How to Compare Auto Insurance Companies in 2026

Comparing auto insurance companies starts with collecting personal and vehicle details, determining coverage needs, researching insurers, and comparing quotes, which can be as low as $32/mo. You’ll also want to look at discounts and claims satisfaction when learning how to compare auto insurance companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2026

Understanding how to compare auto insurance companies begins by collecting your personal and vehicle information, identifying the coverage you need, and reviewing insurers.

- When comparing auto insurers, review price, discounts, and financial strength

- Determine your coverage needs, such as liability, collision, and comprehensive

- Choose the insurer that delivers the best auto insurance rates

Comparing monthly quotes starting at $32, depending on your age, driving record, and coverage choice, is also part of the process.

Beyond price, the comparison should include discounts, financial stability, and claims satisfaction. Each factor plays a role in whether an insurer is the right fit for your budget. Taking the time to weigh these details helps you find the best overall value for your coverage needs.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

6 Steps to Compare Auto Insurers

When comparing auto insurance companies, take action using accurate information, define coverage needs, and confirm provider trustworthiness.

With good driver and vehicle information, plus an honest look at financial strength and customer complaint records, along with the receipt of three identical quotes, differences in price and protection become apparent.

Steps for Comparing Auto Insurance Companies| Step | Action | Purpose |

|---|---|---|

| #1 | Gather Personal Details | Helps insurers provide accurate quotes |

| #2 | Determine Coverage Needs | Ensures you’re protected without overpaying |

| #3 | Research Reputable Insurers | Focus on trusted insurance providers |

| #4 | Compare Multiple Quotes | Weigh prices and coverage options. |

| #5 | Review Available Discounts | Find savings and dependable service |

| #6 | Choose the Best Value | Balance coverage with overall cost |

In practice, the best way to compare car insurance is to line up these factors side by side so you can see which company offers the strongest balance of price, coverage, and reliability (Learn More: A Visual Guide to Auto Insurance).

Step #1: Gather Personal & Vehicle Details

Write down your driver’s license number, Social Security number (for credit-based scoring), vehicle identification number (VIN), current odometer reading, and the average annual mileage.

Also, list recent accidents, tickets, or claims, since insurers use this to adjust premiums.

When comparing auto insurance companies, match coverage and deductibles, then check financial strength and claims satisfaction for reliable protection.

Michelle Robbins Licensed Insurance Agent

Without these, quotes will be estimated rather than accurate. Having this information ready makes a vehicle insurance quotes comparison far more reliable because you’ll be matching actual rates instead of rough estimates.

