Best Auto Insurance for Acuras in 2026

Acura insurance rates start at $85 monthly. Compare the best auto insurance for Acuras from Erie, USAA, and Nationwide. Quotes are high for luxury vehicles, but drivers with new models and advanced safety features can earn discounts of up to 20% from the cheapest car insurance companies for Acuras.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated March 2026

Erie, USAA, and Nationwide have the best auto insurance for Acuras. Erie and USAA both have excellent customer service ratings.

- Bundling your Acura insurance with other policies can save you 30%

- Acura MDX insurance costs $180 monthly for minimum coverage

- Advanced safety features in Acuras can qualify for 15% discounts

Acura owners have specific insurance issues to address due to the luxury amenities, sophisticated safety features, and higher repair bills of their vehicles.

USAA offers cheap rates and big discounts to military members, and Nationwide rewards drivers who have new Acuras with competitive discounts.

Top 10 Companies: Best Auto Insurance for Acuras| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Low Rates |

| #2 | 741 / 1,000 | A++ | Military Savings | |

| #3 | 729 / 1,000 | A | Tech Discounts | |

| #4 | 718 / 1,000 | A+ | Customer Service | |

| #5 | 716 / 1,000 | A+ | Custom Policies | |

| #6 | 711 / 1,000 | A+ | Safety Features | |

| #7 | 693 / 1,000 | A+ | High Mileage | |

| #8 | 691 / 1,000 | A++ | Safe Drivers | |

| #9 | 690 / 1,000 | A | Claim Forgiveness | |

| #10 | 672 / 1,000 | A | Flexible Payments |

Use this guide to find the cheapest car insurance with specialized coverage features that can affect your premium by several hundred dollars a year.

Compare Acura-specific rates and coverage options near you by entering your ZIP code into our free comparison tool.

Factors That Affect Acura Insurance Rates

Finding the right Acura insurance company depends on your coverage needs and the provider’s reputation. Your age, driving history, and the model you drive will also impact monthly premiums.

How much does Acura insurance cost? Acura car insurance costs vary significantly by provider. USAA is the cheapest, but coverage isn’t available to everyone, so it’s important to compare multiple insurance quotes to find the right policy.

Acura Insurance Costs for Minimum vs. Full Coverage

Since Acura is a luxury make, it’s recommended that you carry more than your state’s minimum insurance requirements.

Full coverage costs more but protects your Acura by paying for repairs after accidents, collisions, vandalism, and more. Get the Details: Liability vs. Full Coverage Auto Insurance

Comparing multiple quotes allows Acura owners to find insurers with more generous discounts for safety features that provide better claims service for luxury cars.

Brandon Frady Licensed Insurance Agent

USAA offers the lowest Acura rates, starting at $105 a month, but coverage is only available to military families. State Farm provides an affordable option to all drivers, starting at $110 for minimum coverage.

When you compare Safeco vs. Amica insurance, Acura quotes are cheaper with Safeco at $122 a month, but Amica has higher claims satisfaction ratings and better customer service.

Acura Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $140 | $450 | |

| $130 | $420 | |

| $125 | $410 | |

| $120 | $395 |

| $128 | $430 | |

| $115 | $385 | |

| $122 | $400 | |

| $110 | $370 | |

| $118 | $390 | |

| $105 | $360 |

Due to its status as a luxury vehicle, Acura auto insurance rates triple for full coverage insurance. Nationwide and Erie remain affordable, keeping full coverage premiums under $400 a month.

Amica also delivers a competitive combination of rates and reliable luxury coverage for Acura drivers. Compare Amica vs. Auto-Owners Insurance for more quotes.

