10 Best Auto Insurance Companies in Michigan for 2026

The best auto insurance companies in Michigan are Erie, Nationwide, and Geico, with rates starting at just $32 per month. State Farm stands out for its strong local agent presence across Michigan, while Progressive makes a solid impression with its Snapshot program that can help safe drivers save up to 30%.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

Erie, Nationwide, and Geico top the list of the best auto insurance companies in Michigan. Erie leads the way with rates as low as $32 a month backed by high customer satisfaction.

- Erie is the top pick, offering high repair and claims satisfaction

- The best car insurance companies in MI include car replacement

- Michigan’s required state liability minimum is 50/100/10 coverage

Erie is the go-to choice for drivers seeking the most affordable coverage, while Nationwide helps families save more by bundling auto insurance with home or renters insurance.

Geico adds extra value through telematics, rewarding safe driving with lower premiums. These benefits are significant in Michigan, where high premiums make affordable and dependable coverage a must.

Top 10 Companies: Best Auto Insurance in Michigan| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 684 / 1,000 | A | Regional Strength |

| #2 | 674 / 1,000 | A+ | UBI Availability | |

| #3 | 651 / 1,000 | A++ | Cost Savings | |

| #4 | 646 / 1,000 | A++ | Local Agents | |

| #5 | 634 / 1,000 | A+ | Wide Coverage | |

| #6 | 634 / 1,000 | A+ | High-Risk Drivers | |

| #7 | 631 / 1,000 | A++ | Michigan Roots | |

| #8 | 623 / 1,000 | A | Custom Policies | |

| #9 | 614 / 1,000 | A | Roadside Assistance |

| #10 | 596 / 1,000 | A++ | Safety Features |

Explore coverage options and types of auto insurance plans offered daily by the best auto insurance companies in Michigan through our free quote tool.

Guide to Michigan Auto Insurance Costs

Michigan auto insurance premiums are the most expensive in the country. Compare auto insurance rates by state to see how costs differ.

However, these auto insurance companies in Michigan take different approaches when setting rates for customers and offer better prices to those who avoid claims and accidents.

Michigan Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $278 | $579 | |

| $47 | $124 | |

| $32 | $83 |

| $229 | $478 | |

| $68 | $141 | |

| $176 | $367 | |

| $104 | $217 | |

| $143 | $298 | |

| $126 | $262 |

Erie and Auto-Owners have the cheapest car insurance in Michigan for minimum coverage. Progressive, AAA, and Geico also have competitive rates.

Compare multiple Michigan auto insurance companies to find the right level of coverage that fits your budget.

The shift from minimum coverage to full coverage shows how comprehensive claims due to Michigan’s increased weather-related risks raise prices.

Even Erie charges $50 more per month for full coverage. This isn’t as high a jump as you see with more expensive Michigan car insurance companies like Farmers or Nationwide, but still higher than in other states.

Michigan drivers can trim costs by going with a higher deductible. In particular, it’s a quick way to bring the monthly bill down.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Michigan car insurance is expensive because the state has one of the highest rates of uninsured drivers. Having full coverage protects you from costly out-of-pocket expenses if you’re involved in an accident with someone who doesn’t have enough insurance.

For drivers with multiple cars or valuable vehicles, full coverage is recommended. Without it, you could face significant financial loss, particularly if your car is newer or financed.

How Driver Age Impacts Michigan Insurance Premiums

Age and driving experience also shape how Michigan insurers set their prices. Younger drivers usually pay more because they’re seen as inexperienced and more likely to take risks.

As drivers move into their mid-20s and 30s, premiums often decrease, illustrating how a few safe years behind the wheel can make it easier to qualify for the cheapest car insurance in Michigan.

Michigan Auto Insurance Monthly Rates by Age| Company | Age: 16 | Age: 25 | Age: 45 | Age: 65 |

|---|---|---|---|---|

| $269 | $59 | $65 | $45 |

| $1,146 | $301 | $278 | $274 | |

| $260 | $60 | $47 | $46 | |

| $136 | $338 | $32 | $31 |

| $1,017 | $270 | $229 | $225 | |

| $208 | $73 | $68 | $67 | |

| $616 | $200 | $176 | $174 | |

| $816 | $127 | $104 | $103 | |

| $574 | $171 | $143 | $141 | |

| $970 | $146 | $126 | $124 |

For older drivers, steady or even lower premiums underscore the trust insurers place in their experience and the fewer miles they drive each year.

