CURE Insurance Review for 2026

CURE auto insurance review reveals how the company offers competitive rates with a focus on driver history, not credit or income. For example, a 45-year-old male can expect a minimum coverage rate of $69. Discover if CURE is right for you by getting a CURE auto insurance quote today.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated September 2025

This CURE auto insurance review explores the company’s offerings in New Jersey, Pennsylvania, and Michigan.

CURE Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score Rating | 2.8 |

| Business Reviews | 3.0 |

| Claim Processing | 1.8 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.5 |

| Coverage Value | 2.9 |

| Customer Satisfaction | 1.3 |

| Digital Experience | 2.5 |

| Discounts Available | 2.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 2.5 |

| Policy Options | 3.1 |

| Savings Potential | 3.2 |

CURE, or Citizens United Reciprocal Exchange, offers minimum coverage from $69/month for a 45-year-old male in New Jersey, making it one of the cheapest car insurance options for safe drivers.

If you’re a responsible driver, CURE could be a great fit. Be sure to compare multiple CURE auto insurance quotes to find the best policy that matches your needs.

- Check our CURE auto insurance review with rates from $69/month for safe drivers

- Fair pricing model ignores credit, education, and job, offering accessible rates

- Coverage available in NJ, PA, and MI with flexible options for everyday drivers

To see if you can find lower car insurance rates, enter your ZIP code into our free quote tool and compare prices right now from many different companies in your area.

CURE Auto Insurance Cost

CURE auto insurance rates vary by age, gender, and coverage level, with younger drivers facing the highest premiums. For example, 16-year-old males pay $314 for minimum and $528 for full coverage, while females of the same age pay slightly less.

CURE Auto Insurance Monthly Rates by Age, Gender, & Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $267 | $489 |

| 16-Year-Old Male | $314 | $528 |

| 18-Year-Old Female | $241 | $422 |

| 18-Year-Old Male | $289 | $479 |

| 25-Year-Old Female | $133 | $217 |

| 25-Year-Old Male | $157 | $243 |

| 30-Year-Old Female | $111 | $198 |

| 30-Year-Old Male | $127 | $215 |

| 45-Year-Old Female | $94 | $177 |

| 45-Year-Old Male | $69 | $143 |

| 60-Year-Old Female | $82 | $165 |

| 60-Year-Old Male | $93 | $172 |

| 65-Year-Old Female | $87 | $159 |

| 65-Year-Old Male | $99 | $183 |

Rates decrease with age, reflecting reduced risk, with 45-year-old males paying as low as $69 for minimum and $143 for full coverage. Across all ages, males generally pay more than females, and full coverage consistently costs more than minimum coverage.

Full Coverage Auto Insurance Monthly Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $130 | $160 | $210 | |

| $127 | $152 | $195 |

| $128 | $135 | $145 | |

| $135 | $165 | $220 | |

| $115 | $140 | $175 | |

| $132 | $158 | $205 |

| $118 | $143 | $185 | |

| $125 | $150 | $190 | |

| $120 | $145 | $180 | |

| $110 | $130 | $160 |

Full coverage auto insurance rates increase as credit scores decline, with good credit yielding the lowest premiums. USAA offers the cheapest rate at $110 for good credit, while Farmers charges up to $220 for bad credit. Learn more in our USAA auto insurance review, or read our full breakdown of how credit impacts rates.

Credit scores influence auto insurance rates by indicating risk. Pay bills on time and keep credit use low. For example, staying under 30% usage may reduce your premium.

Jeff Root Licensed Insurance Agent

Most insurers show significant price jumps between credit tiers, but CURE auto insurance remains steady with rates of $128 for good, $135 for fair, and $145 for bad credit. Keeping a strong credit score helps drivers save significantly on monthly premiums.