How Driver Age Affects Acura Car Insurance Prices

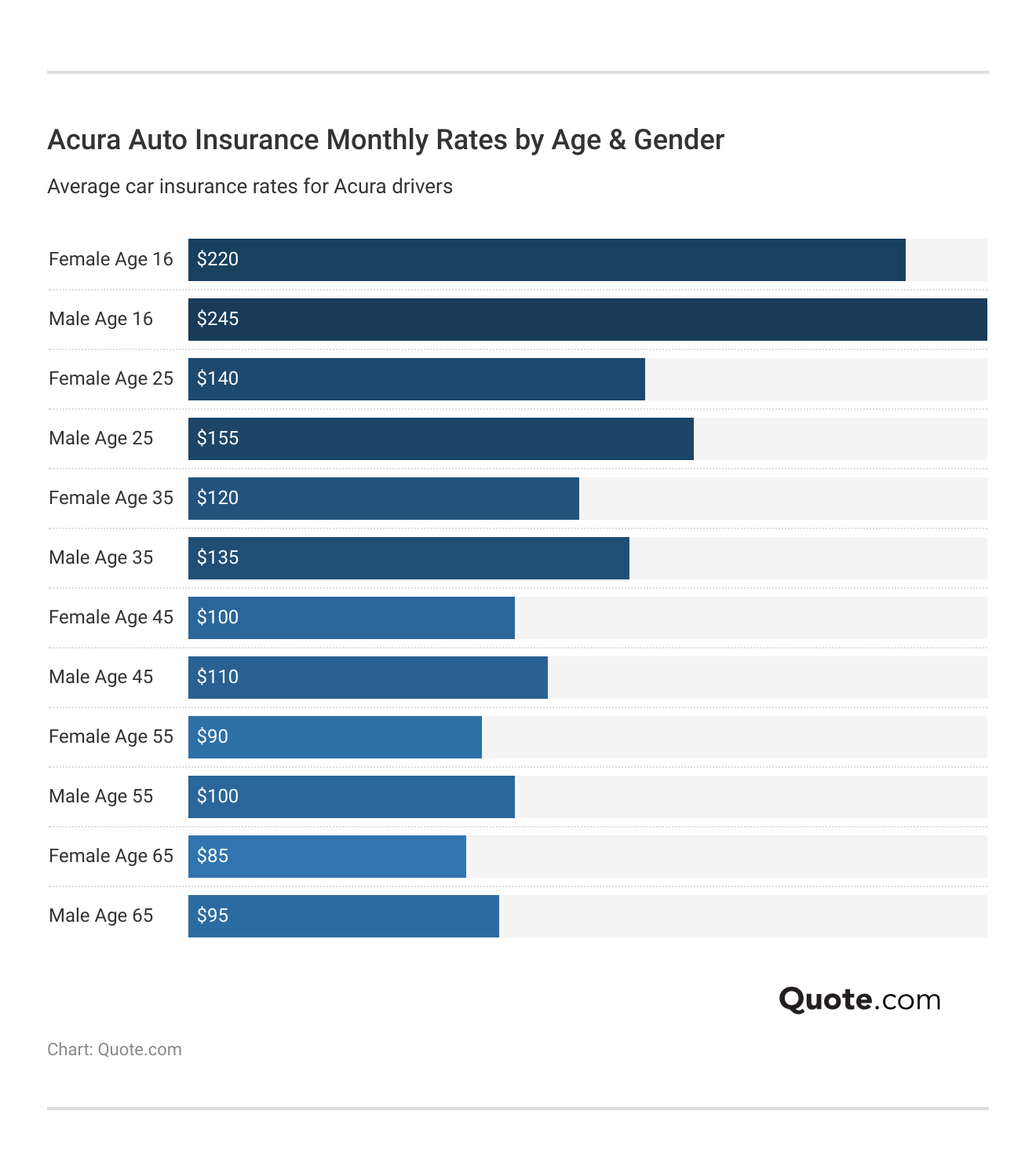

Individual circumstances, like your age and gender, also play a big role in Acura insurance pricing.

Younger drivers pay hundreds more per month since they lack experience behind the wheel, and teen males have the highest Acura quotes at $245 monthly for minimum coverage.

If you’re adding a teen to an Acura policy, Farmers and Safeco offer the best auto insurance for new drivers with accident forgiveness and flexible payment plans.

You can also pick out an older model for young drivers to learn on, as the 2019 Acura TLX insurance cost will be much more affordable than a 2024 or 2025 model.

Once drivers reach 30, monthly rates can drop below $150 for minimum coverage if they avoid claims and maintain safe driving habits.

How Your Driving Record Impacts Acura Premiums

A clean driving record typically results in lower premiums, while tickets, accidents, or DUIs can significantly raise Acura insurance costs.

DUIs and accidents have the biggest impact, raising rates by $70-$80 per month. Shop around to find cheap auto insurance for high-risk drivers because each provider treats infractions differently.

Acura Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $140 | $168 | $196 | $224 | |

| $130 | $156 | $182 | $208 | |

| $125 | $150 | $175 | $200 | |

| $120 | $144 | $168 | $192 |

| $128 | $153 | $178 | $203 | |

| $115 | $138 | $161 | $184 | |

| $122 | $146 | $170 | $194 | |

| $110 | $132 | $154 | $176 | |

| $118 | $142 | $166 | $190 | |

| $105 | $126 | $147 | $168 |

State Farm and Farmers are the cheapest providers of high-risk auto insurance for Acuras, with Farmers having the best accident forgiveness programs for Acura drivers. Read More: State Farm vs. Farmers, Geico, Progressive, and Allstate Review

USAA has the lowest rates after a citation or claim, but only military members and their families can buy a policy.