Some companies implement these changes gradually, offering rewards for safe habits, while others adjust prices more sharply.

High-Risk Car Insurance Costs More in Michigan

Insurers in Michigan weigh your driving history heavily, and that can have a big impact on your monthly payment. Maintaining a clean record helps keep Michigan auto insurance costs manageable.

In contrast, accidents, tickets, or DUIs can significantly increase premiums and often remain elevated for years.

Michigan Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $71 | $81 | $58 |

| $278 | $469 | $1,545 | $384 | |

| $47 | $69 | $72 | $57 | |

| $32 | $45 | $60 | $38 |

| $229 | $304 | $298 | $294 | |

| $68 | $138 | $405 | $127 | |

| $176 | $273 | $240 | $207 | |

| $104 | $154 | $133 | $141 | |

| $143 | $170 | $351 | $208 | |

| $126 | $321 | $616 | $230 |

What really stands out is how companies treat these situations differently. Some only raise rates a little after a ticket or minor accident. A DUI almost always results in the sharpest increase, reflecting how seriously insurers view the risk.

Staying accident-free is also the simplest way to qualify for auto insurance for good drivers and even access the cheapest no-fault car insurance in Michigan, which can make coverage both more affordable and practical.

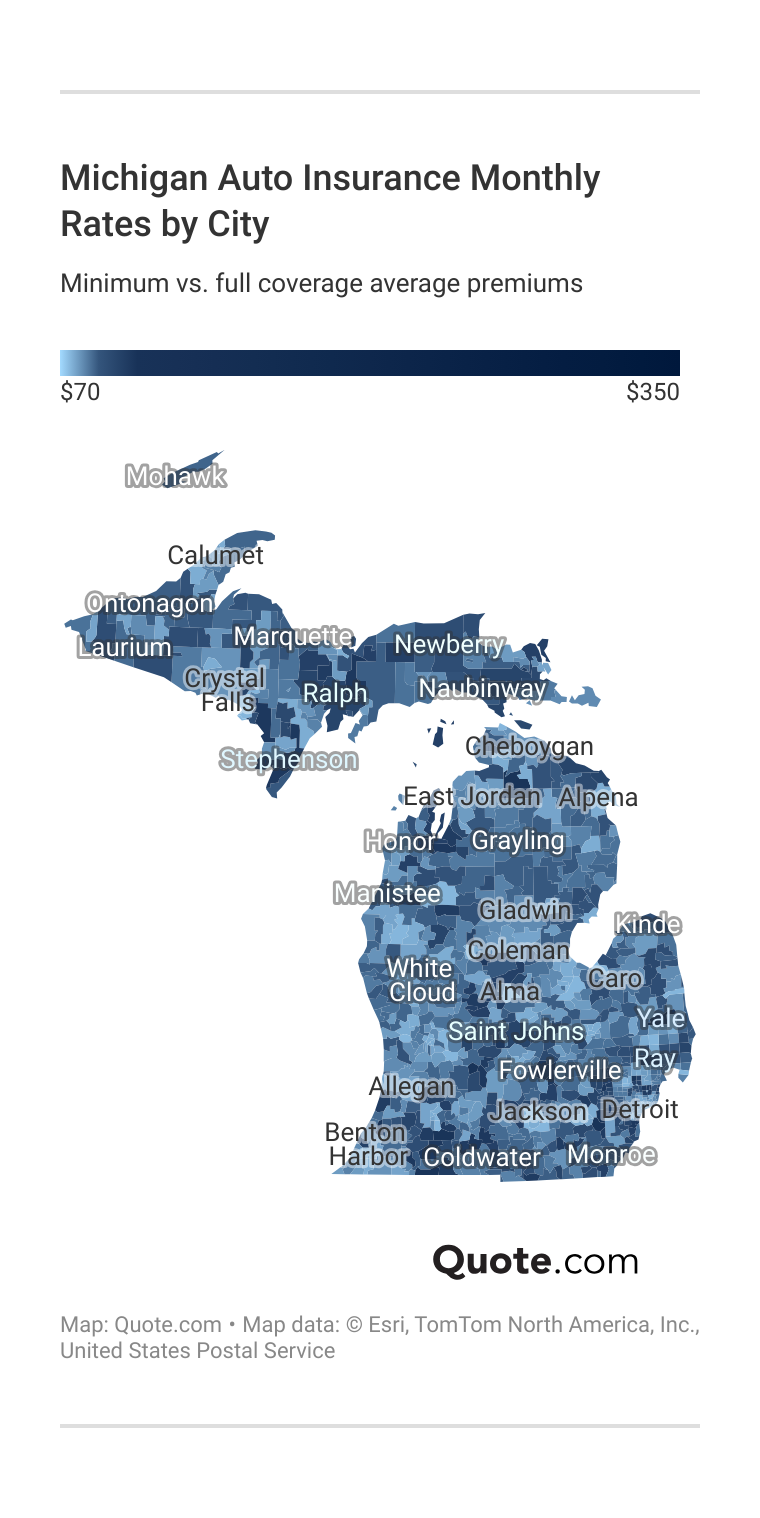

Michigan Insurance Prices Where You Live

Where you live in Michigan can have just as much impact on your auto insurance costs as your driving record or the type of coverage you choose.

Cities with heavy traffic, higher accident rates, or a higher incidence of theft claims typically come with higher premiums. At the same time, smaller towns and rural areas often see lower prices thanks to calmer roads and fewer reported incidents.

Living in a busy city may be more expensive each month, but some companies offset this by offering discounts or programs tailored to higher-risk areas.

In smaller communities, the best auto insurance companies in Michigan often offer drivers lower rates. Our auto insurance guide can help drivers compare these options more easily and see where savings are possible.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michigan No-Fault Car Insurance Requirements

In Michigan, every driver is required to carry specific coverages to comply with the state’s no-fault rules. These requirements combine medical protection, property coverage, and liability limits that step in under specific situations.

The required minimums for personal injury protection (PIP) and personal protection insurance (PPI) are unique to Michigan auto insurance.

This is very different from most states, which usually require bodily injury liability and property damage liability instead. In those states, your insurance pays for others’ injuries and property damage if you’re at fault.