Read more: These 3000 People Got Auto Insurance Right

Step #2: Determine Your Coverage Needs

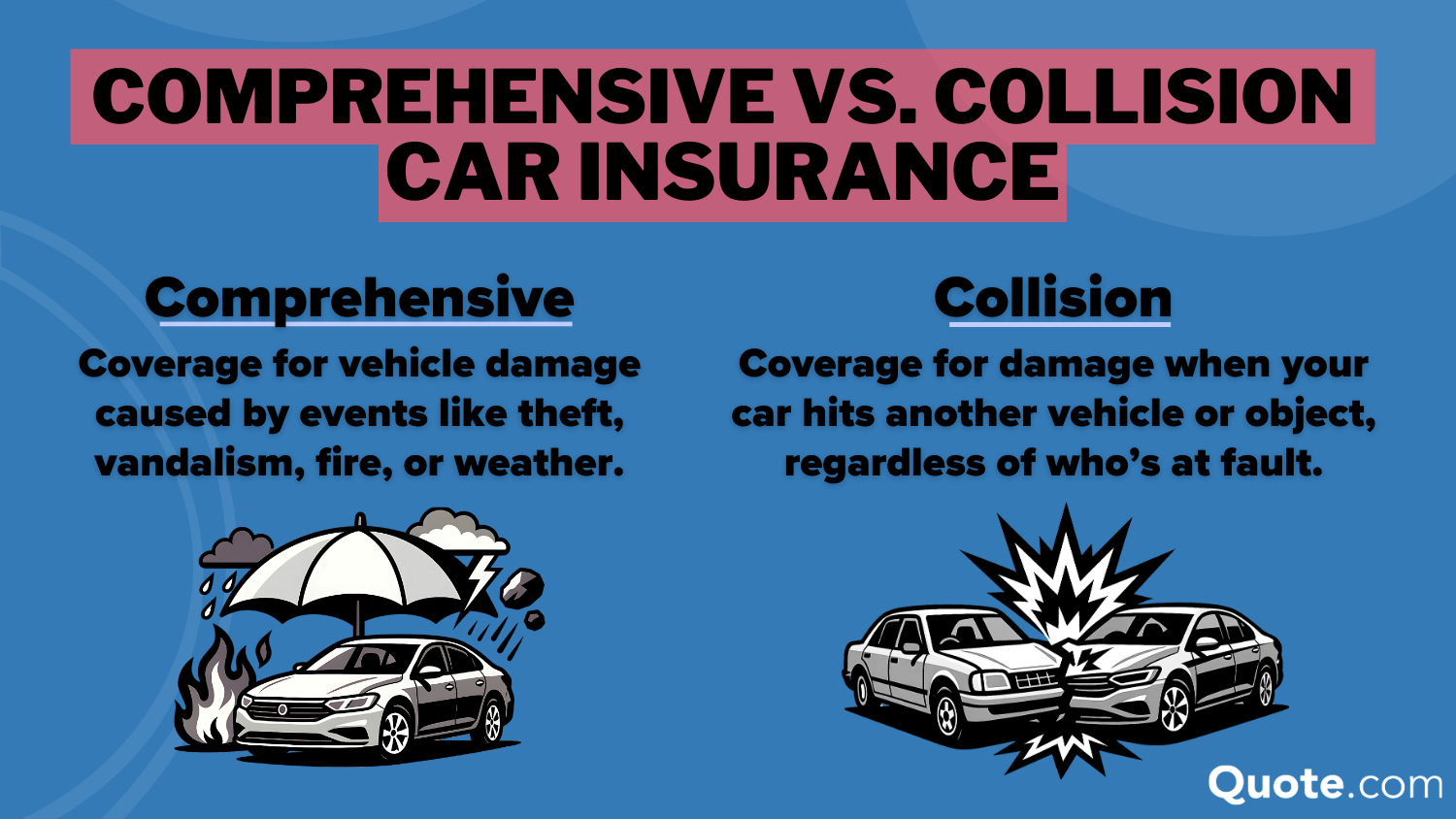

Check your state’s minimum liability requirements, then decide if you also need collision (to cover repairs after an at-fault crash) or comprehensive (for theft, fire, vandalism, or storm damage).

Auto Insurance Coverage Options: Pros & Cons| Coverage | Pros | Cons |

|---|---|---|

| Classic/Collector Car Insurance | Protects valued vintage cars | Mileage limits, strict rules |

| Collision Coverage | Pays for crash damage | Not ideal for older cars |

| Comprehensive Coverage | Covers non-collision damage | Costly, excludes collisions |

| Gap Insurance | Pays loan if car is totaled | Not needed if paid off |

| Liability Insurance | Required, low-cost | Doesn’t cover your car |

| Medical Payments (MedPay) | Pays medical bills fast | Low limits, no wages |

| Personal Injury Protection | Covers medical and wages | Costly, may overlap health |

| Rental Reimbursement | Pays rental during repairs | Daily limits, restricted claims |

| Roadside Assistance | Towing and breakdown help | Limited use, overlaps plans |

| Uninsured Motorist Coverage | Covers uninsured losses | Claims often take time |

If your car is financed, confirm lender requirements, which often include gap insurance. For high-value vehicles, note if you want OEM parts coverage for repairs.

Step #3: Research & Shortlist Insurers

Use NAIC complaint ratios to identify which companies have the fewest complaints relative to their market share. Verify financial stability with AM Best ratings of A- or higher. Then compare J.D. Power claims satisfaction scores for insurers in your region. Eliminate companies with poor ratings in any of these categories (Learn More: 17 Tips to Pay Less for Car Insurance).

Step #4: Request & Compare Quotes

Ask at least three insurers for quotes using identical terms: the same liability limits (e.g., $100,000/$300,000/$100,000), comprehensive and collision deductibles (e.g., $500), and any add-ons you require.

Request written or emailed quotes to confirm exact coverage details. Avoid relying on “ballpark” online rates, which may omit surcharges. By standardizing the terms across providers, you’ll make comparing auto insurance quotes more accurate and meaningful.

Step #5: Evaluate Discounts & Financial Strength

Check each insurer’s discount list for options you qualify for, such as safe driver telematics, multi-car, bundling with renters or home, or low annual mileage. Calculate how much these cut the quoted rate.