Acura Auto Insurance Trends for Different Models

When comparing auto insurance rates by vehicle, several factors influence Acura quotes, including vehicle model, safety ratings, and insurer-specific pricing.

For example, the insurance for an Acura is higher since repairs or replacements cost more for luxury models. However, you may find lower rates on Acura RL car insurance, Acura TSX car insurance, and on coverage for other discontinued models.

Acura Auto Insurance Monthly Rates by Model| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Acura Integra | $145 | $235 |

| Acura TLX | $155 | $245 |

| Acura MDX | $180 | $280 |

| Acura RDX | $165 | $260 |

| Acura ILX | $135 | $225 |

| Acura NSX | $300 | $520 |

| Acura RLX | $165 | $265 |

| Acura CL | $150 | $240 |

| Acura RSX | $140 | $230 |

| Acura ZDX | $175 | $275 |

Luxury sport models also have higher rates. Acura NSX car insurance has the highest rates at $300 monthly due to its supercar status.

Is Acura RSX insurance expensive? Acura RSX insurance rates are lower at $230 a month, and your Acura RSX Type S insurance cost could be even cheaper since that model qualifies for classic auto insurance with some providers.

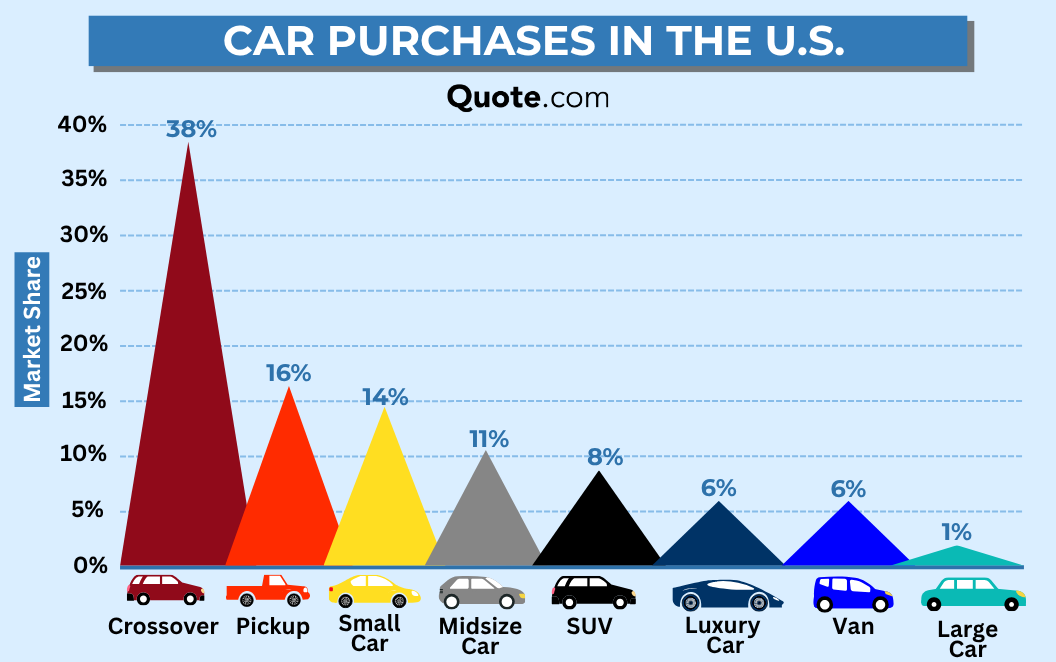

Crossovers are the most popular type of vehicle, which typically leads to lower rates since replacement parts are easy to find. However, Acura RDX insurance rates are pricier at $260 monthly since it’s a luxury car.

Other Acura features that impact insurance costs include advanced safety systems, theft deterrents, and repair complexity. Acura Integra insurance is the most affordable at $145 monthly, while the cost of Acura TLX car insurance averages $155 per month.

The Insurance Institute for Highway Safety (IIHS) often picks Acura models for its Top Safety Pick annual award, including the Integra. This helps lower the 2025 Acura Integra insurance cost and other rates on newer models. Learn More: What does the IIHS do?

This tells insurance companies that Acuras are less likely to get into serious crashes, which often means your monthly insurance rates will be cheaper.

However, an Acura is a luxury vehicle, and although these features may lessen claims or damages, the high repair costs may boost coverage levels and raise rates.

Luxury Car Insurance for Acura MDX vs. Other Vehicles

The Acura MDX is one of the more expensive models to insure, costing more than Acura RSX insurance and Acura RLX car insurance.

It also has higher premiums than luxury and exotic car insurance for other brands, averaging $10 more per month than the Audi Q7.

