GAINSCO Auto Insurance Review for 2026

This GAINSCO auto insurance review explains how $64 monthly rates serve high-risk drivers needing affordable minimum liability coverage fast. GAINSCO Auto Insurance specializes in high-risk drivers and SR-22 coverage and has been owned by State Farm since acquiring the company in 2020.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated November 2025

Explore our GAINSCO auto insurance review to see how it supports high-risk drivers who need SR-22 coverage without the high cost.

GAINSCO Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.0 |

| Business Reviews | 3.0 |

| Claim Processing | 1.8 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.9 |

| Coverage Value | 2.9 |

| Customer Satisfaction | 1.3 |

| Digital Experience | 3.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 3.0 |

| Policy Options | 2.8 |

| Savings Potential | 4.0 |

Plans start at $64 per month, and policyholders can manage everything through GAINSCO’s mobile app. You can qualify for up to 30% in upfront savings with flexible payment options.

Since 2020, the company has operated under State Farm, bringing added stability to its streamlined coverage.

- Gainsco customers access a mobile app for account and policy management

- Non-owner liability coverage is available for drivers without a personal car

- Policies can include rental car reimbursement under specific coverages

See better options to buy auto insurance from GAINSCO Auto Insurance when you use our free comparison tool to compare plans.

Comparing GAINSCO Auto Insurance Rates

Ever wonder why your GAINSCO Auto Insurance rates change so much as you age? Age and gender heavily influence what you’ll pay, making it easier to plan your budget once you understand how those factors work.

If you’re 16, it’s no shock your rates are sky‑high — $298 a month for guys and $251 for girls — because teens are seen as the riskiest drivers. By the time you hit 25, your premium drops significantly because insurers trust your experience more. In your 50s and 60s, rates level out around $65–$70 a month, which is a relief if you’re on a tighter budget.

Just like age and gender play a big role in what you pay, your driving history is just as important. A clean record keeps your monthly minimum around $72. But one ticket adds over $10 more each month, and an accident can push your rate even higher.

GAINSCO vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $72 | $96 | $138 | $84 |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

A DUI is where things sting — your minimum premium nearly doubles, and full coverage skyrockets past $350 a month. That kind of jump can throw off any budget, which is why staying cautious behind the wheel saves you big in the long run.

A single DUI can more than double your GAINSCO minimum premium to $138, so avoiding serious violations is crucial for your budget.

Michelle Robbins Licensed Insurance Agent

And it’s not just your driving history that affects your rates — the company you pick matters just as much. GAINSCO lands at $72 a month for minimum coverage, which beats out Farmers and Liberty Mutual but doesn’t quite undercut Geico or USAA.

GAINSCO vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $72 | $178 |

| $43 | $114 | |

| $96 | $248 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Full coverage tells a similar story — $178 isn’t the cheapest, but it’s far from the most expensive.

If you’ve had trouble getting those super-low rates elsewhere, GAINSCO is a solid middle-ground choice that keeps you insured without breaking the bank.

They also make it easy to bundle auto insurance for multiple vehicles, saving you money and simplifying your policy. It’s all about finding the coverage that works best for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best GAINSCO Auto Insurance Discounts

GAINSCO Auto Insurance discounts are more than just numbers — they’re designed to make your coverage feel like the cheapest car insurance possible while rewarding smart choices. Many GAINSCO reviews even mention how these discounts make a noticeable difference in keeping costs low.

GAINSCO Auto Insurance Discounts| Discount |  |

|---|---|

| Advance Shopping | 10% |

| AutoPay | 10% |

| Bundling | 15% |

| Good Student | 10% |

| Homeowner | 10% |

| Military | 10% |

| Multi-Vehicle | 10% |

| Pay-in-Full | 10% |

| Prior Coverage | 10% |

| Renewal | 10% |

Bundling home and auto insurance gives you the biggest break at 15%, which is great if you’re already paying for both and want to consolidate your separate bills. The 10% good student discount helps families save on one of the most expensive drivers to insure — teens — by rewarding good grades.

Choosing AutoPay or paying in full knocks 10% off and eliminates the worry of late fees or missed payments. Even sticking with GAINSCO, Inc. pays off with a 10% loyalty discount, which not only saves you now but helps keep your rates lower in the future by showing continuous coverage.