Michigan’s system, however, emphasizes covering your own medical needs through PIP and protecting others’ property through PPI, while liability coverage plays a smaller role.

- Personal Injury Protection (PIP): Covers medical bills and lost wages, no matter who caused the accident. Drivers can choose from unlimited medical benefits or capped levels, such as $250,000 or $500,000.

- Property Protection Insurance (PPI): Provides up to $1 million if your car damages stationary property, such as a building, fence, or parked vehicle.

- Bodily Injury Liability per Person: Michigan drivers must carry at least $50,000 for injuries to one person in an accident you cause.

- Bodily Injury Liability per Accident: Drivers must have at least $100,000 for injuries to multiple people in a single accident.

- Property Damage Liability: Law requires at least $10,000 for damage you cause to someone else’s property when driving outside Michigan.

These coverages are the legal minimums, but many drivers choose higher limits or add extras. The best car insurance companies in Michigan give drivers the option to expand their protection with collision auto insurance and comprehensive coverage.

Uninsured and underinsured motorist coverage (UM/UIM) to help cover costs if you’re hit by someone who doesn’t have enough insurance. These choices make it easier to find coverage that feels both practical and reassuring.

Extras such as roadside assistance for breakdowns, rental reimbursement when your car is in the shop, and accident forgiveness to prevent rate increases after a first mistake give drivers the chance to tailor their policies to real-life needs.

Adding more coverage can raise your rates, but the best home and auto insurance companies in Michigan provide bundled savings, making coverage even more affordable for households.

Tips To Lower Michigan Insurance Costs

Discounts are one of the most practical ways to cut auto insurance costs in Michigan, and each company takes a slightly different approach. Some focus on rewarding safe drivers and those with low mileage, giving people a chance to prove that their habits can lower premiums.

Others highlight bundling or multi-vehicle auto insurance discounts, which work especially well for families that want to keep their coverage under one roof. These savings aren’t just extras; they play a big role in making insurance more affordable.

Top Auto Insurance Discounts in Michigan| Company | Bundling | Good Driver | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 15% | 30% | 25% | 30% |

| 25% | 25% | 25% | 30% | |

| 16% | 25% | 10% | 30% | |

| 25% | 23% | 10% | 30% |

| 20% | 30% | 20% | 30% | |

| 25% | 26% | 25% | 25% | |

| 20% | 40% | 12% | 40% | |

| 10% | 30% | 12% | $231/yr | |

| 17% | 25% | 20% | 30% | |

| 13% | 10% | 25% | 30% |

The real value comes in how these programs connect to everyday life. A good driver discount can reward years of safe habits, and usage-based plans are a win for people who don’t spend much time on the road.