Acura MDX vs. Similar SUVs: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Acura MDX | $180 | $280 |

| Audi Q7 | $170 | $265 |

| BMW X5 | $175 | $270 |

| Cadillac XT6 | $172 | $268 |

| Genesis GV80 | $176 | $272 |

| Infiniti QX60 | $178 | $274 |

| Lexus RX | $174 | $271 |

| Lincoln Aviator | $176 | $272 |

| Volvo XC90 | $172 | $268 |

| Kia Telluride | $168 | $265 |

As a full-size SUV, the MDX carries higher insurance premiums than similar cars because of its potential to cause greater damage in a collision.

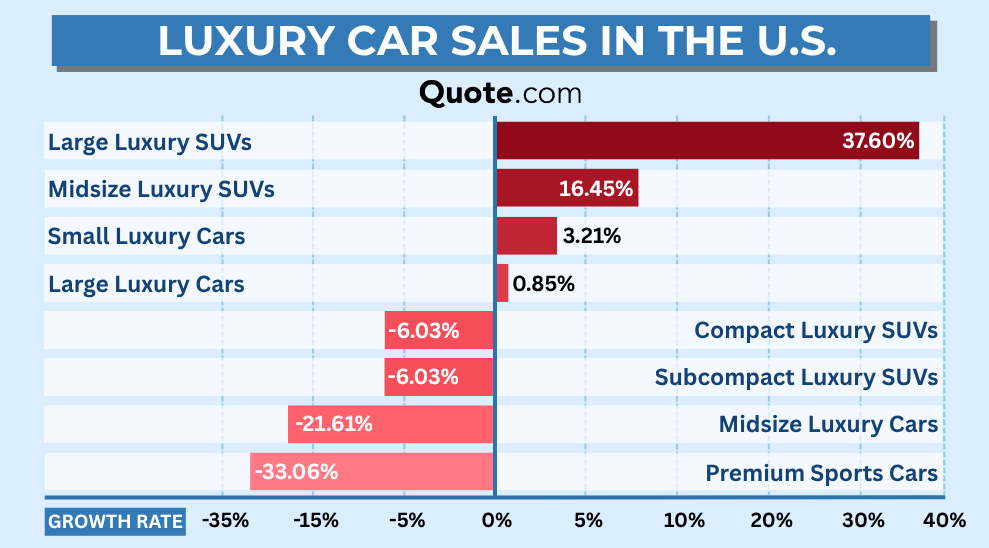

Large luxury SUVs like the MDX are popular with drivers because of their high safety ratings, but repair costs drive up full coverage rates.

Combine the MDX’s high safety ratings with your own safe driving habits to lower your overall risk and get better rates.

Drivers can also lower their rates by driving an older model. For example, the average 2016 Acura MDX insurance cost will be half that of a new model.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Recommended Coverage for Acura Drivers

Are Acuras expensive to insure? That depends on a variety of factors. Acura car insurance is generally more expensive on average because Acuras are considered luxury vehicles.

If you drive a luxury auto like an Acura, you’ll want to carry more than just basic liability insurance.

Auto Insurance Coverage Options for Acuras| Coverage Type | Description |

|---|---|

| Liability | Covers injuries and property damage to others |

| Collision | Covers damage to your car in a crash |

| Comprehensive | Covers theft, fire, vandalism, etc. |

| Uninsured Motorist | Covers you if the other driver is uninsured |

| Medical Payments | Pays for your medical expenses |

| Personal Injury (PIP) | Covers medical + lost wages (some states) |

| Gap Insurance | Covers car loan balance if car is totaled |

| Roadside Assistance | Covers towing and minor roadside help |

| Rental Reimbursement | Covers rental car while yours is repaired |

For instance, adding collision auto insurance covers repairs to your vehicle after an accident, regardless of fault. Adding comprehensive coverage is also recommended because it covers non-collision incidents like vandalism, theft, and fire.

Parking sensors, lane assist, leather interiors, and other high-end features increase Acura repair costs and require higher coverage limits.

When choosing the best policy, it’s important to consider other car insurance coverage for Acuras beyond just the standard policies. Add-ons like accident forgiveness and gap insurance can be essential for protecting newer or financed models.

Many of the top companies also offer OEM coverage on new Acuras, which uses original manufacturer parts for repairs instead of third-party aftermarket parts.

Acura Auto Insurance Coverage Add-Ons by Provider| Company | Claim Forgiveness | Gap Plans | OEM Parts | Rideshare |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | |

| ❌ | ✅ | ✅ | ❌ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | ❌ | |

| ❌ | ❌ | ✅ | ❌ | |

| ✅ | ✅ | ✅ | ❌ | |

| ✅ | ❌ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ |

Always compare coverage options by company, because not all providers offer the same policies. Erie, Allstate, and Travelers are the only insurers offering all of the most common add-ons for Acura car insurance.

