Hugo Insurance Review for 2026

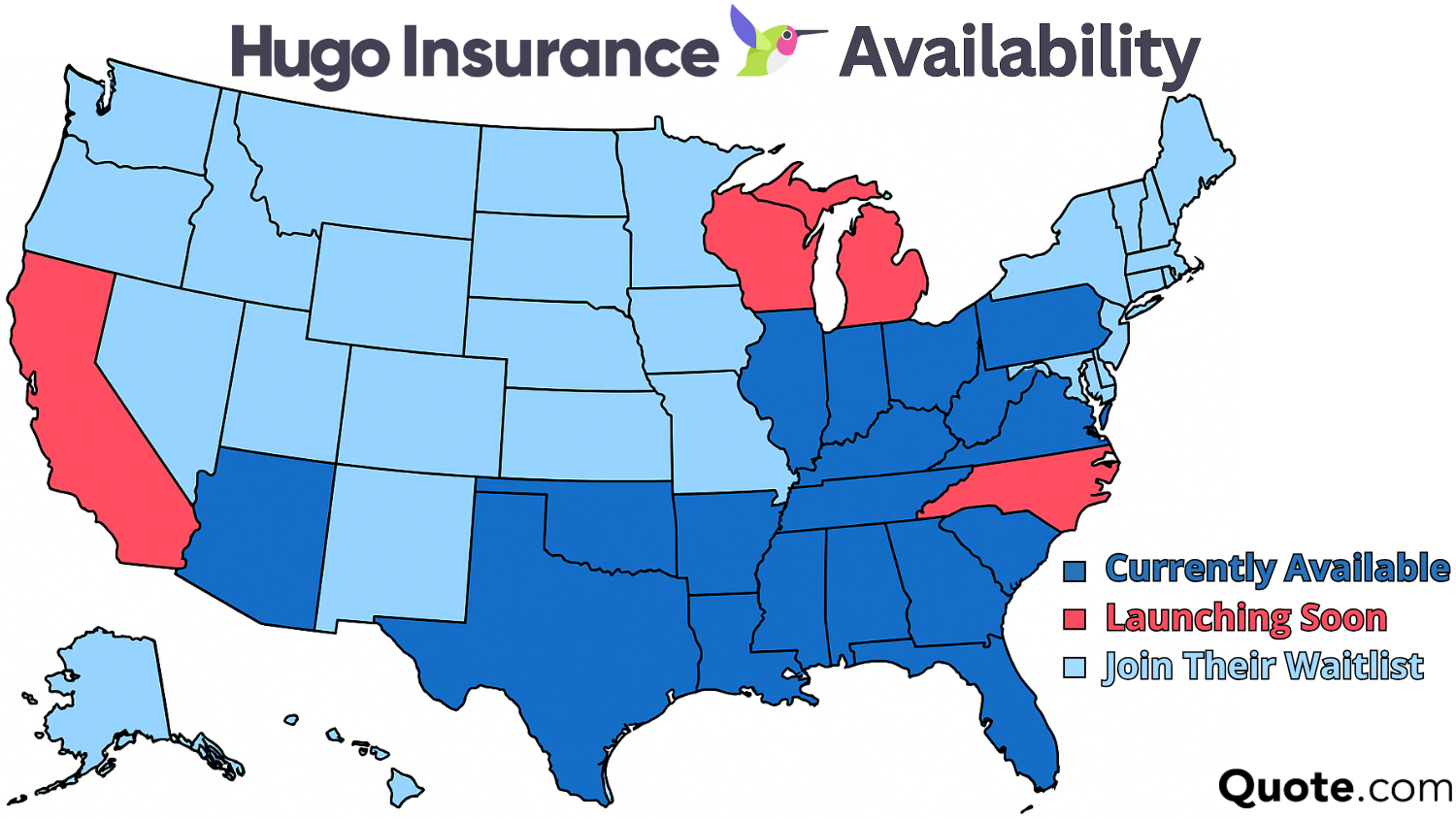

Hugo Insurance provides pay-as-you-go auto coverage starting at $121 per month, designed primarily for drivers who need basic liability protection. There's no down payment, and daily or weekly payments are available, with the option to pause at any time. Hugo's on-demand coverage is available in 16 states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

Hugo Insurance offers flexible, pay-as-you-go auto coverage starting at $121 per month for minimum protection.

