Colonial Life Insurance Review for 2026

Colonial Life insurance starts at $15 monthly for employees with pre-tax payroll, offering orthodontic rider savings and unique workplace benefits. This Colonial Life insurance review helps you compare lump-sum cancer and critical illness insurance with payouts reaching up to $10,000 per covered diagnosis.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated September 2025

Our Colonial Life insurance review found this workplace-focused provider helps employees enhance financial security through supplemental benefit plans.

Colonial Life Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 3.8 |

| Insurance Cost | 2.6 |

| Plan Personalization | 3.5 |

| Policy Options | 3.5 |

| Savings Potential | 3.6 |

As a subsidiary of Unum, Colonial Life offers accident, cancer, and critical illness policies designed to support gaps in traditional health coverage. Learn what unique coverage fits you best with the life insurance guide online.

Employees gain access through their employers and can enroll using electronic tools with pre-tax payroll deductions. With optional features like orthodontic dental riders and lump-sum payouts for major diagnoses, Colonial Life delivers targeted solutions for workers managing unexpected health events.

- Colonial Life insurance offers tiered hospital cash benefits

- Part-time workers may qualify based on the employer plan setup

- 24/7 mobile access to claims, policy forms, and account tools

Learn how Colonial Life insurance supports workplace benefits by entering your ZIP code into our free quote comparison tool.