While Allstate and Travelers are available nationwide, Erie is only available in 12 states. If Erie isn’t available in your state, enter your ZIP code to start comparing Acura insurance coverage options from providers near you.

Easy Ways to Save Money on Acura Insurance

Applying popular hacks to save more money on car insurance, such as garaging, driving safely, and enrolling in usage-based programs, can significantly lower Acura auto insurance costs.

Here are several strategies that can help reduce your insurance rates without sacrificing coverage:

- Enroll in Usage-Based Insurance (UBI): Some insurers track driving habits with apps or devices and reward safe driving with lower rates, even on high-value vehicles.

- Increase Deductibles: Choosing a higher deductible lowers monthly Acura premiums, though it means paying more out of pocket if you file a claim.

- Limit Annual Mileage: Lower mileage reduces the risk of collision damage and theft, so insurers often charge less if you drive fewer miles.

- Park in a Garage: Parking your Acura in a locked garage or secured facility reduces theft and damage risk, qualifying for discounts for vehicle garaging and storing.

Another great way to save is to shop around for companies that specialize in high-value vehicles. Compare Now: Best Auto Insurance for Cadillacs

For instance, Allstate offers tailored policies for new Acuras at competitive rates, which can help lower your Acura NSX insurance cost or Acura MDX premiums without sacrificing coverage.

Getting Cheaper Acura Insurance With Discounts

What is the best car insurance company for Acuras? The right answer often depends on which insurer offers the most relevant discounts for your lifestyle.

Acura vehicles, known for reliability and safety, often qualify for anti-theft auto insurance discounts due to their safety features.

Top Auto Insurance Discounts for Acura Drivers by Provider| Company | Anti-Theft | Bundling | New Car | Safe Driver |

|---|---|---|---|---|

| 10% | 25% | 10% | 18% | |

| 18% | 30% | 10% | 15% | |

| 12% | 16% | 8% | 8% | |

| 15% | 25% | 12% | 15% |

| 10% | 20% | 12% | 20% | |

| 5% | 20% | 15% | 12% | |

| 20% | 15% | 12% | 10% | |

| 15% | 17% | 15% | 20% | |

| 15% | 13% | 8% | 17% | |

| 15% | 10% | 10% | 10% |

Amica and Erie offer the biggest discounts for bundling Acura car insurance with home or renters policies, and drivers with new Acuras get the best discounts from Nationwide and State Farm.

You should shop around and compare car insurance discounts from multiple companies before you buy to see where you could save the most money.

Discount amounts and availability can vary by state, so the cheapest Texas Acura auto insurance won’t be the same as the cheapest car insurance in Florida, depending on which savings programs are available.

Beyond standard discounts or bundling policies, careful choices in how you drive, store, and insure your Acura can make a noticeable difference in what you pay per month.

The Best Insurance Companies for Acuras

Erie, USAA, and Nationwide have the best car insurance coverage for Acuras. USAA and Erie are recognized for their superior customer and claims service.

Nationwide specializes in coverage and discounts for luxury cars with high-tech features. However, not all of these top providers are the largest or most popular.