- Hugo Insurance offers instant coverage with no down payment

- Rates vary by driving record, credit score, and coverage choice

- Hugo car insurance is available in 16 states, soon to be 22

It offers essential coverages like liability and full coverage auto insurance with no upfront costs, plus flexible daily or weekly payments.

This Hugo Insurance review explores how factors like credit score, driving history, and coverage level impact pricing compared to traditional insurers.

Hugo Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.0 |

| Claim Processing | 3.3 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.7 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 3.3 |

| Insurance Cost | 4.5 |

| Plan Personalization | 3.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.1 |

While Hugo’s rates may be higher for full coverage, its convenience and adaptability make it a standout option for drivers who value flexibility or need car insurance for one day.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Cost of Hugo Auto Insurance

Hugo Insurance is a flexible pay-as-you-go option built for drivers who don’t need year-round coverage. Hugo’s average cost of auto insurance is $121 per month for minimum coverage and $330 for full coverage, which is higher than most major insurers.

In comparison, Geico and State Farm offer full coverage for $114 and $123 a month, while Nationwide averages $164 monthly. Rates may also be cheaper if you sign up for usage-based Hugo Insurance alternatives, like Geico DriveEasy and Nationwide SmartMiles.

Hugo vs. Competitors: Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $121 | $330 | |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

While it’s not the cheapest option, Hugo’s appeal comes from its convenience — no down payment, instant coverage activation, and the ability to pause or restart anytime.

It’s especially useful for gig drivers, part-time commuters, or anyone needing short-term protection with Hugo one day insurance.

Unlike traditional insurers, Hugo’s system gives drivers more control over when and how they pay for coverage. Learn more about pay-as-you-go auto insurance.

Hugo Insurance continues to expand across the U.S., offering coverage in several states while preparing to launch in new regions.

Drivers who don’t use their cars daily can save the most with Hugo by paying only for the days they actually drive.

Michelle Robbins Licensed Insurance Agent

This gradual rollout reflects Hugo’s focus on ensuring regulatory compliance and maintaining a smooth customer experience as it scales nationwide.

For drivers in participating states, the company’s instant coverage activation and flexible pay-as-you-go options provide an accessible way to stay insured without long-term contracts.