Bundling home and auto coverage often simplifies things while cutting costs, and anti-theft savings show how even small steps to protect your car can pay off.

Sticking with the same company can pay back over time. For instance, loyalty discounts often kick in after a few years.

Melanie Musson Published Insurance Expert

Michigan drivers will find that understanding how the best auto insurance companies apply these discounts makes it much easier to choose coverage that feels both affordable and practical.

While discounts are a big part of lowering costs, they’re not the only way Michigan drivers can save on auto insurance. Here are a few simple ways to do it:

- Use Telematics Programs: Even when no upfront discount is offered, tracking mileage and driving habits through a telematics app can influence how much you pay at renewal.

- Report Actual Mileage: Submitting odometer readings ensures low-mileage drivers in Michigan aren’t overcharged based on average estimates.

- Revisit Coverage at Renewal: Reviewing collision, liability limits, or medical benefits each year helps you avoid paying for protections you may no longer need.

- Work With Independent Agents: Local Michigan agents often have access to smaller regional insurers that don’t advertise widely but may offer more competitive rates.

- Maintain a Good Credit History: Some insurers in Michigan factor credit into their pricing, so keeping a strong credit history can help lower renewal premiums.

When it comes to the best auto insurance companies in Michigan, savings don’t stop with discounts.

Paying closer attention to how your policy is structured and how insurers assess risk can unlock savings that extend beyond standard programs.

Comparing policies from both well-known providers and good car insurance companies in Michigan that focus on regional drivers can help you find affordable coverage that fits your needs.

Staying proactive about how your policy is structured and who provides it can go a long way toward keeping coverage affordable.

Top Car Insurance Companies in Michigan

In Michigan, a handful of major insurers hold the most influence when it comes to auto insurance coverage. These providers attract the largest share of drivers because they have established a reputation for stability, comprehensive auto insurance coverage, and reliable claims processing.

For drivers, that size and reach matter. Large companies often set the pace for car insurance rates in Michigan, shaping what many households pay for coverage.

Knowing who the top players are provides Michigan drivers with a clearer picture of why prices appear the way they do and which companies offer the most dependable long-term protection.

However, smaller regional carriers, such as Auto-Owners, earn loyalty by focusing on local needs with Michigan-specific programs and perks. Explore this Michigan auto insurance companies list to find the right provider for you.

#1 – Erie: Top Pick Overall

Pros

- Regional Advantage: Erie dominates in Michigan with a strong regional footprint and leads all carriers with a 684/1,000 claims satisfaction score.

- Financial Security: Erie’s excellent A.M. Best rating assures Michigan drivers of consistent claim payments.

- Coverage Perks: Erie Auto Plus gives Michigan drivers accident forgiveness and diminishing deductible options. See why Erie ranks high in Michigan in our Erie insurance review.

Cons

- Limited Reach: Erie is a regional carrier, which limits Michigan customers seeking policies that span multiple states.

- Digital Weakness: Michigan policyholders face fewer mobile and online claims features than those offered by Progressive or Geico.

#2 – Nationwide: Best for UBI Availability

Pros

- UBI Programs: SmartRide telematics and SmartMiles per-mile plans give Michigan drivers usage-based premium reductions up to 40%.

- Financial Backing: Nationwide’s A+ A.M. Best rating secures Michigan drivers’ long-term claims stability.

- Add-On Value: Michigan policyholders can add a total loss deductible waiver for new cars.

Cons

- Average Discounts: Nationwide offers fewer Michigan-specific savings opportunities outside of SmartRide and SmartMiles, limiting additional ways to cut costs.

- Pricing Risk: SmartRide may raise costs for Michigan drivers with inconsistent mileage. Find discounts and policy options for Michigan drivers in our Nationwide auto insurance review.

#3 – Geico: Best for Cost Savings

Pros

- Affordable Rates: Geico is known for offering one of the lowest average premiums in Michigan, making it a solid pick for drivers looking to keep costs down.

- Top Rating: With an A++ A.M. Best rating, Geico provides Michigan policyholders with industry-leading financial security. Find Michigan’s top insurers in our Geico insurance review.