GAINSCO Auto Insurance Coverage Options

GAINSCO car insurance gives you plenty of ways to protect yourself, your car, and your finances when things don’t go as planned. Each coverage option is built around real-life situations drivers encounter, including a unique service that makes auto insurance for high-risk drivers more accessible.

GAINSCO Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Liability | Others’ injuries or damage when at fault |

| Collision | Your car damage after a crash |

| Comprehensive | Theft, fire, weather, vandalism |

| Uninsured/Underinsured Motorist (UM/UIM) | Losses from drivers with little or no insurance |

| Medical Payments (MedPay) | Medical bills for you and passengers |

| Personal Injury Protection (PIP) | Medical bills and lost wages |

| Rental Reimbursement | Rental car costs after a claim |

| Roadside Assistance | Towing, jump-start, breakdown services |

| SR-22 | Proof of insurance for high-risk drivers |

Every policy starts with liability coverage, which takes care of the other driver’s medical bills and property damage if you’re at fault, so you’re not left paying out of pocket.

Collision coverage helps repair your car after a crash, even if you were at fault or struck an object, such as a pole or guardrail.

Comprehensive kicks in for things that aren’t accident-related, like if your car gets stolen, keyed, or hit by a storm.

If you’re hit by someone with no insurance or not enough, uninsured and underinsured motorist coverage makes sure your costs are covered. MedPay and PIP help with medical bills and lost wages for you and your passengers, no matter who’s at fault.

You can add extras like rental coverage and roadside assistance to make dealing with breakdowns and repairs a whole lot easier. One standout feature is GAINSCO’s SR‑22 filing service, which helps high‑risk drivers file proof of insurance with the state and stays legal without the headache.

How GAINSCO Makes Managing Your Policy Easier

GAINSCO Auto Insurance makes it easy to stay on top of your policy—whether you’re making a payment, filing an auto insurance claim, or even canceling your coverage. Their process is built around everyday convenience, with support always available through customer service at the GAINSCO insurance phone number, 1‑866‑GAINSCO.

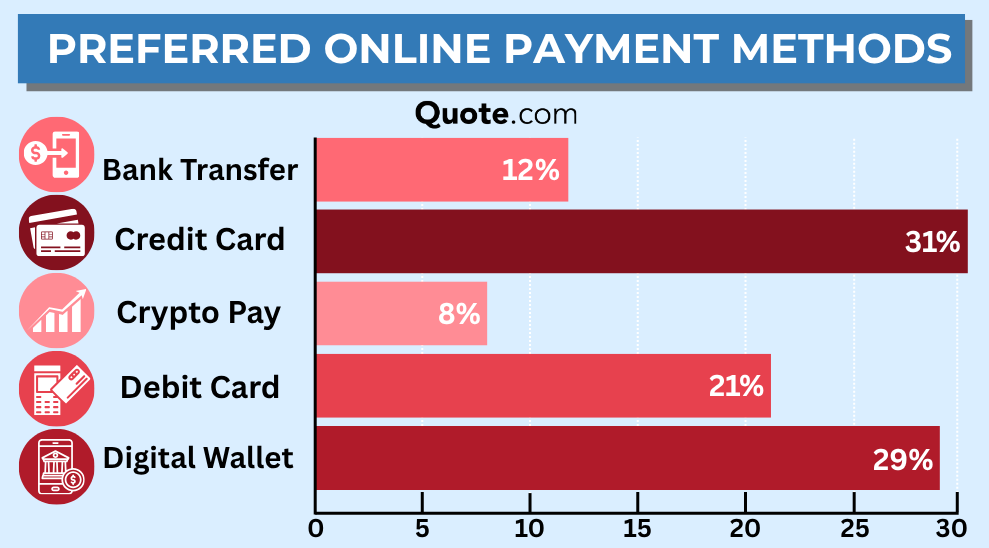

You have four simple ways to pay your GAINSCO bill. Call 1‑866‑GAINSCO between 8 a.m. and 8 p.m. Central to pay by debit or credit card. You can also mail a check or money order, pay online anytime, or visit your agent’s office to pay in person with cash, check, or card.

To make things even easier, call customer service to set up automatic payments so your bill is handled on time every month automatically.

Filing a claim with GAINSCO is simple. Call the GAINSCO insurance claims number, 1‑866‑GAINSCO, on weekdays to speak with a bilingual agent who’ll walk you through it. After hours, leave a message for a callback the next day.

