready for retirement, or protect your income, Auto-Owners is there to offer dependable financial support and service tailored to you.

Auto-Owners Pet Insurance Coverage

Auto-Owners pet insurance, a policy also in partnership with Figo, lands in the middle of the road with an average price of $27 for cats and $42 for dogs, but comprehensive coverage that includes things like surgery and prescriptions, cancer treatment, diagnostics, and hereditary conditions.

With a 5% discount through independent agents and extras such as the Pet Cloud app, reminders, and GPS tracking, it offers good value for pet owners looking for protection and convenience while also answering common questions to ask when considering pet insurance.

Cost of Auto-Owners Pet Insurance

Auto-Owners’ pet insurance costs $27 per month for cats and $42 for dogs, placing it in the mid-range among competitors. While slightly higher than low-cost options like Pets Best, it’s competitive with providers such as Nationwide and Lincoln Financial, and more affordable than Trupanion.

Auto-Owners vs. Competitors: Pet Insurance Monthly Rates| Insurance Company | Cats | Dogs |

|---|---|---|

| $24 | $39 | |

| $27 | $42 | |

| $28 | $44 | |

| $27 | $41 | |

| $27 | $43 | |

| $25 | $38 |

| $22 | $35 | |

| $26 | $40 |

| $26 | $40 | |

| $30 | $47 |

Through its partnership with Figo, Auto-Owners offers comprehensive coverage, extra features, and a 5% discount via independent agents, placing it among the best pet insurance companies for value.

Auto-Owners Pet Insurance Coverage Options

Auto-Owners teaming up with Figo offers pet insurance offering comprehensive coverage for medical care. That includes operations, prescription drugs, cancer treatment, sophisticated diagnostic testing and hereditary disorders like hip dysplasia.

When customers use independent agents, they can save 5% and enjoy extras like the Pet Cloud app, medical reminders, GPS tracking, and guides on how to file an auto insurance claim & win, making it a strong choice for pet owners seeking comprehensive protection and convenience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto-Owners Business Insurance

Auto-Owners business insurance provides a flexible industry-specific coverage with premiums beginning at $30 a month for office businesses and $35 for retail or service businesses.

Contractors, garage owners, restaurants, and manufacturers can select custom plans from basic liability to full BOPs, making it easy to compare liability vs. full coverage insurance. Auto-Owners’ flexible options and competitive pricing makes the company a good fit for small and mid-sized businesses.

Cost of Auto-Owners Business Insurance

Auto-Owners’ business insurance rates are customized for each industry and level of coverage, with prices starting at $30 per month for office businesses and $35 per month for retail or service businesses that need general liability.

Contractors pay $50 for minimum coverage and $200 for full coverage, while garages average $60 for liability and $284 for full protection, a range competitive with the best car insurance companies.

Auto-Owners Business Insurance Monthly Rates| Business Type | Minimum Coverage | Full Coverage |

|---|---|---|

| Contractor | $50 | $200 |

| Garage | $60 | $284 |

| Manufacturing | $50 | $180 |

| Office | $30 | $150 |

| Professional Liability | $50 | $165 |

| Restaurant | $40 | $200 |

| Retail/Service | $35 | $180 |

Manufacturing starts at $50 for liability and $180 for full coverage, professional liability ranges from $50 to $165, and restaurants pay $40 for liability or $200 for a full BOP.

This flexible pricing lets business owners choose affordable plans that provide the right level of protection for their operations.

Save Money on Auto-Owners Insurance

Auto-Owners Insurance provides discounts across auto, home, life, pet, and business policies, rewarding safe habits and responsible ownership to make coverage more affordable.

- Claims-Free / Favorable Loss History (Home & Business): Homeowners and businesses with no recent claims or losses are rewarded with reduced rates.

- Healthy Lifestyle Savings (Life Insurance): Non-smokers and healthy individuals may pay less, making it essential to know how to get life insurance quotes.

- Multi-Pet Discount (Pet Insurance): Through Auto-Owners’ Figo partnership, insuring multiple pets can lower overall costs.

- Protective Devices Discount (Home/Business): Extra savings for properties equipped with fire extinguishers, smoke detectors, alarms, or water shut-off systems.

- Teen Driver Monitoring (Auto): Parents can save when they install approved monitoring systems that track a young driver’s habits.

Taking advantage of these savings opportunities ensures you get the most value out of your Auto-Owners policy.

Reviewing your policy each year can also reveal new discount opportunities as your lifestyle, driving habits, or home features change.

Be sure to ask your independent agent which discounts apply to your situation so you can maximize protection while minimizing costs.

Auto-Owners Insurance Reviews & Complaints

Auto-Owners Insurance is well-regarded for its strong customer satisfaction and solid financial footing. For home insurance, J.D. Power gave it a score of 692 out of 1,000, which shows it has higher-than-average satisfaction levels.