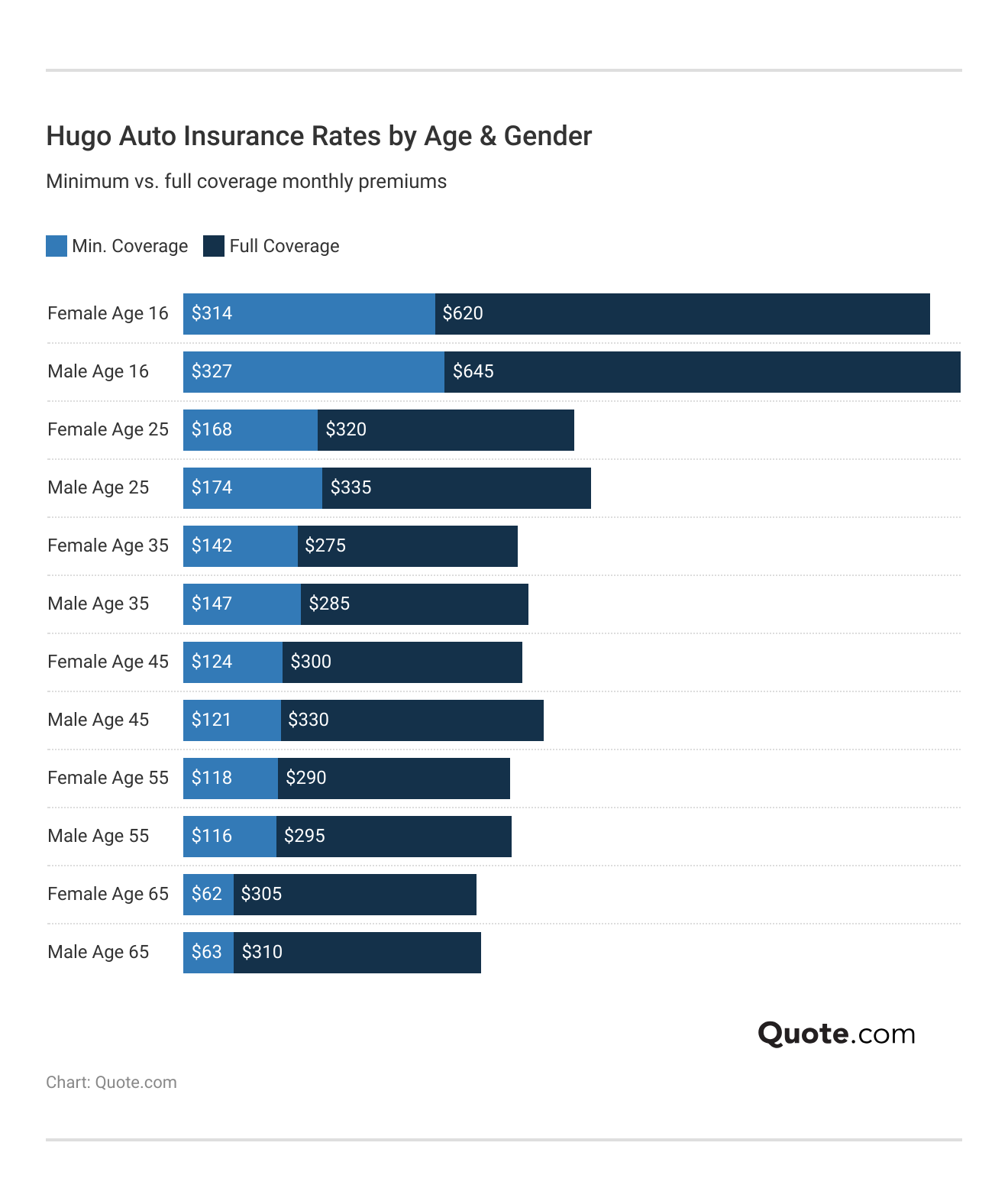

Cost of Hugo Insurance Based on Driver’s Age

Hugo Insurance rates change a lot depending on age, with the biggest difference seen between teen and middle-aged drivers.

Teens pay the highest prices. A 16-year-old male pays $327 per month for minimum coverage and $645 monthly for full coverage.

By age 25, rates drop sharply to around $168-$174 per month for minimum coverage. Coverage costs are much lower for drivers in their 40s at $121 per month.

Older drivers benefit the most, with 65-year-olds paying as little as $62 monthly for minimum protection. Compare cheap auto insurance for seniors to find better rates.

How Driving History Affects Hugo Car Insurance Rates

Compared to other companies, Hugo’s prices are on the higher end. One accident raises the monthly premiums to $161, while a DUI jumps it to $183, and even a simple ticket increases it to $172.

This shows that Hugo can get expensive quickly if you have violations on your record (Read More: Cheap Auto Insurance After a DUI).

Hugo vs. Competitors: Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $121 | $161 | $183 | $172 | |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Geico charges about $43 a month for drivers with a clean record and $71 monthy after an accident, while State Farm stays low at $47 and $57 per month, respectively.

While Hugo isn’t the cheapest, it offers the convenience of pay-as-you-go coverage that can be paused anytime, which may appeal to drivers who don’t own a car or don’t drive often.

How Credit Score Impacts Hugo Auto Insurance Rates

When compared to major companies, Hugo’s rates are lower across all credit levels. Drivers with excellent credit pay $88 per month, while those with good credit pay around $108 monthly.

Even drivers with fair credit pay close to $121, which is higher than the average rate but much cheaper than other insurance companies for drivers with bad credit.

Hugo vs. Competitors: Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $87 | $110 | $130 | $150 | |

| $62 | $105 | $125 | $145 |

| $76 | $115 | $135 | $155 | |

| $43 | $95 | $115 | $135 | |

| $88 | $108 | $121 | $128 | |

| $63 | $102 | $122 | $142 | |

| $56 | $98 | $118 | $138 | |

| $47 | $90 | $110 | $130 | |

| $53 | $112 | $132 | $152 | |

| $32 | $85 | $105 | $125 |

Geico and State Farm charge much less for drivers with excellent credit, with rates starting at $43 and $47 (Learn more: State Farm vs. Farmers, Geico, Progressive, & Allstate).

Hugo car insurance is worth considering if you have less-than-perfect credit, and its pay-as-you-go setup and no-upfront-cost policy make it a convenient choice for drivers who want flexibility without a long-term commitment.

Hugo Car Insurance Coverages

Hugo Insurance provides basic options for the most common problems on the road so you’re not stuck with big repair or replacement costs.

Liability auto insurance coverage helps if you cause damage or injury to others. Adding collision and comprehensive insurance for full coverage pays for repairs after an accident, theft, or bad weather.