Colonial Life Insurance Rates

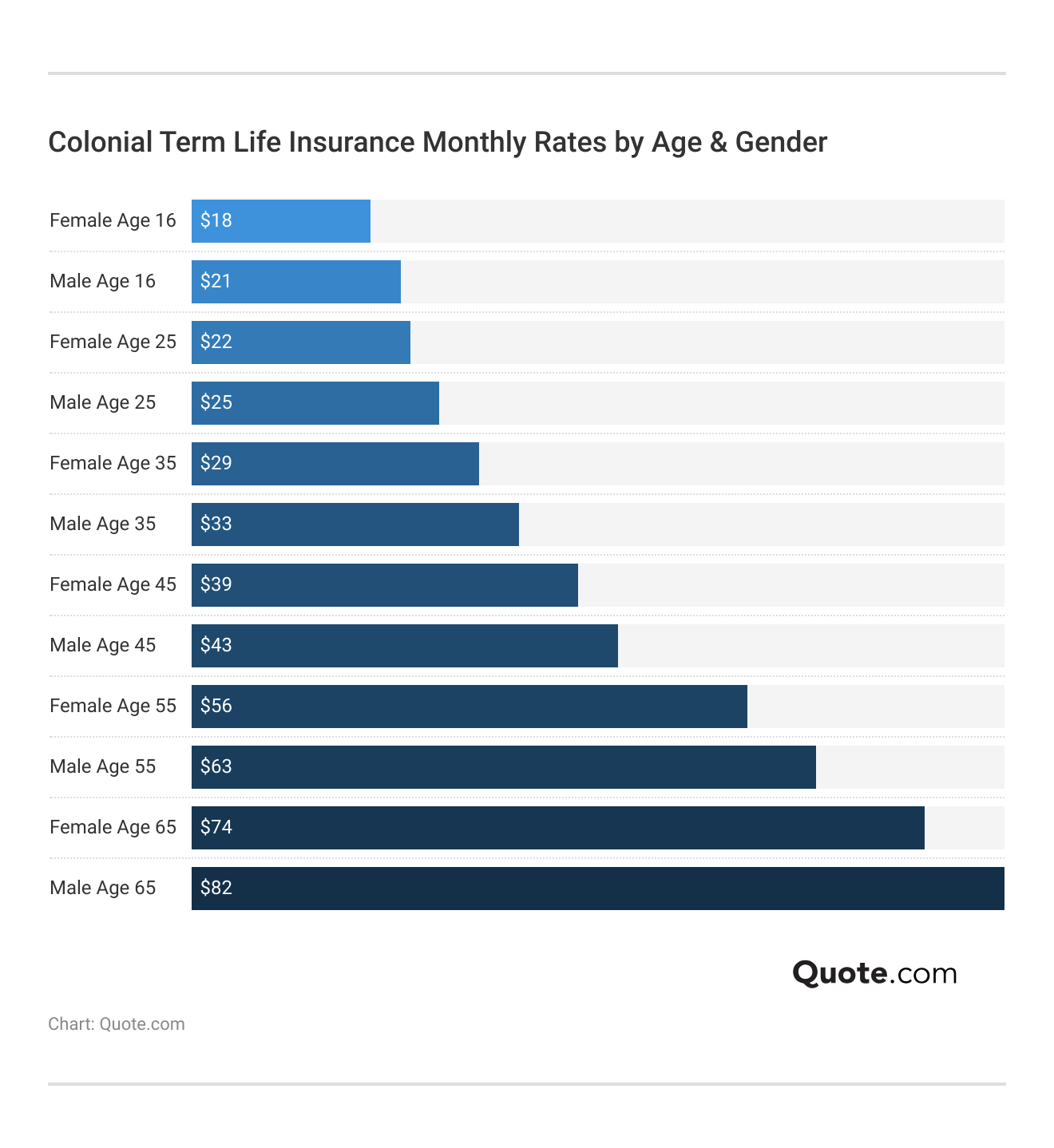

Colonial Life insurance company offers monthly rates that are affordable and vary depending on age and gender. The premiums begin at $15 for 20-year-old females and at $18 for 20-year-old males.

As people age, the cost increases gradually. At age 60, females pay $75 and males pay $90 each month. These plans provided by employers help workers manage costs for serious illnesses and other special benefits at the workplace. The pricing is straightforward, showing how both age and gender affect the expenses.

Colonial Life shows strong competition with the best insurers concerning monthly costs. For term policies at Colonial Life, they average $39. This rate is a bit more than Transamerica’s, which averages about $30, but it is still cheaper when compared to New York Life, where the average is around $40.

Colonial Life vs. Top Competitors: Life Insurance Monthly Rates| Company | Term Policy | Whole Policy |

|---|---|---|

| $32 | $390 |

| $39 | $375 | |

| $36 | $455 | |

| $31 | $425 | |

| $34 | $410 | |

| $40 | $465 | |

| $39 | $475 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

Whole policies cost $375, which is cheaper than Guardian Life’s at $455 and New York Life’s at $465. This shows that Colonial Life offers competitive prices along with additional benefits for the workplace. Because of this, it becomes a nice option for workers who want both value and additional perks.

Colonial Life adjusts your monthly costs based on specific health risk factors. For term life insurance, the rates begin at $45 if there are no medical problems but go up to $102 for people who use tobacco and $115 for those with heart disease.

Colonial Life Insurance Monthly Rates by Health Risk Factor| Risk Factor | Term Policy | Whole Policy |

|---|---|---|

| No Medical Issues | $45 | $125 |

| Age 60+ | $92 | $198 |

| Asthma | $58 | $135 |

| Heart Disease | $115 | $245 |

| High Blood Pressure | $65 | $145 |

| High Cholesterol | $60 | $138 |

| Obesity | $72 | $158 |

| Type 2 Diabetes | $88 | $190 |

| Tobacco User | $102 | $225 |

Entire policies follow a similar pattern, rising from $125 to $245. If you have diabetes or high blood pressure, each condition significantly impacts the cost of your policy, making health a crucial factor in determining your final rate.

These clear levels make it easier for workers to plan their budget correctly regarding workplace benefits that relate directly to their health situation.

Read more: Whole vs. Term Life Insurance

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Colonial Life Insurance Coverage Options

Colonial Life offers a range of supplemental insurance products designed to fill gaps in regular health coverage for workers. These plans can be obtained through programs sponsored by employers and aim to give specific financial help during health-related situations. Below are the major insurance products for which Colonial Life specializes.

- Accident Insurance: Gives advantages for medical costs, accommodation, and lost earnings after covered injuries like broken bones, dislocated joints, or surgeries that happen outside of work.