Use the free Quick Estimate app to upload photos, get an estimate, and track your claim. Alternatively, you can log in to the online portal at any time to check the status and manage your policy.

Canceling your policy is simple. Just send a signed and dated request, and you’ll get a credit for any unused premium. Keep a copy for your records, just in case. According to GAINSCO insurance reviews, customers appreciate how straightforward and hassle‑free the cancellation process is compared to other insurers.

Even after being acquired by State Farm for $400 million, GAINSCO has kept its independent focus while benefiting from the strength of a larger company behind it.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on GAINSCO Auto Insurance

GAINSCO offers numerous discounts, but there are also smart hacks to save even more money on car insurance beyond the usual deals. With a few simple choices, you can keep your costs low while still getting the coverage you need.

- Go With State-Minimum Liability: GAINSCO specializes in affordable liability auto insurance, so sticking with just what your state requires is the cheapest option.

- Skip SR‑22 if You Don’t Need It: If you’re not legally required to carry an SR‑22, you can avoid paying extra for that filing service.

- Drop Extras You Already Have: If you already have roadside assistance or rental coverage elsewhere, removing those add-ons from your GAINSCO policy helps keep your bill down.

- Pay Online or Set Up AutoPay: A GAINSCO payment made through their website or with AutoPay skips late fees and keeps things running smoothly each month.

- Keep Your Coverage Active: GAINSCO rewards drivers who renew on time and maintain continuous coverage, so you don’t risk paying more after a gap.

These tips go beyond standard discounts and help you save by tailoring your policy to your actual needs. It’s always worth requesting a GAINSCO quote and speaking with an agent to see how much more you can save by adjusting your coverage.

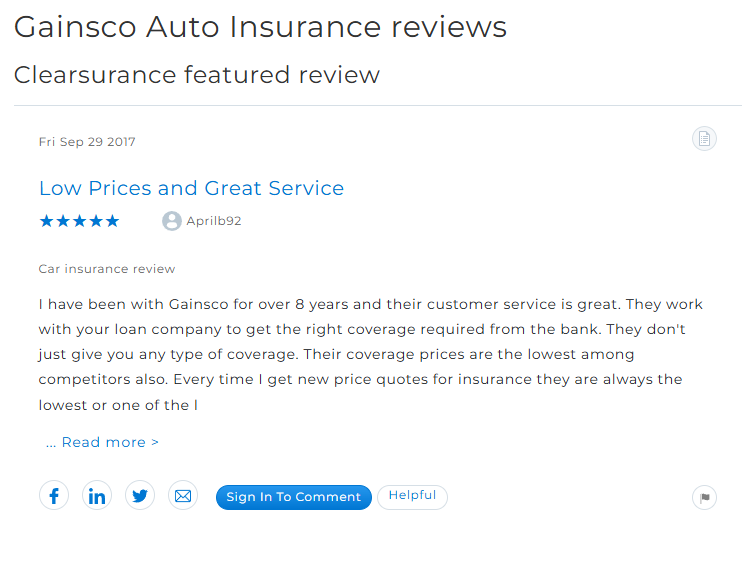

Customer Reviews and Ratings: GAINSCO Auto Insurance

Here’s what the ratings say about GAINSCO Auto Insurance and what they mean for you. Each score highlights a different aspect of the experience, serving as a quick guide to auto insurance and helping you decide if GAINSCO is the right fit.

GAINSCO Insurance Business Ratings and Consumer Reviews| Agency | |

|---|---|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.20 Avg. Complaints |

|

| Score: A- Excellent Financial Strength |

A J.D. Power score of 790 indicates that most customers are generally satisfied, although some mention that claims can take longer than expected. The BBB gives GAINSCO a B, which means they handle things fairly but do have some complaints that haven’t been resolved.

Consumer Reports gives them a 68, so your experience may depend significantly on the local agent you work with.

When comparing GAINSCO reviews and complaints, their complaint index is 1.20, which is just above average. Also, an A- from A.M. Best shows they have the financial strength to back up their promises when it counts.

One customer review reinforces this, saying GAINSCO kept their rates among the lowest for over eight years while delivering great service.

They also appreciated how GAINSCO worked directly with their loan company to make sure the coverage met specific requirements — something not all insurers take the time to do. It’s that kind of personal touch and affordability that keeps people sticking with them year after year.