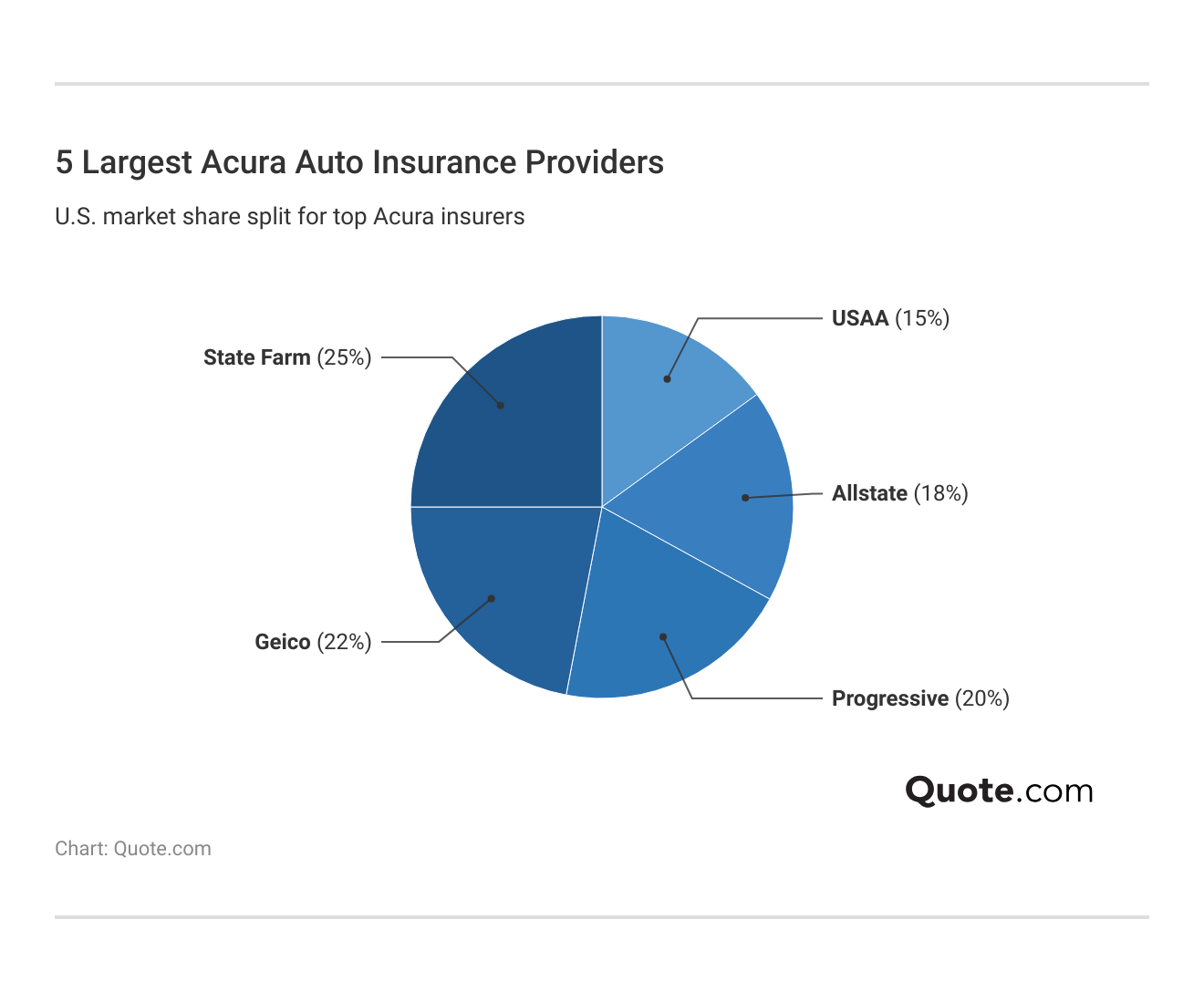

USAA and State Farm rank in our top five best car insurance companies for Acuras, but Progressive and Geico are the most popular. See what makes these providers stand out: State Farm vs. Progressive Auto Insurance

Both Geico and Progressive are among the cheapest auto insurance companies, but our top three companies have higher customer satisfaction ratings, showing that being the biggest may not always be the best choice.

#1 – Erie: Top Pick Overall

Pros

- Value Leader: Erie has competitive full coverage insurance on Acuras at only $395 monthly, with minimum coverage also affordable at $120 per month.

- Superior Claims Process: Acura owners routinely compliment Erie for its straightforward and efficient process in handling damage or theft claims.

- Comprehensive Discounts: Erie provides 25% savings for Acura drivers who bundle home and auto. Get a full discount list in our Erie Insurance review.

Cons

- Limited Geographic Availability: Erie only offers car insurance for Acuras in 12 states, primarily in the Northeast and Midwest.

- Basic Digital Experience: The mobile app lacks vehicle value tracking and OEM parts preference settings for premium policies.

#2 – USAA: Best for Military Savings

Pros

- Military Value: Our USAA car insurance review compares its unmatched savings of $360 monthly for full coverage on Acuras.

- Financial Excellence: With an A++ rating, USAA provides the best Acura car insurance with exceptional financial stability and reliable claims processing capabilities.

- Technology Rewards: The 15% safety feature discount and 10% new car discount combine to lower rates on newer Acuras with advanced collision avoidance systems.

Cons

- Restricted Eligibility: USAA coverage for Acuras is available exclusively to military members and their families, limiting access.

- Smaller Discounts Options: Military families may find fewer ways to reduce their overall Acura insurance costs compared to other companies.

#3 – Nationwide: Best for Tech Discounts

Pros

- Generous Technology Discounts: Its 18% safety feature discount reduces costs for newer Acuras with advanced driver assistance systems.

- Vanishing Deductible Program: Nationwide’s vanishing deductible program reduces deductibles by $100 each year for accident-free driving, up to $500.