- Discount Variety: Michigan drivers can take advantage of unique savings programs, including federal employee and military discounts.

Cons

- Limited Endorsements: Geico policies in Michigan offer fewer optional coverages, such as custom equipment or accident forgiveness.

- Fewer Agents: Michigan drivers may lack access to State Farm’s extensive agent network for in-person service.

#4 – State Farm: Best for Local Agents

Pros

- Local Presence: State Farm supports Michigan drivers through a wide network of in-state agents. Compare Michigan coverage in our State Farm auto insurance review.

- Financial Stability: State Farm’s A++ A.M. Best rating reassures Michigan policyholders of claim reliability.

- Discount Access: Michigan customers qualify for Drive Safe & Save telematics and good-student programs.

Cons

- Limited Online Tools: Michigan drivers report that State Farm’s digital claims features are less advanced than Progressive’s Snapshot app.

- Fewer Add-Ons: Michigan policyholders receive fewer optional coverages, such as gap insurance, compared to Allstate or Progressive.

#5 – Allstate: Best for Wide Coverage

Pros

- Coverage Breadth: Allstate offers Michigan add-ons like new car replacement and rideshare coverage. Learn from the Allstate insurance review how Michigan drivers benefit from wide coverage.

- Strong Backing: Allstate’s A+ A.M. Best rating gives Michigan drivers financial confidence.

- Accident Forgiveness: Allstate offers Michigan drivers accident forgiveness to keep rates from rising after a first at-fault crash.

Cons

- High Premiums: Allstate’s average Michigan auto insurance cost is significantly above the $32 minimum rate shown in the table, making it less budget-friendly.

- Discount Complexity: Michigan customers report difficulty combining Drivewise with multi-policy discounts.

#6 – Progressive: Best for High-Risk Drivers

Pros

- High-Risk Coverage: Progressive provides Michigan SR-22 filings for drivers with suspended licenses.

- Telematics Program: Snapshot rewards Michigan safe driving with behavior-based premium cuts.

- Financial Stability: Progressive’s A+ A.M. Best rating secures Michigan claim reliability. Discover Michigan driver perks highlighted in our Progressive auto insurance review.

Cons

- Claim Delays: Michigan Progressive customers report slower average processing times for claims, which reduces overall satisfaction with the service.

- Rate Increases: High-risk Michigan drivers face renewal rate spikes despite participating in Snapshot.

#7 – Auto-Owners: Best for Michigan Roots

Pros

- Local Legacy: Founded in Lansing, Auto-Owners has built a long tradition of serving Michigan drivers with dependable service.

- Financial Strength: With an A++ rating from A.M. Best, Michigan policyholders can count on Auto-Owners for reliable claims support.

- Unique Coverage: Michigan drivers get extra value from Personal Automobile Plus, which includes a common loss deductible and rental reimbursement.

Cons

- Regional Limit: Michigan customers relocating may struggle with Auto-Owners’ limited national reach. See the Auto-Owners insurance review highlighting Michigan policy benefits.

- Tech Gaps: Auto-Owners offers Michigan drivers limited mobile claims functionality and fewer policy management features, which can make digital servicing less convenient.

#8 – Farmers: Best for Custom Policies

Pros

- Policy Flexibility: Farmers allows Michigan drivers to add custom equipment coverage for modified vehicles. Explore our Farmers insurance review for Michigan custom coverage.

- Reliable Stability: Farmers’ excellent A.M. Best rating supports steady Michigan claims outcomes.

- Telematics Discount: The Signal app offers Michigan safe drivers measurable discounts based on driving behavior.

Cons

- Lower Score: Farmers earned 623/1,000 in Michigan claims satisfaction, reflecting weaker customer experiences with the claims process.

- Premium Concerns: Michigan Farmers’ quotes often exceed budget-friendly averages, creating affordability challenges for policyholders.

#9 – AAA: Best for Roadside Assistance

Pros

- Emergency Support: AAA includes Michigan roadside benefits, such as towing, lockout assistance, and jumpstarts.

- Financial Backing: AAA’s stable A.M. Best rating provides Michigan members with claims stability. Compare Michigan’s claims ratings in this AAA auto insurance review.

- Member Benefits: Michigan policyholders save on hotels, dining, and travel with an AAA membership.

Cons

- Limited Availability: AAA auto insurance in Michigan is only offered to members, restricting access compared to open-market carriers.