- Cancer Insurance: Gives one-time payments to help with expenses such as childcare, lost wages, and travel during cancer treatment. Also provides some preventative screenings.

- Critical Illness Insurance: Gives up to $10,000 for each diagnosis of serious conditions like heart attack, stroke, or major organ failure.

- Hospital Confinement Indemnity Insurance: Gives a set amount of money for hospital stays, outpatient surgeries, or diagnostic tests to help cover high deductibles or surprise hospital expenses.

- Disability Insurance: Provides a portion of the salary when a worker is unable to perform their job due to an illness or injury unrelated to work.

These special plans enable employees to select the level of additional support they desire in conjunction with their primary medical coverage. Find out what permanent life insurance is as you evaluate Colonial’s critical illness plans.

By providing these specific Colonial Life benefits, workers can maintain their financial stability in the event of unforeseen health issues. At the same time, it gives employers a competitive advantage in offering attractive benefits packages.

Colonial Life Insurance Reviews: What Customers Say

Colonial Life insurance gets good grades for financial strength but mixed reviews from customers. A.M. Best gives it a strong A rating, meaning it’s trusted to pay claims reliably.

Colonial Life Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: 65/100 Below Average Satisfaction |

|

| Score: 1.83 More Complaints Than Avg. |

But when we check Colonial Life insurance reviews on Consumer Reports, they have a satisfaction score of 65 out of 100. Customers mention their experience is not so good, giving it a 1.83 rating. There are also more complaints than usual when compared to other companies. This demonstrates that it is crucial to consider both financial stability and customer service issues with care.

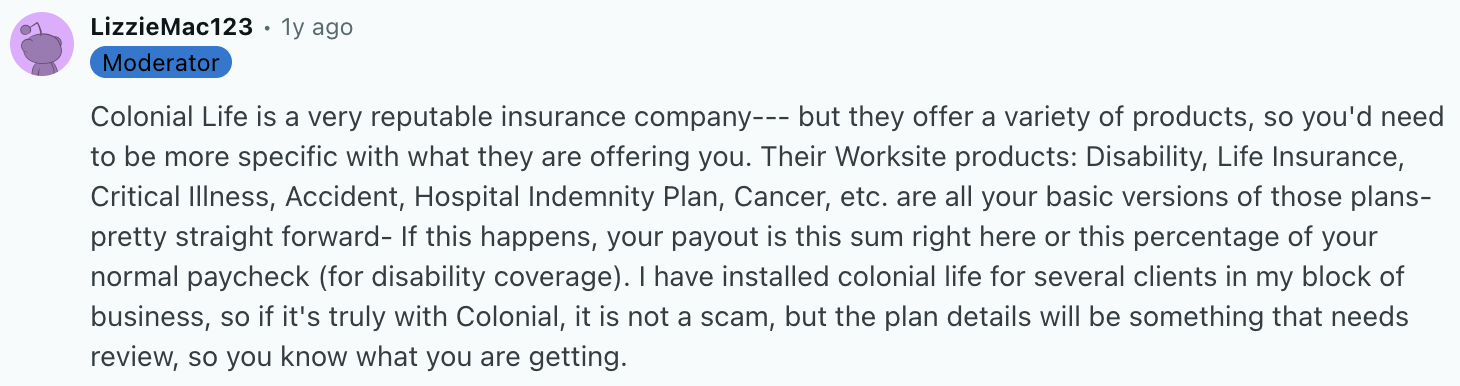

This review of Colonial Life insurance on Reddit speaks highly of a well-known insurance company. They offer standard workplace products, including disability, accident, and hospital indemnity plans. The post emphasizes the importance of reviewing the specific plan details to understand the coverage you receive.

Discover more by reading our guide: What is a life insurance beneficiary?

How to Save on Colonial Life Insurance

If you think about getting Colonial Life insurance at your job, there are useful methods to save money and get the most from your benefits. These tactics can help reduce your monthly payment or offer extra value with optional add-ons and package deals. Understanding what each coverage entails can lead to smarter decisions.