Top Auto Insurance Discounts by Provider & Savings| Company | Bundling | Claims-Free | Low Mileage | Usage-Based |

|---|---|---|---|---|

| 25% | 10% | 30% | 30% | |

| 25% | 15% | 20% | 30% |

| 25% | 10% | 30% | 30% |

| 20% | 9% | 10% | 30% | |

| 25% | 12% | 30% | 25% | |

| 25% | 8% | 30% | 30% |

| 20% | 14% | 20% | 40% | |

| 10% | 10% | 30% | $231/yr | |

| 17% | 11% | 30% | 30% | |

| 13% | 13% | 20% | 30% |

Then confirm the company’s financial stability by reviewing AM Best or Moody’s reports to avoid a carrier that may delay or deny claims. Bringing these details together gives you a clearer auto insurance company comparison that balances savings with long-term reliability.

Read more: Best Good Driver Auto Insurance Discounts

Step #6: Choose Best Overall Value

Compare the adjusted monthly premiums (after discounts) side by side with the coverage offered. For example, a $32 minimum coverage plan from Erie may look cheapest, but a $47 State Farm policy could provide higher liability limits and stronger claims satisfaction.

Reviewing side-by-side comparisons is the best way to compare car insurance rates, as it shows the real value of coverage rather than just the lowest price.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $32 | $84 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Beyond just cost, review whether the policy includes add-ons like rental reimbursement or roadside assistance, since these can make a real difference when you actually need support. It’s also worth checking how each company handles claims, because a slightly higher premium is often justified if it comes with faster payouts and fewer disputes.

Pick the policy that delivers the right mix of cost, protection, and claims reliability. Always look beyond the headline price to see how much coverage you’re actually buying. A slightly higher premium can be worth it if it prevents major out-of-pocket costs after a serious accident.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Coverage by Age & Market Share

Comparing monthly rate trends against market share helps explain the relationship, giving a clearer picture of how to compare auto insurance companies practically. Younger drivers see the steepest monthly premiums, with Liberty Mutual, Progressive, and Travelers auto insurance topping $450, while USAA and Geico sit far lower.

Auto Insurance Monthly Rates by Age| Company | Age: 25 | Age: 35 | Age: 45 | Age: 55 |

|---|---|---|---|---|

| $102 | $95 | $87 | $82 | |

| $78 | $72 | $62 | $59 |

| $98 | $90 | $76 | $72 | |

| $50 | $45 | $43 | $41 | |

| $119 | $110 | $96 | $91 |

| $81 | $75 | $63 | $59 | |

| $77 | $70 | $56 | $52 | |

| $60 | $55 | $47 | $45 | |

| $62 | $58 | $53 | $50 | |

| $46 | $42 | $32 | $30 |

As drivers age, the rates narrow, but the spread remains—USAA, Geico, and State Farm consistently stay on the lower end, while Liberty Mutual and Travelers trend higher. At the same time, the pie chart shows which companies hold the most weight in the market, with State Farm, Progressive, and Geico controlling over half of the national share.

What this means for you is simple: the most prominent companies may dominate in availability and brand recognition, but their rates aren’t always the most competitive. Comparing both cost trends by age and company size helps you decide whether to lean toward a big provider for stability or a smaller competitor for lower premiums.

Instantly compare insurance quotes by entering your ZIP code into our free auto insurance quote comparison tool.

Auto Insurance Rates by Driving Record

Looking at monthly rates by driving record shows how your history affects costs. A clean record keeps premiums lowest with Erie, Geico, and State Farm. After an accident, DUI, or ticket, insurers diverge. Liberty Mutual and Allstate Insurance increase sharply, while Erie and State Farm remain more competitive, even with violations.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $32 | $45 | $60 | $38 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 |

Most striking is how even a single violation can drive up premiums by $30 to $80, depending on the insurer, proving that shopping around matters as much as driving responsibly. This breakdown not only makes you aware of the penalties for violating them, but also which companies are softer on drivers for violations.

Usage-Based Auto Insurance

More and more drivers are using usage-based insurance programs to cut costs, and this chart illustrates why – because savings can really differ among companies.