Pros and Cons of GAINSCO Auto Insurance

GAINSCO Auto Insurance is a good pick if you want affordable liability coverage and some extra help staying on top of state requirements, especially if you’re a high‑risk driver. It has a few unique perks that set it apart, although there are also some downsides to consider.

- Dedicated SR‑22 Filing: GAINSCO handles SR‑22 filings for high‑risk drivers directly with the state, saving you time and making sure you stay compliant without extra hassle or fees.

- Bilingual Claims Support: Customer service and claims teams speak both English and Spanish, making it easier for more drivers to get help when they need it.

- 44-State Availability: GAINSCO is licensed in 44 states, plus D.C., providing high-risk and budget-focused drivers with access to liability auto insurance, even in markets where many insurers won’t write policies.

That said, GAINSCO Insurance Company does have some limitations you should consider before signing up.

- Limited Optional Coverages: There are no premium options, such as gap insurance or umbrella liability, which could leave you more exposed in serious situations.

- Above-Average Complaint Index: According to NAIC data, GAINSCO has a complaint ratio of 1.20, which is slightly higher than the average, reflecting some customer frustration with how claims are handled.

If you’re mainly focused on meeting state requirements with low‑cost liability auto insurance, GAINSCO has a lot to offer — just know it’s not built for drivers who want full‑service coverage or advanced add‑ons. To see how much you might save, it’s worth requesting a GAINSCO insurance quote to compare your options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find Affordable Coverage With GAINSCO Auto Insurance

GAINSCO offers affordable auto insurance designed for drivers who need straightforward, state‑compliant coverage at a low price. One advantage is the presence of independent agents who help tailor liability limits, while a drawback is the lack of advanced online tools.

Drivers who prefer personal guidance and minimal policies tend to benefit the most. Their reach across 44 states also sets them apart. To lower your GAINSCO premium, consider raising your deductible to cut monthly costs and avoid filing minor claims that could increase rates.

Improving your driving record over time can also help reduce your insurance premiums. You can also request GAINSCO insurance quotes directly from an agent or online to see how different options affect your rate.

Use the GAINSCO insurance login to manage your policy, view coverage, and make payments online. Use our quote tool to compare multiple auto insurance quotes and find your best rate in minutes.

Frequently Asked Questions

What insurance company is GAINSCO affiliated with?

GAINSCO is backed by State Farm, which acquired the company in 2020 to expand coverage options for high-risk drivers, especially those needing SR‑22 filings.

How much is GAINSCO auto insurance?

GAINSCO rates start at about $64 a month for basic coverage, but what you pay depends on things like your driving history, age, and where you live.

Is GAINSCO legit?

Yes, GAINSCO is legit. They’ve been in business since 1978, operating in 44 states plus D.C., and are backed by State Farm, which acquired them for $400 million.

According to a recent State Farm auto insurance review, this acquisition strengthened GAINSCO’s financial position and customer confidence. They also hold an A rating from A.M. Best, indicating strong financial stability.

Is GAINSCO a good insurance company?

Yes, Gainsco auto insurance is a solid option if you’re a high-risk driver seeking state-minimum liability coverage at affordable monthly rates. Many customers choose it for SR-22 filings and bilingual claims support, though it lacks full coverage options.

Does GAINSCO cover windshield replacement?

Gainsco does not include windshield replacement in its standard liability plans. To cover glass damage, you’ll need to add comprehensive coverage, which pays for windshield repair or replacement from theft, weather, or debris.

What states allow GAINSCO?

Gainsco is licensed in 44 states plus D.C., with a strong presence in Texas, Florida, Georgia, South Carolina, and Virginia. As one of the notable auto insurance companies in Texas, Gainsco is a popular choice for high-risk drivers looking for affordable liability coverage. Availability may vary, so please check with an agent in your ZIP code to confirm eligibility.

How do I file a claim with GAINSCO?

You can call the Gainsco insurance claims number at 1‑866‑GAINSCO Monday through Friday from 7 to 7 Central, or just use the Quick Estimate app to snap some photos, get a fast estimate, and keep track of your claim online.

Does GAINSCO offer roadside assistance?

You can definitely add roadside assistance to your policy. It covers things like towing, jump-starts, fuel delivery, and even lockouts for just a small extra monthly fee.

Is there a grace period for GAINSCO insurance?

Yes, Gainsco provides a short grace period—typically 7–10 days—if you miss a payment before canceling your policy. Keep in mind that what happens if you cancel auto insurance is that you could face fines, a lapse in coverage, or even license suspension, depending on your state.