- Accident Insurance: Gives one-time payments for injuries like broken bones, burns, and dislocated joints. It helps cover costs that regular health insurance might not cover.

- Critical Illness Insurance: Provides up to $10,000 for each covered diagnosis, such as cancer, heart attack, or stroke.

- Cancer Insurance: Covers treatments such as chemotherapy, radiation, and hospital stays.

- Hospital Indemnity Insurance: Provides daily cash benefits while you are in the hospital, including the ICU.

- Disability Insurance: It provides a portion of a worker’s salary for those unable to work due to illness or injury. Colonial Life offers both short-term and long-term options.

Here are a few more opportunities to unlock even greater savings:

- Dental Insurance with Orthodontic Rider: Gives coverage for regular cleanings, X-rays, and braces services. This optional addition is ideal for families with children.

- Multi-Policy Discount Program: Workers who sign up for multiple policies, such as accident and cancer insurance, can receive a discount of up to 25% on their total premiums.

- Pre-Tax Payroll Deduction Option: Allows premiums to be taken out before taxes, which makes your taxable income lower.

- Guaranteed Issue Enrollment Periods: Colonial Life sometimes skips medical exams when you first sign up. Taking this opportunity means you can get coverage without paying more.

- Wellness Benefit Rider: Gives yearly payments for finishing certain preventive health checks, like mammograms or blood tests.

By carefully selecting plans that fit your needs and signing up at the right times, Colonial Life insurance can give you good extra protection without costing too much. Compare what a life insurance annuity is with Colonial Life’s workplace benefit protections.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decide if You Should Choose Colonial Life

Selecting the right employee benefits is crucial for attracting and retaining top talent, as well as ensuring they feel secure about their financial well-being. But choosing these benefits can seem hard. Studies show that worry about money makes employees less productive than taking sick days, highlighting the need for good benefits. See what single premium life insurance entails and how Colonial Life policies differ.

Colonial Life offers up to 25% premium discounts for multi-policy enrollment. For example, combining accident and cancer plans lowers costs.

Melanie Musson Published Insurance Expert

Founded in 1937, now part of the Fortune 500 company Unum, Colonial Life & Accident Insurance Company offers a range of life and supplemental insurance plans through employer-sponsored programs. With more than 10,000 agencies, approximately 1,000 home office staff members, and serving around 3 million clients from over 80,000 companies, Colonial continues to provide dependable coverage to businesses and their employees.

Colonial Life and Accident offers a range of life insurance and supplemental insurance policies that may be appealing to some consumers, along with the option to deduct those premiums from an employee’s pre-tax income.

Though Colonial Life has some negative reviews online, it appears to have no major red flags on its record. One major downside is the lack of online rate quotes, so we advise consumers to do some comparison shopping to ensure that Colonial Life truly offers the best rate. Explore Colonial Life insurance benefits today by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Can I borrow from my Colonial Life insurance policy?

Colonial Life insurance policies generally do not include a loan feature, as most are term or supplemental workplace plans that do not build cash value to borrow against. Understand what is universal life insurance and see how it combines coverage with cash value.

What does the Colonial Life Accident Insurance payout chart show employees?

The Colonial Life Accident Insurance payout chart displays employees’ exact benefit amounts for covered injuries, including burns, fractures, and dislocations, clarifying claim expectations.

What does Colonial Life Supplemental Insurance include for workers?

Colonial Supplemental Insurance offers benefits such as accident, cancer, critical illness, hospital confinement, and disability plans that help workers cover expenses beyond those covered by standard medical insurance. Explore Colonial Life insurance plans by entering your ZIP code into our free quote comparison tool.

What are the pros and cons of Colonial Life Insurance plans?

Colonial Life Insurance plans offer guaranteed acceptance life insurance with level monthly premiums and no medical exams, but with lower benefits, higher senior rates, and fewer flexible options compared to traditional policies.

What does Colonial Life Disability Insurance provide through employers?