Top Usage-Based Auto Insurance (UBI) Programs| Company | Program | Savings | System |

|---|---|---|---|

| Drivewise® | 30% | Mobile App | |

| KnowYourDrive | 15% | Mobile App |

| YourTurn® | 30% | Mobile App |

| Signal® | 30% | Mobile App | |

| DriveEasy | 25% | Mobile App | |

| RightTrack® | 30% | In-Vehicle Device |

| SmartRide® | 25% | Mobile App / In-Vehicle Device | |

| Snapshot® | $231/yr | Mobile App | |

| Drive Safe & Save™ | 20% | Mobile App / In-Vehicle Device | |

| IntelliDrive® | 30% | Mobile App |

Most insurers now offer mobile app programs like Allstate’s Drivewise, Geico’s DriveEasy, and Progressive’s Snapshot, which track driving habits such as speed, braking, and mileage to calculate discounts.

Savings range from 15% with American Family’s KnowYourDrive to 30% with Erie, Farmers, Liberty Mutual, and Travelers. Nationwide and State Farm offer hybrid systems with apps or in-vehicle devices. For safe drivers, enrolling in a UBI program is one of the most effective ways to cut premiums without reducing coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance by Premiums Written

The lead of State Farm, with $47 billion in U.S. auto premiums and a 20% market share, tops Geico and Progressive’s total combined market share of another third.

The next tier comprises Allstate, USAA, and Liberty Mutual, followed by Farmers, Nationwide, American Family, and Travelers, each holding smaller but significant shares.

Top 10 Auto Insurance Companies by Premiums Written| Company | Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| $30B | 67% | 14% | |

| $9B | 68% | 4% |

| $15B | 71% | 6% | |

| $45B | 70% | 18% | |

| $17B | 72% | 7% |

| $10B | 69% | 5% | |

| $39B | 68% | 16% | |

| $47B | 64% | 20% | |

| $8B | 66% | 3% | |

| $24B | 65% | 8% |

Liberty Mutual and Farmers report over 70%, meaning they pay a larger share of premiums in claims compared to State Farm or USAA.

This shows not only who the biggest insurers are, but also how efficiently they handle claims relative to revenue, helping you weigh stability with cost and coverage.