Contact Gainsco customer service right away to avoid these risks and keep your policy active.

Does GAINSCO offer home insurance?

No, GAINSCO home insurance isn’t offered. GAINSCO focuses exclusively on auto insurance, specializing in liability coverage and SR‑22 filings for high‑risk drivers. If you need homeowners coverage, you’ll need to work with another insurer.

How does GAINSCO car insurance finance work?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does GAINSCO cover rental cars?

GAINSCO is backed by State Farm, which acquired the company in 2020 to expand coverage options for high-risk drivers, especially those needing SR‑22 filings.

GAINSCO rates start at about $64 a month for basic coverage, but what you pay depends on things like your driving history, age, and where you live.

Is GAINSCO legit?

Yes, GAINSCO is legit. They’ve been in business since 1978, operating in 44 states plus D.C., and are backed by State Farm, which acquired them for $400 million.

According to a recent State Farm auto insurance review, this acquisition strengthened GAINSCO’s financial position and customer confidence. They also hold an A rating from A.M. Best, indicating strong financial stability.

Is GAINSCO a good insurance company?

Yes, Gainsco auto insurance is a solid option if you’re a high-risk driver seeking state-minimum liability coverage at affordable monthly rates. Many customers choose it for SR-22 filings and bilingual claims support, though it lacks full coverage options.

Does GAINSCO cover windshield replacement?

Gainsco does not include windshield replacement in its standard liability plans. To cover glass damage, you’ll need to add comprehensive coverage, which pays for windshield repair or replacement from theft, weather, or debris.

What states allow GAINSCO?

Gainsco is licensed in 44 states plus D.C., with a strong presence in Texas, Florida, Georgia, South Carolina, and Virginia. As one of the notable auto insurance companies in Texas, Gainsco is a popular choice for high-risk drivers looking for affordable liability coverage. Availability may vary, so please check with an agent in your ZIP code to confirm eligibility.

How do I file a claim with GAINSCO?

You can call the Gainsco insurance claims number at 1‑866‑GAINSCO Monday through Friday from 7 to 7 Central, or just use the Quick Estimate app to snap some photos, get a fast estimate, and keep track of your claim online.

Does GAINSCO offer roadside assistance?

You can definitely add roadside assistance to your policy. It covers things like towing, jump-starts, fuel delivery, and even lockouts for just a small extra monthly fee.

Is there a grace period for GAINSCO insurance?

Yes, Gainsco provides a short grace period—typically 7–10 days—if you miss a payment before canceling your policy. Keep in mind that what happens if you cancel auto insurance is that you could face fines, a lapse in coverage, or even license suspension, depending on your state.

Contact Gainsco customer service right away to avoid these risks and keep your policy active.

Does GAINSCO offer home insurance?

No, GAINSCO home insurance isn’t offered. GAINSCO focuses exclusively on auto insurance, specializing in liability coverage and SR‑22 filings for high‑risk drivers. If you need homeowners coverage, you’ll need to work with another insurer.

How does GAINSCO car insurance finance work?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does GAINSCO cover rental cars?

Yes, GAINSCO is legit. They’ve been in business since 1978, operating in 44 states plus D.C., and are backed by State Farm, which acquired them for $400 million.

According to a recent State Farm auto insurance review, this acquisition strengthened GAINSCO’s financial position and customer confidence. They also hold an A rating from A.M. Best, indicating strong financial stability.

Yes, Gainsco auto insurance is a solid option if you’re a high-risk driver seeking state-minimum liability coverage at affordable monthly rates. Many customers choose it for SR-22 filings and bilingual claims support, though it lacks full coverage options.

Does GAINSCO cover windshield replacement?

Gainsco does not include windshield replacement in its standard liability plans. To cover glass damage, you’ll need to add comprehensive coverage, which pays for windshield repair or replacement from theft, weather, or debris.

What states allow GAINSCO?

Gainsco is licensed in 44 states plus D.C., with a strong presence in Texas, Florida, Georgia, South Carolina, and Virginia. As one of the notable auto insurance companies in Texas, Gainsco is a popular choice for high-risk drivers looking for affordable liability coverage. Availability may vary, so please check with an agent in your ZIP code to confirm eligibility.

How do I file a claim with GAINSCO?