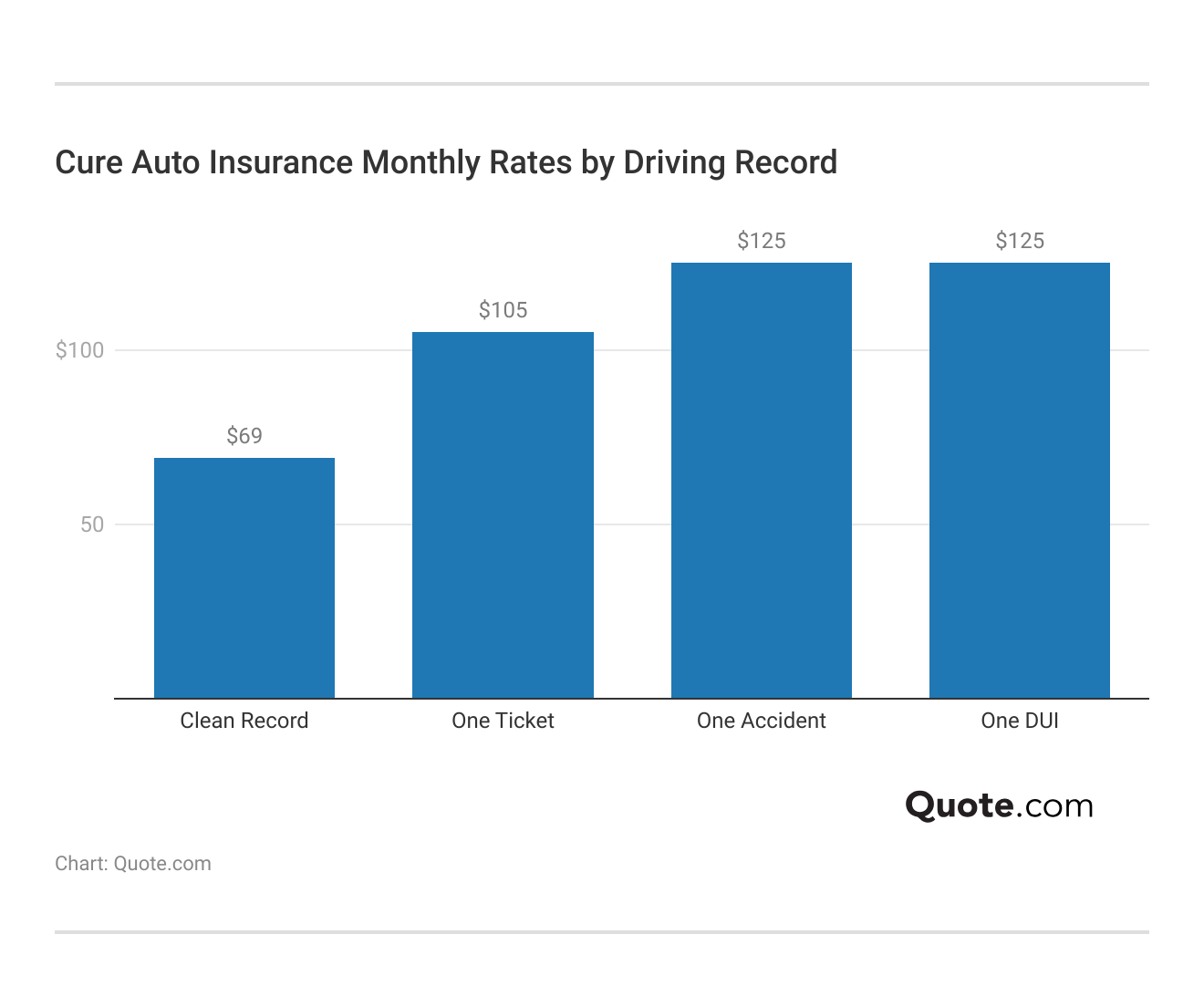

CURE auto insurance rates increase with driving violations. For minimum coverage, a clean record costs $50, rising to $69 with one ticket, $100 with an accident, and $125 with a DUI. Full coverage starts at $100 and climbs to $125 for accidents and DUIs, showing how infractions impact monthly premiums.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $72 | $128 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $32 | $84 |

Auto insurance monthly rates vary by provider and coverage level. USAA offers the lowest premiums, at $32 for minimum coverage and $84 for full coverage. In contrast, Liberty Mutual has the highest rates, at $96 for minimum coverage and $248 for full coverage.

CURE auto insurance falls in the mid-range, charging $72 for minimum and $128 for full coverage. Overall, rates tend to rise significantly with full coverage, and provider choice greatly affects monthly costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Smart Ways to Save With CURE Auto Insurance

CURE offers a range of discounts that can significantly lower your premium. From safe driving habits to secure parking, these savings opportunities reward responsible behavior and help drivers manage costs.