Auto-Owners Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 692 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 80/100 Positive Customer Feedback |

|

| Score: 0.75 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength |

These third-party ratings give a clear snapshot of how Auto-Owners performs in key areas like claims handling, customer satisfaction, and financial strength.

Consumer Reports rated Auto-Owners 80/100. Auto-Owners insurance reviews complaints highlight a low 0.75 complaint index and an A++ A.M. Best financial strength rating.

A customer review, much like those on Reddit, notes a great Auto-Owners insurance claim experience after hail damage, showing how these 3,000 people got auto insurance right.

Michael Blanchette was praised for being professional, quick, kind, and for explaining everything in plain, easy-to-understand language. The customer said they were beyond happy with Auto-Owners, adding to its strong reputation for friendly, helpful service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Auto-Owners Insurance

Pros

- High Customer Satisfaction Scores: Above-average ratings from J.D. Power and Consumer Reports, plus positive Auto-Owners car insurance reviews for claims handling.

- Strong Financial Stability: Holds an A++ rating from A.M. Best, reflecting superior ability to pay claims.

- Wide Range of Coverage Options: Includes auto, home, life, pet, and business insurance, with flexible policy customization.

Cons

- Availability Limited to 26 States: Not offered nationwide, which restricts access for some customers.

- Higher Home Insurance Rates: Pricing is above competitors like State Farm or Farmers for similar coverage amounts. Explore our Farmers insurance review.

Get Cheap Auto-Owners Insurance Now

Auto-Owners provides car insurance starting at $45 per month and also offers home, life, pet, and business insurance to meet a range of needs.

If you’re looking for a balance of low monthly rates and dependable protection, Auto-Owners stands out as a competitive choice.

Auto-Owners Insurance: Business, Home, Life, and Pet Coverage| Type | Coverage | Features | Best for |

|---|---|---|---|

| Business | Property, liability, auto | Policy endorsements | Small businesses |

| Home | Dwelling, liability, items | Add-ons, bundling | Homeowners, renters |

| Life | Term, whole, universal | Annuities, cash value | Families, individuals |

| Pet | Accident, illness, Rx | 24/7 vet access | Pet owners |

Our Auto-Owners insurance review highlights its affordable auto rates, flexible policy options, and benefits like comprehensive auto insurance, accident forgiveness, gap coverage, ID theft, and pet insurance. Weaknesses include higher home costs and limited availability in 26 states.

Checking out different quotes is a key step in getting the best rates. Enter your ZIP code into our free tool today to see what quotes might look like for you.

Frequently Asked Questions

How should drivers use Auto-Owners insurance rating when comparing policies?

A strong Auto-Owners insurance rating should be considered alongside pricing, coverage options, and discounts when choosing the best policy.

Can I bundle policies with my Auto-Owners car insurance quote?

Yes, bundling auto with home, life, or business insurance may reduce your Auto-Owners car insurance quote by up to 25%.

Shopping around for multiple quotes can help you save. Enter your ZIP code into our free comparison tool to get started.

Can I use Auto-Owners Insurance road trouble service if I’m not the driver?

Yes, coverage usually applies to the insured vehicle, making it helpful when looking for cheap auto insurance for high-risk drivers, since assistance is provided regardless of who is driving.

Does Auto-Owners insurance cover rental cars for long-term leases?

Coverage usually applies to short-term rentals. For long-term leases, Auto-Owners may require a different policy type, so it’s best to confirm with your agent.

Is Auto-Owners Insurance a good company for pet coverage?

It is a good company for pet insurance through its Figo partnership, offering medical, hereditary, and wellness coverage with a 5% discount via independent agents.

How does Auto-Owners Home Insurance review rate discounts?

Auto-Owners home insurance review highlights savings through multi-policy bundling, safety features, and loyalty discounts, with added benefits like cheap auto insurance for multiple vehicles offering up to 25% in reductions.

What does Auto-Owners comprehensive coverage include?

Auto-Owners comprehensive coverage protects against non-collision events like theft, fire, vandalism, hail, falling objects, and animal-related accidents.

Who should consider Auto-Owners gap insurance?

It’s ideal for drivers with new cars, small down payments, or long-term loans, where the loan balance may exceed the vehicle’s depreciated value.

Do Auto-Owners insurance discounts apply to young drivers?

Yes, young drivers can access cheap auto insurance for teens with good student discounts up to 20% and teen driver monitoring discounts of 7%.

Is Auto-Owners health insurance available in all states?

No, Auto-Owners operates in 26 states, so availability of supplemental health-related coverages depends on your location.

When should I use the Auto-Owners insurance customer service phone number instead of my agent?

Can I bundle different coverages under one Auto-Owners insurance policy?

Does Auto-Owners rental car coverage pay for a rental while my car is being repaired?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.