You can call the Gainsco insurance claims number at 1‑866‑GAINSCO Monday through Friday from 7 to 7 Central, or just use the Quick Estimate app to snap some photos, get a fast estimate, and keep track of your claim online.

Does GAINSCO offer roadside assistance?

You can definitely add roadside assistance to your policy. It covers things like towing, jump-starts, fuel delivery, and even lockouts for just a small extra monthly fee.

Is there a grace period for GAINSCO insurance?

Yes, Gainsco provides a short grace period—typically 7–10 days—if you miss a payment before canceling your policy. Keep in mind that what happens if you cancel auto insurance is that you could face fines, a lapse in coverage, or even license suspension, depending on your state.

Contact Gainsco customer service right away to avoid these risks and keep your policy active.

Does GAINSCO offer home insurance?

No, GAINSCO home insurance isn’t offered. GAINSCO focuses exclusively on auto insurance, specializing in liability coverage and SR‑22 filings for high‑risk drivers. If you need homeowners coverage, you’ll need to work with another insurer.

How does GAINSCO car insurance finance work?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does GAINSCO cover rental cars?

Gainsco does not include windshield replacement in its standard liability plans. To cover glass damage, you’ll need to add comprehensive coverage, which pays for windshield repair or replacement from theft, weather, or debris.

Gainsco is licensed in 44 states plus D.C., with a strong presence in Texas, Florida, Georgia, South Carolina, and Virginia. As one of the notable auto insurance companies in Texas, Gainsco is a popular choice for high-risk drivers looking for affordable liability coverage. Availability may vary, so please check with an agent in your ZIP code to confirm eligibility.

How do I file a claim with GAINSCO?

You can call the Gainsco insurance claims number at 1‑866‑GAINSCO Monday through Friday from 7 to 7 Central, or just use the Quick Estimate app to snap some photos, get a fast estimate, and keep track of your claim online.

Does GAINSCO offer roadside assistance?

You can definitely add roadside assistance to your policy. It covers things like towing, jump-starts, fuel delivery, and even lockouts for just a small extra monthly fee.

Is there a grace period for GAINSCO insurance?

Yes, Gainsco provides a short grace period—typically 7–10 days—if you miss a payment before canceling your policy. Keep in mind that what happens if you cancel auto insurance is that you could face fines, a lapse in coverage, or even license suspension, depending on your state.

Contact Gainsco customer service right away to avoid these risks and keep your policy active.

Does GAINSCO offer home insurance?

No, GAINSCO home insurance isn’t offered. GAINSCO focuses exclusively on auto insurance, specializing in liability coverage and SR‑22 filings for high‑risk drivers. If you need homeowners coverage, you’ll need to work with another insurer.

How does GAINSCO car insurance finance work?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does GAINSCO cover rental cars?

You can call the Gainsco insurance claims number at 1‑866‑GAINSCO Monday through Friday from 7 to 7 Central, or just use the Quick Estimate app to snap some photos, get a fast estimate, and keep track of your claim online.

You can definitely add roadside assistance to your policy. It covers things like towing, jump-starts, fuel delivery, and even lockouts for just a small extra monthly fee.

Is there a grace period for GAINSCO insurance?

Yes, Gainsco provides a short grace period—typically 7–10 days—if you miss a payment before canceling your policy. Keep in mind that what happens if you cancel auto insurance is that you could face fines, a lapse in coverage, or even license suspension, depending on your state.

Contact Gainsco customer service right away to avoid these risks and keep your policy active.

Does GAINSCO offer home insurance?

No, GAINSCO home insurance isn’t offered. GAINSCO focuses exclusively on auto insurance, specializing in liability coverage and SR‑22 filings for high‑risk drivers. If you need homeowners coverage, you’ll need to work with another insurer.

How does GAINSCO car insurance finance work?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does GAINSCO cover rental cars?

Yes, Gainsco provides a short grace period—typically 7–10 days—if you miss a payment before canceling your policy. Keep in mind that what happens if you cancel auto insurance is that you could face fines, a lapse in coverage, or even license suspension, depending on your state.

Contact Gainsco customer service right away to avoid these risks and keep your policy active.

No, GAINSCO home insurance isn’t offered. GAINSCO focuses exclusively on auto insurance, specializing in liability coverage and SR‑22 filings for high‑risk drivers. If you need homeowners coverage, you’ll need to work with another insurer.

How does GAINSCO car insurance finance work?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does GAINSCO cover rental cars?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.