Auto Insurance Coverage Options

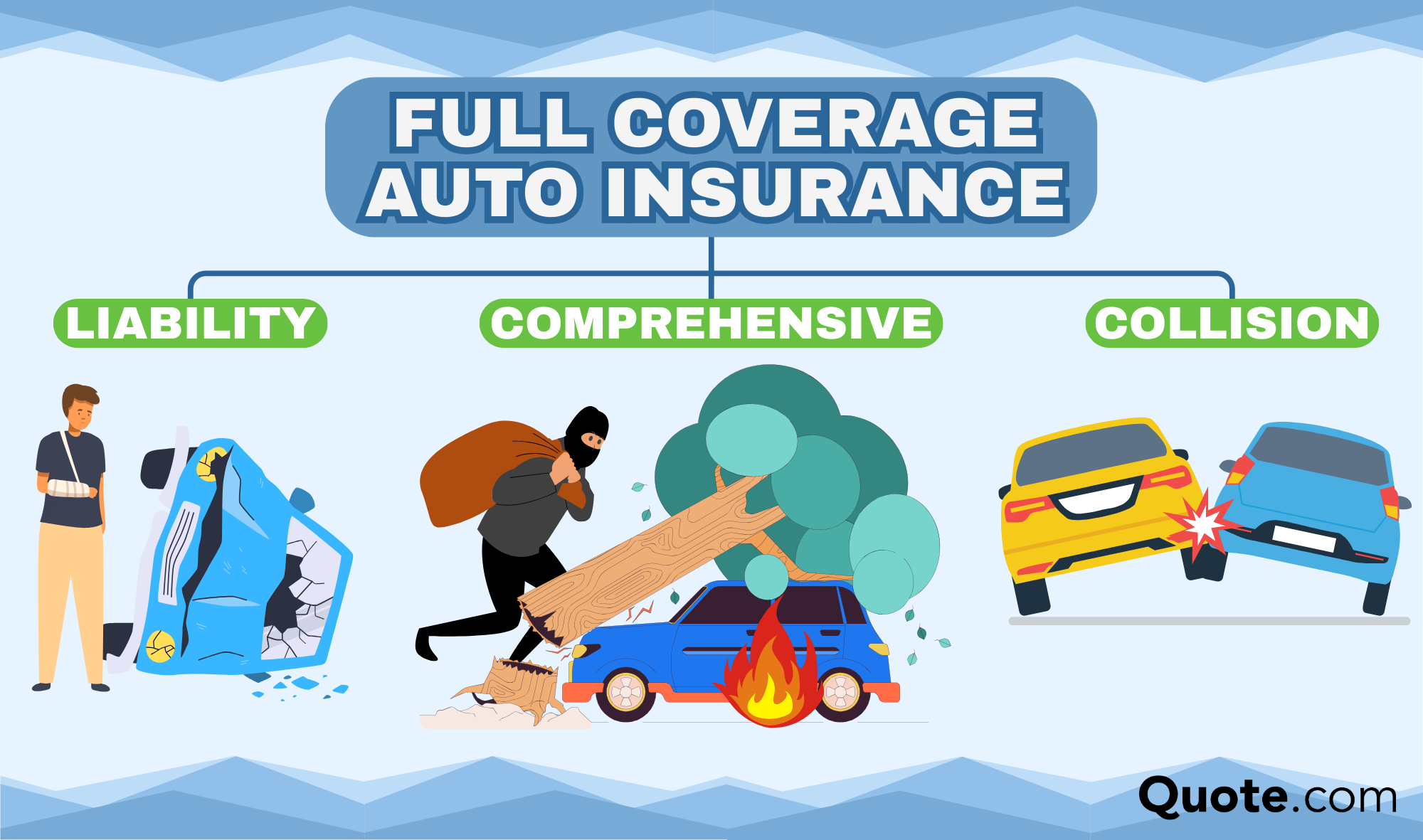

The minimum you’ll need in most states that want you to have coverage for injuries or damages you cause is this: Collision covers repairs to damages sustained in an accident, while comprehensive covers perils such as theft, weather, and vandalism.

Select protections based on your car’s value and how you drive.

Auto Insurance Coverage Options: Key Details & U.S. Requirements| Coverage | What it Covers | Required? |

|---|---|---|

| Classic/Collector Car Insurance | Agreed vintage value | Optional for classic cars |

| Collision Coverage | Accident repair costs | Optional, lender required |

| Comprehensive Coverage | Non-collision damage | Optional, covers risks |

| Gap Insurance | Loan value shortfall | Optional for financed cars |

| Liability Insurance | Injuries, property damage | Required in most states |

| Medical Payments (MedPay) | Basic medical bills | Optional medical add-on |

| Personal Injury Protection | Medical bills, lost wages | Required in some states |

| Rental Reimbursement | Rental during repairs | Optional rental coverage |

| Roadside Assistance | Towing, breakdown help | Optional emergency service |

| Uninsured/Underinsured Motorist | Uninsured-driver damage | Required in some states |

Medical options like personal injury protection (PIP) and MedPay pay for medical bills, whereas uninsured motorist coverage is in place when the other driver doesn’t have insurance.

Optional add-ons like gap insurance, roadside assistance, rental car coverage, and classic car policies may be necessary for financed vehicles, frequent drivers, or people insuring a vintage car.

Read More: Best Classic Car Insurance

Factors for Comparing Auto Insurers

It’s best to consider more than the monthly premium when you’re comparing auto insurance companies. This list will help break down what you should be considering against each other.

The coverage options show what you’ll get and what you won’t be getting for your premium, while discounts show a little of the elbow grease that goes into getting that price.

Key Factors for Comparing Auto Insurance Companies| Factor | Description |

|---|---|

| Accident Forgiveness | First accident won’t raise rates |

| Availability | Coverage across states or regions |

| Bundling Options | Discounts for combining multiple policies |

| Claims Process | Filing ease and processing time |

| Coverage Options | Types of coverage the company offers |

| Customer Reviews | Ratings from customers and agencies |

| Customer Service | Support quality and availability |

| Digital Experience | Online tools and mobile features |

| Discounts Available | Types of discounts offered |

| Financial Strength | Company’s ability to pay claims |

| Policy Customization | Ability to adjust coverage options |

| Premium Costs | Monthly or annual insurance rates |

| Rental Reimbursement | Rental coverage during repairs |

| Roadside Assistance | Emergency help included in policy |

| Usage-Based Programs | App or device rewards safe driving |

Customer service, claims handling, and financial strength give you a sense of how dependable the insurer will be when you need them most. Digital experience and availability matter if you want easy access through apps or if you travel across states.

Drivers who request identical quotes from at least three insurers often save 15–20% because it exposes hidden fees and makes discounts easier to compare.