CURE Auto Insurance Discounts & Savings| Discount | Potential Savings |

|---|---|

| Good Driver | 40% |

| Safe Parking | 25% |

| Anti-Theft Device | 25% |

| Loss-Free | 20% |

| Homeowner | 17% |

| Senior Citizen | 15% |

| Multi-Car | 10% |

| Good Student | 10% |

| Prior Coverage | 9% |

| Defensive Driving Course | 5% |

If you have multiple vehicles, the 17 car insurance discounts you can’t miss include the multi-vehicle discount for combining cars into one policy. Whether you’re a student, homeowner, or simply maintain a clean record, a discount will likely apply to you.

CURE may offer extra savings through lesser-known options like usage-based programs that reward safe driving, discounts for paperless billing or auto-pay, reduced rates for paying in full, and potential savings for drivers with low annual mileage.

- Usage-Based Programs: While not always advertised, insurers like CURE may offer driving behavior programs where premiums are adjusted based on how safely you drive using a mobile app or device.

- Paperless Billing or Auto-Pay Discounts: Many insurers offer small savings for going paperless or setting up automatic payments. It’s worth checking if CURE does, too.

- Pay-in-Full Discount: Paying your premium in full upfront instead of monthly installments can often lead to additional savings.

- Low Annual Mileage Program: While low mileage isn’t on your table, some insurers (possibly CURE) offer lower rates for drivers under a specific annual mileage threshold.

In addition to these common discounts, coverage options such as usage-based plans, auto-pay and low-mileage plans can also help you save with CURE.

It’s worth exploring all available offers to maximize your savings and get the best value from your coverage.

CURE Auto Insurance Coverage Options

CURE auto insurance provides affordable coverage options that safeguard drivers against unforeseen circumstances. Whether you need to get on the road in a hurry or it’s time to get comprehensive, these core coverages help ensure you and your assets are ready for whatever the road throws at you.

- Liability Coverage: Pays for bodily injury and property damage you cause to others in an at-fault accident, and is required in most states.

- Personal Injury Protection (PIP): With medicare advantage vs. original medicare in mind, this covers medical expenses, lost wages, and related costs after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Offers financial protection in the event you are hit by a driver without insurance or with not enough insurance to cover your losses.

- Collision Coverage: Replaces or repairs your vehicle after an accident. It does not matter if you caused the accident snow during a snowstorm.

- Comprehensive Coverage: Safeguards your vehicle against non-collision damages including theft, vandalism, fire, and weather-related issues.

Understanding these key coverages is the first step toward selecting the right level of protection for your unique driving needs.

With CURE car insurance, you will be able to tailor your policy to fit your car, your life, and your wallet, without sacrificing the coverage and protection you deserve. No matter if you drive every day or just on occasion, it provides the practical protection and peace of mind you need.

CURE Auto Insurance Customer Reviews & Ratings

CURE auto insurance is rated above average on all major review platforms. J.D. Power rates it as having an average customer satisfaction (790 out of 1,000), while Consumer Reports gives it a 68 out of 100, mixed reviews.

CURE Auto Insurance Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: B Good Business Practices |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.20 Avg. Complaints |

|

| Score: B Fair Financial Strength |

The company maintains a fair financial strength rating of “B” from A.M. Best and a “B” grade for business practices. However, a higher-than-average complaint score of 1.20 suggests room for improvement in customer relations.

A Reddit user praised CURE auto insurance for its outstanding customer service, quick response times, and the lowest rates they’ve found. With multiple vehicles insured and no claims filed, they say they have no plans to switch providers.

While CURE could improve complaint frequency, many customers still value its low rates and responsive service. For those focused on affordability and simple coverage, CURE is worth considering, especially when guided by real-world feedback and tips on how to file an auto insurance claim & win it each time.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

CURE Auto Insurance Pros and Cons

CURE auto insurance, like any insurance company, has its pros and cons. Learning about these can assist you in deciding if it meets your driving criteria, budget, and area. Here is a quick breakdown of the primary pros and cons in terms of pricing, coverage options, availability, and customer feedback.