Colonial Disability Insurance provides a portion of lost wages to employees who are unable to work due to illness or injury, offering customizable short-term or long-term options through employer payroll deduction. Explore comparing plans and getting an insurance plan that works for you with Colonial Life benefits.

What does Colonial Mutual Income Protection Insurance offer policyholders?

Colonial Mutual Income Protection Insurance provides policyholders with monthly income replacement when illness or injury prevents them from working, helping households stay financially secure during their recovery.

What do Colonial Life review complaints typically mention?

Colonial Life reviews frequently mention claim delays or denials, as well as issues with customer service. However, the company maintains strong financial ratings and offers clear plan details to minimize misunderstandings.

Is Colonial Life a pyramid scheme?

Colonial Life is not a pyramid scheme; it is a legitimate insurance provider, owned by Unum, offering employer-sponsored benefits and regulated insurance products nationwide.

What do Colonial Life employee reviews highlight?

Colonial Life employee reviews highlight flexible schedules and competitive commissions for agents, but also note high turnover and challenging sales quotas in some markets. Discover how the worst states for filing auto insurance claims disrupt the market.

What do Colonial Life health insurance reviews focus on?

Colonial Health Insurance reviews primarily focus on supplemental benefits, including hospital confinement and critical illness coverage, which help offset medical costs rather than replace primary health insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How does the Colonial Life login portal work?

Colonial Life insurance policies generally do not include a loan feature, as most are term or supplemental workplace plans that do not build cash value to borrow against. Understand what is universal life insurance and see how it combines coverage with cash value.

The Colonial Life Accident Insurance payout chart displays employees’ exact benefit amounts for covered injuries, including burns, fractures, and dislocations, clarifying claim expectations.

What does Colonial Life Supplemental Insurance include for workers?

Colonial Supplemental Insurance offers benefits such as accident, cancer, critical illness, hospital confinement, and disability plans that help workers cover expenses beyond those covered by standard medical insurance. Explore Colonial Life insurance plans by entering your ZIP code into our free quote comparison tool.

What are the pros and cons of Colonial Life Insurance plans?

Colonial Life Insurance plans offer guaranteed acceptance life insurance with level monthly premiums and no medical exams, but with lower benefits, higher senior rates, and fewer flexible options compared to traditional policies.

What does Colonial Life Disability Insurance provide through employers?

Colonial Disability Insurance provides a portion of lost wages to employees who are unable to work due to illness or injury, offering customizable short-term or long-term options through employer payroll deduction. Explore comparing plans and getting an insurance plan that works for you with Colonial Life benefits.

What does Colonial Mutual Income Protection Insurance offer policyholders?

Colonial Mutual Income Protection Insurance provides policyholders with monthly income replacement when illness or injury prevents them from working, helping households stay financially secure during their recovery.

What do Colonial Life review complaints typically mention?

Colonial Life reviews frequently mention claim delays or denials, as well as issues with customer service. However, the company maintains strong financial ratings and offers clear plan details to minimize misunderstandings.

Is Colonial Life a pyramid scheme?

Colonial Life is not a pyramid scheme; it is a legitimate insurance provider, owned by Unum, offering employer-sponsored benefits and regulated insurance products nationwide.

What do Colonial Life employee reviews highlight?

Colonial Life employee reviews highlight flexible schedules and competitive commissions for agents, but also note high turnover and challenging sales quotas in some markets. Discover how the worst states for filing auto insurance claims disrupt the market.

What do Colonial Life health insurance reviews focus on?

Colonial Health Insurance reviews primarily focus on supplemental benefits, including hospital confinement and critical illness coverage, which help offset medical costs rather than replace primary health insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How does the Colonial Life login portal work?

Colonial Supplemental Insurance offers benefits such as accident, cancer, critical illness, hospital confinement, and disability plans that help workers cover expenses beyond those covered by standard medical insurance. Explore Colonial Life insurance plans by entering your ZIP code into our free quote comparison tool.

Colonial Life Insurance plans offer guaranteed acceptance life insurance with level monthly premiums and no medical exams, but with lower benefits, higher senior rates, and fewer flexible options compared to traditional policies.