- Luxury Vehicle Specialization: Nationwide offers gap coverage, OEM parts guarantees, and agreed-value coverage designed specifically for premium vehicles like Acura.

Cons

- Complex Coverage Details: Some Acura drivers report confusion with On Your Side Claims Service procedures and coverage exclusions for aftermarket modifications.

- Limited Availability: Despite its name, Nationwide is not available in Alaska, Hawaii, or Louisiana. Check your availability in our Nationwide insurance review.

#4 – Amica: Best for Customer Service

Pros

- Superior Service: Amica has above-average claims satisfaction according to J.D. Power surveys, especially comprehensive claims for damaged or stolen Acuras.

- Cost-Effective Coverage: Our Amica insurance review explains how Acura policyholders can earn annual dividend payments that can be applied to premiums.

- New Car Incentives: Combine the 10% new car discount and the 10% safety feature discount for more consistent savings on newer Acura models.

Cons

- Stringent Acceptance Criteria: Amica’s underwriting standards for luxury vehicles like Acuras can be more selective than with other insurance providers.

- Higher Average Rates: Full coverage for Acuras can reach $420 a month or higher with Amica.

#5 – State Farm: Best for Personalized Policies

Pros

- Acura-Specific Coverage: Our State Farm auto insurance review shows that it specializes in coverage for Acura’s all-wheel steer system and adaptive cruise control.

- Robust Agency Network: Acura owners benefit from State Farm’s extensive agent availability, providing personalized assistance with policy questions or claims.

- Solid Financial Backing: State Farm car insurance has an A+ rating and few complaints, providing drivers with reliable service and payouts when filing Acura insurance claims.

Cons

- Limited New Car Benefits: The 15% new car discount only applies to vehicles less than one model year old, excluding most leased Acuras and certified pre-owned vehicles.

- Regional Renewal Issues: Acura drivers in higher-risk states like Florida or California often report higher rates or that their coverage is cancelled at renewal.

#6 – Auto-Owners: Best for Safety Features

Pros

- Safety Feature Recognition: Acura drivers can enjoy a 15% discount on advanced safety features like collision mitigation and lane-keeping assist.

- Affordable Coverage: Auto-Owners offers competitive minimum and full coverage auto insurance for Acuras starting at $125 a month.

- Financial Stability: With an A+ A.M. Best rating, it provides Acura owners with reliable claims processing. See More: Auto-Owners Insurance Review

Cons

- Limited Availability: Does not cover Acuras in all states, so availability may be limited to drivers of high-end cars.

- Basic Digital Platform: The online portal lacks mobile photo submission for claims and real-time claim tracking.

#7 – Allstate: Best for High-Mileage Drivers

Pros

- Pay-Per-Mile Policies: High-mileage Acura drivers who don’t qualify for other pay-as-you-go auto insurance programs can still get lower rates with Allstate Milewise Unlimited.

- High-Tech Discounts: The generous 20% safety feature discount and 10% new car discount provide the highest combined savings for drivers with newer Acuras.

- New Vehicle Protection: Allstate offers new car replacement coverage for total losses on Acuras under two years old with fewer than 15,000 miles.

Cons

- Highest Premium Costs: At $450 monthly for full coverage, Allstate charges Acura owners the highest rates. Compare more quotes for free: Allstate Insurance Review

- Variable Service Quality: Some Acura drivers report inconsistent experiences with mobile app functions and varying regional agent expertise with luxury vehicles.

#8 – Travelers: Best for Safe Drivers

Pros

- High-Mileage Coverage: Our Travelers car insurance review highlights IntelliDrive usage-based coverage that rewards safe driving habits regardless of annual mileage.

- Safe Driving Discounts: Acura drivers who avoid speeding tickets, accidents, and claims can save 17% on their annual premiums with Travelers.

- Solid Financial Foundation: With an A++ rating, Travelers offers Acura owners exceptional financial security for their premium vehicle coverage.

Cons

- Premium Pricing: Travelers charges Acura owners more than several competitors for similar levels of coverage.

- Limited Technology Incentives: The 13% safety feature discount and 8% new car discount provide modest savings compared to other Acura auto insurance companies.

#9 – Farmers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Our Farmers review confirms its excellent first-accident forgiveness benefits, which protect claim-free Acura drivers from rate increases.

- Flexible Coverage Tiers: Acura owners benefit from Farmers’ Smart Plan, Road Plan, and Premier Plan options that allow customization based on vehicle value and usage.

- Strong Technology Recognition: Combine its 15% safety feature discount and 12% new car discount to get over 25% off for newer Acuras with the latest security features.

Cons

- Higher Base Rates: At $430 monthly for full coverage, Farmers charges Acura owners significantly more than most competitors.