Melanie Musson Published Insurance Expert

Add-ons such as roadside assistance, rental reimbursement, usage-based insurance programs, and accident forgiveness can be major factors in convenience and long-term savings.

Reviewing all these pieces together helps you determine which company offers the best mix of affordability, support, and flexibility for your situation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discounts to Look for Between Companies

Finding the right auto insurance discount can significantly reduce your premium. Instead of focusing only on base rates, it pays to know the common savings programs most insurers offer and which ones you may qualify for.

- Vehicle Safety Features: Cars with airbags, anti-lock brakes, or lane-change alerts often qualify for reduced rates.

- Bundling and Multi-Vehicle: Insurers cut costs when you combine home, renters, or multiple vehicles under one policy.

- Payment Options: Paying annually or semi-annually instead of monthly can lower your total premium.

- Driver-Based Discounts: Good students, safe drivers, seniors, and those who complete defensive driving courses may see significant savings.

- Occupation and Low Mileage: Certain professions and drivers with fewer annual miles can receive lower rates.

These discounts vary by insurer, but stacking the ones you qualify for can make a noticeable difference. Always confirm eligibility upfront so you know your quote reflects every possible savings opportunity.

Read more: How Airbags Affect Auto Insurance Rates

The Best Way to Compare Auto Insurance

When you compare auto insurance companies, the process is more than finding the lowest rate. Gather exact personal and vehicle details, set coverage requirements, and check financial strength, complaint ratios, and claims satisfaction.

Rates may start at $32, but the real value comes from balancing cost with stability and coverage needs.

Discounts, usage-based plans, and add-ons such as roadside assistance or accident forgiveness also alter the actual cost. You’ll discover actual differences in price and protection by receiving identical quotes and comparing side-by-side.

An auto insurance guide enables you to concentrate on these essentials before deciding on a policy.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

Why is auto insurance comparison shopping important?

What’s the importance of doing an auto insurance premium comparison? When you compare different quotes, you can get better rates, find stronger coverage options, and avoid paying more than you should.

What’s the most effective way to compare insurance companies?

So, what’s the right way to compare car insurance quotes fairly across companies? Start by checking financial strength ratings (A.M. Best A- or higher), NAIC complaint ratios, and J.D. Power claims satisfaction. These measures show how stable and reliable an insurer is, not just how cheap their quote looks.

Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you.

How do I compare auto insurance quotes side-by-side?

To compare auto insurance quotes side by side, use identical coverage limits and insurance deductibles across at least three companies. For example, compare $100,000/$300,000/$100,000 liability with a $500 deductible. This avoids misleading “low” quotes that don’t provide the same level of protection.

What’s the best way to compare auto insurance rates by age?

The best way to compare auto insurance rates by age is to look at quotes from several companies using the same coverage limits for each age group.

What should I look for when comparing auto insurance companies?

What should I double-check when reviewing and comparing car insurance? Review each insurer’s coverage options, financial stability, NAIC complaint ratios, and claims satisfaction scores. Compare discounts you qualify for and check whether each quote includes the same liability limits, deductibles, and add-ons.

How does comparing car insurance companies by market share help me make a decision?

It allows you to see which insurers have the largest market presence and the strongest long-term stability. Large companies often offer broader availability, better customer support options, and an excellent claims process. For example, State Farm, Progressive, and Geico Insurance control over half the U.S. market.

How do I compare third-party car insurance policies?

Compare third-party car insurance by checking state minimum liability limits against what companies offer. While minimums keep costs down, choosing higher liability limits often provides better long-term protection at only a modest premium increase.

What are the benefits of comparing multiple car insurance quotes at the same time?

When you compare multiple auto insurance quotes, you can expose pricing differences of 15–20% on average. This happens because discounts and surcharges vary by company, even when coverage terms are identical.

How can I make a car insurance online quote comparison as accurate as possible?

Enter precise details like VIN, mileage, and recent tickets or claims. Online tools often estimate with incomplete info, but exact details lead to more accurate quotes and fewer surprises when you finalize coverage.

Why should I compare car insurance quotes from different companies instead of sticking with one provider?

Each company weighs risk factors differently. While one may prioritize age, another may weigh credit score more heavily. Comparing quotes across companies ensures you don’t overpay because of a single insurer’s formula.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

How do auto insurance rate comparisons change based on your driving record?

How can I compare insurance rates by ZIP code?

Is it possible to compare car insurance without personal information?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.