- Added Cost: Annual membership fees increase overall expenses for Michigan drivers.

#10 – Travelers: Best for Safety Features

Pros

- Safety Incentives: IntelliDrive telematics rewards Michigan drivers for safe driving behaviors. Get insights from the Travelers auto insurance review on premium trends for Michigan drivers.

- Strong Stability: Travelers’ superior A.M. Best rating secures long-term claims ability in Michigan.

- Coverage Benefits: Accident Forgiveness and roadside assistance enhance driver protection in Michigan.

Cons

- Lowest Score: Travelers’ Michigan claims satisfaction is 596/1,000, the weakest in this ranking.

- High Premiums: Travelers’ Michigan rates are often higher than the state’s average costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Best Michigan Car Insurance Now

The best auto insurance companies in Michigan, including Erie, Nationwide, and Geico, all bring something different. Erie is known for its dependable claims support, Nationwide makes it easy to adjust coverage based on how you drive, and Geico is a favorite for keeping premiums affordable.

Finding the right fit means thinking about what matters most to you, whether that’s price, flexibility, or support. Many drivers also consult reviews of top auto insurance companies in Michigan to gauge how others rate their experiences before making a decision.

Conversations about the best car insurance in Michigan on Reddit often highlight these strategies, with real drivers sharing tips on how to lower costs by bundling policies, driving safely, or adjusting deductibles to match your budget.

The easiest way to narrow it down is to get multiple auto insurance quotes online. Comparing both local and national insurers helps you uncover unique savings opportunities and better match your coverage to your lifestyle.

To find companies that fit your needs, review quotes side by side and enter your ZIP code to discover the best options in your area.

Frequently Asked Questions

Which auto insurance is best in Michigan?

Erie is often the top pick in Michigan for claims satisfaction, scoring above 680 out of 1,000 in J.D. Power’s study. At the same time, Geico is known for some of the lowest monthly premiums, and Auto-Owners stands out with Michigan-specific coverage perks and strong financial stability.

How much should I pay for auto insurance in Michigan?

On average, Michigan drivers pay about $135 per month for minimum coverage and $270 for full coverage. Younger drivers may pay more than double this, while experienced drivers with clean records often pay significantly less.

Why is my Michigan auto insurance so high?

Michigan’s no-fault system requires insurers to cover medical expenses through PIP, which results in higher premiums. Detroit residents, for example, pay the highest rates due to higher accident and theft claims compared to residents of smaller towns.

How can I lower my car insurance rates in Michigan?

Rates can be reduced by opting for higher deductibles, choosing a capped PIP option like $250,000 instead of unlimited, enrolling in a telematics program that tracks safe driving, or bundling policies for savings of up to 25%.

Does my credit score affect Michigan car insurance?

Yes. Michigan insurers factor in credit-based insurance scores, and studies show drivers with poor credit may pay 60% more than those with excellent credit for the same policy.

What city in Michigan has the highest car insurance?

Detroit drivers end up paying the highest rates in Michigan, primarily because thefts and accidents occur more frequently there. On the other hand, places like Ann Arbor and Grand Rapids usually see premiums that can be up to 40% cheaper, since drivers in those cities are less likely to file auto insurance claims.

What is the new car insurance law in Michigan?

The 2020 reform allows drivers to choose from different PIP coverage levels, such as unlimited, $500,000, or $250,000, instead of being required to carry unlimited benefits. This change was designed to help reduce premiums across the state.

Which insurance company in Michigan has the most complaints?

According to NAIC data, Allstate and State Farm receive the most consumer complaints in Michigan, particularly about claim delays and unsatisfactory settlements, despite their large market share.

What is a good car insurance deductible in Michigan?

A deductible between $500 and $1,000 is pretty common. Choosing $500 means you’ll have lower out-of-pocket costs if you’re in a crash, while going with $1,000 can cut your monthly premiums by about 15%. That trade-off often works well for safe drivers and can bring down the average cost of auto insurance in Michigan.

Which insurance company in Michigan has the highest customer satisfaction?

Auto-Owners and Erie lead Michigan in J.D. Power’s customer satisfaction ratings, with Erie performing especially well in claims handling, and Auto-Owners is praised for its strong network of local agents.

Which type of insurance should be avoided in Michigan?

Can I drive in Michigan with out-of-state auto insurance?

Does car color affect insurance in Michigan?

What is the cheapest car insurance company in Michigan?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.