What does Colonial Life Disability Insurance provide through employers?

Colonial Disability Insurance provides a portion of lost wages to employees who are unable to work due to illness or injury, offering customizable short-term or long-term options through employer payroll deduction. Explore comparing plans and getting an insurance plan that works for you with Colonial Life benefits.

What does Colonial Mutual Income Protection Insurance offer policyholders?

Colonial Mutual Income Protection Insurance provides policyholders with monthly income replacement when illness or injury prevents them from working, helping households stay financially secure during their recovery.

What do Colonial Life review complaints typically mention?

Colonial Life reviews frequently mention claim delays or denials, as well as issues with customer service. However, the company maintains strong financial ratings and offers clear plan details to minimize misunderstandings.

Is Colonial Life a pyramid scheme?

Colonial Life is not a pyramid scheme; it is a legitimate insurance provider, owned by Unum, offering employer-sponsored benefits and regulated insurance products nationwide.

What do Colonial Life employee reviews highlight?

Colonial Life employee reviews highlight flexible schedules and competitive commissions for agents, but also note high turnover and challenging sales quotas in some markets. Discover how the worst states for filing auto insurance claims disrupt the market.

What do Colonial Life health insurance reviews focus on?

Colonial Health Insurance reviews primarily focus on supplemental benefits, including hospital confinement and critical illness coverage, which help offset medical costs rather than replace primary health insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How does the Colonial Life login portal work?

Colonial Disability Insurance provides a portion of lost wages to employees who are unable to work due to illness or injury, offering customizable short-term or long-term options through employer payroll deduction. Explore comparing plans and getting an insurance plan that works for you with Colonial Life benefits.

Colonial Mutual Income Protection Insurance provides policyholders with monthly income replacement when illness or injury prevents them from working, helping households stay financially secure during their recovery.

What do Colonial Life review complaints typically mention?

Colonial Life reviews frequently mention claim delays or denials, as well as issues with customer service. However, the company maintains strong financial ratings and offers clear plan details to minimize misunderstandings.

Is Colonial Life a pyramid scheme?

Colonial Life is not a pyramid scheme; it is a legitimate insurance provider, owned by Unum, offering employer-sponsored benefits and regulated insurance products nationwide.

What do Colonial Life employee reviews highlight?

Colonial Life employee reviews highlight flexible schedules and competitive commissions for agents, but also note high turnover and challenging sales quotas in some markets. Discover how the worst states for filing auto insurance claims disrupt the market.

What do Colonial Life health insurance reviews focus on?

Colonial Health Insurance reviews primarily focus on supplemental benefits, including hospital confinement and critical illness coverage, which help offset medical costs rather than replace primary health insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How does the Colonial Life login portal work?

Colonial Life reviews frequently mention claim delays or denials, as well as issues with customer service. However, the company maintains strong financial ratings and offers clear plan details to minimize misunderstandings.

Colonial Life is not a pyramid scheme; it is a legitimate insurance provider, owned by Unum, offering employer-sponsored benefits and regulated insurance products nationwide.

What do Colonial Life employee reviews highlight?

Colonial Life employee reviews highlight flexible schedules and competitive commissions for agents, but also note high turnover and challenging sales quotas in some markets. Discover how the worst states for filing auto insurance claims disrupt the market.

What do Colonial Life health insurance reviews focus on?

Colonial Health Insurance reviews primarily focus on supplemental benefits, including hospital confinement and critical illness coverage, which help offset medical costs rather than replace primary health insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How does the Colonial Life login portal work?

Colonial Life employee reviews highlight flexible schedules and competitive commissions for agents, but also note high turnover and challenging sales quotas in some markets. Discover how the worst states for filing auto insurance claims disrupt the market.

Colonial Health Insurance reviews primarily focus on supplemental benefits, including hospital confinement and critical illness coverage, which help offset medical costs rather than replace primary health insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How does the Colonial Life login portal work?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.