Auto Insurance Coverage Options Offered by Hugo| Coverage | What it Covers |

|---|---|

| Liability | Injuries/damage you cause others |

| Collision | Damage to your car from a crash |

| Comprehensive | Theft or weather-related damage |

| Personal Injury Protection (PIP) | Medical bills and lost wages |

| Medical Payments (MedPay) | Medical costs after an accident |

| Uninsured Motorist | Injuries from uninsured drivers |

| Underinsured Motorist | Costs not covered by other driver |

Hugo Insurance full coverage does include PIP, MedPay, and UM/UIM add-ons, but only in states where it’s required. And it does not offer add-ons like rental reimbursement or roadside assistance.

Hugo car insurance isn’t like standard companies. It works best for drivers who barely drive and don’t want to commit to six- or twelve-month policies.

Hugo offers two main plans, unlimited basic and unlimited full, to fit different kinds of drivers. The unlimited basic plan is great if you drive most days and only need basic liability protection to meet state rules.

It has no upfront costs, flexible payments, and an auto reload option that keeps your policy active without extra effort. You’ll also get a coverage extension, giving you a few extra days to pay if needed.

Hugo vs. Competitors: Key Features to Compare| Feature |  | |||

|---|---|---|---|---|

| Earn Cash Rewards | ❌ | ✅ | ❌ | ✅ |

| Flexible Payments | ❌ | ✅ | ❌ | ❌ |

| Instant Insurance | ✅ | ✅ | ✅ | ✅ |

| Monitored Driving | ❌ | ❌ | ✅ | ✅ |

| No Down Payment | ❌ | ✅ | ❌ | ❌ |

| No Upfront Fees | ❌ | ✅ | ❌ | ❌ |

| Pay at Your Pace | ❌ | ✅ | ❌ | ❌ |

| Simple Daily Rate | ❌ | ✅ | ❌ | ❌ |

The unlimited full plan includes everything in the basic plan but adds full coverage that protects both your car and passengers. It also includes same-day claim payouts, giving drivers faster access to support after an accident.

Hugo’s system makes getting insured simple. It’s a Hugo no-deposit car insurance online option that gives instant proof of insurance and full control through your phone.

For drivers who value convenience, Hugo’s daily car insurance or Hugo pay-by-day insurance makes it possible to pay only for what you use, helping you save without giving up peace of mind.

Ways to Save on Hugo Auto Insurance

Hugo Insurance helps drivers spend less by letting them control when and how they pay for coverage. You only pay for the days you drive, which is perfect if you don’t use your car every day.

You can also save by raising your deductible, driving safely, and checking your policy to make sure it still fits your needs.

- Raise Your Deductible: Picking a higher insurance deductible can lower your monthly payment while keeping good coverage.

- Pause When Not Driving: Hugo’s pay-as-you-go setup lets you pause your plan and avoid paying when your car isn’t in use.

- Compare Prices Often: Look at your Hugo Insurance quote before renewal to make sure you’re still getting a fair rate.

- Drive Safely: Keeping a clean driving record helps you avoid higher costs.

- Check Your Policy: Review your coverage and drop extras you don’t need to save more, as a Hugo car insurance review suggests for keeping costs low and coverage simple.

These simple steps make it easy to manage your Hugo policy while keeping your insurance affordable.

The biggest savings come from safe driving and maintaining a good credit score by making insurance and other bill payments on time.

Hugo Insurance Reviews and Complaints

Hugo pay-as-you-go insurance reviews have earned positive feedback from both customers and industry rating agencies. Hugo Insurance BBB reviews rate the company an A-, reflecting strong business practices and customer service standards.

Consumer Reports also scores Hugo 96 out of 100, showing that most drivers are satisfied with the company’s affordability, convenience, and easy-to-manage policies.

Hugo Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A- Good Business Practices |

|

| Score: 96/100 Positive Customer Feedback |

|

| Score: 0.62 Fewer Complaints Than Avg. |

|

| Score: B+ Good Financial Strength |

The NAIC gives Hugo a 0.62 complaint score, showing fewer complaints than most insurers, and A.M. Best (B+) confirms the company’s good financial strength.

Many Hugo car insurance reviews and Hugo Insurance reviews on Reddit mention how easy it is to manage coverage or make changes anytime. It received a mix of professional praise and positive feedback from online communities.

Drivers on Reddit often highlight how easy it is to pause or restart their policy and appreciate that Hugo doesn’t lock them into long-term contracts, something many insurers won’t offer.