Pros

- Low Prices for Good Drivers: CURE auto quote information indicate that the company has competitive pricing for drivers that have clean records and need low priced auto insurance.

- Fair Pricing Model: CURE insurance does not charge premiums based on credit score, education level, or other variables, making it more accessible and cheaper for most drivers.

- Wide Range of Coverage: With comprehensive options like liability and uninsured motorist protection, CURE car insurance allows customers to customize their coverage. Be sure to check how to compare auto insurance companies to ensure you get the best coverage value.

CURE auto insurance stands out for its fair, nontraditional pricing model and competitive rates, which benefit good drivers and those often penalized by factors like credit score or education level.

Cons

- Limited Coverage Areas: NJ CURE insurance is only available in New Jersey, Pennsylvania, and Michigan, meaning drivers in other states won’t benefit from CURE auto insurance.

- Mixed Customer Satisfaction: Based on CURE auto insurance reviews, some customers report dissatisfaction with the claims process, which can be frustrating when needing timely assistance.

CURE’s flexible coverage makes it a solid choice for drivers wanting customization, but its limited availability and mixed claims reviews are key factors to consider.

Carefully evaluating these pros and cons can help you decide if CURE is the right fit for your budget, coverage needs, and service expectations.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Affordable & Fair CURE Auto Insurance for Drivers

CURE auto insurance offers affordable coverage, with rates as low as $69 per month for minimum coverage for a 45-year-old male in New Jersey. Check our CURE auto insurance review to see how its unique pricing model, excluding credit score, education, and occupation, makes it an accessible option for many drivers.

CURE offers customizable coverage, 24/7 roadside assistance, and discounts for good drivers, students, and multi-car policies. Though limited to NJ, PA, and MI, it’s a smart pick for budget-conscious drivers who apply insights from 17 tips to pay less for car insurance.

Find out which insurers have the lowest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

Is CURE auto insurance legit in how it sets its pricing?

Yes, CURE uses a unique pricing model that avoids credit score, education, and occupation, focusing solely on driving history to determine your premium.

Does NJ CURE car insurance offer coverage for high-risk drivers?

Yes, NJ CURE car insurance provides affordable policies for high-risk drivers without drastically increasing rates due to past violations.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

How accurate is an online CURE insurance quote?

A CURE insurance quote online gives a close estimate, but your final premium may vary after verifying all your details and driving history, as explained in 26 hacks to save more money on car insurance, where understanding quote variability is just one of the many ways to make smarter insurance decisions.

How much is CURE auto insurance with a clean record?

Drivers with a clean record may pay around $50–$72 per month for minimum coverage, depending on age and state.

Does CURE roadside assistance have service limits?

Yes, there may be limits on the number of service calls or miles covered for towing each policy term, depending on your plan.

Does CURE auto insurance cover rental cars after an accident?

Rental car costs may be covered if you’ve purchased optional rental reimbursement coverage and your claim is approved. If your claim is denied, refer to what to do when you’re denied insurance coverage for guidance on your next steps.

Is CURE auto insurance good for first-time car owners?

Yes, CURE can be a good option for first-time car owners due to its straightforward policies and affordable entry-level rates.

How much does CURE auto insurance full coverage cost?

Full coverage rates vary by age and driving history, with a 45-year-old male paying around $143 per month, depending on location and risk factors.

Do the services offered by CURE auto insurance include roadside assistance?

Yes, CURE includes 24/7 roadside assistance with its collision auto insurance policies, covering common emergencies like flat tires, dead batteries, and lockouts.

Can I manage my policy through CURE auto customer service online?

Yes, CURE offers an online portal where you can make payments, update information, request changes, and access policy documents.

What do CURE auto insurance Michigan reviews say about pricing?

Is an NJ CURE insurance quote based on credit score or income?

Can I make policy changes through CURE customer service?

Is there a fee for late CURE auto insurance payments?

How do I reach claims support through the CURE auto insurance customer service number?

What discounts are mentioned in CURE car insurance reviews?

How does CURE auto insurance score in Consumer Reports compared to other providers?

Does CURE motorcycle insurance offer liability coverage?

Does CURE insurance offer full coverage for all vehicle types?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.