- Inconsistent Luxury Repair Network: Some Acura drivers report delays in finding certified repair facilities for specialized components like precision all-wheel steering.

#10 – Safeco: Best for Flexible Payments

Pros

- Flexible Payment Options: Acura owners appreciate Safeco’s quarterly, semi-annual, and monthly payment schedules, plus specialized luxury car insurance coverage.

- Competitive Pricing: Safeco provides full coverage for Acura drivers at a cost of $400 monthly, representing reasonable value for comprehensive luxury vehicle protection.

- Balanced Discount Structure: The 15% safety feature discount and 12% new car discount provide solid savings for Acura owners.

Cons

- Service Differences: Acura policyholders report inconsistent claim settlement times and local agent expertise with luxury vehicle repairs. Read More: Safeco Insurance Review

- Average Financial Rating: Safeco holds an A rating, which is stable enough for luxury Acuras but not remarkable when compared to A++ competitors offering similar coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where to Find Affordable Acura Car Insurance

Erie, USAA, and Nationwide stand out as having the best auto insurance for Acuras. Erie provides the best balance of price, customer service, and luxury auto coverage.

Remember that factors like your driving record, specific Acura model, and location significantly impact rates.

Shop with specialized carriers that understand high-value vehicles, then keep your rates low over time by maintaining a clean driving record.

Dani Best Licensed Insurance Agent

Take advantage of car insurance discounts you can’t miss, including anti-theft, safe driver, and new car discounts, to lower Acura auto insurance rates even more.

Use our free comparison tool to see what Acura insurance quotes look like in your area.

Frequently Asked Questions

Who has the best auto insurance for Acuras?

Erie, USAA, and Nationwide have the best car insurance for Acuras, with excellent financial stability and competitive rates. If you ever need to file an auto insurance claim, Erie and USAA have the highest customer satisfaction.

Is Acura considered a luxury car for insurance?

Insurance companies do consider Acura a luxury make, which will raise your premiums. You’ll also see even higher rates for larger Acura models, even compared to sports cars. For instance, the average insurance cost for Acura RDX drivers is $20-$30 more per month than what Acura RSX insurance costs.

Are Acuras expensive to insure?

Acuras cost more to insure than average vehicles due to luxury features and higher repair costs. Acura MDX insurance rates are often higher than other premium brands like Volvo and BMW. Why is Acura expensive to insure? Its luxury status and expensive replacement parts drive up premiums. Learn what to do if you can’t afford your auto insurance.

How much is Acura insurance?

A good monthly payment for Acura car insurance ranges from $85 to $245. Do Acuras have affordable auto insurance? That depends on your model. The Acura Integra insurance cost is the most affordable at $145 monthly. Maintaining a clean driving record and driving a safer model will get you cheaper quotes. Enter your ZIP code to explore your Acura insurance options.

At what age is Acura auto insurance the most expensive?

Acura car insurance is the most expensive for drivers under 25, with premiums nearly double the average. Drivers between 40 and 50 get the most affordable auto insurance until age 60, after which Acura insurance rates begin increasing slightly again.

Learn More: Cheap Auto Insurance for Teens

Does credit score affect Acura insurance rates?

Your credit score affects Acura car insurance premiums significantly. Drivers with excellent credit scores can save up to 25% compared to those with poor credit.

What state has the most expensive Acura car insurance?

Michigan has the most expensive Acura car insurance due to its unique no-fault insurance laws. Rates can be 50% higher than the national average, with full coverage often exceeding $300 monthly.

What is the best car insurance in Texas for Acuras?

USAA and Nationwide have the best auto insurance in Texas, offering big discounts for Acura safety features and vanishing deductibles for claim-free drivers. However, USAA is only available to military families living in Texas.

Is an Acura MDX expensive to insure?

Acura MDX insurance costs around $280 monthly for full coverage, but Erie offers the cheapest Acura MDX car insurance for $185 a month. Use our free comparison tool to compare quotes by vehicle.

Is Acura ILX insurance expensive?

No, Acura ILX auto insurance rates are lower than other models, starting at $135 monthly for minimum coverage and $225 per month for full coverage. You can lower your Acura ILX insurance cost further by signing up for usage-based insurance with Nationwide or Allstate.

What cars are insurance companies refusing to insure?

Is an Acura RDX expensive to insure?

How much is Acura TL insurance?

Does Geico insure Acuras?

Is Acura a high-maintenance car?

Is it expensive to fix an Acura?

What is the most common problem with Acuras?

Is Lexus or Acura better for car insurance?

Where can I get affordable Acura car insurance in Florida?

Should I insure my Acura through the Acura Insurance Agency?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.