Many users recommend Hugo for its no-down-payment setup and instant activation, saying it’s perfect for people who need quick, short-term coverage. Check out our auto insurance guide for a better understanding before buying insurance.

Pros and Cons of Hugo Car Insurance

Hugo Insurance has gained attention for its flexible, pay-as-you-go system that gives drivers more control over when and how they pay for coverage.

It’s built for people who want simple, short-term protection without being tied to an annual contract. Many customers appreciate its convenience and fast sign-up process.

- Flexible Coverage: Drivers can pause or restart their policy anytime, which is great for those who don’t drive every day.

- Instant Activation: Coverage begins right after purchase, making it ideal for drivers who need proof of insurance fast.

- No Upfront Costs: Hugo doesn’t require a down payment, so you can start coverage without large upfront expenses.

However, like any insurer, Hugo has a few drawbacks that may not work for everyone. Its flexibility comes with higher costs for full coverage and limited availability in some states.

And according to Hugo Insurance claims reviews, customer service may not be as responsive compared to larger, more established companies.

- Higher Full Coverage Rates: Monthly costs are higher than most major insurers, especially for full coverage plans.

- Limited Availability: Hugo is still expanding, so it’s not yet available in all states.

While it’s not the cheapest auto insurance for full coverage, its flexibility and ease of use make it a strong option for part-time or gig drivers looking for simple and reliable insurance.

Hugo Insurance is a great choice for drivers who want quick, no-hassle protection they can manage on their own schedule, as long as it’s available in your state.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Compare Hugo Insurance Options Now

Hugo auto insurance is more expensive, starting at $121 per month, but it offers the freedom to pay only for the days you drive while still getting essential coverage like liability, comprehensive, and collision auto insurance protection.

Hugo pay-as-you-go car insurance is best for part-time or gig drivers who prefer short-term coverage without the hassle of upfront payments or long-term contracts.

Even though Hugo’s full coverage plans can be pricier than major insurers, its no-down-payment setup, instant activation, and pause-anytime feature make it stand out for convenience.

To find the most affordable policy for your needs, it’s always smart to compare rates from multiple companies. Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

Frequently Asked Questions

Is Hugo a valid insurance company?

Yes. Hugo is a licensed and legitimate insurance provider that offers flexible, pay-as-you-go auto coverage. It partners with trusted underwriters to ensure policies meet state insurance requirements. Learn how to compare auto insurance companies to see if it’s the right fit for you.

What kind of insurance is Hugo Insurance?

Hugo is a no-down-payment car insurance company that offers pay-as-you-go policies with no upfront fees that allow drivers to pay only for the days they drive and pause coverage when they aren’t using it.

Is Hugo Insurance full coverage?

Yes. Hugo offers both minimum liability and full coverage options, which can include collision, comprehensive, and uninsured motorist protection, depending on your state and plan selection.

Is the Hugo Insurance app safe?

Yes. The Hugo app is secure and uses encryption to protect your personal and payment information. It allows drivers to manage, pause, or reactivate coverage instantly and safely.

Is Hugo cheaper than traditional insurance?

It depends on your driving habits. Hugo is often cheaper for drivers who don’t use their car every day, while traditional policies may be more cost-effective for people who drive regularly. Compare multiple auto insurance quotes in order to find the best company based on your specific needs.

Which insurance company has the most complaints?

According to NAIC data, larger companies like Allstate and Liberty Mutual tend to receive more complaints, while Hugo’s 0.62 complaint index is well below the national average, showing strong customer satisfaction.

What company owns Hugo Insurance?

Hugo operates independently and issues coverage through licensed insurance partners. It manages customer service and policy tools directly through its digital platform.

Does Hugo car insurance have a grace period?

No. Since Hugo is a pay-as-you-go insurer, there is no traditional grace period. Coverage is only active on the days you’ve paid for, so payments must be kept current to stay protected. Browse more insights about the hacks to save money on auto insurance.

Where is Hugo Insurance available?

Hugo is available in 16 states and continues to expand. Drivers in areas not yet covered can join a waitlist to be notified when Hugo auto insurance becomes available.

Who should consider using Hugo car insurance?

Hugo is best for part-time, gig, or seasonal drivers who want short-term coverage they can pause or adjust anytime. It’s also helpful for those who prefer not to commit to long-term contracts. Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

What are the pros and cons of Hugo Insurance?

How does Hugo handle claims?

Does Hugo Insurance cover motorcycles?

How much does Hugo Insurance cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.